SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2023

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Indemnity Policy

Area responsible for issuing

Vice Presidency of Governance, Risks and Compliance

Target Audience

Employees, managers, executives, officers and directors of Eletrobras.

Approval

Resolution 192/2023, of 11/24/2023, of the

Board of Directors of Eletrobras.

Repository

Eletrobras policies can be found on the website:

https://eletrobras.com/pt/Paginas/Estatuto-Politicas-e-Manuais.aspx

Copyright and confidentiality

The contents of this document may not be reproduced

without proper authorization. All rights belong to Eletrobras.

Maximum revision period: 5 years.

Table of Contents

| Introduction |

4 |

| 1 Objective |

5 |

| 2 References |

5 |

| 3 Guidelines |

5 |

| 4 Responsibilities |

9 |

| 5 Concepts |

13 |

| 6 General Provisions |

14 |

| 7 Appendices |

16 |

Introduction

This policy aims to attract and retain qualified

employees, collaborators, administrators and executives, considering that:

| a) | the Company carries out its

activities in a regulated environment of high complexity and responsibility, and is subject to multiple national and foreign regulators,

including the Brazilian Securities and Exchange Commission (“CVM”), the National Electric Energy Agency (ANEEL) and the U.S.

Securities and Exchange Commission (SEC), in addition to the listing regulations of B3 S.A. – Brasil, Bolsa, Balcão (“B3”),

the New York Stock Exchange (NYSE) and other places where the company has securities listed for trading; |

| b) | due to the above, the exercise

of the functions assigned to the beneficiaries implies the assumption, at high levels, of risks and responsibilities that may entail personal

obligations or penalties to the beneficiaries, including on their assets, as a result of regular management acts; and |

| c) | the protection offered by Seguros

D&O (D&O Insurance), in isolation, may not be sufficient to provide security for the Company's employees, administrators, collaborators

and executives to perform their duties, subject to the premises of CVM Guidance Opinion No. 38/2018 and the guidelines defined in Eletrobras'

Articles of Incorporation. |

In view of the premises described above, it

is necessary to create a formal and standardized regulation for Eletrobras companies, both for the use of the Indemnity Contract, whose

draft is an integral part of this policy, in the form of Appendix I, and for the activation of D&O Insurance.

1 Objective

Establish guidelines and responsibilities

for the assumption, by CENTRAIS ELÉTRICAS BRASILEIRAS S.A. – ELETROBRAS ("Company" or "Eletrobras"),

of an obligation to indemnify and hold harmless the beneficiaries who enter into a Term of Adhesion to the Indemnity Contract, for costs

and expenses incurred in claims that seek to hold them responsible for acts performed in the regular exercise of their functions in the

Company, in accordance with the provisions of the Company's Articles of Incorporation.

2 References

2.1 Eletrobras' Articles

of Incorporation.

2.2 CVM Guidance Opinion

No. 38/2018.

2.3 Rule

10D-1 promulgated pursuant to the Exchange Act ("Rule 10D-1") and Section 303A.14 of the New York Stock Exchange Listed Companies

Manual.

3 Guidelines

3.1 General

3.1.1

The obligation to indemnify shall apply in relation to the beneficiary's performance in the Company, in the Company's controlled entities

and in other entities to which the Company may appoint him/her for a given position.

3.1.2

The assumption of the obligation to indemnify and maintain indemnity provided for in this policy and in the Indemnity Contract is complementary

to the coverage of the D&O Insurance.

3.1.3 The

expenses arising from acts of the beneficiaries practiced shall not be subject to indemnification, among others to be provided for in

the Indemnity Contracts:

| a) | outside the exercise of its

attributions or powers; |

| b) | with bad faith, willful misconduct, gross negligence or

fraud; |

| c) | in its own interest or that

of third parties, to the detriment of the Company's corporate interest. |

3.1.4 The

following shall also not be subject to indemnity: (i) indemnities arising from a social action provided for in article 159 of Law No.

6.404/1976, or compensation for losses referred to in article 11, paragraph 5, item II, of Law No. 6.385/1976; and (ii) any indemnity

requests by Eletrobras and/or its subsidiaries against the beneficiary, the purpose of which is the recovery of a remuneration incentive

erroneously granted to the beneficiary, under the terms of applicable US legislation, notably Rule 10D-1 and Section 303A.14 of the New

York Stock Exchange Listed Companies Manual.

3.1.5 The maximum and global indemnity limit

as a result of the Indemnity Contracts under this policy is R$500 million, adjusted annually by the Broad National Consumer Price Index

(IPCA), as of the date of approval of this policy.

3.2 Beneficiaries

3.2.1 Under

the terms of Eletrobras' Articles of Incorporation, the following are eligible for beneficiaries: (a) members of the Board of Directors,

Fiscal Council, Executive Board, Advisory Committees of the Company or its wholly-owned subsidiaries; (b) employees and collaborators

holding management positions of the Company or its wholly-owned subsidiaries; and (c) employees, collaborators and agents of the Company

or its wholly-owned subsidiaries who legally act by delegation of the Company's managers or its wholly-owned subsidiaries.

3.2.2 It

will be up to the Board of Directors, subject to the above guidelines, to define the positions that will be covered with the benefit,

having previously heard the People Committee (CPES) and the Legal Affairs Support Committee (CAAJ).

3.2.2.1 Only

the occupants of the positions selected by the Board of Directors, who effectively adhere to the Indemnity Agreement, by signing a Term

of Adhesion with the Company or its wholly-owned subsidiaries, will be classified as beneficiaries and, consequently, will be entitled

to the right to indemnification and the right to indemnity under this policy.

3.2.3

Once the positions have been defined, the Company shall enter into the Terms of Adhesion with the managers, employees, collaborators and

agents who hold the respective positions, as well as with their eventual successors (who, after the execution of the respective Term of

Adhesion, will be considered beneficiaries for the purposes of this policy), unless otherwise stated by the Board of Directors of Eletrobras.

3.2.4

The Company may treat beneficiaries who are in similar or even equal positions or situations differently, including with regard to their

hierarchical level in the Company's organizational structure, and is not obliged, by any rule of equality or analogy, to extend to everyone

the conditions it deems applicable only to one or more of them.

3.3 Indemnity Requests

3.3.1 Beneficiaries

who wish to receive the benefit in relation to a certain claim that seeks to hold them responsible for acts practiced in the regular exercise

of their functions in the Company (or other positions that the beneficiary assumes in subsidiaries of the Company or other entities for

which the Company has indicated them for a certain position) and that involves or may involve conviction of the beneficiary to any penalty,

fine or constriction, may submit to the Company requests for indemnification, advance and/or reimbursement of costs and expenses related

to their defense or manifestation (such as testimonies or clarifications of any nature) in relation to the claim in question (“Indemnity

Request” or “Request”).

