Barnes Group Inc. (NYSE: B), a diversified global manufacturer

and logistical services company, today reported financial results

for the third quarter 2011. Net sales grew 12 percent to $325.4

million, up from $289.9 million in the third quarter of 2010.

Excluding the favorable impact of foreign exchange, net sales were

up 10 percent. Net income for the third quarter grew 54 percent to

$23.2 million, or $0.41 per diluted share, from $15.1 million, or

$0.27 per diluted share, a year earlier.

($ millions; except

Three months ended September

30,

Nine months ended September 30,

per share data)

2011

2010

Change

2011

2010

Change

Net Sales $ 325.4 $ 289.9 $ 35.5 12.2 % $ 972.1 $ 849.9 $

122.2 14.4 % Operating Income $ 32.9 $ 24.8 $ 8.1 32.7 % $

95.9 $ 68.2 $ 27.7 40.7 % % of Sales 10.1 % 8.6 % 1.5 pts. 9.9 %

8.0 % 1.9 pts. Net Income $ 23.2 $ 15.1 $ 8.1 53.9 % $ 64.6 $ 41.8

$ 22.9 54.8 % % of Sales 7.1 % 5.2 % 1.9 pts. 6.7 % 4.9 % 1.8 pts.

Net Income Per Diluted

Share $ 0.41 $ 0.27 $ 0.14 51.9 % $ 1.15 $ 0.75 $ 0.40 53.3 %

“Barnes Group generated double-digit sales growth during the

third quarter as our end-markets continued their recovery,” said

Gregory F. Milzcik, Barnes Group Inc. President and Chief Executive

Officer. “And, as a result of our on-going focus on profitable

growth and improved productivity, we delivered a 54 percent

increase in net income over last year’s third quarter.”

Logistics and Manufacturing Services

- Barnes Group Inc.’s Logistics and

Manufacturing Services segment recorded sales of $151.6 million in

the third quarter of 2011, up $12.7 million or 9 percent from last

year’s third quarter. This segment achieved $10.5 million of

organic sales growth from its aerospace aftermarket and North

American distribution businesses. Foreign currency translation

positively affected third quarter 2011 net sales by approximately

$2.2 million.

- Operating profit at Logistics and

Manufacturing Services increased 49 percent to $16.0 million, from

$10.8 million in the third quarter of 2010. The increase in

profitability was positively impacted by higher sales and further

productivity improvements in the North American distribution

businesses. The aerospace aftermarket business likewise benefited

from volume leverage on higher sales. Operating profit increases

for the segment were partially offset by costs associated with

strategic initiatives and higher management fees related to our

Revenue Sharing Programs.

Precision Components

- Barnes Group Inc.’s Precision

Components segment recorded sales of $176.6 million in the third

quarter of 2011, up $22.6 million, a 15 percent increase from last

year’s third quarter. Organic sales grew $17.9 million in the

quarter primarily as a result of increases in the segment’s North

American and European industrial manufacturing businesses and from

better performance in the transportation industry, including

automotive. Net sales in the segment’s aerospace OEM business also

achieved double-digit growth. Foreign currency translation

positively affected third quarter 2011 net sales by approximately

$4.7 million.

- Operating profit at Precision

Components was $16.9 million, an increase of 21 percent. The

operating profit improvement resulted from the beneficial impact of

higher sales levels combined with productivity gains and lean

initiatives. These improvements were offset in part by added costs

for strategic and productivity initiatives and increased costs

related to outsourcing certain manufacturing processes.

Additional Information

- The Company’s interest expense was $1.9

million, a decrease of $3.3 million from last year’s third quarter.

The reduction in interest expense was a result of a lower average

interest rate and the non-recurrence of debt discount amortization

related to the 3.75% Convertible Notes. The lower average interest

rate reflects the shift to a higher percentage of variable rate

debt due to the retirement of the 7.80% Notes, the redemption of

the 3.75% Convertible Notes, which were funded with the variable

rate credit facility, and the expiration of the interest rate swap

agreements.

