A.M. Best Affirms Ratings of Centene Corporation and Its Insurance Subsidiaries

June 07 2011 - 12:00PM

Business Wire

A.M. Best Co. has affirmed the issuer credit rating (ICR)

of “bb-” and debt ratings of Centene Corporation (Centene)

(headquartered in St. Louis, MO) (NYSE: CNC) and the financial

strength ratings (FSR) of B+ (Good) and ICRs of “bbb-”of the

majority of its insurance subsidiaries. The outlook for these

ratings is stable.

Concurrently, A.M. Best has upgraded the ICR to “bbb+” from

“bbb” and affirmed the FSR of B++ (Good) of Centene’s

subsidiary, Celtic Insurance Company (Chicago, IL). The

outlook for these ratings is stable.

In addition, A.M. Best has assigned a debt rating of “bb-” to

$250 million 5.75% senior unsecured notes due 2017 issued by

Centene. The outlook assigned to this rating is stable.

A.M. Best also has withdrawn the debt rating of “bb-” on

Centene’s $175 million 7.25% senior unsecured notes due 2014. (See

below for a detailed listing of the ratings.)

The affirmation of Centene’s ratings is based on its multi-state

market presence as it currently manages Medicaid contracts in eight

states with start-up operations in three additional states. Centene

has consistently recorded premium revenue growth over the last five

years, driven by organic growth, acquisitions and new state

contracts. Additionally, the revenue from Centene’s specialty

services operations has grown to approximately 25% of operating

income for the organization.

Centene’s financial flexibility is supported by parent company

cash, subsidiary dividends and a $350 million revolving credit

agreement. Centene’s financial leverage was 28.4% as of March 31,

2011; it is expected to increase slightly in the near term with

improvement through the year. Interest coverage was approximately

10 times at year-end 2010 and is expected to remain at

approximately the same level for the full year 2011.

Offsetting factors include Centene’s revenue and net income

dependence on state and federally funded Medicaid programs, which

are under pressure due to budget constraints and general economic

conditions. Although Centene continues to make capital

contributions in support of its subsidiaries, the risk-based

capitalization of the Medicaid insurance subsidiaries is considered

modest. Additionally, Centene’s managed Medicaid results are being

negatively affected by operations in Florida, which are incurring

significant operating losses due to higher than anticipated medical

utilization.

The ICR upgrade of Celtic Insurance Company reflects its

favorable operating performance as it has reported profitable

earnings for the past five years. In addition, the level of

risk-based capital has remained stable after paying a sizeable

dividend in 2008 shortly after Celtic Insurance Company was

acquired by Centene. Celtic Insurance Company is Centene’s main

subsidiary that provides health products targeted at the uninsured

and underinsured in the commercial individual and small group

market segments on a stand-alone basis and in conjunction with

state subsidized programs.

The FSR of B+ (Good) and ICRs of “bbb-” have been affirmed for

the following subsidiaries of Centene Corporation:

- Peach State Health Plan,

Inc.

- Superior Health Plan, Inc.

- Buckeye Community Health Plan,

Inc.

- Coordinated Care Corporation

Indiana, Inc.

- Managed Health Services Insurance

Corporation

- Absolute Total Care, Inc.

- Sunshine State Health Plan

Inc.

- Bankers Reserve Life Insurance

Company of Wisconsin

The principal methodology used in determining these ratings is

Best’s Credit Rating Methodology -- Global Life and Non-Life

Insurance Edition, which provides a

comprehensive explanation of A.M. Best’s rating process and

highlights the different rating criteria employed. Additional key

criteria utilized include: “Rating Health Insurance Companies”;

“Rating Members of Insurance Groups”; “Understanding BCAR for Life

and Health Insurers”; “Risk Management and the Rating Process for

Insurance Companies”; “Assessing Country Risk”; and “A.M. Best

Ratings & the Treatment of Debt.” Methodologies can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is the world's oldest and

most authoritative insurance rating and information source. For

more information, visit www.ambest.com.

Copyright © 2011 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

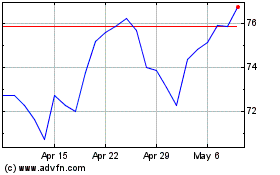

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Centene (NYSE:CNC)

Historical Stock Chart

From Jul 2023 to Jul 2024