Chemed Corporation (Chemed) (NYSE:CHE), which operates VITAS

Healthcare Corporation (VITAS), the nation’s largest provider of

end-of-life care, and Roto-Rooter, the nation’s largest commercial

and residential plumbing and drain cleaning services provider,

reported financial results for its first quarter ended March 31,

2011, versus the comparable prior-year period, as follows:

Consolidated operating results:

- Revenue increased 7.2% to $331

million

- GAAP Diluted EPS $0.84 equal to prior

year

- Adjusted EPS increased 12.6% to

$1.07

VITAS segment operating results:

- Net Patient Revenue of $236 million, an

increase of 5.7%

- Average Daily Census (ADC) of 12,919,

an increase of 4.8%

- Admissions of 15,798, an increase of

6.4%

- Net Income of $18.1 million, a decline

of 1.7%

- Adjusted EBITDA of $33.2 million, an

increase of 1.4%

- Adjusted EBITDA margin of 14.1%, a

decrease of 60 basis points

Roto-Rooter segment operating results:

- Revenue of $95.2 million, an increase

of 10.9%

- Job count of 179,716, an increase of

5.8%

- Net Income of $8.5 million, an increase

of 8.9%

- Adjusted EBITDA of $15.6 million, an

increase of 13.8%

- Adjusted EBITDA margin of 16.4%, an

increase of 42 basis points

VITAS

Net revenue for VITAS was $236 million in the first quarter of

2011, which is an increase of 5.7% over the prior-year period. Both

periods include revenue from the reversal of Medicare Cap accruals.

Excluding this impact of Medicare Cap, revenue increased 6.1%. This

revenue growth was the result of increased ADC of 4.8%, driven by

an increase in admissions of 6.4%, combined with Medicare price

increases of approximately 2.1%. This growth was partially offset

by geographic and level of acuity mix shift of the patient

base.

Average revenue per patient per day in the quarter, excluding

the impact of Medicare Cap, was $201.82, which is 1.2% above the

prior-year period. Routine home care reimbursement and high acuity

care averaged $157.93 and $696.25, respectively, per patient per

day in the first quarter of 2011. During the quarter, high acuity

days of care were 8.2% of total days of care, 35 basis points lower

than the prior-year quarter.

In the first quarter of 2011, VITAS recorded a positive revenue

adjustment of $1.0 million due to the reversal of estimated

Medicare Cap billing limitations recorded in prior periods. This

compares with a similar adjustment of $1.7 million for reversal of

Medicare Cap recorded in the first quarter of 2010. The reversal of

these Medicare Cap liabilities relates predominantly to VITAS’

largest Medicare provider number.

Of VITAS’ 33 unique Medicare provider numbers, 31 provider

numbers, or 94%, have a Medicare Cap cushion of 15% or greater for

the current Medicare Cap period. One provider has a Medicare Cap of

5% and one small program has a modest Medicare Cap liability. VITAS

generated an aggregate Medicare Cap cushion of $223 million,

or 26%, during the trailing twelve-month period.

The first quarter of 2011 gross margin, excluding the impact of

Medicare Cap, was 21.5%, which is a decline of 74 basis points from

the first quarter of 2010. This decline in margin is a result of

increased costs related to the newly mandated physician visit for

recertification, expansion of our community liaison program as well

as costs associated with our continued expansion of inpatient

units.

Selling, general and administrative expense was $18.7 million in

the first quarter of 2011, which is an increase of 3.1% when

compared to the prior-year quarter. Adjusted EBITDA totaled

$33.2 million in the quarter, an increase of 1.4% over the

prior-year period. Adjusted EBITDA margin, excluding the impact

from Medicare Cap, was 13.7% in the quarter which was 30 basis

points below the prior-year quarter.

Roto-Rooter

Roto-Rooter’s plumbing and drain cleaning business generated

sales of $95.2 million for the first quarter of 2011, an increase

of 10.9% over the prior-year quarter. Roto-Rooter’s gross margin

was 44.2% in the quarter, a 103 basis point decline when compared

to the first quarter of 2010. Adjusted EBITDA in the first quarter

of 2011 totaled $15.6 million, an increase of 13.8%, and the

Adjusted EBITDA margin was 16.4% in the quarter, an increase of 42

basis points, when compared to the prior-year quarter.