- The Company’s effective tax rate for

the third quarter of 2011 was 26.1 percent, compared to 20.0

percent in the third quarter of last year. The increase in the

effective tax rate was primarily driven by a projected shift in the

mix of earnings attributable to higher-taxing jurisdictions, and

the effect of an increase in the repatriation of a portion of

current year earnings to the U.S.

Revised 2011 Outlook

Barnes Group Inc. now expects 2011 revenue to grow about 13

percent from 2010, and earnings per diluted share to be in the

range of $1.43 to $1.48, up 51 to 56 percent from 2010. Said

Milzcik, “The positive trends of improving sales and enhanced

profitability is anticipated to carry through to the fourth quarter

of this year and we’re now expecting to deliver performance that is

at the high end of or better than our previous guidance.”

This updated outlook does not include any impact from the

potential sale of the Barnes Distribution Europe (“BDE”) business,

comprised of the businesses that operate as Kent, BD France and

Toolcom, in response to a binding offer from Berner SE. The offer

was received in the third quarter 2011 and is subject to customary

conditions and approvals. Where required by local law, including in

France, Barnes Group has initiated a consultation on the proposed

transaction with its relevant works councils, trade unions and

other employee organizations. Upon completion of these

consultations, the transaction will be subject to consideration and

approval by Barnes Group’s Board of Directors.

Barnes Group’s BDE businesses are currently reported within the

Company’s Logistics and Manufacturing Services segment and had 2010

revenues of approximately $105 million. If Barnes Group accepts the

offer following the consultation processes, it would expect to

report its BDE businesses as Discontinued Operations and to record

a pretax loss of about $20 million, inclusive of non-cash

impairments of long-lived assets and subject to change for various

factors, such as foreign currency translation, transaction costs

and closing adjustments. The Company expects that EPS reported

on a Continuing Operations basis would improve by approximately

$0.10 per diluted share if the BDE businesses were to be reported

as Discontinued Operations at December 31, 2011.

Conference Call

Barnes Group Inc. will conduct a conference call with investors

to discuss third quarter 2011 results at 8:30 a.m. EST today,

October 28, 2011. A webcast of the live call and an archived replay

will be available on the Barnes Group investor relations link at

www.BGInc.com. The conference call is also available by direct dial

at (888) 679-8034 in the U.S. or (617) 213-4847 outside of the U.S.

(request the Barnes Group Earnings Call); Participant Code:

59843412.

About Barnes Group

Founded in 1857, Barnes Group Inc. (NYSE:B) is a diversified

global manufacturer and logistical services company focused on

providing precision component manufacturing and operating service

support. The Barnes Group’s more than 4,800 dedicated employees, at

more than 60 locations worldwide, are committed to achieving

consistent and sustainable profitable growth. For more information,

visit www.BGInc.com. Barnes Group, the Critical Components

People.

Forward-Looking Statements

This release may contain certain forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are made based upon management's good

faith expectations and beliefs concerning future developments and

their potential effect upon the Company and can be identified by

the use of words such as "anticipated," "believe," "expect,"

"plans," "strategy," "estimate," "project," and other words of

similar meaning in connection with a discussion of future operating

or financial performance. These forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially from those expressed in the forward-looking

statements. The risks and uncertainties, including whether the

transaction proposed by Berner SE will be consummated and others

described in our periodic filings with the Securities and Exchange

Commission, include, among others, uncertainties arising from the

current or worsening disruptions in financial markets; future

financial performance of the industries or customers that we serve;

changes in market demand for our products and services; integration

of acquired businesses; restructuring costs or savings; the impact

of the proposed acquisition of the BDE businesses by Berner SE and

any other future strategic actions, including acquisitions, joint

ventures, divestitures, restructurings, or strategic business

realignments, and our ability to achieve the financial and

operational targets set in connection with any such actions;

introduction or development of new products or transfer of work;

changes in raw material or product prices and availability; foreign

currency exposure; our dependence upon revenues and earnings from a

small number of significant customers; a major loss of customers;

the outcome of pending and future claims or litigation or

governmental, regulatory proceedings, investigations, inquiries,

and audits; uninsured claims and litigation; outcome of

contingencies; future repurchases of common stock; future levels of

indebtedness; and numerous other matters of global, regional or

national scale, including those of a political, economic, business,

competitive, environmental, regulatory and public health nature.

