Centene Corporation (NYSE: CNC) today announced its financial

results for the quarter ended June 30, 2006. Second Quarter Summary

-- Revenues of $495.3 million, a 41.7% increase over the 2005

second quarter. -- Earnings from operations of $6.3 million

compared to $22.3 million in the 2005 second quarter. -- Earnings

per diluted share of $0.11 (includes $9.7 million of adverse

development in the first quarter 2006 medical claims reserves)

versus $0.34 in the comparable prior year quarter. -- Operating

cash flows of $5.1 million. -- Quarter-end Medicaid Managed Care

membership of 1.1 million. -- Medicaid Managed Care G&A expense

ratio of 12.3% and Specialty Services G&A ratio of 17.4%. --

Membership growth of 33.5% over the 2005 second quarter. -- Days in

claims payable of 42.6. Other Events -- Commenced operations in

Georgia with 216,000 members. -- Acquired MediPlan Corporation,

adding 13,600 Medicaid members in Canton, Ohio. -- Acquired Cardium

Health Services Corporation, a Connecticut-based chronic disease

management company. -- Acquired managed vision business of OptiCare

Health Systems, Inc. effective July 1. -- Awarded two long-term

care contracts in Arizona for Maricopa and Yuma/LaPaz counties. The

2006 second quarter results include approximately $9.7 million of

adverse medical cost development in estimated claims liabilities

from the 2006 first quarter. The adverse development was largely

attributable to: (1) increased medical expense for maternity

related cases, including NICU, (2) increased physician costs, (3)

increased costs associated with injectibles such as Synagis and

Somatropin, and (4) increases in the estimated days for members

hospitalized as of March 31, 2006. Approximately $3.7 million of

the development occurred in Indiana and $2.2 million occurred in

Texas. There has been a slight positive development for 2005

claims. Approximately $7.1 million of the development related to

March claims and $2.5 million was for February claims. In Indiana,

there were a number of factors which affected our results. We saw a

continuation of increased medical expenses associated with the

members added in late 2005, higher percentage of admissions for

NICU births and increased Synagis and Somatropin utilization. In

addition, our estimated hospital inpatient days increased

significantly primarily because of the deteriorating condition of

several complex and high-cost cases and missed patient bed-day

estimates. Pharmacy costs stabilized in the 2006 second quarter and

are expected to decrease in the 2006 third quarter. In Texas, we

are currently experiencing higher costs because of a case mix shift

to a higher percentage of members in the pregnant women and newborn

categories driving increases in related costs such as NICU,

radiology and Synagis, and from members moving out of Primary Care

Case Management into a managed care environment. We also had

several deteriorating complex and high cost cases. In Georgia, our

subsidiary Peach State Health Plan, Inc., began managing care for

216,000 Medicaid and SCHIP members in the Atlanta and Central

regions effective June 1, 2006. The state of Georgia has scheduled

membership operations to commence in the Southwest region in

September. During the 2005 fourth quarter, we were awarded

contracts in Texas to expand operations to the Corpus Christi

market, and operations are scheduled to commence in September 2006.

