Fresh Del Monte Produce Inc. (NYSE:FDP) today reported financial

results for the fourth quarter and year ended January 1, 2010.

Excluding asset impairment and other charges, net, the Company

reported earnings per diluted share of $0.36 for the fourth quarter

of 2009, compared with earnings per diluted share of $0.41 in the

fourth quarter of 2008. Excluding asset impairment and other

charges, net, earnings per diluted share for the full year were

$2.63, compared with earnings per diluted share of $2.82 for the

full year of 2008.

“We delivered a solid fourth quarter, particularly in the face

of a prolonged economic slowdown which affected profitability in

our Europe and Asia banana businesses,” said Mohammad Abu-Ghazaleh,

Chairman and Chief Executive Officer at Fresh Del Monte Produce.

“Our performance was driven by strong sales in our gold pineapple

and fresh-cut product lines. Moving forward, our primary objectives

for 2010 are to continue expanding our core product lines,

controlling costs, and maintaining our commitment to increase

shareholder value over the long-term.”

Net sales for the quarter were $872.1 million, compared with

$831.0 million in the fourth quarter of 2008. The increase in net

sales was primarily driven by improved performance in the Company’s

gold pineapple and fresh-cut product lines, along with higher net

sales for the Company’s banana business segment. Net sales were

negatively impacted by lower sales of the Company’s other products

and services and prepared food business segments. The Company also

benefited from a 14-week fourth quarter in 2009, compared with a

13-week fourth quarter in 2008.

Gross profit for the quarter was $65.1 million, compared with

gross profit of $69.4 million in the fourth quarter of 2008,

excluding other charges, net, for both periods. The decrease in

gross profit was due to significantly lower profitability in the

Company’s banana business segment in Europe and Asia.

Operating income for the quarter was $28.9 million, compared

with $30.2 million in the prior year, excluding asset impairment

and other charges, net, for both periods. The decline was

principally due to the decrease in gross profit.

Net income for the quarter was $22.8 million, compared with

$26.2 million in the fourth quarter of 2008, excluding asset

impairment and other charges, net. The decrease in net income was

primarily attributable to lower gross profit, higher selling,

general and administrative expenses, partially offset by lower

interest expense.

Fresh Del Monte Produce Inc. and

Subsidiaries Condensed Consolidated Statements of Income

(U.S. dollars in millions, except share and per share data) -

(Unaudited) Quarter ended Year ended

Income Statement: January 1, December 26,

January 1, December 26, 2010

2008 2010

2008 Net sales $ 872.1 $ 831.0 $ 3,496.4 $

3,531.0 Cost of products sold 807.0 761.6 3,170.4 3,184.0 Other

(credits) charges (1)

(1.9 )

0.9 15.2

3.0 Gross profit 67.0 68.5 310.8 344.0

Selling, general and administrative expenses 43.2 39.0 165.8

162.5 Gain (loss) on sales of property, plant and equipment 7.0

(0.2 ) 11.2 7.5 Asset impairment and other (credits) charges, net

(2)

(3.5 ) 2.4

8.0 18.4

Operating income 34.3 26.9 148.2 170.6 Interest

expense, net 2.8 4.4 11.2 13.1 Other income (expense), net

(3.5 ) 0.2

(5.2 ) 4.5

Income before income taxes 28.0 22.7 131.8 162.0

Provision for (benefit from) income taxes

1.0 (0.2 )

(12.8 ) 4.8

Net income

$ 27.0

$ 22.9 $

144.6 $ 157.2

Less: Net income (loss) attributable to noncontrolling

interests

(1.2 )

- 0.7

(0.5 ) Net income attributable to Fresh

Del Monte Produce Inc.