The Company assumes no obligation to update our forward-looking

statements.

BARNES GROUP INC. CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share data)

Unaudited Three

months ended September 30, Nine months ended September

30, 2011 2010 %

Change 2011 2010 %

Change Net sales $ 325,394 $ 289,901 12.2 $ 972,098 $

849,930 14.4 Cost of sales 210,864 184,989 14.0 621,401

540,833 14.9 Selling and administrative expenses 81,586

80,079 1.9 254,782

240,915 5.8 292,450 265,068

10.3 876,183 781,748 12.1

Operating income 32,944 24,833 32.7 95,915 68,182 40.7

Operating margin 10.1 % 8.6 % 9.9 % 8.0 % Interest expense

1,917 5,177 (63.0 ) 7,950 15,273 (47.9 ) Other expense (income),

net (425 ) 773 NM 378

2,161 (82.5 ) Income before income taxes 31,452

18,883 66.6 87,587 50,748 72.6 Income taxes 8,207

3,779 NM 22,938 8,992

NM Net income $ 23,245 $ 15,104 53.9 $

64,649 $ 41,756 54.8 Common dividends $ 4,432

$ 4,373 1.3 $ 13,197 $ 13,159 0.3

Per common share: Net income: Basic $ 0.42 $ 0.27 55.6 $

1.17 $ 0.75 56.0 Diluted 0.41 0.27 51.9 1.15 0.75 53.3 Dividends

0.08 0.08 - 0.24 0.24 - Weighted average common shares

outstanding: Basic 55,834,038 55,346,517 0.9 55,325,541 55,428,865

(0.2 ) Diluted 56,380,585 55,839,970 1.0 56,095,069 56,048,170 0.1

BARNES GROUP INC. OPERATIONS BY REPORTABLE BUSINESS

SEGMENT (Dollars in thousands) Unaudited

Three months ended September

30, Nine months ended September 30, 2011

2010 % Change 2011

2010 % Change Net sales

Logistics and Manufacturing Services $ 151,600 $ 138,937 9.1 $

456,910 $ 412,679 10.7 Precision Components 176,598 154,012

14.7 523,974 446,397 17.4 Intersegment sales (2,804 )

(3,048 ) 8.0 (8,786 ) (9,146 ) 3.9

Total net sales $ 325,394 $ 289,901 12.2 $ 972,098

$ 849,930 14.4 Operating profit

Logistics and Manufacturing Services $ 16,034 $ 10,799 48.5 $

45,837 $ 29,296 56.5 Precision Components 16,910

14,034 20.5 50,078 38,886

28.8 Total operating profit 32,944 24,833 32.7 95,915

68,182 40.7 Interest expense 1,917 5,177 (63.0 ) 7,950

15,273 (47.9 ) Other expense (income), net (425 )

773 NM 378 2,161 (82.5 )

Income before income taxes $ 31,452 $ 18,883

66.6 $ 87,587 $ 50,748 72.6

BARNES GROUP INC.

