Brown & Brown, Inc. (NYSE: BRO) today announced its financial

results for the third quarter of 2011.

Net income for the third quarter of 2011 was $44,173,000, or

$0.30 per share, compared with $44,293,000, or $0.31 per share for

the same quarter of 2010, a decrease of 0.3%. Total revenue for the

third quarter ended September 30, 2011 was $260,401,000, compared

with 2010 third-quarter revenue of $247,616,000, an increase of

5.2%.

Total revenue for the nine months ended September 30, 2011 was

$769,445,000, compared with total revenue for the same period of

2010 of $743,554,000. Net income for the nine-month period ended

September 30, 2011 was $127,501,000, or $0.88 per share, compared

with $129,606,000, or $0.90 per share for the same period of

2010.

J. Powell Brown, President and Chief Executive Officer of Brown

& Brown, Inc., noted, "We continue to swim upstream against a

very difficult economy. We are pleased that our Services, National

Programs and Wholesale Brokerage Divisions achieved positive

internal revenue growth for the third quarter."

In the third quarter of 2011, $2,600,000 was expensed as a

result of a legal claim first raised in 1994 that a subsidiary of

the Company vigorously defended for 17 years until exhausting all

appellate avenues for review. This claim expense reduced the

Company's diluted net income per share for the third quarter of

2011 by $0.01.

Brown & Brown, Inc., through its subsidiaries, offers a

broad range of insurance and reinsurance products and services.

Additionally, certain Brown & Brown subsidiaries offer a

variety of risk management, third party administration, and other

services. Serving business, public entity, individual, trade and

professional association clients nationwide, the Company is ranked

by Business Insurance magazine as the United States' seventh

largest independent insurance intermediary. The Company's Web

address is www.bbinsurance.com.

This press release may contain certain statements relating to

future results which are forward-looking statements, including

those relating to future financial results and to acquisition

opportunities. These statements are not historical facts, but

instead represent only the Company's current belief regarding

future events, many of which, by their nature, are inherently

uncertain and outside of the Company's control. It is possible that

the Company's actual results, financial condition and achievements

may differ, possibly materially, from the anticipated results,

financial condition and achievements contemplated by these

forward-looking statements. Further information concerning the

Company and its business, including factors that potentially could

materially affect the Company's financial results and condition, as

well as its other achievements, are contained in the Company's

filings with the Securities and Exchange Commission. Some factors

include: general economic conditions around the country; downward

commercial property and casualty premium pressures; the effects of

legislative and regulatory changes in Florida pertaining to the

insurance industry, including those relating to coastal property

coverages; the competitive environment; the integration of the

Company's operations with those of businesses or assets the Company

has acquired or may acquire in the future and the failure to

realize the expected benefits of such integration; and the

potential occurrence of a disaster that affects certain areas of

the States of California, Florida, Indiana, Michigan, New Jersey,

New York, Pennsylvania, Texas and/or Washington, where significant

portions of the Company's business are concentrated. All

forward-looking statements made herein are made only as of the date

of this release, and the Company does not undertake any obligation

to publicly update or correct any forward-looking statements to

reflect events or circumstances that subsequently occur or of which

the Company hereafter becomes aware.

Brown & Brown, Inc.

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

(unaudited)

For the For the

Three Months Ended Nine Months Ended

September 30 September 30

-------------------- -------------------

2011 2010 2011 2010

--------- --------- --------- ---------

REVENUES

Commissions and fees $ 257,177 $ 246,102 $ 764,612 $ 737,829

Investment income 317 345 934 1,022

Other income, net 2,907 1,169 3,899 4,703

--------- --------- --------- ---------

Total revenues 260,401 247,616 769,445 743,554

--------- --------- --------- ---------

EXPENSES

Employee compensation and benefits 126,877 122,001 379,286 365,556

Non-cash stock-based compensation 2,856 1,495 8,338 5,230

Other operating expenses 38,434 31,301 109,489 101,256

Amortization 13,725 12,869 40,790 38,072

Depreciation 3,062 3,116 9,276 9,498

Interest 3,565 3,607 10,780 10,847

Change in estimated acquisition

earn-out payables (810) 193 656 (1,036)

--------- --------- --------- ---------

Total expenses 187,709 174,582 558,615 529,423

--------- --------- --------- ---------

Income before income taxes 72,692 73,034 210,830 214,131

Income taxes 28,519 28,741 83,329 84,525

--------- --------- --------- ---------

Net income $ 44,173 $ 44,293 $ 127,501 $ 129,606

========= ========= ========= =========

Net income per share:

Basic $ 0.31 $ 0.31 $ 0.89 $ 0.91

========= ========= ========= =========

Diluted $ 0.30 $ 0.31 $ 0.88 $ 0.90

========= ========= ========= =========

Weighted average number of shares

outstanding:

Basic 138,690 138,093 138,475 137,802

========= ========= ========= =========

Diluted 140,443 139,507 140,120 139,128

========= ========= ========= =========

Dividends declared per share $ 0.0800 $ 0.0775 $ 0.2400 $ 0.2325

========= ========= ========= =========

Brown & Brown, Inc.