$ 28.2

$ 22.9 $

143.9 $ 157.7

Net income per ordinary share

attributable to Fresh Del Monte Produce Inc. - Basic

$ 0.44 $

0.36 $ 2.26

$ 2.49

Net income per ordinary share

attributable to Fresh Del Monte Produce Inc. - Diluted

$ 0.44 $

0.36 $ 2.26

$ 2.48 Weighted average

number of ordinary shares: Basic

63,606,778

63,540,689

63,570,999 63,344,941

Diluted

63,781,092

63,602,862 63,668,352

63,607,786 Selected

Income Statement Data: Depreciation and amortization

$ 20.5 $

21.2 $ 83.7

$ 83.5 Non-GAAP

Measures: Reported net income per share - Diluted $ 0.44 $ 0.36

$ 2.26 $ 2.48 Other (credits) charges (1) (0.03 ) 0.01 0.24 0.05

Asset impairment and other (credits) charges, net (2)

(0.05 ) 0.04

0.13 0.29

Adjusted net income per share - Diluted (3)

$

0.36 $ 0.41

$ 2.63 $

2.82 Reported gross profit $ 67.0 $ 68.5

$ 310.8 $ 344.0 Other (credits) charges (1)

(1.9 ) 0.9

15.2 3.0

Adjusted gross profit (3)

$ 65.1

$ 69.4 $

326.0 $ 347.0

(1) For 2009, Other (credits)

charges relate principally to an insurance reimbursement related to

flood damage in our Brazil banana operations and our decision to

discontinue pineapple operations in Brazil. For 2008, they relate

to flood damage in our Brazil and Costa Rica banana operations.

(2) For 2009, Asset impairment and

other (credits) charges relate principally to exit activities in

Brazil, Hawaii and Germany and impairments of intangible assets

offset by an insurance reimbursement. For 2008, they relate to

flood damage in our Brazil and Costa Rica banana operation and to

exit activities in the United Kingdom and Hawaii.

(3) Management reviews adjusted

net income, adjusted net income per share and adjusted gross profit

and considers these measures relevant to investors because

management believes they better represent the underlying business

trends and performance of the Company.

Fresh Del Monte Produce Inc.

and Subsidiaries Business Segment Data (U.S. dollars

in millions) - (Unaudited) Quarter

ended January 1, 2010 December 26, 2008

Segment Data: Net Sales Gross Profit Net

Sales Gross Profit Banana $ 385.5 44 % $

3.7 (1) 6 % $ 365.8 44 % $ 22.3 33 % Other Fresh Produce 375.4 43 %

49.9 74 % 341.9 41 % 31.7 46 % Prepared Food 89.3 10 % 10.3 15 %

93.6 11 % 13.2 19 % Other Products and Services 21.9 3 %

3.1 5 % 29.7 4 % 1.3 2 % Total $ 872.1 100 % $

67.0 100 % $ 831.0 100 % $ 68.5 100 %

Year

ended January 1, 2010 December 26, 2008

Segment Data: Net Sales Gross Profit Net

Sales Gross Profit Banana $ 1,510.9 43 % $ 108.7

(1 ) 35 % $ 1,420.2 40 % $ 117.7 (2 ) 34 % Other Fresh Produce

1,551.5 44 % 148.7 (3 ) 48 % 1,559.8 44 % 171.1 50 % Prepared Food

337.4 10 % 52.2 17 % 412.4 12 % 51.9 15 % Other Products and

Services 96.6 3 % 1.2 0 % 138.6 4 % 3.3

1 % Total $ 3,496.4 100 % $ 310.8 100 % $ 3,531.0 100 % $ 344.0 100

%

Quarter ended Year ended January

1, December 26, January 1, December 26,

Net Sales by Geographic Region: 2010 2008

2010 2008 North America $ 405.1 46 % $ 381.2

46 % $ 1,675.9 48 % $ 1,633.1 46 % Europe 266.4 30 % 247.2 30 %

995.2 28 % 1,081.4 30 % Asia 84.3 10 % 102.1 12 % 420.2 12 % 408.1

12 % Middle East 91.6 11 % 71.6 9 % 314.1 9 % 275.8 8 % Other

24.7 3 % 28.9 3 % 91.0 3 % 132.6 4 %

Total $ 872.1 100 % $ 831.0 100 % $ 3,496.4 100 % $ 3,531.0 100 %

(1) Banana gross profit for the

quarter and year ended January 1, 2010 included an insurance

reimbursement of $2.1 million related to flood damage at our banana

farms in Brazil.