3.3.2

The Requests must be sent in the form and terms provided for in the Indemnity Contract simultaneously with (i) Vice Presidency of Finance

and Investor Relations, (ii) Legal Vice Presidency and (iii) Vice Presidency of Governance, Risks and Compliance, together with

all documents and information available to the beneficiary related to the claim (including a copy of the letter, summons, notification,

assessment or summons received, and other documents that are available), being certain that the Company may request, from the beneficiary,

any supplements of information and documents, which must be presented to the Company within the period indicated by it.

3.4 Activation

of D&O Insurance

3.4.1 Upon

receiving an Indemnity Request, the Company shall trigger, as a first measure, the D&O Insurance to guarantee the fulfillment of the

indemnity obligations established in this policy and the financial security of the Company.

3.4.2 In

cases where the claim is covered by the D&O Insurance, the Vice Presidency of Finance and Investor Relations shall adopt the necessary

measures with the insurer to obtain the coverage related to the claim, as provided for in the current D&O Insurance policy. The Company

will provide the beneficiary with information and guidance on the procedures to be followed, in accordance with the current D&O Insurance

policy, and may request information on the claims.

3.4.2.1 The beneficiary, in turn, must provide

the information requested by the Company to obtain coverage related to the claim and will submit all additional documents requested from

it.

3.4.3 All

procedures related to payment and/or reimbursement under the D&O Insurance must comply with the provisions of the policy in force

and with the procedures established in this policy. The beneficiary will lose the benefits provided for in the D&O Insurance, as well

as in this policy and in the Indemnity Contract, if, by their actions or omissions, they impair or compromise the defense of the Company's

claim or insurance coverage under the D&O Insurance.

3.4.4 Both

the Company and the beneficiary must always seek the approach in the best interest of the Company, without compromising the reimbursements

and/or advances that the Company may make.

3.4.5 Whenever

there is coverage by the insurer responsible for the D&O Insurance, there will be no coverage by the Indemnity Contract, except if

the amount to be indemnified exceeds the amount of the coverage, if the indemnified amount is less than the amount of the D&O Insurance

deductible, or in the event that the Company chooses to anticipate expenses, as provided for in this policy, respecting the obligations

assumed by the beneficiary in the subrogation clause provided for in the Indemnity Contract.

3.5 Indemnity

Contract

3.5.1 The

Company shall analyze whether the Indemnity Request is covered by the Indemnity Contract in the following cases: (a) negative by the insurer

responsible for the D&O Insurance; (b) absence of response from the insurer about the coverage in a reasonable time to enable the

processing of the Request in compliance with the term in progress to comply with the obligation or exercise the right of defense; (c)

need to advance expenses to ensure the exercise of the beneficiary's broad defense, pursuant to sub-item 3.7.3 below; (d) amount to be

indemnified less than the amount of the deductible provided for in the respective D&O Insurance; or (e) amount to be indemnified exceeds

the amount of the D&O Insurance coverage.

3.6 Analysis

of Indemnity Requests

3.6.1 Upon

receipt of a Request, the resolution on the granting of the indemnity will be the responsibility of the Legal Vice Presidency and the

Vice Presidency of Governance, Risks and Compliance, observing that, in the cases of sub-item 4.2.1.4, the admissibility decision must

be submitted to the review of the Board of Directors, having previously heard CAAJ in the form of sub-item 4.3.

3.6.2 The

Request that is inadmissible by the Legal Vice Presidency and Vice Presidency of Governance, Risks and Compliance will not be submitted

for review by the Board of Directors, even if it is any of the cases of sub-item 4.2.1.4, without prejudice to the provisions of sub-item

4.2.1.10 ofthis policy.

3.6.3 The

Company may, whenever it deems necessary, due to the circumstance and/or complexity of the claim or due to any conflicting interest of

the Legal Vice President, coordinate the hiring of independent, impartial and unblemished external legal counsel, to give an opinion on

the admissibility of the Indemnity Request.

3.7 Company

Decisions

3.7.1 When

analyzing the Indemnity Request, the Company must decide: (a) whether the claim in question is subject to indemnity; and (b) on the incidence

of any of the causes of exclusion of indemnity, including with regard to the timeliness of sending the Request. The decision will initially

be made based on the factual and evidentiary set available at the time of the resolution, and the Company may request clarification, information

and the presentation of additional documents from the respective beneficiary.

3.7.2 Any

and all decisions of the Company on Indemnity Requests, regardless of the deliberation body, shall be provisional and, at the sole discretion

of the Company, may be reviewed or revoked at any time, by means of a new judgment of value in the light of the existing factual and evidentiary

set, including after the end of the claim.

3.7.2.1 Decisions

within the scope of the claim will not bind the Company's decisions nor will they constitute unequivocal evidence of characterization

or mischaracterization of indemnity exclusions, the evaluation of which must be made by the Company, in a discretionary and duly substantiated

manner.

3.7.3 The

Company may partially and provisionally grant the indemnity related to the claim to advance expenses to its beneficiaries, regardless

of the activation and/or coverage of the D&O Insurance, in order to avoid the perishing of the beneficiary's material right due to

the non-exercise of the ample defense with the claim.

3.7.3.1 If the Company decides to advance

expenses, the beneficiary shall be obliged to return the amounts advanced in cases where, subsequently (including after a final decision

within the scope of the claim), the Company understands that it has been proven that the act performed by the beneficiary was not subject

to indemnification under the terms of this policy, the D&O Insurance or the respective Indemnity Contract.

3.8 Reimbursement

Requests

3.8.1 Once

the indemnity has been granted, even on a provisional basis, if the beneficiary has directly borne any of the costs and expenses indemnifiable

by the Company, it may request the respective reimbursement, delivering to the Company copies of proof of payment of expenses or collection

documents that demonstrate the payment of the respective costs and guarantee deposits, subject to the terms of the Indemnity Contract

and this policy.

3.8.2 Reimbursement

may only be made if the amount of the costs and expenses requested are reasonable, as assessed by the Company, and comply with the Company's

standards and policies applied in similar cases.

3.9 Conflict Situations

3.9.1 The

rules provided for in this sub-item shall be adopted when more than half of the members of the Board of Directors are involved in the

same claim or in claims related to the same taxable event and/or origin, presented jointly in a single Request or not.

3.9.2 For the Requests submitted to the Board

of Directors of Eletrobras pursuant to sub-item 4.2.1.4 and involving the conflict situations indicated in sub-item 3.9.1 above, the Board

of Directors shall establish a Temporary Indemnity Committee composed of three independent

expert jurists of notorious knowledge and unblemished

reputation, so that said collegiate body may resolve, by majority of its members, on the admissibility of Requests related to conflict

situations.

3.9.3 The

selection of the lawyers who will compose the Temporary Indemnity Committee will be the responsibility of the Legal Vice Presidency, unless

said Vice Presidency has a conflicting interest in relation to the Request or the claim, in which case the choice will be up to the Board

of Directors, after hearing CAAJ in advance.

