DaVita Downgraded to Neutral - Analyst Blog

March 08 2012 - 10:55AM

Zacks

We are downgrading our recommendation on DaVita

Inc. (DVA) to Neutral based on an unfavorable shift in

payor mix, headwinds from debt refinancing and ongoing concerns

related tothe health care reform. However, the company’s strong

cash flow and steady inorganic growth together limit the

downside.

DaVita reported fourth-quarter operating earnings of $1.58 per

share, which topped the Zacks Consensus Estimate of $1.48 and $1.13

in the prior-year quarter. Operating income amounted to $149.4

million, compared with $111.9 million in the fourth quarter of

2010.

DaVita has been generating strong operating cash flow, which

increased at a 3-year CAGR (2008–2011) of 24%. The strong cash

flows allow the company to meet its capital expenditure needs as

well as repurchase shares and spend on acquisitions, which has been

DaVita’s preferred business strategy over the years.

During 2011, the company increased its tally of outpatient

dialysis centers by 208, which can be credited to acquisitions and

opening of new centers. Apart from domestic acquisitions, the

company is also looking for acquisition opportunities in all major

European and Asian countries.

While DaVita’s Epogen purchase deal with Amgen

Inc. (AMGN) has marginally increased the cost of Epogen in

the near term, it is expected to significantly reduce the company’s

future expenditure on the drug. It is likely that the company

received substantial discounts and rebates under the agreement,

which prompted it to sign a seven-year deal despite the fact that

Epogen’s patent is set to expire in 2014 and low-cost competing

products will be available in the market.

On the flip side, a significant portion of DaVita’s dialysis and

related lab services revenues are generated from patients who have

commercial payors as the primary payor. However, the mix of

treatments reimbursed by non-government payors, as a percentage of

total treatments, has been falling consistently over the years due

to the wide disparity in the payment rates of commercial insurance

and government schemes.

Moreover, the impact of the health care reform could adversely

affect DaVita’s earnings. One provision requires the establishment

of health insurance exchanges, which is expected to reduce the

number of policyholders opting for commercial insurance.

Moreover, even those policyholders who choose to stay with

commercial insurance are likely to opt for policies with limited

benefits, carrying lower reimbursement rates. Consequently, the

earnings of DaVita could be adversely affected by the establishment

of the exchanges.

The Zacks Consensus Estimate for DaVita’s first-quarter earnings

is currently pegged at $1.45 per share, up about 51% year over

year. For 2012, earnings are expected to be about $6.24 per share,

climbing about 21% year over year.

DaVita currently caries a Zacks #3 Rank, implying a short-term

‘Hold’ rating.

AMGEN INC (AMGN): Free Stock Analysis Report

DAVITA INC (DVA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

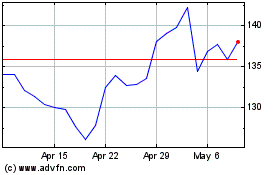

DaVita (NYSE:DVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

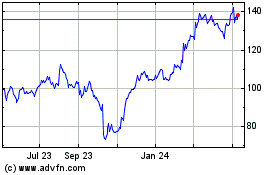

DaVita (NYSE:DVA)

Historical Stock Chart

From Nov 2023 to Nov 2024