(2) Banana gross profit for the

year ended December 26, 2008 included charges of $3.0 million

recorded during the second and fourth quarter quarter of 2008

related to wages paid to idle workers and write-offs of packaging

material inventory incurred as a result of extensive flood damage

at our banana farms in Brazil and Costa Rica, respectively.

(3) Other fresh produce gross profit for the year ended

January 1, 2010 included charges of $17.1 million recorded during

the second quarter of 2009 related to the write-down of growing

crop inventory resulting from our decision to discontinue pineapple

planting in Brazil.

Fresh Del Monte Produce

Inc. and Subsidiaries Condensed Consolidated Statements of

Cash Flows (U.S. dollars in millions) - (Unaudited)

Year ended January 1, December 26,

2010 2008 Operating activities: Net income $

144.6 $ 157.2 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

83.7 83.5 Amortization of debt issuance costs 3.3 1.8 Asset

impairment charges 15.3 15.7 Gain on sales of property, plant and

equipment (11.2 ) (7.3 ) Foreign currency translation adjustment

8.0 8.3 Other changes (15.1 ) 9.1 Changes in operating assets and

liabilities: Receivables 45.8 0.1 Inventories 19.8 (38.8 ) Prepaid

expenses and other current assets 5.5 (10.6 ) Accounts payable and

accrued expenses (40.1 ) 8.0 Other noncurrent assets and

liabilities (3.5 ) (22.0 )

Net cash provided by

operating activities 256.1 205.0

Investing activities: Capital expenditures (84.5 )

(101.5 ) Proceeds from sales of property, plant and equipment 17.6

16.5

Purchase of subsidiaries, net of

cash acquired

- (414.5 )

Net cash used in investing

activities (66.9 ) (499.5 )

Financing

activities: Net (payments) proceeds on long-term debt (198.0 )

271.8 Contributions from noncontrolling interests 14.8

10.6

Proceeds from stock options

exercised

1.0

22.1

Net cash (used in) provided by financing activities

(182.2 ) 304.5

Effect of exchange

rate changes on cash (0.1 ) (12.6 ) Net

increase (decrease) in cash and cash equivalents 6.9 (2.6 ) Cash

and cash equivalents, beginning 27.6 30.2

Cash and cash equivalents, ending $ 34.5 $ 27.6

Fresh Del Monte Produce Inc. and

Subsidiaries Condensed Consolidated Balance Sheets

(U.S. dollars in millions) - (Unaudited) January

1, December 26, 2010 2008

Assets Current assets: Cash and cash equivalents $ 34.5 $

27.6 Trade accounts receivable, net 309.8 348.0 Other accounts

receivables, net 65.2 62.0 Inventories 436.9 459.8 Other current

assets 54.0 77.2 Total current assets 900.4

974.6 Investment in and advances to unconsolidated

companies 10.4 8.0 Property, plant and equipment, net 1,068.5

1,085.2 Goodwill 409.0 401.1 Other noncurrent assets 207.7

182.1 Total assets $ 2,596.0 $ 2,651.0

Liabilities

and shareholders' equity Current liabilities: Accounts payable

and accrued expenses $ 316.9 $ 379.6 Current portion of long-term

debt and capital lease obligations 4.9 358.0 Other current

liabilities 35.5 36.8 Total current liabilities

357.3 774.4 Long-term debt and capital lease

obligations 320.3 154.8 Other noncurrent liabilities 223.2

207.9 Total liabilities 900.8 1,137.1

Total Fresh Del Monte Produce Inc. shareholders' equity 1,673.1

1,496.9 Noncontrolling interests 22.1 17.0 Total

shareholders' equity 1,695.2 1,513.9 Total

liabilities and shareholders' equity $ 2,596.0 $ 2,651.0

Selected Balance Sheet Data: Working capital $ 543.1

$ 200.2 Total Debt $ 325.2 $ 512.8

Fourth Quarter 2009 Business Segment Performance

(As reported in business segment data)