3.9.4 In cases where there is a need to establish

a Temporary Indemnity Committee, the Company may resolve, on a precautionary basis and aiming at the non-perishment of the right to the

timely exercise of ample defense, for the partial and provisional granting of the indemnity, in order to authorize the hiring, by the

Company, of a law firm to promote the defense of the beneficiaries who submit the Indemnity Request, which must carry out a prior assessment

of admissibility regarding the possible existence of a conflict of interest between the beneficiaries and the Company. In pronouncing

the office for the compatibility of the interests of the beneficiaries and the Company, the office will promote the joint defense of the

beneficiaries, and the Temporary Indemnity Committee, as soon as it is installed, will be responsible for assessing any specific claims

of beneficiaries, including any separate hiring of various professionals to sponsor their defenses.

3.9.5 The CAAJ, the Vice Presidency of Governance,

Risks and Compliance and the Legal Vice Presidency will provide operational support to the operation of the Temporary Indemnity Committee.

3.9.6 For the purposes of this policy, an independent

expert will not be considered to be one who, under the terms of B3's Novo Mercado regulations, cannot be classified as an independent

director of the Company.

4 Responsibilities

4.1 Beneficiary

4.1.1 Without prejudice to other obligations

under this policy and the Indemnity Contract, as a condition to any indemnity under this policy, the beneficiary shall:

4.1.1.1 Be

fully compliant with all obligations and responsibilities attributed to it in this policy, in the Indemnity Contract, in the respective

Term of Adhesion, in the other contracts that the beneficiary enters into with the Company (including employment or services agreement),

in the Articles of Incorporation of Eletrobras and in the other regulations issued by the Company.

4.1.1.2 Immediately transfer to the Company

any amount that may be refunded directly to the beneficiary or any person related to it, if the Company makes the payment of any amounts

to the beneficiary under the terms of this policy, agreeing to request, in a timely manner, any and all requests for refund of amounts

that may be requested by the Company and/or its advisors, delivering a copy of the respective Requests.

4.1.1.3 Keep

confidential all information related to the Company's business of which it is aware, as well as any information related to an indemnifiable

event, under the terms of this policy, including related to the claim and its respective defense.

4.1.1.4 Submit

to the company the justifications and documents evidencing the reasonableness of the expenses that will be subject to anticipation and/or

reimbursement, including legal services.

4.2 Board of Directors

4.2.1 Without

prejudice to other duties provided for in this policy, the Board of Directors shall:

4.2.1.1 Resolve

on changes or revocation of this policy and its appendices, as well as ensure its proper compliance, decide on omitted cases, criteria

and exceptional treatments, and resolve on its interpretation, integration and application.

4.2.1.2 Resolve

on specific terms and conditions of the terms of adhesion and decide on any amendments to the Indemnity Contracts.

4.2.1.3 Define

the positions that will be eligible for the benefit, after recommendation of the CPES and opinion of CAAJ.

4.2.1.4 Resolve

on the admissibility of Indemnity Requests previously approved pursuant to sub-item 3.6, when:

| a) | presented to the Company by

members of the Board of Directors, Fiscal Council, Executive Board and/or Advisory Committees of the Company, in all cases, who are in

the exercise of their mandates; |

| b) | may imply payment, by the Company,

of a benefit in an amount greater than R$18 million; |

| c) | relating to the claim that

deals with an act, commissive or omissive, fact or allegation related to the violation of the anti-corruption law and/or involving environmental

crime. |

4.2.1.5 Approve

the execution of agreements in claims that are the subject of Requests approved under the terms of sub-item 4.2.1.4.

4.2.1.6 Ensure

that the Company's procedures ensure that decisions are taken independently and in accordance with the Company's interest, including the

interest of attracting and retaining qualified and capable professionals in its board of directors and employees.

4.2.1.7 In

the event of filing an Indemnity Application in relation to which a member of the Board of Directors has a conflicting interest, assess

the situation in order to ensure the removal of the respective director from the related decision-making process.

4.2.1.8 Take

steps to ensure that any other beneficiaries who are in a situation of conflict of interest are excluded from the analysis of their respective

Indemnity Requests.

4.2.1.9 Choose

the independent external lawyers who will compose any Temporary Indemnity Committee, if the Legal Vice Presidency has a conflicting interest

with the analysis of the Request.

4.2.1.10 Review, at its discretion, any decisions

and statements made by members of the Executive Board of Eletrobras or members of CAAJ or CPES in the application of this policy and in

the exercise of the Company's rights under the Indemnity Contracts, regardless of policy change.

4.3 Legal

Affairs Support Committee (CAAJ)

4.3.1 Without prejudice to other duties provided

for in this policy, CAAJ shall:

4.3.1.1 Give

an opinion to the Board of Directors on the selection of positions whose members will be able to enter into an Indemnity Contract with

the Company.

4.3.1.2 Give an opinion to the Board of Directors

on the admissibility of Indemnity Requests submitted by beneficiaries pursuant to sub-item 4.2.1.4.

4.3.1.3 To advise the Board of Directors on

the conclusion of settlements in claims that are the subject of Requests submitted to the Board of Directors, in the form of the sub-item

4.2.1.5.

4.3.1.4 Ensure that the Company's procedures

ensure that decisions are taken independently and in accordance with the Company's interest, including the interest of attracting and

retaining qualified and capable professionals in its board of directors and employees.

4.3.1.5 Evaluate

and recommend to the Board of Directors the need to hire independent, impartial and unblemished external legal counsel to analyze potential

cases of conflict of interest indicated in this policy, including the related Indemnity Requests.

4.3.1.6 Supervise

the strategy for conducting the defense of claims subject to indemnity, together with the lawyers and/or law firm hired by the Company,

and evaluate any requests for authorization for the beneficiary to directly conduct its defense, provided that it is verified that such

measure does not conflict with the Company's interests.

4.3.1.7 Monitor,

with the support of the Legal Vice Presidency, the progress of the claims and periodically report to the Board of Directors.

4.3.1.8 Give an opinion to the Board of Directors

on the issuance of supplementary rules for the indemnity procedure provided for in this policy.

4.4 People

Committee (CPES)

4.4.1 It

will be up to the CPES to recommend the positions whose members will be able to enter into, with the Company, an Indemnity Contract.

4.5 Vice

Presidency of Governance, Risks and Compliance

4.5.1 The Vice Presidency

of Governance, Risks and Compliance will be responsible for:

4.5.1.1 Resolve,

together with the Legal Vice Presidency, on the admissibility of Indemnity Requests presented pursuant to sub-item 3.3.

4.5.1.2 Instruct

the supporting material of the Indemnity Requests aiming at its submission to CAAJ and the Board of Directors for consideration and deliberation.

4.5.1.3 Interact

with the other areas of the company for adequate instruction of the support material for the analysis of the Indemnity Requests.

4.5.1.4 Communicate

to the competent areas regarding the decisions taken by the Company's governance bodies within the scope of this policy.

4.6 Legal

Vice Presidency

4.6.1 The Legal Vice Presidency shall:

4.6.1.1 Resolve,

together with the Vice Presidency of Governance, Risks and Compliance, on the admissibility of Indemnity Requests presented pursuant to

sub-item 3.3.