We will also begin serving Medicaid members in Lubbock and a small

number of SCHIP members in Austin, effective September 1. In

addition, we were recently awarded a contract to provide managed

care for SSI recipients in the San Antonio and Corpus Christi

markets, for which membership operations are scheduled to start in

January 2007. Our Specialty Services segment has experienced

significant year-over-year growth largely due to acquisitions and

contract awards. During this past quarter, the Arizona Health Care

Cost Containment System awarded our subsidiary, CenCorp Health

Solutions, two managed care program contracts to provide Long Term

Care services in Maricopa and Yuma/LaPaz counties. Bridgeway Health

Solutions, a member of the CenCorp family of specialty companies,

will provide those services when the contracts become effective

October 2006. Michael F. Neidorff, Centene's Chairman and Chief

Executive Officer, said, "While we are truly disappointed with our

second quarter results, we have identified the issues and we are

undertaking steps to resolve them in a sustainable manner. We have

initiated some very specific corrective actions at the corporate

and health plan levels to protect against issues of this magnitude

in the future." The following table depicts membership in Centene's

managed care organizations by state at June 30, 2006 and 2005: -0-

*T 2006 2005 --------------- --------------- Georgia 216,000 -

Indiana 193,000 152,800 Kansas 117,100 103,000 Missouri 32,900

39,900 New Jersey 59,000 52,900 Ohio 73,100 59,600 Texas 235,800

243,800 Wisconsin 174,600 173,400 --------------- ---------------

TOTAL 1,101,500 825,400 =============== =============== *T The

following table depicts membership in Centene's managed care

organizations by member category at June 30, 2006 and 2005: -0- *T

2006 2005 --------------- --------------- Medicaid 863,500 637,300

SCHIP 221,600 176,200 SSI 16,400 (a) 11,900 (b) ---------------

--------------- TOTAL 1,101,500 825,400 ===============

=============== (a) 8,900 at-risk; 7,500 ASO (b) 5,500 at-risk;

6,400 ASO *T Statement of Earnings -- For the 2006 second quarter,

revenues increased 41.7% to $495.3 million from $349.6 million in

the 2005 second quarter. -- The HBR for Centene's Medicaid and

SCHIP populations, which reflects medical costs as a percent of

premium revenues, was 84.0% and 83.4% for the three and six month

periods ending June 30, 2006, respectively; increases of 3.1% and

2.7% over the comparable 2005 periods. The 2006 second quarter

increase was caused primarily by $9.7 million for adverse medical

cost development. The increase for the six months ended June 30,

2006 is caused primarily by increased costs associated with the

$9.7 million of adverse development, members in the Indiana market

and physician and injectibles costs in other markets. -- General

and administrative (G&A) expense as a percent of revenues for

the Medicaid Managed Care segment was 12.3% in the second quarter

of 2006 compared to 10.5% in the second quarter of 2005. The 2006

second quarter included $4.7 million in costs associated with the

start-up of the new health plan in Georgia. -- Earnings from

operations decreased to $6.3 million in the second quarter of 2006

from $22.3 million in the second quarter of 2005. -- Net earnings

were $4.9 million, or $0.11 per diluted share, in the second

quarter of 2006 compared to $15.2 million, or $0.34 per diluted

share, for the second quarter of 2005. -- For the six months ended

June 30, 2006, revenues increased 39.3% to $950.4 million from

$682.0 million for the same period in the prior year. Medicaid

Managed Care G&A expenses as a percent of revenues increased to

12.1% in the first half of 2006 compared to 10.6% in the first half

of 2005. Earnings from operations decreased to $18.9 million in the

first half of 2006 from $43.6 million in the first half of 2005.

Net earnings were $13.7 million, or $0.31 per diluted share, in the

first half of 2006. Balance Sheet and Cash Flow At June 30, 2006,

the Company had cash and investments of $349.4 million, including

$323.9 million held by its regulated entities and $25.5 million

held by its unregulated entities. Medical claims liabilities

totaled $187.2 million, representing 42.6 days in claims payable.

Consistent with 2005, the state of Wisconsin delayed payment of the

June premium of approximately $30 million until July 2006.

Similarly, we did not receive Texas' $2.8 million June delivery

payment until July 2006. A reconciliation of the Company's change

in days in claims payable from the immediately preceding

quarter-end is presented below: -0- *T Days in claims payable,

March 31, 2006 43.0 Increase for Georgia claims 2.8 Decrease in

claims inventory (1.5) Payment of annual physician performance

bonuses (0.7) Conversion of pharmacy benefits to U.S. Script (1.0)

