Brunswick Corp - Aggressive Growth

November 22 2011 - 7:00PM

Zacks

Brunswick Corp (BC) operates in markets that are highly

sensitive to the economy, so this is a pretty aggressive play. But,

with earnings momentum this Zacks #1 Rank (Strong Buy) could turn

around sharply if economic worries start to fade.

Company Description

Brunswick Corp is best known for making bowling and billiard

equipment under the Brunswick name, but the company also makes

marine engines and accessories under the Mercury, Mariner, and

other brands as well as fitness equipment.

Well Ahead of Expectations

On Oct 27 the company released third-quarter results that showed

an 8% increase in sales, to $877 million. Brunswick said increasing

market share was the biggest factor on the top line and also led to

the best operating results in 5 years.

Net income came in at $4.7 million, but thanks to plenty of

charges, that comes out to EPS of $0.33. Analysts polled by Zacks

were looking for just 6 cents per share. There is a wide

discrepancy over the amount of those charges factored into the EPS

figure, but most major sources have the quarter listed as

better-than-expected.

Upward Revisions

The Zacks Consensus Estimate for this year is now at $0.72 after

upward revisions. Next year's average projection is up 12 cents, to

$1.38.

Last year the company lost $0.54 per share, so this is quite a

turnaround story this year, followed by a 92% growth rate next

year.

Valuations

Brunswick won't be luring any value investors in at these levels

though. Shares are at 12 times the 2012 estimate, but are still

trading at over 7 times book value. The price to sales of 0.4 times

is pretty good though.

The Chart

Shares of BC have been trending lower lately, but as they start

to look oversold traders may start coming in. This stock is still a

Zacks #1 Rank (Strong Buy) but this is still a highly aggressive

play.

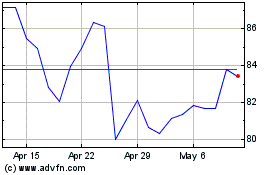

Brunswick (NYSE:BC)

Historical Stock Chart

From Jun 2024 to Jul 2024

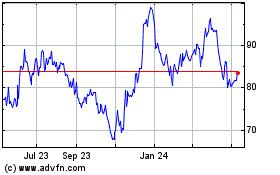

Brunswick (NYSE:BC)

Historical Stock Chart

From Jul 2023 to Jul 2024