4.6.1.2 Present

its preliminary legal analysis on the admissibility of Indemnity Requests submitted to CAAJ and the Board of Directors (unless the Legal

Vice Presidency has a

conflicting interest), including any exclusions

of indemnity and potential situations of conflict of interest related to the claim and the decision-making process related to the Request.

4.6.1.3 Monitor

the progress of claims for which indemnity is granted by the Company and report them periodically to the CAAJ and the Board.

4.6.1.4 Evaluate

the reasonableness of the prices of the legal services to be contracted and provided to the beneficiaries, as well as the other expenses

incurred in connection with the claims subject to indemnity, as well as their compatibility with market standards and the Company's policies.

4.6.1.5 Give

legal support to the manifestations of CAAJ and the deliberations of the Board of Directors that concern this policy.

4.6.1.6 Choose

the independent external lawyers to compose any Temporary Indemnity Committee, unless the Legal Vice Presidency has a conflicting interest

in the Request in question, in which case the choice will be made by Eletrobras' Board of Directors, as established in sub-item 4.2.1.9.

4.6.1.7 Request,

as the requesting area and whenever it deems appropriate, the hiring of independent, impartial external legal counsel of unblemished reputation

to support the Company's decisions.

4.7 Vice

Presidency of Finance and Investor Relations

4.7.1 The Vice Presidency of Finance and Investor

Relations shall:

4.7.1.1 Request

from the beneficiaries any additional information and documents necessary for the analysis and assessment of the Request, assess whether

the Request falls under the current D&O Insurance policy coverage and decide whether the insurance is applicable.

4.7.1.2 To

express its opinion on technical aspects related to the activation of the D&O Insurance, its coverage and exclusions, in light of

the Indemnity Requests and related claims.

4.7.1.3 Conduct

all interactions with contracted D&O Insurance insurers.

4.7.1.4 Provide

any clarifications to the Board of Directors on conditions, coverage, procedures and exclusions related to the D&O Insurance and status

of the Indemnity Requests, including the progress of claim analysis and positions on claims directed to the insurer.

4.7.1.5 Authorize

the payment of reimbursements and/or advances to beneficiaries related to Indemnity Requests that have been granted under the terms of

this policy.

4.7.1.6 Periodically

communicate to CAAJ, the Board of Directors and the Executive Board, the list of claims communicated to the D&O Insurance insurer

and the respective status.

4.8 Temporary

Indemnity Committee

4.8.1 The Temporary Indemnity Committee shall:

4.8.1.1 Resolve

on the admissibility of Indemnity Requests in the event of sub-item 3.9.1 above.

4.8.1.2 Perform

the other duties of CAAJ and the Board of Directors related to the treatment and monitoring of the demands and Indemnity Requests referred

to in sub-item 4.8.1.1.

4.8.1.3 Evaluate,

even if a posteriori, the decisions rendered by the Board of Directors regarding the Indemnity Requests referred to in sub-item

4.8.1.1.

4.8.1.4 Report

to the Audit Committee, CAAJ and the Board of Directors their statements and decisions.

5 Concepts

5.1 Agreement

– Judicial or extrajudicial agreement of any kind – including adherence to the installment program, the execution of a

leniency or amnesty agreement, or a conduct adjustment term, commitment term or equivalent – in a claim subject to indemnification.

5.2 Beneficiary

– Person holding a position selected by the Board to participate in the Indemnity Policy that signs, with the Company, the Term

of Adhesion to the Indemnity Contract and this Indemnity Policy.

5.3 Benefit

– Rights granted to the beneficiary due to the execution of the Indemnity Contract, provided that the requirements and conditions

contained in this policy and in the Indemnity Contract are met.

5.4 CAAJ

– Legal Affairs Support Committee that advises the Board of Directors of Eletrobras.

5.5 Indemnity

Contract – Contract that will regulate the indemnity commitment to be entered into between the Company and the beneficiary,

under the terms of this policy, according to Appendix I.

5.6 CPES

– People Committee that advises the Board of Directors of Eletrobras.

5.7 Claim

– Any inquiry, investigation, complaint, assessment, procedure or proceeding, whether administrative, judicial or arbitral,

in any degree of jurisdiction, whether in Brazil or abroad, and/or any other similar procedure, including within the scope of the stock

exchange or other regulatory or self-regulatory entities that seek to hold the beneficiary responsible for acts performed exclusively

in the regular exercise of its functions in the Company.

5.8 Articles

of Incorporation – Eletrobras’ Articles of Incorporation.

5.9 D&O

Insurance – Any and all civil liability insurance policies contracted by the Company for the benefit of its managers, fiscal

councilors, members of advisory committees and/or employees.

5.10 Conflict

of Interest Situations (and related or similar expressions, such as situations of conflicting interest, conflict situations, etc.)

- Situations of potential conflict of interest, in which the beneficiary must refrain from participating in the deliberation on the Indemnity

Request, notably those in which: (i) the beneficiary who submitted the Request is a member of the body that will deliberate on said Request;

or (ii) the member of the body that deliberates on the Request may benefit from the decision related to the request made by another Beneficiary,

due to the practice of the same acts, facts or omissions that gave rise to the claims that are the subject of the Request.

5.11 Term

of Adhesion – Legal instrument signed by the professional (employee, collaborator, administrator and executive) and by the Company,

through which the professional is classified as a beneficiary and expresses his total acquiescence to the terms and conditions of this

policy, the Indemnity Contract and the Term of Adhesion itself, according to Appendix II.

6 General Provisions

6.1 The

manifestations and resolutions of the Board of Directors, CPES, CAAJ and Temporary Indemnity Committee related to the attributions portrayed

in this policy must be taken by an absolute majority of votes, except for any matters that, by law or by the Articles of Incorporation,

require a qualified quorum.

6.1.1 The

resolutions of the Legal Vice Presidency together with the Vice Presidency of Governance, Risks and Compliance must be taken in a consensual

manner.

6.2 Unless

otherwise provided in the Indemnity Contract, all notices and communications to the Company related to the policy and the Indemnity Contract

must be sent to the following emails: vgr@eletrobras.com, vjr@eletrobras.com and vfr@eletrobras.com, with proof of delivery.

6.3 This

policy takes effect on the date of its approval and is subject to change, revision or revocation at any time, by decision of the Company's

Board of Directors.

6.3.1 The

termination or amendment of this policy shall not affect the validity of the rights relating to the Requests already submitted on the

basis of the Indemnity Contracts entered into in accordance with this policy.

6.4 The

relevant legislation and the company's specific legal provisions and agreements must be observed.

6.5 Situations

not provided for in this policy must be analyzed by the Vice Presidencies involved, being justified in writing. The conclusions must be

ratified by Eletrobras' Board of Directors, subject to the provisions of current legislation and Eletrobras' Articles of Incorporation.

6.6 In

order to meet the specificities of each process, this policy can be broken down into other specific normative documents, always in line

with the principles and guidelines established herein.

