Healthcare Realty Trust Announces First Quarter Dividend

May 11 2009 - 5:02PM

PR Newswire (US)

NASHVILLE, Tenn., May 11 /PRNewswire-FirstCall/ -- Healthcare

Realty Trust Incorporated (NYSE:HR) today announced its common

stock cash dividend for the quarter ended March 31, 2009. This

dividend, in the amount of $0.385 per share, is payable on June 5,

2009 to shareholders of record on May 22, 2009. The total dividend

of $22.8 million is approximately 83 percent of cash flows from

operations determined in accordance with GAAP. The Company's cash

flow statement is provided below. Healthcare Realty Trust is a real

estate investment trust that integrates owning, managing and

developing income-producing real estate properties associated

primarily with the delivery of outpatient healthcare services

throughout the United States. The Company had investments of

approximately $2.1 billion in 204 real estate properties and

mortgages as of March 31, 2009, excluding assets classified as held

for sale and including an investment in one unconsolidated joint

venture. The Company's 199 owned real estate properties, excluding

assets classified as held for sale, are comprised of six facility

types, located in 28 states, totaling approximately 12.1 million

square feet. The Company provides property management services to

approximately 8.5 million square feet nationwide. In addition to

the historical information contained within, the matters discussed

in this press release may contain forward-looking statements that

involve risks and uncertainties. These risks are discussed in

filings with the Securities and Exchange Commission by Healthcare

Realty Trust, including its Annual Report on Form 10-K for the year

ended December 31, 2008 under the heading "Risk Factors," and as

updated in its Quarterly Reports on Form 10-Q filed thereafter.

Forward-looking statements represent the Company's judgment as of

the date of this release. The Company disclaims any obligation to

update forward-looking material. HEALTHCARE REALTY TRUST

INCORPORATED Condensed Consolidated Statements of Cash Flows (1)

(Dollars in thousands) (Unaudited) Three Months Ended March 31,

2009 -------------- Cash flows from operating activities: Net

income $20,880 Non-cash items: --------------- Depreciation and

amortization - real estate 16,872 Depreciation and amortization -

other 808 Provision for bad debt, net of recoveries 437 Impairments

22 Straight-line rent receivable (353) Straight-line rent liability

113 Equity in losses from unconsolidated joint ventures 2

Stock-based compensation 1,288 Provision for deferred

post-retirement benefits 1,492 Re-measurement gain of equity

interest upon acquisition (2,701) Other non-cash items 254 ---

Total non-cash items 18,234 Other items: ------------ Accounts

payable and accrued liabilities 1,090 Other liabilities 981 Other

assets 1,199 Gain on sales of real estate properties (12,609)

Payment of partial pension settlement (2,300) State income taxes

paid, net of refunds 53 -- Total other items (11,586) ------- Net

cash provided by operating activities (2)(3) 27,528

------------------------------------------------ ------ Cash flows

from investing activities: Acquisition and development of real

estate properties (33,076) Funding of mortgages and notes

receivable (3,451) Distributions received from unconsolidated joint

ventures - Proceeds from sales of real estate 63,907 Proceeds from

mortgages and notes receivable repayments 38 -- Net cash provided

by investing activities 27,418 Cash flows from financing

activities: Net repayment on unsecured credit facility (4,000)

Repayments on notes and bonds payable (20,548) Dividends paid

related to the fourth quarter 2008 (22,829) Proceeds from issuance

of common stock 183 Proceeds received from noncontrolling interests

529 Distributions to noncontrolling interests (43) --- Net cash

used in financing activities (46,708) ------- Increase in cash and

cash equivalents 8,238 Cash and cash equivalents, beginning of

period 4,138 ----- Cash and cash equivalents, end of period $12,376

======= (1) The Condensed Consolidated Statements of Cash Flows do

not include all of the information and footnotes required by

generally accepted accounting principles for complete financial

statements. (2) First quarter 2009 dividends to be paid of $22.8

million, divided by 'Net cash provided by operating activities' of

$27.5 million, is equal to 83%. (3) Net cash provided by operating

activities will fluctuate significantly quarter to quarter based on

the Company's operating results, as well as the timing of certain

payments of the Company's obligations. DATASOURCE: Healthcare

Realty Trust CONTACT: Gabrielle M. Andres, Corporate

Communications, +1-615-269-8175 Web Site:

http://www.healthcarerealty.com/

Copyright

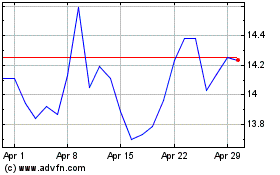

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From May 2024 to Jun 2024

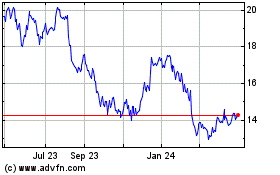

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From Jun 2023 to Jun 2024