Job count in the first quarter of 2011 increased 5.8% when

compared to the prior-year period. During the first quarter of

2011, total residential jobs increased 4.7%, as residential

plumbing jobs increased 5.4% and residential drain cleaning jobs

increased 4.5%, when compared to the first quarter of 2010.

Residential jobs represented 72% of total job count in the quarter.

Total commercial jobs increased 8.7%, with commercial

plumbing/excavation job count increasing 10.2% and commercial drain

cleaning increasing 8.1% when compared to the prior-year quarter.

The “All Other” residential and commercial job category increased

3.6%.

Roto-Rooter continues to have periodic discussions with existing

franchisees to acquire franchise territories. Management will be

highly disciplined in terms of valuation, risk assessment and

overall return on investment of any potential acquisition. The

timing or actual completion of any acquisition cannot be

predicted.

Chemed Consolidated Debt

and Cash Flows

Chemed had total debt of $161 million at March 31, 2011. This

debt is net of the discount taken as a result of convertible debt

accounting requirements. Excluding this discount, aggregate debt is

$187 million and is due in May 2014. Chemed’s total debt

equates to less than one times trailing twelve-month adjusted

EBITDA.

In March 2011 Chemed replaced its existing credit facility with

a new Credit Agreement. Terms of this Credit Agreement consist of a

five-year $350 million revolving credit facility. The interest rate

on this Credit Agreement has a floating rate that is currently

LIBOR plus 175 basis points. This Credit Agreement provides Chemed

with increased flexibility in terms of acquisitions, share

repurchases, dividends and other corporate needs. In addition, an

expansion feature is included in this facility that provides Chemed

the opportunity to increase its revolver and/or enter into term

loans for an additional $150 million. At March 31, 2011, this

credit facility had approximately $322 million of undrawn borrowing

capacity after deducting $28 million for letters of credit issued

under this facility to secure the Company’s workers’ compensation

insurance.

Capital expenditures for the first quarter of 2011 aggregated

$6.2 million and compared favorably to depreciation and

amortization during the same period of $7.3 million.

The Company increased its quarterly dividend per share in the

third quarter of 2010, from $0.12 per share to $0.14 per share. The

company purchased $96.3 million of treasury stock in the fourth

quarter of 2010 and an additional $21.8 million in the first

quarter of 2011. Total shares repurchased in the first quarter of

2011 totaled 341,513. Approximately $97.4 million is remaining

under Chemed’s previously announced share repurchase program.

Management will continually evaluate cash utilization alternatives,

including share repurchase, debt repurchase, acquisitions and

increased dividends to determine the most beneficial use of

available capital resources.

Guidance for

2011

VITAS expects to achieve full-year 2011 revenue growth, prior to

Medicare Cap, of 7% to 9%. Admissions in 2011 are estimated to

increase 5% to 7% and full-year Adjusted EBITDA margin, prior to

Medicare Cap, is estimated to be 15.3% to 16.3%. Effective

October 1, 2010, Medicare increased the average hospice

reimbursement rates by approximately 2.1%. Consistent with prior

years, our guidance assumes VITAS will incur an additional $3.7

million of estimated Medicare contractual billing limitations for

the remainder of 2011.

Roto-Rooter expects to achieve full-year 2011 revenue growth of

5% to 8%. The revenue estimate is a result of increased pricing of

approximately 3.0%, a favorable mix shift to higher revenue jobs,

with job count growth estimated at 0% to 3%. Adjusted EBITDA margin

for 2011 is estimated in the range of 16.5% to 17.5%.

Based upon the above metrics, an effective tax rate of 39.0% and

a full-year average diluted share count of 21.6 million, management

estimates 2011 earnings per diluted share, excluding non-cash

expense for stock options, the non-cash interest expense related to

the accounting for convertible debt and other items not indicative

of ongoing operations will be in the range of $4.65 to $4.85. This

compares to Chemed’s 2010 adjusted earnings per diluted share of

$4.17.

Conference

Call

Chemed will host a conference call and webcast at 10 a.m., ET,

on Tuesday, April 26, 2011, to discuss the Company's quarterly

results and to provide an update on its business. The dial-in

number for the conference call is (800) 510-0178 for U.S. and

Canadian participants and (617) 614-3450 for international

participants. The participant passcode is 43461477. A live webcast

of the call can be accessed on Chemed's website at www.chemed.com by clicking on Investor Relations

Home.

