Bladex Reports Net Income of US$40.1 Million for the First Quarter 2005

May 05 2005 - 9:30AM

PR Newswire (US)

Bladex Reports Net Income of US$40.1 Million for the First Quarter

2005 First Quarter 2005 Financial Highlights PANAMA CITY, May 5

/PRNewswire-FirstCall/ -- Banco Latinoamericano de Exportaciones,

S.A. (NYSE:BLX) ("Bladex" or "the Bank") announced today its

results for the first quarter ended March 31, 2005. The table below

depicts selected key figures and ratios for the periods indicated

(the Bank's financial statements are prepared in accordance with

U.S. GAAP, and all figures are stated in U.S. dollars): Key Figures

1Q04 4Q04 1Q05 Net Income (US$ million) $29.8 $53.9 $40.1 EPS (*)

$0.76 $1.39 $1.03 Return on Average Equity 20.2% 33.1% 24.4% Tier 1

Capital Ratio 37.9% 42.8% 41.6% Net Interest Margin 1.69% 1.46%

1.66% (*) Earnings per share calculations are based on the average

number of shares outstanding during each period. Comments from the

Chief Executive Officer Jaime Rivera, Chief Executive Officer of

Bladex, stated, "During the first quarter we made steady progress

on a number of fronts. "The figures make it clear that the

management effort with respect to our portfolio in Argentina has

paid off handsomely. The exposure net of the allowance for credit

losses is now down to 2% of assets and 8% of equity, and we have,

for the first time since June 2002, placed an Argentine loan back

on an interest accrual basis. "Commercially, our trade portfolio

continues growing. Year-on-year, our trade portfolio grew a full

28%, more than four times the underlying economic growth rate in

the Region. More than 70% of this growth took place in the last six

months, while our new commercial team established itself. Notably,

the 3% growth during the seasonally-slow first quarter was more

than double last year's growth. "We continue increasing our number

of clients and deploying activities derived from our trade finance

client base. This quarter, for instance, the payments initiative,

where progress has been slower than anticipated, was revamped, and

we made 18 proposals to clients compared to 9 made in the six

months prior. "With the operating expense base stabilized we have

concentrated our expense reduction efforts on funding costs, where

every basis point saved brings savings of about US$200 thousand in

interest expense per year. From December 31, 2004 to March 31,

2005, our liability borrowings average margin over Libor decreased

by 4 basis points. "On another important front, we have started a

project to upgrade our technology platform. While our current

systems work well, we are aware of the advantages that a state of

the art, scalable, flexible, and integrated solution would afford

us in terms of improved client service, shorter response times,

faster product deployment, reduced operational risk, and improved

efficiency. We expect to complete the project within a year.

"Regarding capital management, a subject which our results have

brought to the forefront again, Bladex seeks to balance risk and

return considerations in order to withstand market volatility,

maintain stable access to funding sources, provide a solid base to

finance growth, promote share ownership by long-term investors and

generate competitive returns to shareholders' equity, and we will

act accordingly. In summary, we are making progress on all internal

and external fronts in a manner consistent with our strategy of

expanding our client base and our traditional trade intermediation

activities, while deploying new services that flow naturally from

this franchise." SAFE HARBOR STATEMENT This press release contains

forward-looking statements of expected future developments. The

Bank wishes to ensure that such statements are accompanied by

meaningful cautionary statements pursuant to the safe harbor

established by the Private Securities Litigation Reform Act of

1995. The forward-looking statements in this press release refer to

the growth of the trade portfolio, the increase in the number of

the Bank's clients, the increase in activities engaged in by the

Bank that are derived from the Bank's trade finance client base,

the improvement in the financial strength of the Bank and the

progress the Bank is making on all fronts. These forward-looking

statements reflect the expectations of the Bank's management and

are based on currently available data; however, actual experience

with respect to these factors is subject to future events and

uncertainties, which could materially impact the Bank's

expectations. Among the factors that can cause actual performance

and results to differ materially are as follows: a decline in the

willingness of international lenders and depositors to provide

funding to the Bank, causing a contraction of the Bank's credit

portfolio, adverse economic or political developments in the

Region, particularly in Brazil or Argentina, which could increase

the level of impaired loans in the Bank's loan portfolio and, if

sufficiently severe, result in the Bank's allowance for credit

losses being insufficient to cover losses in the portfolio,

unanticipated developments with respect to international banking

transactions (including, among other things, interest rate spreads

and competitive conditions), a change in the Bank's credit ratings,

events in Brazil or Argentina or other countries in the Region

unfolding in a manner that is detrimental to the Bank, or which

might result in adequate liquidity being unavailable to the Bank,

the Bank's operations being less profitable than anticipated, or

higher than anticipated equity capital requirements. About Bladex

Bladex is a supranational bank originally established by the

Central Banks of Latin American and Caribbean countries to promote

trade finance in the Region. Based in Panama, its shareholders

include central banks and state-owned entities in 23 countries in

the Region, as well as Latin American and international commercial

banks, along with institutional and retail investors. Through March

31, 2005, Bladex had disbursed accumulated credits of over US$130

billion. Bladex is listed on the New York Stock Exchange. Further

investor information can be found at http://www.blx.com/ A LONGER

VERSION OF THIS PRESS RELEASE WITH DETAILED INFORMATION HAS BEEN

FILED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION,

AND CAN BE OBTAINED FROM BLADEX AT: Bladex, Head Office, Calle 50 y

Aquilino de la Guardia, Panama City, Panama Attention: Carlos Yap,

Senior Vice President, Finance Tel. No. (507) 210-8581, e-mail: ,

-or- Investor Relations Firm Melanie Carpenter / Peter Majeski

i-advize Corporate Communications, Inc. Tel: (212) 406-3690,

e-mail: There will be a conference call to discuss the Bank's

quarterly results on May 6, 2005 at 11:00 a.m. New York City time.

For those interested in participating, please dial (800)-262-1292

in the United States or, if outside the United States,

719-457-2680. Participants should give the conference ID# 6842340

to the telephone operator five minutes before the call is set to

begin. There will also be a live audio webcast of the event at

http://www.blx.com/. Bladex's conference call will become available

for review on Conference Replay one hour after the conclusion of

the conference, and will remain available through May 13, 2005.

Please dial (888) 203-1112 or (719) 457-0820 and follow the

instructions. The Conference ID# for the replayed call is 6842340.

DATASOURCE: Banco Latinoamericano de Exportaciones, S.A. CONTACT:

Carlos Yap, Senior Vice President, Finance of Bladex,

+1-507-210-8581, ; Investor Relations Firm: Melanie Carpenter or

Peter Majeski, both of i-advize Corporate Communications, Inc.,

+1-212-406-3690, , for Bladex Web site: http://www.blx.com/

Copyright

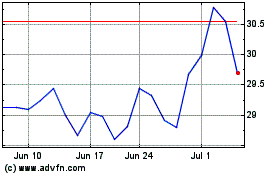

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From May 2024 to Jun 2024

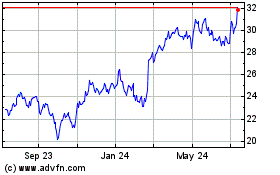

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jun 2023 to Jun 2024