- Current report filing (8-K)

July 29 2010 - 3:44PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (date of earliest event reported): July 28, 2010

ARLINGTON

ASSET INVESTMENT CORP.

(Exact

name of Registrant as specified in its charter)

|

Virginia

|

|

54-1873198

|

|

000-50230

|

|

(State

or Other Jurisdiction

of

Incorporation or Organization)

|

|

(I.R.S.

Employer Identification No.)

|

|

(Commission

File Number)

|

1001

Nineteenth Street North

Arlington,

VA 22209

(Address

of principal executive offices) (Zip code)

(877)

370-4413

(Registrant’s

telephone number including area code)

N/A

(Former name or former address, if

changed from last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Item

2.02.

|

Results

of Operations and Financial

Condition.

|

On July

28, 2010, Arlington Asset Investment Corp. issued a press release announcing its

financial results for the quarter ended June 30, 2010. A copy of the

press release is attached hereto as Exhibit 99.1.

The

information in Item 2.02 of this Current Report on Form 8-K, including

the exhibit furnished pursuant to Item 9.01, shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934 or

otherwise subject to the liabilities under that Section. Furthermore,

the information in Item 2.02 of this Current Report on Form 8-K,

including the exhibit furnished pursuant to Item 9.01, shall not be deemed

to be incorporated by reference into the filings of the Company under the

Securities Act of 1933.

On July

28, 2010, the Company announced that its board of directors has authorized a new

share repurchase program (the “2010 Repurchase Program”), pursuant to which the

Company may repurchase up to 500,000 shares of the Company’s Class A common

stock. The 2010 Repurchase Program replaces the Company’s prior

repurchase program originally authorized in April 2003 (the “2003 Repurchase

Program”), pursuant to which the Company was authorized to repurchase up to

5,000,000 shares of its Class A common stock. The board of directors

terminated the 2003 Repurchase Program and replaced it with the 2010 Repurchase

Program in order to better position the Company to continue share repurchases

while preserving its ability to use its net operating loss carryforwards and net

capital loss carryforwards.

Repurchases

under the 2010 Repurchase Program may be made from time to time on the open

market and in private transactions at management’s discretion in accordance with

applicable federal securities laws. The timing of repurchases and the

exact number of shares of Class A common stock to be purchased will depend upon

market conditions and other factors. The 2010 Repurchase Program will

be funded using the Company’s cash on hand and cash generated from

operations. The 2010 Repurchase Program has no expiration date and

may be suspended or discontinued at any time without prior notice.

During

the three months ended June 30, 2010, the Company repurchased 29,022 shares of

its Class A common stock at an average price of $18.87 per share and a total

cost of $0.5 million. Upon adoption of the 2010 Repurchase Program on

July 28, 2010, the board determined to apply the repurchases made during the

three months ended June 30, 2010 against the shares authorized under the 2010

Repurchase Program, instead of the 2003 Repurchase

Program. Consequently, at July 28, 2010, 470,978 shares of Class A

common stock remained available for purchase under the 2010 Repurchase

Program.

|

Item

9.01.

|

Financial

Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

|

|

99.1

|

|

Arlington

Asset Investment Corp. Press Release dated July 28,

2010.

|

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this Report to

be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

ARLINGTON

ASSET INVESTMENT CORP.

|

|

Date:

July 29, 2010

|

By:

|

/s/ Kurt R. Harrington

|

|

|

Name:

|

Kurt

R. Harrington

|

|

|

Title:

|

Executive

Vice President, Chief Financial Officer

and

Chief Accounting Officer

|

|

|

|

|

|

|

|

|

EXHIBIT

INDEX

|

|

|

|

|

|

|

|

|

99.1

|

|

Arlington

Asset Investment Corp. Press Release dated July 28,

2010.

|

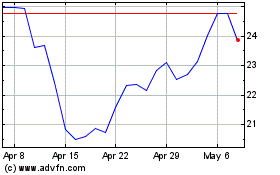

C3 AI (NYSE:AI)

Historical Stock Chart

From May 2024 to Jun 2024

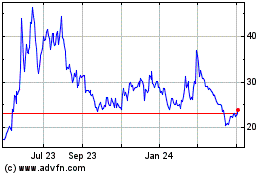

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2023 to Jun 2024