--------------- Days in claims payable, June 30, 2006 42.6

=============== *T Outlook The table below depicts the Company's

revised guidance for the balance of 2006: -0- *T Q3 Q4

------------------- ------------------- Low High Low High Revenue

(in millions) $ 615.0 $ 620.0 $ 670.0 $ 680.0 Earnings per diluted

share $ 0.29 $ 0.32 $ 0.35 $ 0.41 *T J. Per Brodin, Centene's Chief

Financial Officer, stated, "This guidance includes the effect of

all recent acquisitions and contract awards and anticipates that

the operations for the Southwest region of Georgia and the Texas

expansion will commence on September 1 and the Arizona Long Term

Care contract in October. This guidance also reflects management's

updated assumptions regarding the Company's health benefits ratio

for the remainder of the year." Conference Call As previously

announced, the Company will host a conference call Tuesday, July

25, 2006, at 8:30 a.m. (Eastern Time) to review the financial

results for the second quarter ended June 30, 2006, and to discuss

its business outlook. Michael F. Neidorff and J. Per Brodin will

host the conference call. Investors are invited to participate in

the conference call by dialing 800-273-1254 in the U.S. and Canada,

706-679-8592 from abroad, or via a live Internet broadcast on the

Company's website at www.centene.com, under the Investor Relations

section. Today's call will also be accompanied by slides which are

posted on the Company's website at centene.com. A replay will be

available for on demand listening shortly after the completion of

the call until 11:59 PM Eastern Time on August 8, 2006 at the

aforementioned URL, or by dialing 800-642-1687 in the U.S. and

Canada, or 706-645-9291 from abroad, and entering access code

1800936. About Centene Corporation Centene Corporation is a leading

multi-line healthcare enterprise that provides programs and related

services to individuals receiving benefits under Medicaid,

including Supplemental Security Income (SSI) and the State

Children's Health Insurance Program (SCHIP). The Company operates

health plans in Georgia, Indiana, Kansas, Missouri, New Jersey,

Ohio, Texas and Wisconsin. In addition, the Company contracts with

other healthcare organizations to provide specialty services

including behavioral health, disease management, nurse triage,

pharmacy benefit management and treatment compliance. Information

regarding Centene is available via the Internet at www.centene.com.

The information provided in the second, fourth, fifth, sixth and

seventh paragraphs following the bullet listing under "Other

Events," and the table and paragraph under "Outlook" above contain

forward-looking statements that relate to future events and future

financial performance of Centene. Subsequent events and

developments may cause the Company's estimates to change. The

Company disclaims any obligation to update this forward-looking

financial information in the future. Readers are cautioned that

matters subject to forward-looking statements involve known and

unknown risks and uncertainties, including economic, regulatory,

competitive and other factors that may cause Centene's or its

industry's actual results, levels of activity, performance or

achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or

implied by these forward-looking statements. Actual results may

differ from projections or estimates due to a variety of important

factors, including Centene's ability to accurately predict and

effectively manage health benefits and other operating expenses,

competition, changes in healthcare practices, changes in federal or

state laws or regulations, inflation, provider contract changes,

new technologies, reduction in provider payments by governmental

payors, major epidemics, disasters and numerous other factors

affecting the delivery and cost of healthcare. The expiration,

cancellation or suspension of Centene's Medicaid managed care

contracts by state governments would also negatively affect

Centene. -0- *T CENTENE CORPORATION AND SUBSIDIARIES CONSOLIDATED

BALANCE SHEETS (In thousands, except share data) June 30, Dec. 31,

2006 2005 ------------------ (Unaudited) ASSETS Current assets:

Cash and cash equivalents $131,436 $147,358 Premium and related

receivables, net of allowances of $175 and $343, respectively

96,852 44,108 Short-term investments, at fair value (amortized cost

$77,049 and $56,863, respectively) 76,700 56,700 Other current

assets 20,714 24,439 --------- -------- Total current assets

325,702 272,605 Long-term investments, at fair value (amortized

cost $120,252 and $126,039, respectively) 117,257 123,661

Restricted deposits, at fair value (amortized cost $24,283 and

$22,821, respectively) 24,008 22,555 Property, software and

equipment, net 90,344 67,199 Goodwill 215,376 157,278 Other

intangible assets, net 20,203 17,368 Other assets 8,246 7,364

--------- -------- Total assets $801,136 $668,030 =========

======== LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Medical claims liabilities $187,204 $170,514 Accounts payable and

accrued expenses 52,540 29,790 Unearned revenue 15,413 13,648

Current portion of long-term debt and notes payable 1,034 699

--------- -------- Total current liabilities 256,191 214,651

Long-term debt 164,462 92,448 Other liabilities 6,444 8,883

--------- -------- Total liabilities 427,097 315,982 Stockholders'

equity: Common stock, $.001 par value; authorized 100,000,000

shares; issued and outstanding 43,200,752 and 42,988,230 shares,

respectively 43 43 Additional paid-in capital 200,622 191,840

Accumulated other comprehensive income: Unrealized loss on

investments, net of tax (2,276) (1,754) Retained earnings 175,650

161,919 --------- -------- Total stockholders' equity 374,039

352,048 --------- -------- Total liabilities and stockholders'

equity $801,136 $668,030 ========= ======== CENTENE CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS (In thousands,

except share data) Three Months Ended Six Months Ended June 30,

June 30, ---------------------- --------------------- 2006 2005

2006 2005 ----------- ---------- ---------- ---------- (Unaudited)