6.7 The

normative documents and the provisions contrary to this policy are revoked.

7 Appendices

Appendix I – Indemnity Contract

Appendix II – Term of Adhesion

Appendix I

INDEMNITY CONTRACT

By this private instrument, on the one hand,

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

– ELETROBRAS, a publicly-held company, headquartered in the City and State of Rio de Janeiro, at Rua da Quitanda, 196, Loja

A, CEP 20.091-005, enrolled with the CNPJ under No. 00.001.180/0001-26, herein represented in the form of its Articles of Incorporation

("Company"),

and, on the other hand, the "Beneficiary"

who has signed the Term of Adhesion;

Company and Beneficiary jointly hereinafter

referred to as "Parties" and individually as "Party".

WHEREAS:

I. The

Company carries out its activities in an environment of high complexity and responsibility, subject to multiple national and foreign regulators,

including the Brazilian Securities and Exchange Commission (CVM), the National Electric Energy Agency (ANEEL) and the U.S. Securities

and Exchange Commission (SEC), in addition to the listing regulations of B3 S.A. – Brasil, Bolsa, Balcão, the New

York Stock Exchange (NYSE) and other places where the Company has securities listed for trading;

II. The

valid exercise of certain functions assigned to the Beneficiary may imply the attribution of responsibilities that imply obligations to

pay indemnities and/or penalties of various kinds to third parties, with impacts on the Beneficiary's assets, as a result of regular management

acts;

III. Pursuant

to its Articles of Incorporation, the Company approved an Indemnity Policy, which governs the rules for the asset protection of its executives

for acts performed in the regular exercise of their functions, in order to guarantee the Beneficiary the conditions to exercise them safely,

subject to the provisions of the Indemnity Policy;

IV. The

protection offered by the liability insurance of officers and managers contracted by the Company ("D&O"), in isolation,

may not be sufficient to provide security to the Beneficiary in the regular exercise of their functions; and

V. As

a way of attracting and retaining qualified professionals, ensuring market conditions compatible with the function performed and the related

risks, the Company wishes to provide, to certain professionals, complementary protection to D&O against extraordinary circumstances

that may cause them damage by virtue of the regular exercise of their functions, subject to the premises of CVM Guidance Opinion No. 38/2018;

The Parties HEREBY RESOLVE, in the

best form of law, to enter into this Indemnity Contract, which shall be governed by the following clauses and conditions:

1. Definitions

1.1. Capitalized

terms and expressions in this Contract shall have the meaning assigned to them at the earliest opportunity in which they are referred

to, both plural and singular.

1.2. Without

prejudice to the foregoing, the following words and expressions (whether plural or singular, and their derivatives) shall have the following

meanings:

(i) "Beneficiary" means the

beneficiary qualified in the respective Term of Adhesion;

(ii) “Contract” means this

Indemnity Contract;

(iii) "Defense" means the

defense, response, manifestation or clarification within the scope of a Claim that may give rise to indemnification under this Contract;

(iv) “Claim” – Any

inquiry, investigation, complaint, assessment, procedure or proceeding, whether administrative, judicial or arbitral, in any degree of

jurisdiction, whether in Brazil or abroad, and/or any other similar procedure, including within the scope of the stock exchange or other

regulatory or self-regulatory entities that seek to hold the beneficiary responsible for acts performed exclusively in the regular exercise

of its functions in the Company.

(v) “Business Day” means

any day, other than a Saturday, Sunday or other day on which commercial banks are authorized by law to remain closed in the City of Rio

de Janeiro, State of Rio de Janeiro;

(vi) “Vacancy Event” means

the voluntary termination or not (with or without cause), resignation or removal from office, termination of employment or mandate, including

by virtue of death, permanent disability, retirement or by mutual agreement, or any other event that implies the termination of the employment

or services relationship, with or without a relationship, of the Beneficiary with the Company or its wholly-owned subsidiaries;

(vii) “Coverage Period”

means the period indicated in the Term of Adhesion;

(viii) “Indemnity Policy”

means the Company's Indemnity Policy approved by the Board of Directors and available at https://eletrobras.com/pt/Paginas/Estatuto-Politicas-e-Manuais.aspx

(ix) "Term of Adhesion" means

the term of adhesion entered into between the Company and the respective Beneficiary, the model of which is an integral part of this Contract;

and

(x) “Maximum Indemnity Amount”

means the maximum and global limit of the Company's obligation to indemnify in favor of all Beneficiaries covered by the Indemnity Policy,

as provided for in the Indemnity Policy.

2. Purpose

2.1. The

purpose of this Contract is to establish and regulate the Company's obligation to indemnify and hold harmless the Beneficiary for the

costs and expenses incurred in Claims seeking to hold the Beneficiary liable for acts carried out in the regular exercise of his/her duties

at the Company, as detailed in Clause 3.1 below.

2.2. The

obligation to indemnify provided for herein shall be valid in relation to the regular exercise of the Beneficiary's functions in the Company

and in the other positions that the Beneficiary assumes in subsidiaries of the Company or other entities to which the Company has appointed

him/her for a given position.

3. Obligation

to Indemnify

3.1. Under

the terms of this Contract, provided that the Beneficiary is in compliance with all its obligations to the Company, the Company undertakes

to directly bear (or reimburse the Beneficiary for, as defined in the Indemnity Policy) the following expenses (“Expenses”):

(i) legal and administrative costs, charges

and expenses incurred for the Beneficiary's Defense in connection with any Claims, including attorneys' fees, technical assistants' fees,

expert fees, court costs, judicial deposits, fines, interest and taxes;

(ii) resources or assets (including procedural

insurance) necessary to present and maintain the Beneficiary's Defense, including to make judicial or administrative deposits, so that

the

Beneficiary does not have its own goods, assets

or rights affected or encumbered, nor obstacles to obtaining a certificate of tax regularity due to the respective Claim (negative or

positive with negative effects), as detailed in Clause 5.5 below; and

(iii) any amounts that the Beneficiary is

ordered to pay as a result of a final and unappealable conviction in Claims, even if as a result of agreements entered into pursuant to

Clause 6.

3.2. Limitations

on the Obligation to Indemnify. Without prejudice to the provisions of the Policy, the Company's obligation to indemnify set forth

in this Clause 3 is subject to the following limitations:

(i) the maximum aggregate amount to be indemnified

under all Indemnity Contracts entered into by the Company is limited to the Maximum Indemnity Amount, provided that, if this amount is

reached, any right to indemnity of the Beneficiary will cease and the Company may require the Beneficiary to assume the Defense of any

and all Claims under the conduct of the Company, including with regard to the obligation to pay the Expenses;

(ii) the Company will only be obliged to indemnify

for regular management acts, thus considering the decisions, technical manifestations and actions carried out diligently, in accordance

with good faith, aiming at the Company's corporate interest and in compliance with its fiduciary duties, practiced during the Coverage

Period, being certain that, regardless of the end of the Coverage Period, the Company's obligations established herein in relation to

acts, facts or omissions of the Beneficiary occurred during the Coverage Period will remain valid, even if the Beneficiary's relationship

with the Company has ended;

(iii) the Beneficiary will not have any right

to indemnification or reimbursement in Claims in which the Company is a counterparty, including actions filed under the terms of art.