A taped replay of the conference call will be available

beginning approximately 24 hours after the call's conclusion. It

can be accessed by dialing (888) 286-8010 for U.S. and Canadian

callers and (617) 801-6888 for international callers and will be

available for one week following the live call. The replay passcode

is 97719698. An archived webcast will also be available at

www.chemed.com.

Chemed Corporation operates in the healthcare field through its

VITAS Healthcare Corporation subsidiary. VITAS provides daily

hospice services to approximately 13,000 patients with severe,

life-limiting illnesses. This type of care is focused on making the

terminally ill patient's final days as comfortable and pain-free as

possible.

Chemed operates in the residential and commercial plumbing and

drain cleaning industry under the brand name Roto-Rooter.

Roto-Rooter provides plumbing and drain service through

company-owned branches, independent contractors and franchisees in

the United States and Canada. Roto-Rooter also has licensed master

franchisees in Indonesia, Singapore, Japan, and the

Philippines.

This press release contains information about Chemed’s EBITDA,

Adjusted EBITDA and Adjusted Diluted EPS, which are not measures

derived in accordance with GAAP and which exclude components that

are important to understanding Chemed’s financial performance. In

reporting its operating results, Chemed provides EBITDA, Adjusted

EBITDA and Adjusted Diluted EPS measures to help investors and

others evaluate the Company’s operating results, compare its

operating performance with that of similar companies that have

different capital structures and evaluate its ability to meet its

future debt service, capital expenditures and working capital

requirements. Chemed’s management similarly uses EBITDA, Adjusted

EBITDA and Adjusted Diluted EPS to assist it in evaluating the

performance of the Company across fiscal periods and in assessing

how its performance compares to its peer companies. These measures

also help Chemed’s management to estimate the resources required to

meet Chemed’s future financial obligations and expenditures.

Chemed’s EBITDA, Adjusted EBITDA and Adjusted Diluted EPS should

not be considered in isolation or as a substitute for comparable

measures calculated and presented in accordance with GAAP. We

calculated Adjusted EBITDA Margin by dividing Adjusted EBITDA by

service revenue and sales. A reconciliation of Chemed’s net income

to its EBITDA, Adjusted EBITDA and Adjusted Diluted EPS is

presented in the tables following the text of this press

release.

Forward-Looking

Statements

Certain statements contained in this press release and the

accompanying tables are "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words "believe," "expect," "hope," "anticipate," "plan" and

similar expressions identify forward-looking statements, which

speak only as of the date the statement was made. Chemed does not

undertake and specifically disclaims any obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. These

statements are based on current expectations and assumptions and

involve various risks and uncertainties, which could cause Chemed's

actual results to differ from those expressed in such

forward-looking statements. These risks and uncertainties arise

from, among other things, possible changes in regulations governing

the hospice care or plumbing and drain cleaning industries;

periodic changes in reimbursement levels and procedures under

Medicare and Medicaid programs; difficulties predicting patient

length of stay and estimating potential Medicare reimbursement

obligations; challenges inherent in Chemed's growth strategy; the

current shortage of qualified nurses, other healthcare

professionals and licensed plumbing and drain cleaning technicians;

Chemed’s dependence on patient referral sources; and other factors

detailed under the caption "Description of Business by Segment" or

"Risk Factors" in Chemed’s most recent report on form 10-Q or 10-K

and its other filings with the Securities and Exchange Commission.

You are cautioned not to place undue reliance on such

forward-looking statements and there are no assurances that the

matters contained in such statements will be achieved.