CONSOLIDATED BALANCE SHEETS (Dollars in thousands)

Unaudited

September 30,2011

December 31,2010

Assets Current assets Cash and cash equivalents $ 38,843 $

13,450 Accounts receivable 225,676 197,715 Inventories 227,463

216,382 Deferred income taxes 31,469 10,449 Prepaid expenses and

other current assets 12,179 12,212 Total

current assets 535,630 450,208 Deferred income taxes

24,147 42,722 Property, plant and equipment, net 216,263 218,434

Goodwill 389,972 384,241 Other intangible assets, net 281,282

290,798 Other assets 19,323 16,854 Total

assets $ 1,466,617 $ 1,403,257

Liabilities and

Stockholders' Equity Current liabilities Notes and overdrafts

payable $ 8,144 $ 4,930 Accounts payable 101,322 98,191 Accrued

liabilities 103,566 86,602 Long-term debt - current 769

93,141 Total current liabilities 213,801 282,864

Long-term debt 338,828 259,647 Accrued retirement benefits

94,473 112,886 Other liabilities 35,968 35,741 Total

stockholders' equity 783,547 712,119 Total

liabilities and stockholders' equity $ 1,466,617 $ 1,403,257

BARNES GROUP INC. CONSOLIDATED STATEMENTS OF CASH

FLOWS (Dollars in thousands) Unaudited

Nine months ended September 30,

2011 2010 Operating

activities: Net income $ 64,649 $ 41,756 Adjustments to

reconcile net income to net cash from operating activities:

Depreciation and amortization 43,855 38,988 Amortization of

convertible debt discount 1,633 4,251 (Gain) loss on disposition of

property, plant and equipment (400 ) 253 Stock compensation expense

5,866 5,619 Withholding taxes paid on stock issuances (1,089 ) (287

) Changes in assets and liabilities: Accounts receivable (27,462 )

(27,671 ) Inventories (11,385 ) (19,492 ) Prepaid expenses and

other current assets (1,457 ) (5,420 ) Accounts payable 4,867

11,359 Accrued liabilities 14,119 5,906 Deferred income taxes 1,968

4,469 Long-term retirement benefits (16,784 ) (12,155 ) Other

95 (579 ) Net cash provided by

operating activities 78,475 46,997

Investing

activities: Proceeds from disposition of property, plant and

equipment 3,352 1,384 Capital expenditures (25,169 ) (22,463 )

Business acquisitions, net of cash acquired (3,495 ) - Other

(3,424 ) (2,393 ) Net cash used by investing

activities (28,736 ) (23,472 )

Financing activities:

Net change in other borrowings 3,023 3,384 Payments on long-term

debt (354,167 ) (243,658 ) Proceeds from the issuance of long-term

debt 339,290 241,667 Premium paid on convertible debt redemption

(9,803 ) - Proceeds from the issuance of common stock 26,829 3,871

Common stock repurchases (22,369 ) (9,014 ) Dividends paid (13,197

) (13,159 ) Excess tax benefit on stock awards 8,607 - Other

(2,098 ) (160 ) Net cash used by financing activities

(23,885 ) (17,069 ) Effect of exchange rate changes on cash

flows (461 ) (159 ) Increase in cash and cash

equivalents 25,393 6,297 Cash and cash equivalents at

beginning of period 13,450 17,427

Cash and cash equivalents at end of period $ 38,843 $

23,724

BARNES GROUP INC. RECONCILIATION OF NET

CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(Dollars in thousands) Unaudited

Nine months ended September 30, 2011

2010 Free cash flow: Net

cash provided by operating activities $ 78,475 $ 46,997 Capital

expenditures (25,169 ) (22,463 ) Free cash

flow $ 53,306 $ 24,534

Notes:

1) The Company defines free cash flow as net cash provided by

operating activities less capital expenditures. The Company

believes that the free cash flow metric is useful to investors and

management as a measure of cash generated by business operations

that can be used to invest in future growth, pay dividends,

repurchase stock and reduce debt. This metric can also be used to

evaluate the Company's ability to generate cash flow from business

operations and the impact that this cash flow has on the Company's

liquidity.

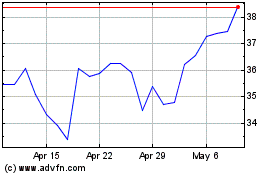

Barnes (NYSE:B)

Historical Stock Chart

From Apr 2024 to May 2024

Barnes (NYSE:B)

Historical Stock Chart

From May 2023 to May 2024