Bananas

Net sales increased 5% to $385.5 million during the quarter,

compared to the prior year. The increase was primarily driven by

higher sales in the Company’s Europe, Middle East and North America

regions. Volume was up 7%. Worldwide pricing decreased $0.15 or 1%

to $12.98 per unit. The slight decrease in worldwide banana selling

prices was principally due to considerably lower banana selling

prices in Asia. Gross profit decreased by $18.6 million to $3.7

million. Banana gross profit included a $2.1 million insurance

reimbursement for flood damage at the Company’s farms in Brazil.

Unit costs increased 4%.

Other Fresh Produce

Net sales for the quarter increased 10% to $375.4 million,

primarily attributable to higher volume and selling prices in the

Company’s gold pineapple and fresh-cut product lines. Gross profit

increased $18.2 million to $49.9 million, primarily due to lower

unit costs and higher selling prices.

- Gold pineapple – Net sales

increased 19% to $137.6 million. Volume increased 18%. Pricing

increased 1%. Unit cost decreased 7%, primarily due to higher

volume.

- Melon – Net sales increased 15%

to $69.5 million, principally the result of a 23% increase in

volume. Pricing decreased 7%, due to higher industry supply in the

marketplace. Unit cost was in line with the prior year period.

- Fresh-cut – Net sales increased

15% to $76.5 million. The growth in net sales in the quarter was

primarily due to further expansion of our fresh-cut fruit product

line in retail grocery stores, club stores and convenience stores.

Volume was 8% higher. Pricing increased 7%. Unit cost decreased 6%,

mainly due to lower fruit cost and ongoing operational efficiencies

and improvements.

- Non-tropical – Net sales

decreased 6% to $35.4 million. Volume decreased 2%. Pricing was 5%

lower. Unit cost decreased 10%.

- Tomato – Net sales decreased 2%

to $29.4 million. Volume was 1% lower. Pricing decreased 2%. Unit

cost increased 2%.

Prepared Food

Net sales decreased 5% to $89.3 million for the fourth quarter,

primarily the result of lower sales of the Company’s canned

pineapple and beverage product lines, partially offset by higher

sales in the Company’s Middle East poultry and processed meat

businesses and favorable exchange rates. Gross profit for the

quarter was $10.3 million, compared with $13.2 million in the

fourth quarter of 2008.

Other Products and

Services

Net sales decreased 26% to $21.9 million for the quarter, due to

lower net sales in the Company’s third-party freight and Argentine

grain businesses. Gross profit was $3.1 million, compared with $1.3

million in the prior year period.

Income Taxes

Income tax expense recorded in the fourth quarter was $1.0

million. Tax expense included a tax benefit of $5.3 million related

to the reduction of valuation allowances.

Cash Flows for the Full-Year

Net cash provided by operating activities for the full-year of

2009 was $256.1 million, compared with $205.0 million for 2008. The

increase was primarily due to lower accounts receivable and

inventory balances, offset by lower net income, and higher payments

for accounts payable and accrued expenses.

Total Debt

Total debt decreased from $512.8 million at the end of 2008 to

$325.2 million at the end of 2009, a $187.6 million decrease.

Conference Call and Web Cast Data

Fresh Del Monte will host a conference call and simultaneous web

cast at 10:00 a.m. Eastern Time today to discuss the fourth quarter

and Full-Year 2009 financial results and to review the Company’s

progress and outlook. The Web cast can be accessed on the Company’s

Investor Relations home page at www.freshdelmonte.com. The call

will be available for re-broadcast on the Company’s Web site

approximately two hours after the conclusion of the call.