CHEMED CORPORATION AND SUBSIDIARY COMPANIES

CONSOLIDATED STATEMENT OF INCOME (in thousands, except per

share data)(unaudited)

Three Months Ended March 31,

2011 2010

Service revenues and sales

$ 330,918 $ 308,813

Cost of services provided and goods sold

237,458

219,137 Selling, general and administrative expenses (aa)

55,654 48,538 Depreciation

6,288 5,469 Amortization

970 1,224 Total costs and

expenses

300,370 274,368 Income

from operations

30,548 34,445 Interest expense

(3,244

) (2,952 ) Other income/(expense)--net (bb)

2,102 186 Income before income taxes

29,406 31,679 Income taxes

(11,305 )

(12,321 ) Net income

$ 18,101 $ 19,358

Earnings Per Share Net income

$

0.86 $ 0.86 Average number of shares

outstanding

21,055 22,593

Diluted Earnings Per Share Net income

$ 0.84

$ 0.84 Average number of shares outstanding

21,568 23,021 (aa)

Selling, general and administrative ("SG&A") expenses comprise

(in thousands): Three Months Ended March 31,

2011 2010

SG&A expenses before long-term incentive compensation and the

impact of market value gains of deferred compensation plans

$ 50,578 $ 48,350 Long-term incentive compensation

3,012 - Market value gains on assets held in deferred

compensation trusts

2,064 188

Total SG&A expenses

$ 55,654 $ 48,538

(bb) Other income/(expense)--net comprises (in

thousands): Three Months Ended March 31,

2011 2010 Market

value on assets held in deferred compensation trusts

$

2,064 $ 188 Interest income

61 75 Loss on disposal of

property and equipment

(21 ) (94 ) Other

(2 ) 17 Total other

income/(expense)--net

$ 2,102 $ 186

CHEMED CORPORATION AND SUBSIDIARY COMPANIES

CONSOLIDATED BALANCE SHEET (in thousands, except per share

data)(unaudited)

March 31,

2011 2010

Assets Current assets Cash and cash equivalents

$

59,745 $ 112,119 Accounts receivable less allowances

92,912 87,412 Inventories

7,967 7,609 Current

deferred income taxes

13,352 15,008 Prepaid expenses

9,538 9,886 Total current assets

183,514 232,034 Investments of deferred compensation plans

held in trust

31,897 25,925 Properties and equipment, at

cost less accumulated depreciation

79,146 75,189

Identifiable intangible assets less accumulated amortization

56,061 57,239 Goodwill

458,434 450,149 Other assets

13,676 13,692 Total Assets

$ 822,728 $ 854,228

Liabilities Current liabilities Accounts payable

$

38,249 $ 49,844 Income taxes

8,250 12,150 Accrued

insurance

35,511 34,478 Accrued compensation

39,469

37,613 Other current liabilities

14,457

12,439 Total current liabilities

135,936 146,524

Deferred income taxes

24,164 24,969 Long-term debt

161,054 153,853 Deferred compensation liabilities

31,437 25,522 Other liabilities

6,267

5,374 Total Liabilities

358,858

356,242

Stockholders' Equity Capital stock

30,709 30,087 Paid-in capital

379,167 343,967

Retained earnings

488,439 419,985 Treasury stock, at cost

(436,427 ) (298,031 ) Deferred compensation payable

in Company stock

1,982 1,978

Total Stockholders' Equity

463,870

497,986 Total Liabilities and Stockholders' Equity

$

822,728 $ 854,228

CHEMED CORPORATION

AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENT OF CASH

FLOWS (in thousands)(unaudited)

Three

Months Ended March 31,

2011 2010

Cash Flows from

Operating Activities Net income

$ 18,101 $ 19,358

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

7,258 6,693 Noncash long-term

incentive compensation

2,595 - Provision for uncollectible

accounts receivable

2,111 2,472 Stock option expense

1,933 2,051 Amortization of discount on convertible notes

1,846 1,726 Provision for deferred income taxes

814

(2,282 ) Amortization of debt issuance costs

246 157

Changes in operating assets and

liabilities, excluding amounts acquired in business

combinations:

Decrease/(increase) in accounts receivable

17,923 (36,445 )

Increase in inventories

(239 ) (66 ) Decrease in

prepaid expenses

747 502 Decrease in accounts payable and

other current liabilities

(12,137 ) (381 ) Increase

in income taxes

9,739 13,955 Increase in other assets

(3,667 ) (1,672 ) Increase in other liabilities

3,227 2,724 Excess tax benefit on share-based compensation

(1,895 ) (1,135 ) Other uses

(61

) (6 ) Net cash provided by operating activities

48,541 7,651

Cash Flows from

Investing Activities Capital expenditures

(6,173

) (5,424 )

Proceeds from sales of property and

equipment

33 27 Other uses

(142 ) (157 )

Net cash used by investing activities

(6,282 )

