BlackRock Announces 9% Increase in Quarterly Common Stock Dividend

February 23 2012 - 4:38PM

Business Wire

BlackRock, Inc. (NYSE: BLK) today announced that its Board of

Directors approved a nine percent increase in the company’s

quarterly common stock dividend, to $1.50 per share from $1.375 per

share. The dividend is payable on March 23, 2012 to shareholders of

record as of March 7, 2012.

BlackRock’s Board of Directors also approved an increase in the

availability under the company’s existing share repurchase program

to allow for the repurchase of up to 5.0 million shares of

BlackRock common stock.

“The Board’s decision to further increase the dividend and our

share repurchase capacity reinforces our collective confidence in

BlackRock’s financial strength and the diversity of our earnings

model as well as our continued commitment to delivering strong

shareholder value,” said Laurence D. Fink, Chairman and Chief

Executive Officer. “Today’s announcement reflects our focus on

returning a meaningful amount of cash to shareholders through both

dividends as well as share repurchases.”

The share repurchase program provides for repurchase of

BlackRock’s common shares in the open market or in privately

negotiated transactions, from time to time, depending on market

conditions and at the discretion of management. The program, which

has no stated expiration date, was originally approved in July

2010, and prior to this approval, had approximately 3.6 million

shares of remaining authorization as of December 31, 2011.

About BlackRock

BlackRock is a leader in investment management, risk management

and advisory services for institutional and retail clients

worldwide. At September 30, 2011, BlackRock’s AUM was $3.345

trillion. BlackRock offers products that span the risk spectrum to

meet clients’ needs, including active, enhanced and index

strategies across markets and asset classes. Products are offered

in a variety of structures including separate accounts, mutual

funds, iShares® (exchange-traded funds), and other pooled

investment vehicles. BlackRock also offers risk management,

advisory and enterprise investment system services to a broad base

of institutional investors through BlackRock Solutions®.

Headquartered in New York City, as of September 30, 2011, the firm

has approximately 10,200 employees in 27 countries and a major

presence in key global markets, including North and South America,

Europe, Asia, Australia, and the Middle East and Africa. For

additional information, please visit the Company's website at

www.blackrock.com.

Forward-looking Statements

This press release, and other statements that BlackRock may

make, may contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act, with respect to

BlackRock’s future financial or business performance, strategies or

expectations. Forward-looking statements are typically identified

by words or phrases such as “trend,” “potential,” “opportunity,”

“pipeline,” “believe,” “comfortable,” “expect,” “anticipate,”

“current,” “intention,” “estimate,” “position,” “assume,”

“outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,”

“achieve,” and similar expressions, or future or conditional verbs

such as “will,” “would,” “should,” “could,” “may” or similar

expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and BlackRock assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

In addition to risk factors previously disclosed in BlackRock’s

Securities and Exchange Commission (“SEC”) reports and those

identified elsewhere in this report the following factors, among

others, could cause actual results to differ materially from

forward-looking statements or historical performance: (1) the

introduction, withdrawal, success and timing of business

initiatives and strategies; (2) changes and volatility in

political, economic or industry conditions, the interest rate

environment, foreign exchange rates or financial and capital

markets, which could result in changes in demand for products or

services or in the value of assets under management; (3) the

relative and absolute investment performance of BlackRock’s

investment products; (4) the impact of increased competition; (5)

the impact of future acquisitions or divestitures; (6) the

unfavorable resolution of legal proceedings; (7) the extent and

timing of any share repurchases; (8) the impact, extent and timing

of technological changes and the adequacy of intellectual property

and information security protection; (9) the impact of legislative

and regulatory actions and reforms, including the Dodd-Frank Wall

Street Reform and Consumer Protection Act, and regulatory,

supervisory or enforcement actions of government agencies relating

to BlackRock, Barclays Bank PLC or The PNC Financial Services

Group, Inc.; (10) terrorist activities, international hostilities

and natural disasters, which may adversely affect the general

economy, domestic and local financial and capital markets, specific

industries or BlackRock; (11) the ability to attract and retain

highly talented professionals; (12) fluctuations in the carrying

value of BlackRock’s economic investments; (13) the impact of

changes to tax legislation, including taxation on products or

transactions which could affect the value proposition to clients

and, generally, the tax position of the Company; (14) BlackRock’s

success in maintaining the distribution of its products; (15) the

impact of BlackRock electing to provide support to its products

from time to time; and (16) the impact of problems at other

financial institutions or the failure or negative performance of

products at other financial institutions.

BlackRock's Annual Report on Form 10-K and BlackRock's

subsequent filings with the SEC, accessible on the SEC's website at

www.sec.gov and on BlackRock’s website at

www.blackrock.com, discuss these factors in more detail and

identify additional factors that can affect forward-looking

statements. The information contained on the Company’s website is

not a part of this press release.

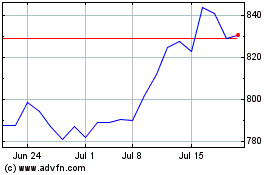

BlackRock (NYSE:BLK)

Historical Stock Chart

From Jun 2024 to Jul 2024

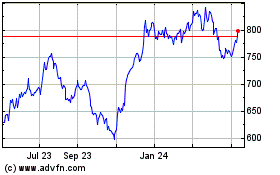

BlackRock (NYSE:BLK)

Historical Stock Chart

From Jul 2023 to Jul 2024