159 of Law 6.404/76, or in any other case in which there is incompatibility of the Beneficiary's interests with the interests of the Company;

and

(iv) the Company will not indemnify the Beneficiary

for Expenses that are incompatible with the Company's hiring policies, or that are considered by the Company to be out of market or unreasonable.

4. Exclusion

of the Obligation to Indemnify

4.1. Without

prejudice to the provisions of the Policy, the obligation to indemnify provided for in this Agreement will no longer be applicable and

enforceable against the Company if, at any time, the Beneficiary:

(i) acts, through action or omission, in bad

faith, willful misconduct, gross negligence, fraudulently, in a conflict of interest, for the benefit of third parties, outside the exercise

of its functions or to the detriment of the corporate interest, or practices any unlawful conduct;

(ii) does not cooperate with the Company in

the conduct of the defense, or fails to take reasonable measures to mitigate any loss, as directed by the Company and its representatives;

(iii) does not timely present the documents

and information requested by the Company or its representatives to prepare or conduct the defense, or to protect its rights, or if it

practices any act that may impair the preparation or conduct of the defense or the theses adopted by the defense (such as delay or non-attendance

at hearings);

(iv) is not diligent in receiving and transmitting

to the Company notifications, summonses, subpoenas and documents of any nature that may be sent to the Beneficiary, or fails to keep persons

authorized to receive such documents in the event of the Beneficiary's absence (instructed in writing to transmit any document received

to the Company in a timely manner);

(v) discloses strategic and confidential information

against the interests of the Company; or

(vi) violates any of the rules for conducting

Claims provided herein, including with regard to the execution of agreements – that is, if the Beneficiary enters into an agreement

or transaction without the prior authorization of the Company.

4.2. The

filing of a Claim against the Beneficiary that is based on allegations that may imply any of the exclusions provided for above will not

necessarily imply the exclusion of the Company's obligation established herein, and it is up to the Company, under the terms of its Indemnity

Policy, to analyze the factual and evidentiary set involved (or alleged) in the Claim in question, in its different procedural stages,

including after the closing of the process, to determine the occurrence, or not, of any exclusion cases established above.

4.3. Any

decision by the Company to exclude the obligation provided for herein to the Beneficiary does not bind a new judgment to be carried out

by the Company after the end of the Claim, especially in case of acquittal.

5. Indemnity

Procedure

5.1. Indemnity

Request. In the event of a Claim that, in the opinion of the Beneficiary, may give rise to the right to indemnification under the

terms of this Contract, the Beneficiary must send a written Indemnity Request to the Company within: (i) one third of the legal term available

for the Defense of such Claim; or (ii) five (5) Business Days from its knowledge of the Claim, either by letter, summons, notification,

notice, subpoena or any other written means, whichever occurs first (“Indemnity Requests”).

5.1.1. The

Indemnity Request must be accompanied by all documents and information in the possession of the Beneficiary (or accessible to it) that

are related to the Claim or that may contribute to the understanding and analysis of the Claim, as well as to the preparation of the respective

Defense – including a copy of the official letter, notification, assessment or summons received – and must be sent to the

following addresses (being certain that the Company may change the communication rules provided for herein, including to reflect the modifications

to its Indemnity Policy):

Recipients: Vice

Presidency of Finance and Investor Relations;

Legal Vice Presidency;

and

Vice Presidency of Governance,

Risks and Compliance

Email: vfr@eletrobras.com;

vjr@eletrobras.com; and vgr@eletrobras.com

5.1.2. The

omission or delay of the Beneficiary in submitting an Indemnity Request to the Company within the term and form established above will

release the Company from its obligation to indemnify in relation to the respective Claim, unless the Company understands that the delay

did not cause prejudice to the Defense.

5.2. Analysis

of the Request. Upon receipt of the Indemnity Request, the Company will activate the D&O insurance in relation to the respective

Claim, if applicable, and will resolve: (a) whether the Claim in question is subject to indemnity; and (b) on the incidence of any of

the causes of exclusion or limitation of indemnity, including with regard to the timeliness of sending the Request. The Company may also

partially and provisionally grant the indemnity related to any Claim to advance Expenses, regardless of the activation and/or coverage

of the D&O insurance, in order to avoid the perishing of the Beneficiary's material right due to the non-exercise of the opportunity

to be heard by the Claim.

5.2.1. The

Company's decision will be taken based on the factual and evidentiary set available at the time of the resolution, being certain that

any and all decisions of the Company on Indemnity Requests, regardless of the deliberation body, will be provisional and,

at the Company's sole discretion, may be reviewed or revoked at any time, by means of a new judgment of value in the light of the factual

and evidential set revealed, including after the manifestation of the D&O insurance, or even after the end of the Claim.

5.2.2. The

Company will use its best efforts to communicate to the Beneficiary about its resolution in the period corresponding to up to 2/3 (two

thirds) of the legal term available for the Defense of the Claim, and the Company's communication to the Beneficiary sent to the email

address of the Indemnity Request is considered valid and effective.

5.2.3. The

Company may request documentary supplementation to count the term referred to in Clause 5.2.2 above, without the Beneficiary being responsible

for any liability action against the Company.

5.3 Handling

of the Claim. If the Company agrees that this is a Claim subject to indemnity, or chooses to advance the payment of Expenses (without

prejudice to the possibility of reviewing such decision), the Company will have the prerogative to conduct the Defense and appoint, at

its sole discretion, lawyers to sponsor the Defense on behalf of the Beneficiary. The Company shall express its intention to handle or

not handle the Defense of the Claim in the same communication to the Beneficiary provided for in Clause 5.2.2 above.

5.3.1. In

the event that the Company does not exercise its prerogative to handle the Defense, the Beneficiary must handle it in good faith and diligently,

and must choose and hire directly the lawyers who will sponsor the Defense.

5.3.2. If

the Beneficiary wishes to handle his/her own defense, he/she must indicate this intention in the Indemnity Request, in which case, in

addition to the information provided for in Clause 5.1.1, the Request must be accompanied by a copy of the fee proposal of the service

provider sought by the Beneficiary.

5.3.3. The

Defense of any Claim will be handled in good faith through a first-rate office and/or with proven expertise in the matter under discussion

in said Claim, according to the choice of the Party handling the Defense, subject to the Company's contracting policies. Both Parties

shall endeavor to ensure that it is conducted diligently by their respective lawyers.

5.3.4. The

Party that is not handling the Defense may, at its sole discretion and at its own expense, hire lawyers or experts to monitor the handling

of the Claim and shall be reasonably informed of the relevant procedures related to any Claim.