(5,554 )

Cash Flows from Financing Activities

Purchases of treasury stock

(24,260 ) (2,516 )

Decrease in cash overdrafts payable

(8,310 ) (1,216 )

Proceeds from issuance of capital

stock

3,647 2,672 Dividends paid

(2,977 ) (2,739 )

Debt issuance costs

(2,708 ) - Excess tax benefit on

share-based compensation

1,895 1,135 Other sources

282 270 Net cash used by financing

activities

(32,431 ) (2,394 )

Increase/(Decrease) in Cash and Cash Equivalents

9,828 (297 ) Cash and cash equivalents at beginning of year

49,917 112,416 Cash and cash

equivalents at end of period

$ 59,745 $

112,119

CHEMED CORPORATION AND SUBSIDIARY

COMPANIES CONSOLIDATING STATEMENT OF INCOME FOR THE

THREE MONTHS ENDED MARCH 31, 2011 AND 2010 (in

thousands)(unaudited)

Chemed VITAS Roto-Rooter

Corporate Consolidated

2011

Service revenues and sales $ 235,673 $ 95,245 $ -

$ 330,918 Cost of services provided and goods sold

184,300 53,158 - 237,458 Selling, general and administrative

expenses (a) 18,711 26,740 10,203 55,654 Depreciation 4,167 1,984

137 6,288 Amortization 483 132

355 970 Total costs and expenses

207,661 82,014 10,695

300,370 Income/(loss) from operations 28,012 13,231 (10,695

) 30,548 Interest expense (a) (48 ) (64 ) (3,132 ) (3,244 )

Intercompany interest income/(expense) 1,213 639 (1,852 ) -

Other income/(expense)—net

30 (9 ) 2,081 2,102

Income/(loss) before income taxes 29,207 13,797 (13,598 )

29,406 Income taxes (a) (11,082 ) (5,286 )

5,063 (11,305 ) Net income/(loss) $ 18,125 $

8,511 $ (8,535 ) $ 18,101

2010

Service revenues and sales $ 222,940 $ 85,873 $ -

$ 308,813 Cost of services provided and goods sold

172,093 47,044 - 219,137 Selling, general and administrative

expenses (b) 18,145 24,758 5,635 48,538 Depreciation 3,485 1,951 33

5,469 Amortization 771 123 330

1,224 Total costs and expenses 194,494

73,876 5,998 274,368

Income/(loss) from operations 28,446 11,997 (5,998 ) 34,445

Interest expense (b) (32 ) (68 ) (2,852 ) (2,952 ) Intercompany

interest income/(expense) 1,289 702 (1,991 ) -

Other income/(expense)—net (b)

(39 ) 10 215 186

Income/(loss) before income taxes 29,664 12,641 (10,626 ) 31,679

Income taxes (b) (11,226 ) (4,828 ) 3,733

(12,321 ) Net income/(loss) $ 18,438 $ 7,813

$ (6,893 ) $ 19,358 The "Footnotes to

Financial Statements" are integral parts of this financial

information.

CHEMED CORPORATION AND SUBSIDIARY

COMPANIES CONSOLIDATING SUMMARY OF EBITDA FOR THE

THREE MONTHS ENDED MARCH 31, 2011 AND 2010 (in

thousands)(unaudited)

Chemed VITAS

Roto-Rooter Corporate Consolidated 2011

Net income/(loss) $ 18,125 $ 8,511 $ (8,535 ) $ 18,101

Add/(deduct): Interest expense 48 64 3,132 3,244 Income taxes

11,082 5,286 (5,063 ) 11,305 Depreciation 4,167 1,984 137 6,288

Amortization 483 132 355

970 EBITDA 33,905 15,977 (9,974 ) 39,908

Add/(deduct): Legal expenses of OIG investigation 511 - - 511

Acquisition expenses 64 6 - 70 Expenses of class action litigation

- 495 - 495 Long-term incentive compensation - - 3,012 3,012 Stock

option expense - - 1,933 1,933 Advertising cost adjustment (c) -

(250 ) - (250 ) Interest income (37 ) (7 ) (17 ) (61 ) Intercompany

interest income/(expense) (1,213 ) (639 )

