TULSA, Okla., May 1 /PRNewswire-FirstCall/ -- Helmerich &

Payne, Inc. (NYSE:HP) reported net income of $102,054,000 ($0.96

per diluted share) from operating revenues of $473,644,000 for its

second fiscal quarter ended March 31, 2008, compared with net

income of $106,861,000 ($1.02 per diluted share) from operating

revenues of $372,536,000 during last year's second fiscal quarter

ended March 31, 2007. Included in this year's second quarter net

income are $0.04 per share of after-tax gains from the sale of

portfolio securities and drilling equipment. Included in net income

for the second fiscal quarter of 2007 was approximately $0.18 per

share from after-tax gains related to the sale of two platform

rigs, and $0.05 per share from after-tax gains related to an

ongoing insurance settlement for hurricane damages to offshore

platform Rig 201 and other asset sales. For the six months ended

March 31, 2008, the Company reported net income of $209,884,000

($1.98 per diluted share) from operating revenues of $930,307,000,

compared with net income of $217,647,000 ($2.08 per diluted share)

from operating revenues of $758,935,000 during the six months ended

March 31, 2007. Included in net income were after-tax gains from

the sale of portfolio securities and drilling equipment, including

insurance proceeds, of $0.07 per share for the first six months of

fiscal 2008, and $0.39 per share for the first six months of fiscal

2007. Helmerich & Payne, Inc. also announced today that it had

signed three additional long-term contracts with three exploration

and production companies to operate three new FlexRigs(R)* in the

U.S. The name of the customers and other terms were not disclosed.

This brings to 97 the total number of new FlexRigs with at least

three-year term commitments that have been announced by the Company

since March 2005. To date, 87 of these new builds have been

completed, with the remaining 10 scheduled for completion during

this calendar year. FlexRigs are expected to represent about 70% of

the Company's global land fleet by the end of calendar 2008.

Company President and C.E.O. Hans Helmerich commented, "During the

Company's second quarter, we experienced declines in our offshore

and international business, while our U.S. land segment continued

to perform at historically high levels. As we move into the second

half of the fiscal year, we expect to deliver operating income

growth in all three of our drilling segments. As evidenced by our

announcement today, we continue to see a very encouraging level of

demand for new H&P FlexRigs, which have clearly become the

standard for reliability, performance and well cost efficiencies in

U.S. land drilling. With energy market conditions, both domestic

and internationally, pointing toward increasing and more

challenging drilling activity, we are very well positioned to

compete and continue to gain market share while delivering

attractive returns to our shareholders." The Company's U.S. land

rig business continued to experience an increase in revenue day

activity and higher average rig revenue per day during the quarter.

The increase in daily revenue, however, was more than offset by

daily field cost increases. Segment operating income from the

Company's U.S. land rig operations was up substantially from one

year ago, but relatively flat sequentially with $143,841,000 of

operating income during this year's first fiscal quarter and

$143,740,000 operating income during this year's second quarter.

The Company recorded a sequential $409 increase in rig revenue per

day to $24,415, which is the segment's highest quarterly average in

the Company's history and reflects the strong dayrate premium that

the Company's fleet commands in the U.S. land market. However,

average rig expenses increased by $662 to $11,557 per day. As a

result, the average rig margin per day decreased sequentially by

$253 to $12,858 per day. The Company's U.S. land rig utilization

was 94% during this year's second quarter, compared with 97% for

last year's second quarter and 95% for this year's first quarter.

Additionally, the Company's U.S. land rig activity increased 3%

sequentially to 14,272 revenue days during this year's second

quarter, as more newly constructed rigs were deployed to the field.

Given improving market conditions, the Company expects continued

expansion in its U.S. land rig activity during the third fiscal

quarter, as well as strong daily rig margins in the segment.

Segment operating income for the Company's offshore operations was

$3,603,000 for this year's second quarter, compared with $3,805,000

for last year's second quarter and $4,114,000 for this year's first

quarter. Average rig utilization in the offshore segment increased

sequentially from 56% to 65% during the quarter ending March 31,

2008, and is expected to increase to over 80% during the current

third fiscal quarter. As a result and in combination with

anticipated improvement in average daily rig margins in the third

quarter, the Company expects offshore segment operating income to

increase from the second to the third fiscal quarter. All nine of

the Company's offshore segment rigs are contracted, eight of which

are currently active. The ninth rig is scheduled to commence

operations in the second quarter of fiscal 2009. Segment operating

income for the Company's international land operations was

$12,752,000 for this year's second quarter, compared with

$19,874,000 for last year's second quarter and $21,156,000 for this

year's first quarter. The sequential decline this year was mostly

attributable to an adjustment of $5.9 million relating to the

depreciation of certain assets recorded in prior years. (This

adjustment had a negative impact to the second quarter's net income

of approximately $0.04 per share.) As expected, the decline in

segment operating income was also attributable to a reduction in

average rig utilization from 81% to 73% during the second quarter.

