Earnings Preview: Brinker - Analyst Blog

January 20 2012 - 7:45AM

Zacks

Dallas-based Brinker

International Inc. (EAT) is slated to

release its second quarter 2012 results on Tuesday, January 24,

before the market opens. The current Zacks Consensus Estimate for

the second quarter is pegged at 45 cents per share, representing an

annualized growth of 18.27%. The Zacks Consensus Sales estimate is

$686.0 million.

With respect to earnings surprises

over the trailing four quarters, Brinker has outperformed the Zacks

Consensus Estimate in all the quarters. The average earnings

surprise stands at positive 9.11%, implying that the company has

outdone the Zacks Consensus Estimate by the same magnitude over the

same period.

Previous Quarter

Recap

The owner of Chili’s Grill &

Bar and Maggiano's Little Italy restaurant posted first quarter

2012 adjusted earnings per share of 30 cents, surpassing the Zacks

Consensus Estimate of 27 cents and the prior- year quarter earnings

of 21 cents. The upside in earnings was attributable to higher

restaurant margin as well as lower share count.

During the quarter, total revenue

climbed 2.1% year over year to $668.4 million attributed to a 2.0%

upside in system-wide comparable restaurants sales. Restaurant

operating margin expanded 80 basis points (bps) year over year to

15.8%.

Outlook

The casual dining restaurant

company reaffirmed its adjusted earnings guidance range of $1.80 to

$1.95 for fiscal 2012. The company continues to expect full-year

revenues and comparable-restaurant sales to increase 2%–3% year

over year.

Agreement of Estimate

Revisions

In the last 30 days, out of the 17

analysts covering the stock, none of the analysts slashed the

estimates but 2 analysts raised the same for the second quarter.

Likewise, for the third quarter, 2 out of 16 analysts increased

their estimates but none moved in the opposite direction.

Similarly, for fiscal 2012 and 2013, 2 analysts have made upward

revisions while not a single analyst moved in the opposite

direction. This implies that the analysts are slightly positive

regarding the performance of the company.

In the last 7 days, none of the

analysts have budged their estimates, implying that the analysts do

not see any near-term catalysts and thus are maintaining their view

on the stock.

The upward revision in the

analysts’ estimates was based on improved comps at both Chili’s and

Maggiano’s, operating margin expansion, unit growth and benefit

from share repurchases.

Magnitude of Estimate

Revisions

Over the last 60 days, there has

been no change in the earnings estimate of 45 cents for the second

quarter of 2012 and 55 cents for the third quarter of 2012.

Therefore, the analysts expect the company to report in line. In

the last 30 days, estimates for 2012 and 2013 have jumped by a

penny to $1.85 and $2.15, respectively.

The current Zacks Consensus

Estimate for the third quarter, fiscal 2012 and 2013 reflect a

year-over-year growth of 16.76%, 21.82% and 15.91%, respectively.

The Zacks Consensus Sales Estimates for the third quarter, fiscal

2012 and 2013 are $727 million, $2.81 billion and $2.88 billion

respectively.

Earning

Surprises

The current Zacks Consensus

Estimates for the ongoing quarter reflects a 4.44% upside potential

while the third quarter of 2012 reflects a 1.82% downside risk

(essentially a proxy for future earning surprises). Similarly,

fiscal 2011 contain a 0.00% growth potential. However, 2012 has a

downside potential of 0.93%.

Our Take

We believe that Brinker remains one

of the strongest long-term players in the casual dining segment and

besides repositioning its Chili’s brand, the company is also

undertaking several sales initiatives to sustain its positive sales

momentum and record more sustainable and stable growth.The

company’s strategy to shift to franchised operation, focus on

international expansion in order to move away from the

over-supplied domestic market and remain in a cost-control mode for

quite some time, also looks promising for its business. The company

remains on track to double its EPS and achieve margin expansion of

400 bps by 2015.

On the flip side, food cost

inflation, lower consumer spending due to uncertain economic

environment and stiff competition with respect to price, service,

location and concept in order to drive traffic may adversely affect

Brinker’s top and bottom-line growth.

Hence, the company holds a Zacks #2

Rank, which implies a short-term Buy rating. We also reiterate our

long-term Neutral recommendation.

One of the competitors of

Brinker’s, McDonald’s Corporation (MCD), is slated

to release its fourth quarter results on January 24, 2011, before

the opening bell, while another rival, Yum! Brands

Inc. (YUM) will announce fourth quarter results on

February 1, after the market closes.

BRINKER INTL (EAT): Free Stock Analysis Report

MCDONALDS CORP (MCD): Free Stock Analysis Report

YUM! BRANDS INC (YUM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

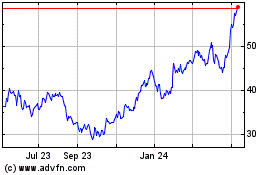

Brinker (NYSE:EAT)

Historical Stock Chart

From May 2024 to Jun 2024

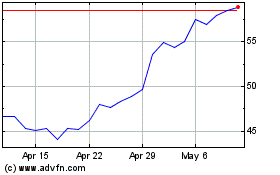

Brinker (NYSE:EAT)

Historical Stock Chart

From Jun 2023 to Jun 2024