About Fresh Del Monte Produce Inc.

Fresh Del Monte Produce Inc. is one of the world’s leading

vertically integrated producers, marketers and distributors of

high-quality fresh and fresh-cut fruit and vegetables, as well as a

leading producer and distributor of prepared food in Europe, Africa

and the Middle East. Fresh Del Monte markets its products worldwide

under the Del Monte® brand, a symbol of product innovation,

quality, freshness and reliability for more than 100 years.

Forward-looking Information

This press release contains certain forward-looking statements

regarding the intent, beliefs or current expectations of the

Company or its officers with respect to the Company’s plans and

future performance. These forward-looking statements are based on

information currently available to the Company and the Company

assumes no obligation to update these statements. It is important

to note that these forward-looking statements are not guarantees of

future performance and involve risks and uncertainties. In this

press release, these statements appear in a number of places and

include statements regarding the intent, belief or current

expectations of the Company or its officers (including statements

preceded by, followed by or that include the words “believes,”

“expects,” “anticipates” or similar expressions). The Company’s

plans and performance may differ materially from those in the

forward-looking statements as a result of various factors,

including (i) the uncertain global economic environment and the

timing and strength of a recovery in the markets we serve, and the

extent to which adverse economic conditions continue to affect the

Company’s sales, volume and results, including its ability to

command premium prices for certain of the Company’s principal

products, or increase competitive pressures within the industry,

(ii) the impact of governmental initiatives in the United

States and abroad to spur economic activity, including the effects

of significant government monetary or other market interventions on

inflation, price controls and foreign exchange rates,

(iii) the Company’s anticipated cash needs in light

of its liquidity, (iv) the continued ability of the

Company’s distributors and suppliers to have access to sufficient

liquidity to fund their operations, (v) trends and other

factors affecting the Company’s financial condition or results of

operations from period to period, including changes in product mix

or consumer demand for branded products such as the Company’s,

particularly as consumers remain price-conscious in the current

economic environment, as well as anticipated price and expense

levels, the impact of weather on crop quality and yields, the

impact of prices for petroleum based products and packaging

materials and the availability of sufficient labor during peak

growing and harvesting seasons, (vi) the impact of pricing and

other actions by our competitors, particularly during periods of

low consumer confidence and spending levels, (vii) the impact

of foreign currency fluctuations, (viii) the Company’s plans for

expansion of its business (including through acquisitions) and cost

savings, (ix) the Company’s ability to successfully integrate

acquisitions into its operations, (x) the timing and cost of

resolution of pending legal and environmental proceedings, (xi) the

impact of changes in tax accounting or tax laws (or interpretations

thereof), and the impact of settlements of adjustments proposed by

the Internal Revenue Service or other taxing authorities in

connection with the Company’s tax audits, and (xii) the cost and

other implications of changes in regulations applicable to our

business, including potential legislative or regulatory initiatives

in the Unites States or elsewhere directed at mitigating the

effects of climate change. The Company’s plans and performance may

also be affected by the factors described in Item 1A. – “Risk

Factors” in Fresh Del Monte Produce Inc.’s Annual Report on Form

10-K/A for the year ended December 26, 2008 along with other

reports that the Company has on file with the Securities and

Exchange Commission.

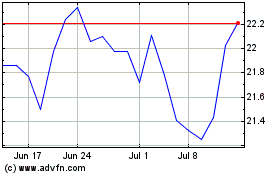

Fresh Del Monte Produce (NYSE:FDP)

Historical Stock Chart

From Apr 2024 to May 2024

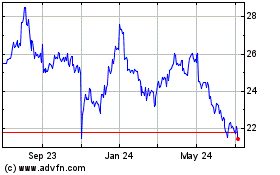

Fresh Del Monte Produce (NYSE:FDP)

Historical Stock Chart

From May 2023 to May 2024