UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment

No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary

Proxy Statement

¨ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive

Proxy Statement

x Definitive

Additional Materials

¨ Soliciting

Material Pursuant to § 240.14a-12

Chubb Limited

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if

Other Than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| ¨ | Fee paid previously with

preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item

25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On May 7, 2024, Chubb Limited submitted the following

response to Institutional Shareholder Services (ISS) on ISS’ proxy research report relating to Chubb’s 2024 Annual

General Meeting of Shareholders:

Chubb respectfully requests that ISS consider the following points

of correction and clarification with respect to the recommendations and analyses of:

| · | Agenda Item 15 (shareholder proposal on Scope 3 greenhouse gas emissions reporting); |

| · | Agenda Item 16 (shareholder proposal on pay gap reporting); and |

| · | Agenda Item 14 (approval of the Sustainability Report). |

Further detail is provided below. We would be happy to discuss with

ISS at any available opportunity.

Agenda Item 15 – Shareholder proposal on Scope 3 greenhouse

gas emissions reporting

ISS reports that Chubb already meets or exemplifies all of ISS’

climate disclosure pillars in its Climate Awareness Scorecard, and concludes Chubb has “higher” disclosure with a score of

3/10 under ISS’ QualityScore measure for Carbon and Climate and for Environment.

Despite Chubb’s exemplary climate disclosure by ISS’ assessment, ISS

concludes Chubb should disclose Scope 3 greenhouse gas (GHG) emissions, as requested by the shareholder proposal in Agenda Item 15, because

it “will likely help shareholders better understand the company’s climate-related risk and evaluate the effectiveness of the

policies the company has enacted”. We believe this is incorrect. As Chubb has explained in its disclosure, there is no agreed methodology

to calculate Scope 3 insurance-associated emissions, and even if there were, such a calculation would not reflect Chubb’s climate-related

risk, nor provide any basis to assess whether Chubb is effectively contributing to a reduction of emissions in the real economy.

In its analysis, ISS recognizes that the calculation of Scope

3 emissions “may not be feasible at this time”. As the ISS report notes, only one insurance peer has disclosed insurance-associated

emissions, and even then, only for Scope 1 and 2 estimates associated with one segment (commercial P&C only). The one method for estimating

Scope 3 emissions referenced by ISS is deeply flawed as external evaluators have concluded and as we explained in our opposition statement

on Agenda Item 15. We further request that ISS reconsider its assumptions on the proposal about extended timelines and limits that are

not included on the proposal’s face and that make the request sound more reasonable than it actually is.

In the interest of a mutual understanding of climate issues, we seek

further dialogue with ISS to understand how ISS undertook its own estimation of Chubb’s Scope 3 emissions. We, and the broader insurance

industry, would appreciate understanding how ISS has resolved the methodological and data quality concerns for Scope 3 emissions counting,

including those specifically discussed in the company’s opposition statement on Agenda Item 15 and the feasibility concerns ISS

acknowledges in its report.

There are serious costs to creating, piloting and publishing a novel

counting mechanism, and Chubb has determined it would be imprudent for the company and its shareholders to bear such costs. This is particularly

so because of the growing weight of evidence that Scope 3 disclosure does not lead to a reduction in real-world emissions. Instead,

Chubb believes its climate strategy, which is focused on supporting new technologies, building resilience through risk engineering and

our technical underwriting criteria, will do far more to reduce real-world emissions than allocating our resources to counting. Chubb

is a leader on climate in the insurance industry, with a deeply thought-out strategy that aims to capitalize on how insurers can best

address climate risk and impact greenhouse gas emissions.

We also request correction from ISS on its discussion of climate regulations.

For example, the report states that “[t]he Corporate Sustainability Reporting Directive” will mandate Scope 3 disclosure for

large European insurers. In fact, CSRD requires the development of regulations that “specify the information that undertakings are

to disclose the following factors: (i) climate change mitigation, including as regards scope 1, scope 2 and, where relevant,

scope 3 greenhouse gas emissions” (Directive 2013/34/EU Article 29b as amended by Directive EU 2022/2464) (emphasis

added). CSRD implementing regulations provide numerous potential reporting metrics on climate change and ask companies to make a dual

materiality analysis on individual metrics, including Scope 3 emissions. Scope 3 disclosure is not explicitly required under CSRD.

We also are concerned that the ISS report creates the misleading

impression that Chubb is not in compliance with, or subject to some controversy regarding climate-related laws or regulations. We

are not aware of any facts that show that Chubb is not in compliance with the requirements of climate disclosure regulations.

Agenda Item 16 – Shareholder proposal on pay gap reporting

With respect to Agenda Item 16, Chubb requests that ISS update its

report to state that, as described on page 64 of the proxy statement, disclosure on Chubb’s gender and racial pay gap analysis

is also included in its 2023 Sustainability Report. Doing so will clarify that Chubb intends to continue disclosing the results of our

adjusted racial and gender pay gap analysis on an annual basis in the Sustainability Report.

Chubb further seeks to clarify, for ISS’ clients, that the difference

between Chubb’s existing disclosure and the proponent’s request is simply the metric of an unadjusted pay gap. We believe

that ISS’ clients would be well-served by transparency about what an unadjusted pay gap metric does not do. The unadjusted

metric does not take into account geographic distribution of a company’s workforce (we are present in 54 countries and territories),

the structure of the workforce organization (40,000 employees at Chubb), or an individual’s role, level, scope of responsibilities

or location. As such, this metric does not provide actionable information for Chubb on representation within the company’s employee

base, on equitable compensation, or on the fairness of our compensation programs. It also cannot be compared to the unadjusted pay gap

of other organizations, again because of their different geographic and structural distribution and employee roles.

There is no real-world issue or controversy raised by the proponents

or ISS with respect to the equity of Chubb’s compensation programs, so it is incorrect for the ISS report to state that disclosing

unadjusted pay gap could mitigate risks related to public scrutiny. In fact, we believe it is quite the opposite; unadjusted pay gap carries

the significant risk of being misused and misconstrued. Again, we believe ISS’ clients would benefit from greater transparency around

this metric.

Agenda Item 14 - Approval of the Sustainability Report of Chubb

Limited for the year ended December 31, 2023

Chubb notes that in ISS’ recommendation “FOR”

Agenda Item 14, the approval of the Sustainability Report, page 4 of its report mistakenly flags this agenda item as being one

“deserving attention due to contentious issues or controversy”.

ISS’ analysis states that its recommendation on this agenda item

is qualified because external assurance is only provided on the greenhouse gas emissions metrics disclosed in the Sustainability Report,

and not the full report. But, as ISS acknowledges in its analysis, Swiss law does not require external assurance on Chubb’s Sustainability

Report. ISS also does not identify any issue with Chubb’s disclosure, nor has there been any concern raised by ISS or any other

shareholder or stakeholder with respect to the accuracy of Chubb’s disclosure. Chubb therefore believes that qualifying this recommendation

and flagging it as contentious and controversial is an error that should be corrected. Chubb requests ISS remove the flag on pages 2

and 4, as well as the qualification on page 38.

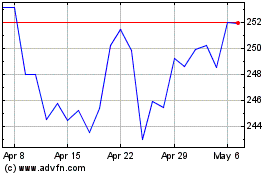

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Apr 2024 to May 2024

DBA Chubb (NYSE:CB)

Historical Stock Chart

From May 2023 to May 2024