5.4. Information

and Cooperation. In the event that the Company agrees that this is a Claim subject to indemnity, or chooses to advance the payment

of Expenses (without prejudice to the possibility of reviewing such decision), the Party handling the Defense will guarantee the other

Party the right to receive a copy of the minutes or filed copies of the procedural documents, as well as information about the progress

of the Claim or any other information that is necessary and/or pertinent. In addition, in the above cases, the Parties will cooperate

reciprocally in the definition of the strategy and preparation of the Defense, agreeing to provide the information and documents of which

they are aware or in their possession and that are necessary for this purpose, provided that the Parties will maintain confidentiality

about the non-public information that they may have access to under this Contract.

5.5. Constrictions.

If the assets or resources of the Beneficiary, including those held in joint ownership with a spouse, partner or family members, are subject

to constriction or unavailability in the context of a Claim in relation to which the Company chooses to anticipate Expenses or indemnify

the Beneficiary, the Company will make efforts to enable the release of the affected assets and resources, so that the Beneficiary does

not continue with its own goods, assets or rights affected or encumbered, nor has obstacles to obtaining a certificate of tax regularity

due to the respective Claim (negative or positive with negative effects).

5.5.1. In

the event of any type of constriction or unavailability of assets or any type of resources held by the Beneficiary, the Company may, at

its discretion, as from 30 (thirty) days from the delivery of the documents proving the blockage, pay the Beneficiary monthly compensation

in an amount to be arbitrated by the Company, corresponding to up to 100% (one hundred percent) of their regular monthly remuneration

paid by the Company, for as long

as the effects of the unavailability persist,

in order to allow the Beneficiary to meet their daily and everyday expenses that cannot be honored due to the blockade.

5.5.2. When

arbitrating the amount of the monthly compensation to the Beneficiary (if any), the Company will take into account the extent of the constriction

and/or blocking and the damages caused to the Beneficiary due to said blocking. Payment to the Beneficiary will be made by means of a

deposit in a current account of a formal representative, expressly designated by the Beneficiary.

5.5.3 The

Beneficiary shall reimburse the Company for all payments made based on the provisions of this Clause 5.5 et seq., within a maximum period

of thirty (30) days from the date on which the assets and resources are unblocked, regardless of the result of the Claim in which the

blockage occurred.

5.6. Payments.

If, in relation to a Claim, the Company agrees with the Beneficiary's right to indemnity or chooses to advance the payment of Expenses

(without prejudice to the possibility of reviewing such decision), the Company may, at its discretion, choose to pay the Expenses directly

to third parties within the scope of the Claims, or reimburse the Beneficiary, in which case the reimbursement will be made within 15

(fifteen) Business Days from the receipt of a written request from the Beneficiary accompanied by all documents proving the Expenses.

5.7. Review

of Indemnity and Reimbursement. In view of the provisional nature of the Company's decisions set forth in Section 5.2.1 above, the

Beneficiary acknowledges that any review by the Company of its decision regarding the Beneficiary's right to indemnification in relation

to a Claim:

(i) will not give rise to liability to the

Company for the acts eventually performed by the Company in the handling of the Claim;

(ii) will not confer any liability action

against the Company, due to the outcome of the Claim, regardless of whether or not the Company has chosen to handle the Defense; and

(iii) will imply the assumption by the Beneficiary

of the obligation to assume the Defense of the Claim within the period indicated by the Company, including with regard to the payment

of fees, without prejudice to the obligation to reimburse the Company pursuant to Clause 5.7.1 below.

5.7.1. Whenever

the Company reassesses its decision to understand that the Claim and/or its respective Expenses are not, in whole or in part, subject

to indemnification under this Contract, the D&O insurance or the Indemnity Policy, the Beneficiary will be obliged to reimburse the

Company for all Expenses paid and/or incurred by it.

5.7.2. The

review of the indemnity must be communicated by the Company to the Beneficiary, by means of a notification containing the rationale for

the review of the indemnity decision, accompanied by the documentation that supports the decision, as well as the respective proof of

expenses and the calculation memory of the amounts to be reimbursed.

5.7.3. The

Beneficiary shall have a period of up to 20 (twenty) Business Days, counted from the receipt of the notice of review, to reimburse the

amounts to the Company, monetarily restated by the variation of the IPCA from the date of disbursement, and the Company and/or its subsidiaries

are hereby authorized, in case of default of the Beneficiary, to retain any amounts due to the Beneficiary, in any capacity, for compensation

or to make payment on account and order, of any amounts due by the Beneficiary to the Company or its subsidiaries.

6. Agreements

and Transactions

6.1. The

execution of a judicial or extrajudicial agreement of any kind – including adherence to an installment program, the execution of

a leniency or amnesty agreement, or a conduct adjustment term, commitment term or equivalent – in any Claim subject to indemnification

("Agreement") will depend on the prior approval of the Company. The execution of an Agreement by the Beneficiary in any

Claim without the prior consent of the Company will exempt the Company from the obligation to indemnify in relation to the respective

Claim, in addition to giving rise to reimbursement by the Beneficiary pursuant to Clause 5.7.1 above.

6.2 If,

by offer of counterparty or own initiative, the Beneficiary wishes to enter into any Agreement, the Beneficiary must notify the Company

detailing all the terms and conditions of the intended Agreement, including, if possible, a copy of the Agreement to be entered into.

Upon receipt of the notification from the Beneficiary (and of the additional documents and information that may be requested by the Company

to evaluate the proposed Agreement), the Company shall express its agreement or not with the execution of the Agreement within 10 (ten)

Business Days, with silence being interpreted as the Company's refusal to enter into the Agreement.

6.3. The

Company will not be obliged to indemnify the Beneficiary in relation to any Claim in which the Company: (i) responds to the notification

of Agreement referred to in Clause 6.1 by consenting to its execution or acceptance; or (ii) sends notification to the Beneficiary indicating

the opportunity to enter into the Agreement and requesting that it be entered into by the Beneficiary; and, in both cases, the Beneficiary

fails to enter into the Agreement within the terms agreed with the third party in question, and, in the case of an Agreement whose execution

depends on the exclusive initiative of the Beneficiary, the term will be up to five (5) Business Days from the receipt of the respective

notification from the Company.

7. Subrogation

7.1. The

amount to be indemnified by the Company under this Agreement shall be reduced to reflect any amount actually received by the Beneficiary

in connection with a Claim subject to indemnity, including as a result of the Beneficiary's right of recourse or indemnity (including

by reason of insurance).

7.2. The

Company will automatically subrogate itself to the rights of compensation, indemnification, reimbursement or recourse to which the Beneficiary

is entitled in relation to any Claim that has given rise to the payment of compensation made by the Company, including amounts due to

the Beneficiary under the coverage of D&O insurance policies.

7.3. Beneficiary

agrees to sign all documents and perform all acts necessary to ensure, to the Company, the right to subrogation provided above, including

those that may be necessary to allow the filing of lawsuits by the Company.