The average rig margin per day corresponding to the quarter was

$14,396, or 2% higher than that of the first quarter. Average

international rig utilization is expected to increase to over 75%

during the third fiscal quarter ending June 30, 2008. Helmerich

& Payne, Inc. is primarily a contract drilling company. As of

May 1, 2008, the Company's existing fleet included 175 U.S. land

rigs, 27 international land rigs and nine offshore platform rigs.

Helmerich & Payne, Inc.'s conference call/webcast is scheduled

to begin this morning at 11:00 a.m. ET (10:00 a.m. CT) and can be

accessed at http://www.hpinc.com/ under Investors. If you are

unable to participate during the live webcast, the call will be

archived for a year on H&P's website indicated above.

Statements in this release and information disclosed in the

conference call and webcast that are "forward-looking statements"

within the meaning of the Securities Act of 1933 and the Securities

Exchange Act of 1934 are based on current expectations and

assumptions that are subject to risks and uncertainties. For

information regarding risks and uncertainties associated with the

Company's business, please refer to the "Risk Factors" and

"Management's Discussion & Analysis of Results of Operations

and Financial Condition" sections of the Company's SEC filings,

including but not limited to, its annual report on Form 10-K and

quarterly reports on Form 10-Q. As a result of these factors,

Helmerich & Payne, Inc.'s actual results may differ materially

from those indicated or implied by such forward-looking statements.

*FlexRig(R) is a registered trademark of Helmerich & Payne,

Inc. HELMERICH & PAYNE, INC. Unaudited (in thousands, except

per share data) Three Months Ended Six Months Ended CONSOLIDATED

Dec. 31 March 31 March 31 STATEMENTS OF INCOME 2007 2008 2007 2008

2007 Operating Revenues: Drilling - U.S. Land $347,644 $365,263

$269,145 $712,907 $539,045 Drilling - U.S. Offshore 27,281 29,789

28,703 57,070 64,457 Drilling - International 78,602 75,757 71,950

154,359 149,796 Real Estate 3,136 2,835 2,738 5,971 5,637 456,663

473,644 372,536 930,307 758,935 Operating costs and other:

Operating costs, excluding depreciation 235,795 253,958 199,456

489,753 398,923 Depreciation 43,984 51,872 32,952 95,856 63,103

General and administrative 13,903 14,090 13,350 27,993 23,963 Gain

from involuntary conversion of long-lived assets (4,810) - (5,170)

(4,810) (5,170) Income from asset sales (842) (1,946) (32,336)

