For Immediate Release

Chicago, IL – February 3, 2012 – Zacks Equity Research

highlights SLM Corp. ( SLM) as the Bull of the Day

and Darden Restaurants, Inc. ( DRI) as the Bear of

the Day. In addition, Zacks Equity Research provides analysis on

Green Mountain Coffee Roasters ( GMCR),

Peet's Coffee & Tea Inc. ( PEET) and

Starbucks Corporation ( SBUX).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

Sallie Mae, or SLM Corp.'s (

SLM) fourth-quarter 2011 core earnings were a penny above the Zacks

Consensus Estimate. Improvements in net interest income, loan loss

provision, expenses and discontinued operations supported the core

earnings figure. Recently, the company announced a dividend hike

and a new share repurchases authorization.

We believe that such shareholder-friendly efforts will give a

boost to investors confidence in the stock. Moreover, its leading

position in the student lending market, cost curtailment

initiatives and the federal student loan assets acquisition augur

well. Though pausing new federal student loan origination to comply

with the legislation would affect revenue generation at the

company, we believe that its diversifying efforts coupled with an

economic recovery, though at a sluggish pace, will bolster its

earnings.

Our six-month target price of $18.00 equates with 8.7x our

earnings estimate for 2012. Combined with a quarterly dividend of

$0.125 per share, this target price implies an expected total

return of about 22.1% over that period. This is consistent with our

Outperform recommendation on the shares.

Bear of the Day:

Although Darden Restaurants, Inc. ( DRI)

registered improving blended comparable restaurant sales for the

last few quarters, recent woes at Olive Garden continue to nag the

company. Stiff competition resulting in higher discounting rates

and promotional offers, increasing food costs for the upcoming

quarter and cautious consumer spending add to the worry.

Moreover, a recent cut in guidance compels us to downgrade the

stock from a Neutral to Underperform recommendation. The company

now expects earnings per share from continuing operations to grow

4-7% as against the lower end of 12-15% guided earlier.

Our six-month target price of $40.00 equates to about 11.2x our

estimate for 2012. The target price implies an expected total

negative return of 9.5% over that period. We recommend an

Underperform rating on the shares.

Latest Posts on the Zacks Analyst Blog:

Green

Mountain Brews

Profits

Green Mountain Coffee Roasters ( GMCR) reported

robust first-quarter 2012 results with its adjusted earnings of 60

cents per share, which surged 233% year on year from 18 cents in

the prior-year quarter. The adjusted earnings also exceeded the

Zacks Consensus Estimate of 36 cents per share.

The adjusted earnings exclude the acquisition-related expenses,

expenses related to SEC inquiry, amortization of identifiable

intangibles, and gain on sale of subsidiary. Including these

one-time items, earnings soared to 66 cents per share as compared

to 2 cents per share in the prior-year quarter.

The year-on-year upswing came on the back of success of Keurig

Single-Cup Brewing System, supported by owned and non-owned

beverage brands in K-Cup packs coupled with strong holiday

sales.

In comparison with the first quarter results, Green Mountain

projects second quarter 2012 adjusted earnings per share in the

range of 60 cents to 65 cents and the ensuing fiscal 2012 adjusted

earnings within $2.55–$2.65 per share. The Zacks Consensus Estimate

for the next quarter is pegged at 74 cents and $2.57 per share for

fiscal 2012.

Our Take

The company is expected to continue to add new brands to the

Keurig Single-Cup brewing system, which will help drive incremental

brewer adoption, and increase system awareness.

Although Green Mountain enjoys a sound position in a prospering

industry with its strategic acquisitions holding out promises,

coffee’s vulnerability to highly volatile global prices and

presence of tough competitors like Peet's Coffee & Tea

Inc. ( PEET) and Starbucks Corporation (

SBUX) concern us.

Currently, Green Mountain holds the Zacks #4 Rank, which

translates into a short-term ‘Sell’ rating. Over the long term, we

prefer to rate the stock as Neutral.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

DARDEN RESTRNT (DRI): Free Stock Analysis Report

GREEN MTN COFFE (GMCR): Free Stock Analysis Report

PEETS COFFE&TEA (PEET): Free Stock Analysis Report

STARBUCKS CORP (SBUX): Free Stock Analysis Report

SLM CORP (SLM): Free Stock Analysis Report

To read this article on Zacks.com click here.

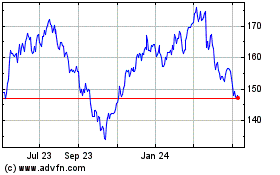

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From May 2024 to Jun 2024

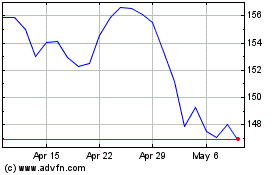

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Jun 2023 to Jun 2024