8. Statements

and Obligations of the Beneficiary

8.1. The

Beneficiary acknowledges and agrees that:

(i) nothing in this Agreement shall confer

on the Beneficiary rights relating to the guarantee of permanence as a director, officer, vice president, member of an external committee,

employee, manager, collaborator and/or service provider of the Company, or interfere in any way with the Company's right to terminate

at any time the relationship with the Beneficiary; and

(ii) the Company may amend and modify the

terms and conditions of this Agreement to, among other purposes, adapt them to the terms of legislation, regulations and/or supervening

rule, and the Beneficiary agrees to enter into the respective amendments, as directed by the Company.

9. Indemnity

Policy

9.1. The

Beneficiary declares to be aware of and expressly adheres to the terms and conditions of the Company's Indemnity Policy, as well as the

Company's Articles of Incorporation and its regulations, policies, codes, manuals and other rules of the Company in force, undertaking

to fully respect them, including with regard to future updates.

10. General

Provisions

10.1. Length

of Term. This Contract shall be in force in relation to any Beneficiary during the Coverage Period, provided that if the Company validly

receives a Claim from the Beneficiary after the Claims Coverage Period involving acts performed by the Beneficiary during the Coverage

Period, then the obligation to indemnify shall be valid and effective with respect to such Claim until it is definitively resolved (regardless

of the time limit of the Coverage Period).

10.2. Binding

Obligation. This Contract constitutes a valid and binding contract, enforceable in accordance with the terms and conditions agreed

herein, obliges the Parties, as well as their heirs or successors, in any capacity. Nevertheless, the Parties undertake to amend this

Contract whenever necessary to adapt to any modifications to the Indemnity Policy that may be approved, including with regard to the procedures

for sending indemnity requests by the Beneficiary, handling defenses, etc.

10.3. Independence

of Contractual Provisions. If any provision of this Contract is held to be void, unenforceable, invalid or inoperative, no other provision

shall be affected thereby. Likewise, all other provisions of this Contract shall remain valid and enforceable as if such void, unenforceable,

invalid or inoperative provision was not a part of this Contract. In this case, it will be up to the Board of Directors to determine the

rules for replacing such null, unenforceable, invalid or inoperative provision with another that best represents the original will of

the Parties.

10.4. Absence

of Waiver. No waiver of any breach or default of this Contract by the Company shall be deemed valid unless made in writing. The failure

of the Company to require compliance with any provisions of this Contract shall not be considered as a waiver or dispensation of the rights

arising from such provisions.

10.5. Assignment.

This Contract, with all rights and obligations contained herein, may not be assigned or transferred by the Beneficiary, in whole or in

part, in any capacity, without the prior and express consent of the Company.

10.6. Compensation.

The Company and its subsidiaries are hereby authorized to withhold and offset amounts due to the Beneficiary in any capacity for compensation

or to make payment on account of any amounts due by the Beneficiary to the Company or its subsidiaries.

10.7. Jurisdiction.

The central court of the City of Rio de Janeiro, RJ, is hereby elected, to the exclusion of any other, however privileged it may be, to

settle any questions arising from this Contract.

10.8. Electronic

Signature. The Parties acknowledge the veracity, authenticity, integrity, validity and effectiveness of this Contract and its terms,

pursuant to article 219 of the Civil Code, in electronic format and/or signed by the Parties by means of electronic certificates, even

if they are electronic certificates not issued by ICP-Brasil, pursuant to article 10, paragraph 2, of Provisional Measure No. 2.200-2,

of August 24, 2001, as, for example, through the upload and existence of this instrument, as well as the affixing of the respective electronic

signatures in this Contract, on the platform to be indicated by the Company.

Appendix II

TERM OF ADHESION

By this instrument, [FULL NAME], [nationality],

[marital status], [profession], resident and domiciled at [full address, CEP included], bearer of identity card RG No. [xxx], issued by

[xxx] and enrolled with the CPF under No. [xxx] (“Beneficiary”), expressly agrees, without reservations, with all the

terms and conditions of the Indemnity Contract (“Contract”), dated [mm].[dd].2023, approved by the (i) Meeting

of the Board of Directors of [mm].[dd].2023 and approved by the (ii) [xxx] Committee of the Company; in addition to the Indemnity

Policy (“Indemnity Policy”), approved by the [xxx]th Meeting of the Board of Directors of [mm].[dd].2023 of Centrais

Elétricas Brasileiras S.A. - Eletrobras, a publicly-held company, enrolled with the CNPJ/MF under No. 00.001.180/0001-26, headquartered

in the City and State of Rio de Janeiro, at Rua da Quitanda, No. 196, Loja A, CEP 20.091-005 (“Company”).

1. Capitalized

terms, but not defined in this Term of Adhesion (“Term of Adhesion”), shall have the meaning assigned to them in the

Contract and the Indemnity Policy.

2. Initially,

the Parties agree that, for the purposes of the Contract, “Coverage Period” means the period beginning on the date

of signature of this Term of Adhesion and ending on the occurrence of a Beneficiary Vacancy Event.

3. In

addition, the Beneficiary undertakes before the Company and its subsidiaries, irrevocably and irreversibly, to:

(i) Fully comply with all obligations assigned

to his position in accordance with the terms of the Articles of Incorporation, the Company's policies, his employment contract, as well

as the Laws and regulations applicable to the Company;

(ii) Fully comply with all provisions of the

Contract and the Indemnity Policy; and

(iii) Keep confidential all information related

to the Company's business of which it is aware, as well as any information related to Expenses, Claim or Indemnity Request (“Confidential

Information”), as well as use its best efforts so that Confidential Information does not become known to third parties. Confidential

Information shall not be considered to be information that: (i) was in the public domain at the time it was disclosed to the Beneficiary

or subsequently became public domain, without disclosure having been made by the Beneficiary; (ii) was legally disclosed to the Beneficiary

by third parties who, to the Beneficiary's best knowledge, were not in breach of any confidentiality obligation; (iii) must be disclosed

by the Beneficiary by reason of an order or decision issued by an authority, only to the extent of such an order; or (iv) become public

in the course of the Claims.

4. Any

changes to this Term of Adhesion will only produce any effects, before the Parties and/or third parties, if they are entered into in writing

and by all Parties.

5. In case of questions or controversies regarding

the application of this Term of Adhesion, the dispute shall be settled observing the same method of dispute resolution provided for in

the Contract.

[Place], [date].

_________________________________________

[Beneficiary]

_________________________________________

Company

Witnesses:

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: December 4, 2023

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Eduardo Haiama

|

|

| |

Eduardo Haiama

Vice-President of Finance and Investor Relations |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

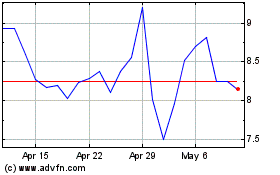

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

From Apr 2024 to May 2024

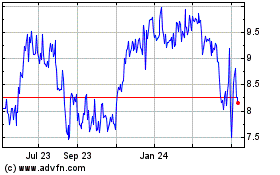

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

From May 2023 to May 2024