1,852 - Adjusted EBITDA $ 33,230 $

15,582 $ (3,194 ) $ 45,618 2010 Net

income/(loss) $ 18,438 $ 7,813 $ (6,893 ) $ 19,358 Add/(deduct):

Interest expense 32 68 2,852 2,952 Income taxes 11,226 4,828 (3,733

) 12,321 Depreciation 3,485 1,951 33 5,469 Amortization 771

123 330 1,224

EBITDA 33,952 14,783 (7,411 ) 41,324 Add/(deduct): Legal expenses

of OIG investigation 160 - - 160 Stock option expense - - 2,051

2,051 Advertising cost adjustment (c) - (389 ) - (389 ) Interest

income (45 ) (2 ) (28 ) (75 ) Intercompany interest

income/(expense) (1,289 ) (702 ) 1,991

- Adjusted EBITDA $ 32,778 $ 13,690 $

(3,397 ) $ 43,071 The "Footnotes to Financial

Statements" are integral parts of this financial information.

CHEMED CORPORATION AND SUBSIDIARY COMPANIES

RECONCILIATION OF ADJUSTED NET INCOME (in thousands,

except per share data)(unaudited)

Three Months Ended March 31,

2011 2010 Net income as reported

$ 18,101 $

19,358 Add/(deduct): After-tax cost of long-term incentive

compensation

1,880 - After-tax stock option expense

1,223 1,298

After-tax additional interest expense

resulting from the change in accounting for the conversion feature

of the convertible notes

1,132 1,047 After-tax cost of legal expenses of OIG

investigation

317 99 After-tax cost of expenses of class

action litigation

301 - After-tax cost of acquisition

expenses

44 - Adjusted net income

$

22,998 $ 21,802 Earnings Per Share As Reported

Net income

$ 0.86 $ 0.86 Average number of shares

outstanding

21,055 22,593 Diluted Earnings Per

Share As Reported Net income

$ 0.84 $ 0.84 Average

number of shares outstanding

21,568 23,021

Adjusted Earnings Per Share Net income

$

1.09 $ 0.96 Average number of shares outstanding

21,055 22,593 Adjusted Diluted Earnings Per Share Net

income

$ 1.07 $ 0.95 Average number of shares

outstanding

21,568 23,021 The

"Footnotes to Financial Statements" are integral parts of this

financial information.

CHEMED CORPORATION AND SUBSIDIARY

COMPANIES OPERATING STATISTICS FOR VITAS SEGMENT

(unaudited)

Three Months Ended March 31, OPERATING STATISTICS

2011 2010

Net revenue ($000) (d) Homecare

$ 168,652 $ 157,226

Inpatient

27,386 26,291 Continuous care

38,625

37,674 Total before Medicare cap allowance

$

234,663 $ 221,191 Medicare cap allowance

1,010

1,749 Total

$ 235,673 $ 222,940

Net revenue as a percent of total before

Medicare cap allowance

Homecare

71.8 % 71.1 % Inpatient

11.7 11.9

Continuous care

16.5 17.0 Total before

Medicare cap allowance

100.0 100.0 Medicare cap allowance

0.4 0.8 Total

100.4 %

100.8 % Average daily census ("ADC") (days) Homecare

8,833 8,112 Nursing home

3,033 3,162

Routine homecare

11,866 11,274 Inpatient

450 442

Continuous care

603 606 Total

12,919 12,322 Total Admissions

15,798

14,844 Total Discharges

15,552 14,461 Average length of stay

(days)

78.9 75.8 Median length of stay (days)

13.0

13.0 ADC by major diagnosis Neurological

34.0 % 32.6

% Cancer

17.9 18.8 Cardio

11.8 11.9 Respiratory

6.7 6.6 Other

29.6 30.1 Total

100.0 % 100.0 % Admissions by major diagnosis

Neurological

19.5 % 18.6 % Cancer

31.7 33.5

Cardio

11.1 11.6 Respiratory

9.1 8.4 Other

28.6 27.9 Total

100.0 %

100.0 % Direct patient care margins (e) Routine homecare

51.5 % 51.3 % Inpatient

13.0 15.2 Continuous

care

20.5 20.7 Homecare margin drivers (dollars per patient

day) Labor costs

$ 55.38 $ 53.93 Drug costs

7.94 7.77 Home medical equipment

5.94 6.94 Medical

supplies

2.76 2.44 Inpatient margin drivers (dollars per

patient day) Labor costs

$ 306.66 $ 286.81 Continuous

care margin drivers (dollars per patient day) Labor costs

$

544.16 $ 526.47 Bad debt expense as a percent of revenues

0.6 % 1.0 % Accounts receivable -- Days of revenue

outstanding- excluding unapplied Medicare payments

55.3 43.4

Days of revenue outstanding- including unapplied Medicare payments

29.1 29.2 The "Footnotes to Financial Statements" are

integral parts of this financial information.