(Unaudited) Revenues: Premiums $476,079 $348,416 $911,641 $679,360

Services 19,214 1,212 38,730 2,644 ----------- ----------

---------- ---------- Total revenues 495,293 349,628 950,371

682,004 ----------- ---------- ---------- ---------- Expenses:

Medical costs 400,229 282,215 761,901 549,971 Cost of services

14,317 728 29,905 1,571 General and administrative expenses 74,441

44,365 139,663 86,824 ----------- ---------- ---------- ----------

Total operating expenses 488,987 327,308 931,469 638,366

----------- ---------- ---------- ---------- Earnings from

operations 6,306 22,320 18,902 43,638 Other income (expense):

Investment and other income 3,891 2,523 7,431 4,643 Interest

expense (2,456) (634) (4,454) (1,196) ----------- ----------

---------- ---------- Earnings before income taxes 7,741 24,209

21,879 47,085 Income tax expense 2,776 8,960 8,148 17,425

----------- ---------- ---------- ---------- Net earnings $4,965

$15,249 $13,731 $29,660 =========== ========== ==========

========== Earnings per share: Basic earnings per common share

$0.12 $0.36 $0.32 $0.71 Diluted earnings per common share $0.11

$0.34 $0.31 $0.66 Weighted average number of shares outstanding:

Basic 43,169,590 42,203,946 43,079,243 41,884,044 Diluted

44,839,149 45,087,772 44,794,558 44,984,818 CENTENE CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands,

except share data) Six Months Ended June 30,

------------------------------ 2006 2005 --------------

------------- (Unaudited) Cash flows from operating activities: Net

earnings $13,731 $29,660 Adjustments to reconcile net earnings to

net cash provided by operating activities -- Depreciation and

amortization 9,541 5,901 Excess tax benefits from stock

compensation -- 3,782 Stock compensation expense 7,154 2,304 Loss

on sale of investments 33 39 Deferred income taxes (287) 1,191

Changes in assets and liabilities -- Premium and related

receivables (45,710) (38,364) Other current assets 1,859 (2,224)

Other assets (1,123) (946) Medical claims liabilities 16,690

(12,387) Unearned revenue 1,705 5,701 Accounts payable and accrued

expenses 10,658 (2,716) Other operating activities 191 1,034

-------------- ------------- Net cash provided by (used in)

operating activities 14,442 (7,025) -------------- -------------

Cash flows from investing activities: Purchase of property,

software and equipment (23,472) (8,768) Purchase of investments

(113,665) (74,928) Sales and maturities of investments 97,445

84,984 Acquisitions, net of cash acquired (60,710) (21,342)

-------------- ------------- Net cash used in investing activities

(100,402) (20,054) -------------- ------------- Cash flows from

financing activities: Proceeds from exercise of stock options 3,761

2,864 Proceeds from borrowings 71,967 10,000 Payment of long-term

debt and notes payable (4,487) (4,242) Excess tax benefits from

stock compensation 1,977 -- Common stock repurchases (3,180) --

Other financing activities -- (50) -------------- ------------- Net

cash provided by financing activities 70,038 8,572 --------------

------------- Net decrease in cash and cash equivalents (15,922)