INTERNAL GROWTH SCHEDULE

Core Commissions and Fees (1)

Three Months Ended September 30, 2011

(in thousands)

(unaudited)

Total Less

Quarter Quarter Total Net Acquisi- Internal Internal

Ended Ended Net Growth tion Net Net

09/30/11 09/30/10 Change % Revenues Growth $ Growth %

-------- -------- ------- ------ -------- -------- --------

Florida

Retail $ 34,840 $ 34,173 $ 667 2.0% $ 1,674 $ (1,007) (2.9)%

National

Retail 87,307 80,611 6,696 8.3% 10,227 (3,531) (4.4)%

Western

Retail 26,680 25,028 1,652 6.6% 3,539 (1,887) (7.5)%

-------- -------- ------- -------- --------

Total

Retail 148,827 139,812 9,015 6.4% 15,440 (6,425) (4.6)%

-------- -------- ------- -------- --------

Professional

Programs 11,525 11,675 (150) (1.3)% - (150) (1.3)%

Special

Programs 38,637 37,542 1,095 2.9% 675 420 1.1%

-------- -------- ------- -------- --------

Total

National

Programs 50,162 49,217 945 1.9% 675 270 0.5%

-------- -------- ------- -------- --------

Wholesale

Brokerage 34,505 34,369 136 0.4% - 136 0.4%

Services 16,450 11,786 4,664 39.6% 4,352 312 2.6%

-------- -------- ------- -------- --------

Total Core

Commissions

and

Fees (1) $249,944 $235,184 $14,760 6.3% $ 20,467 $ (5,707) (2.4)%

======== ======== ======= ======== ========

Reconciliation of Internal Growth Schedule

to Total Commissions and Fees

Included in the Consolidated Statements of Income

For the Three Months Ended September 30, 2011 and 2010

(in thousands)

(unaudited)

Quarter Quarter

Ended Ended

09/30/11 09/30/10

------------- -------------

Total core commissions and fees (1) $ 249,944 $ 235,184

Contingent commissions 7,233 9,667

Divested business - 1,251

------------- -------------

Total commission & fees $ 257,177 $ 246,102

============= =============

(1) Total core commissions and fees are our total commissions and fees less

(i) profit-sharing contingent commissions (revenue derived from special

revenue-sharing commissions from insurance companies based upon the

volume and the growth and/or profitability of the business placed with

such companies during the prior year), and (ii) divested business

(commissions and fees generated from offices, books of business or

niches sold by the Company or terminated).

Brown & Brown, Inc.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

(unaudited)

September 30, December 31,

2011 2010

------------- -------------

ASSETS

Current assets:

Cash and cash equivalents $ 334,497 $ 272,984

Restricted cash and investments 146,033 123,594

Short-term investments 7,612 7,678

Premiums, commissions and fees receivable 212,051 214,446

Deferred income taxes 8,837 20,076

Other current assets 23,664 14,031

------------- -------------

Total current assets 732,694 652,809

Fixed assets, net 59,807 59,713

Goodwill 1,268,957 1,194,827

Amortizable intangible assets, net 481,930 481,900

Other assets 17,915 11,565

------------- -------------

Total assets $ 2,561,303 $ 2,400,814

============= =============

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Premiums payable to insurance companies $ 325,996 $ 311,346

Premium deposits and credits due customers 46,440 28,509

Accounts payable 24,062 33,693

Accrued expenses and other liabilities 90,641 94,947

Current portion of long-term debt 1,142 1,662

------------- -------------

Total current liabilities 488,281 470,157

Long-term debt 250,603 250,067

Deferred income taxes, net 167,074 146,482

Other liabilities 38,784 27,764

Shareholders' equity:

Common stock, par value $0.10 per share;

authorized 280,000 shares; issued and

outstanding 143,382 at 2011 and 142,795 at

2010 14,338 14,279

Additional paid-in capital 303,966 286,997

Retained earnings 1,298,256 1,205,061

Accumulated other comprehensive income 1 7

------------- -------------

Total shareholders' equity 1,616,561 1,506,344

------------- -------------

Total liabilities and shareholders' equity $ 2,561,303 $ 2,400,814

============= =============

Cory T. Walker Chief Financial Officer (386) 239-7250

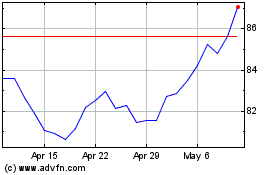

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Apr 2024 to May 2024

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From May 2023 to May 2024