(2,788) (32,822) 288,030 317,974 208,252 606,004 447,997 Operating

income 168,633 155,670 164,284 324,303 310,938 Other income

(expense): Interest and dividend income 1,115 1,220 1,034 2,335

2,278 Interest expense (4,831) (4,773) (1,913) (9,604) (2,832) Gain

on sale of investment securities 130 5,476 177 5,606 26,514 Other

(616) 180 66 (436) 130 (4,202) 2,103 (636) (2,099) 26,090 Income

before income taxes and equity in income of affiliate 164,431

157,773 163,648 322,204 337,028 Income tax provision 60,146 58,784

59,338 118,930 123,436 Equity in income of affiliate net of income

taxes 3,545 3,065 2,551 6,610 4,055 NET INCOME $107,830 $102,054

$106,861 $209,884 $217,647 Earnings per common share: Basic $1.04

$0.98 $1.04 $2.02 $2.11 Diluted $1.02 $0.96 $1.02 $1.98 $2.08

Average common shares outstanding: Basic 103,509 103,883 103,239

103,695 103,276 Diluted 105,615 106,090 104,832 105,740 104,841

HELMERICH & PAYNE, INC. Unaudited (in thousands) CONSOLIDATED

CONDENSED BALANCE SHEETS 3/31/08 9/30/07 ASSETS Cash and cash

equivalents $90,736 $89,215 Other current assets 453,249 409,749

Total current assets 543,985 498,964 Investments 205,660 223,360

Net property, plant, and equipment 2,395,862 2,152,616 Other assets

10,611 10,429 TOTAL ASSETS $3,156,118 $2,885,369 LIABILITIES AND

SHAREHOLDERS' EQUITY Total current liabilities $210,996 $226,612

Total noncurrent liabilities 451,042 398,241 Long-term notes

payable 480,000 445,000 Total shareholders' equity 2,014,080

1,815,516 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $3,156,118

$2,885,369 HELMERICH & PAYNE, INC. Unaudited (in thousands) Six

Months Ended March 31 CONSOLIDATED CONDENSED STATEMENTS OF CASH

FLOWS 2008 2007 OPERATING ACTIVITIES: Net income $209,884 $217,647

Depreciation 95,856 63,103 Changes in assets and liabilities

(23,149) 32,364 Gain from involuntary conversion of long-lived

assets (4,810) (5,170) Gain on sale of assets and investment

securities (8,264) (59,198) Other (6,262) (2,881) Net cash provided

by operating activities 263,255 245,865 INVESTING ACTIVITIES:

Capital expenditures (321,711) (433,900) Insurance proceeds from

involuntary conversion of long-lived assets 8,500 5,170 Proceeds

from sale of assets and investments 11,437 122,759 Other - 214 Net

cash used in investing activities (301,774) (305,757) FINANCING

ACTIVITIES: Dividends paid (9,354) (9,311) Repurchase of common

stock - (17,621) Net decrease in bank overdraft - (10,195) Proceeds

from exercise of stock options 8,284 872 Net proceeds from

short-term and long-term debt 35,000 151,279 Excess tax benefit

from stock-based compensation 6,110 155 Net cash provided by

financing activities 40,040 115,179 Net increase in cash and cash

equivalents 1,521 55,287 Cash and cash equivalents, beginning of

period 89,215 33,853 Cash and cash equivalents, end of period

$90,736 $89,140 SEGMENT REPORTING Three Months Ended Six Months

Ended Dec. 31 March 31 March 31 2007 2008 2007 2008 2007 (in

thousands, except days and per day amounts) U.S. LAND OPERATIONS

Revenues $347,644 $365,263 $269,145 $712,907 $539,045 Direct

operating expenses 165,565 181,757 132,399 347,322 259,756 General

and administrative expense 4,394 4,257 3,151 8,651 6,603

Depreciation 33,844 35,509 23,813 69,353 44,496 Segment operating

income $143,841 $143,740 $109,782 $287,581 $228,190 Revenue days

13,877 14,272 11,156 28,159 21,704 Average rig revenue per day

$24,006 $24,415 $23,032 $24,213 $23,615 Average rig expense per day

$10,895 $11,557 $10,774 $11,231 $10,747 Average rig margin per day

$13,111 $12,858 $12,258 $12,982 $12,868 Rig utilization 95% 94% 97%

94% 98% OFFSHORE OPERATIONS Revenues $27,281 $29,789 $28,703

$57,070 $64,457 Direct operating expenses 19,211 21,918 20,709

41,129 44,847 General and administrative expense 1,098 1,114 1,500

2,212 2,958 Depreciation 2,858 3,154 2,689 6,012 5,467 Segment

operating income $4,114 $3,603 $3,805 $7,717 $11,185 Revenue days

460 514 522 974 1,110 Average rig revenue per day $41,833 $41,209

$29,603 $41,503 $34,488 Average rig expense per day $27,160 $29,144

$19,885 $28,207 $22,012 Average rig margin per day $14,673 $12,065

$9,718 $13,296 $12,476 Rig utilization 56% 65% 64% 60% 68% SEGMENT

REPORTING Three Months Ended Six Months Ended Dec. 31 March 31

March 31 2007 2008 2007 2008 2007 (in thousands, except days and

per day amounts) INTERNATIONAL LAND OPERATIONS Revenues $78,602

$75,757 $71,950 $154,359 $149,796 Direct operating expenses 50,782

50,129 45,704 100,911 93,364 General and administrative expense 938

1,300 1,031 2,238 1,594 Depreciation 5,726 11,576 5,341 17,302

10,890 Segment operating income $21,156 $12,752 $19,874 $33,908

$43,948 Revenue days 1,981 1,795 2,262 3,776 4,628 Average rig

revenue per day $34,522 $39,695 $27,001 $36,981 $27,354 Average rig

expense per day $20,353 $25,299 $15,722 $22,704 $15,291 Average rig

margin per day $14,169 $14,396 $11,279 $14,277 $12,063 Rig

utilization 81% 73% 93% 77% 95% Operating statistics exclude the

effects of offshore platform management contracts, gains and losses

from translation of foreign currency transactions, and do not

include reimbursements of "out-of-pocket" expenses in revenue per

day, expense per day and margin calculations. A management contract

for a customer-owned platform rig working in an international

location was moved from the International segment to the Offshore

segment in the fourth quarter of fiscal 2007. The amounts for

Offshore and International land segments for the three and six

months ended March 31, 2007 have been restated to reflect this

change. Reimbursed amounts were as follows: U.S. Land Operations

$14,277 $16,809 $12,196 $31,086 $26,505 Offshore Operations $2,862

$3,343 $3,840 $6,205 $7,544 International Land Operations $10,213

$4,505 $10,824 $14,718 $22,980 REAL ESTATE Revenues $3,136 $2,835

$2,738 $5,971 $5,637 Direct operating expenses 985 904 1,165 1,889

2,008 Depreciation 627 630 612 1,257 1,201 Segment operating income

$1,524 $1,301 $961 $2,825 $2,428 Segment operating income for all

segments is a non-GAAP financial measure of the Company's

performance, as it excludes general and administrative expenses,

corporate depreciation, income from asset sales and other corporate

income and expense. The Company considers segment operating income

to be an important supplemental measure of operating performance

for presenting trends in the Company's core businesses. This

measure is used by the Company to facilitate period-to-period

comparisons in operating performance of the Company's reportable

segments in the aggregate by eliminating items that affect

comparability between periods. The Company believes that segment

operating income is useful to investors because it provides a means

to evaluate the operating performance of the segments and the

Company on an ongoing basis using criteria that are used by our

internal decision makers. Additionally, it highlights operating

trends and aids analytical comparisons. However, segment operating

income has limitations and should not be used as an alternative to

operating income or loss, a performance measure determined in

accordance with GAAP, as it excludes certain costs that may affect

the Company's operating performance in future periods. The

following table reconciles operating income per the information

above to income before income taxes and equity in income of

affiliates as reported on the Consolidated Statements of Income (in

thousands). SEGMENT REPORTING Three Months Ended Six Months Ended

Dec. 31 March 31 March 31 2007 2008 2007 2008 2007 Operating Income

U.S. Land $143,841 $143,740 $109,782 $287,581 $228,190 Offshore

4,114 3,603 3,805 7,717 11,185 International Land 21,156 12,752

19,874 33,908 43,948 Real Estate 1,524 1,301 961 2,825 2,428

Segment operating income $170,635 $161,396 $134,422 $332,031

$285,751 Corporate general and administrative (7,473) (7,419)

(7,668) (14,892) (12,808) Other depreciation (929) (1,003) (497)

(1,932) (1,049) Inter-segment elimination 748 750 521 1,498 1,052

Gain from involuntary conversion of long-lived assets 4,810 - 5,170

4,810 5,170 Income from asset sales 842 1,946 32,336 2,788 32,822

Operating income $168,633 $155,670 $164,284 $324,303 $310,938 Other

income (expense): Interest and dividend income 1,115 1,220 1,034

2,335 2,278 Interest expense (4,831) (4,773) (1,913) (9,604)

(2,832) Gain on sale of investment securities 130 5,476 177 5,606

26,514 Other (616) 180 66 (436) 130 Total other income (expense)

(4,202) 2,103 (636) (2,099) 26,090 Income before income taxes and

equity in income of affiliate $164,431 $157,773 $163,648 $322,204

$337,028 DATASOURCE: Helmerich & Payne, Inc. CONTACT: Juan

Pablo Tardio of Helmerich & Payne, Inc., +1-918-588-5383 Web

site: http://www.hpinc.com/

Copyright

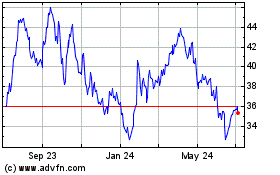

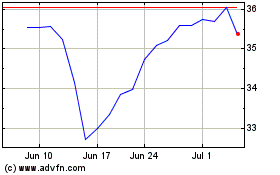

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From May 2024 to Jun 2024

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Jun 2023 to Jun 2024