CHEMED

CORPORATION AND SUBSIDIARY COMPANIES FOOTNOTES TO FINANCIAL

STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2011 AND

2010 (unaudited)

(a)

Included in the results of operations for

the three months ended March 31, 2011, are the following

significant credits/(charges) which may not be indicative of

ongoing operations (in thousands):

VITAS

Roto-Rooter

Corporate Total Selling,

general and administrative expenses Legal expenses of OIG

investigation $ (511 ) $ - $ - $ (511 ) Acquisition expenses (64 )

(6 ) - (70 ) Expenses of class action litigation - (495 ) - (495 )

Long-term incentive compensation - - (3,012 ) (3,012 ) Stock option

expense - - (1,933 ) (1,933 ) Interest expense

Additional interest expense resulting from

the change in accounting for the conversion feature of the

convertible notes

- -

(1,790 )

(1,790 ) Pretax impact on earnings (575 )

(501 ) (6,735 ) (7,811 ) Income tax benefit/(charge) on the above

218 196

2,500 2,914

After-tax impact on earnings

$ (357

) $ (305 )

$ (4,235 ) $

(4,897 ) (b)

Included in the results of operations for

the three months ended March 31, 2010, are the following

significant credits/(charges) which may not be indicative of

ongoing operations (in thousands):

VITAS Corporate

Total Selling, general and administrative

expenses Legal expenses of OIG investigation $ (160 ) $ - $ (160 )

Stock option expense - (2,051 ) (2,051 ) Interest expense

Additional interest expense resulting from

the change in accounting for the conversion feature of the

convertible notes

- (1,655

) (1,655 ) Pretax

impact on earnings (160 ) (3,706 ) (3,866 ) Income tax

benefit/(charge) on the above

61

1,361 1,422

After-tax impact on earnings

$ (99

) $ (2,345 )

$ (2,444 ) (c)

Under Generally Accepted Accounting

Principles ("GAAP"), the Roto-Rooter segment expenses all

advertising, including the cost of telephone directories,

immediately upon the initial release of the advertising. Telephone

directories are generally in circulation 12 months. If a directory

is in circulation for a time period greater or less than 12 months,

the publisher adjusts the directory billing for the change in

billing period. The timing of when a telephone directory is

published can and does fluctuate significantly on a quarterly

basis. This "direct expensing" results in significant fluctuations

in quarterly advertising expense. In the first quarters of 2011 and

2010, GAAP advertising expense for Roto-Rooter totaled $5,918,000

and $5,735,000, respectively. If the expense of the telephone

directories were spread over the periods they are in circulation,

advertising expense for the first quarters of 2011 and 2010 would

total $6,168,000 and $6,124,000, respectively.

(d)

VITAS has 6 large (greater than 450 ADC),

21 medium (greater than 200 but less than 450 ADC) and 26 small

(less than 200 ADC) hospice programs. There is one program as of

March 31, 2011, with Medicare cap cushion of less than 10% for the

first six months of the 2011 Medicare cap year. Additionally, one

small program has a projected Medicare cap liability of $298,000

for the 2011 measurement period.

(e) Amounts exclude indirect patient care and administrative

costs, as well as Medicare Cap billing limitation.

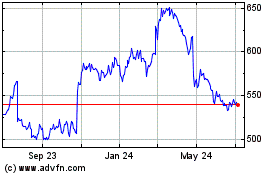

Chemed (NYSE:CHE)

Historical Stock Chart

From Apr 2024 to May 2024

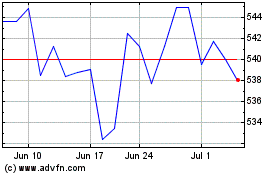

Chemed (NYSE:CHE)

Historical Stock Chart

From May 2023 to May 2024