(18,507) -------------- ------------- Cash and cash equivalents,

beginning of period 147,358 84,105 -------------- -------------

Cash and cash equivalents, end of period $131,436 $65,598

============== ============= Interest paid $4,598 $1,209 Income

taxes paid $1,645 $12,904 Supplemental schedule of non-cash

financing activities: Common stock issued for acquisitions $--

$8,995 CENTENE CORPORATION SUPPLEMENTAL FINANCIAL DATA Q2 Q1 Q4 Q3

2006 2006 2005 2005 ---------- -------- -------- --------

MEMBERSHIP Medicaid Managed Care: Georgia 216,000 - - - Indiana

193,000 193,000 193,300 176,300 Kansas 117,100 118,200 113,300

107,600 Missouri 32,900 34,500 36,000 37,300 New Jersey 59,000

57,500 56,500 50,900 Ohio 73,100 59,000 58,700 58,100 Texas 235,800

237,500 242,000 243,600 Wisconsin 174,600 175,100 172,100 173,900

---------- -------- -------- -------- TOTAL 1,101,500 874,800

871,900 847,700 ========== ======== ======== ======== Medicaid

863,500 683,700 681,100 657,500 SCHIP 221,600 175,300 175,900

176,900 SSI 16,400 15,800 14,900 13,300 ---------- --------

-------- -------- TOTAL 1,101,500 874,800 871,900 847,700

========== ======== ======== ======== Specialty Services(a):

Arizona 93,600 92,300 94,700 94,300 Kansas 39,400 39,200 38,800

37,500 ---------- -------- -------- -------- TOTAL 133,000 131,500

133,500 131,800 ========== ======== ======== ======== (a) Includes

behavioral health contracts only. REVENUE PER MEMBER(b) $159.33

$157.17 $152.48 $147.73 CLAIMS(b) Period-end inventory 186,200

229,800 255,000 206,900 Average inventory 150,100 175,200 153,500

148,300 Period-end inventory per member 0.17 0.26 0.29 0.24 (b)

Revenue per member and claims information are presented for the

Medicaid Managed Care segment. DAYS IN CLAIMS PAYABLE(c) 42.6 43.0

45.4 41.4 (c) Days in Claims Payable is a calculation of Medical

Claims Liabilities at the end of the period divided by average

claims expense per calendar day for such period. CASH AND

INVESTMENTS (in millions) Regulated $323.9 $314.0 $322.6 $305.1

Unregulated 25.5 25.8 27.7 27.7 ---------- -------- --------

-------- TOTAL $349.4 $339.8 $350.3 $332.8 ========== ========

======== ======== ANNUALIZED RETURN ON EQUITY(d) 5.4% 9.8% 16.2%

14.9% (d) Annualized Return on Equity is calculated as follows:

(net income for quarter x 4) divided by ((beginning of period

equity + end of period equity) divided by 2). HEALTH BENEFITS RATIO

BY CATEGORY: Three Months Ended Six Months Ended June 30, June 30,

---------------------------------------------- 2006 2005 2006 2005

---------------------------------------------- Medicaid and SCHIP

84.0% 80.9% 83.4% 80.7% SSI 87.6 85.2 87.6 89.3 Specialty Services

83.7 86.3 83.9 109.3 GENERAL AND ADMINISTRATIVE EXPENSE RATIO BY

BUSINESS SEGMENT: Three Months Ended Six Months Ended June 30, June

30, ---------------------------------------------- 2006 2005 2006

2005 ---------------------------------------------- Medicaid

Managed Care 12.3% 10.5% 12.1% 10.6% Specialty Services 17.4 58.8

19.3 54.6 MEDICAL CLAIMS LIABILITIES (In thousands) Four rolling

quarters of the changes in medical claims liabilities are

summarized as follows: Balance, June 30, 2005 $153,593 Acquisitions

- Incurred related to: Current period 1,443,263 Prior period

(4,424) ----------- Total incurred 1,438,839 ----------- Paid

related to: Current period 1,256,398 Prior period 148,830

----------- Total paid 1,405,228 ----------- Balance, June 30, 2006

$187,204 =========== Centene's claims reserving process utilizes a

consistent actuarial methodology to estimate Centene's ultimate

liability. Any reduction in the "Incurred related to: Prior period"

claims may be offset as Centene actuarially determines "Incurred

related to: Current period." As such, only in the absence of a

consistent reserving methodology would favorable development of

prior period claims liability estimates reduce medical costs.

Centene believes it has consistently applied its claims reserving

methodology in each of the periods presented. *T

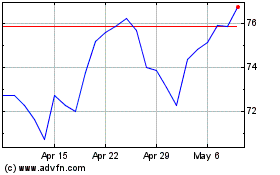

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

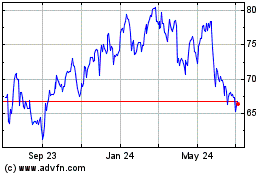

Centene (NYSE:CNC)

Historical Stock Chart

From Jul 2023 to Jul 2024