HSBC to Close Japanese Retail Unit - Analyst Blog

February 23 2012 - 12:50PM

Zacks

As a part of its long-term strategy to revamp its operations to

stabilize capital levels and improve efficiency, HSBC

Holdings Plc (HBC) has decided to close its retail banking

business in Japan. Earlier in May 2011, the CEO of the company had

announced plans to reduce the operating expenses by $3.5 million by

the end of 2013 through restructuring and contraction of its global

business.

HSBC will close six retail banking branches in Japan after four

years of operations. The company announced that from February 23,

2012, it would stop accepting new deposits under its HSBC Premier

Service from those clients who have more than ¥10 million

($124,549) in assets.

Further, HSBC will discontinue selling new investment products

from March 8 as well as cease its operations in Tokyo, Osaka and

Nagoya by July 31. However, the company will continue to offer

corporate banking services in Japan.

Moreover, HSBC also stated that it will gradually phase out its

services for the existing customers. The company would even help

its clients to find alternative banking institution and also

transfer their assets to the other bank without charging

anything.

This is the second pull out for HSBC from the Japanese market.

Earlier in December 2011, the company had announced its plan to

divest its private banking unit in Japan to Credit Suisse

Group (CS). The deal, which is expected to be closed by

mid-2012, is still subjected to regulatory approvals.

However, over the last several months, HSBC has been shedding

its non-core assets and trimming its workforce to control expenses.

In August 2011, the company announced 30,000 layoffs by 2013.

Additionally, HSBC has exited its retail banking businesses in

Chile, Canada, Poland and Russia. Moreover, the company is on the

final stages of talks regarding the sell of its South Korean retail

banking operations to KDB Financial Group.

Further, in January this year, HSBC announced the sale of its

Latin American businesses in Costa Rica, El Salvador and Honduras

for $801 million to Colombia-based Banco Davivienda. Last year, the

company had announced the sale of its 195 non-strategic branches in

the U.S. to First Niagara Financial Group Inc.

(FNFG) for $1 billion and its U.S. credit card business to

Capital One Financial Corporation (COF) for $32.7

billion.

Closing of the Japanese retail banking operations will enable

HSBC to concentrate on its core business. This will also provide

the company with long-term benefits. We expect the company to

continue with such closures and strategic sale of business units to

improve overall profitability going forward.

Currently, HSBC retains a Zacks #4 Rank, which translates into a

short-term Sell rating. Also, considering the fundamentals, we

maintain a long-term Underperform recommendation on the stock.

CAPITAL ONE FIN (COF): Free Stock Analysis Report

CREDIT SUISSE (CS): Free Stock Analysis Report

FIRST NIAGARA (FNFG): Free Stock Analysis Report

HSBC HOLDINGS (HBC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

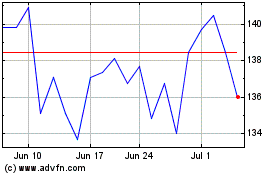

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2024 to May 2024

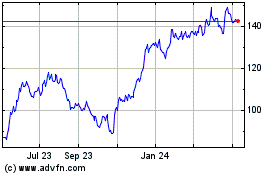

Capital One Financial (NYSE:COF)

Historical Stock Chart

From May 2023 to May 2024