B&G Foods, Inc. (NYSE: BGS) today announced financial

results for the second quarter and first two quarters of 2011,

reporting strong net sales and earnings growth.

Second Quarter 2011 Financial Highlights (vs. year-ago

quarter where applicable):

- Net sales increased 6.9% to $129.4

million

- Net income increased 48.3% to $12.6

million

- Adjusted net income* increased 36.6% to

$12.9 million

- Diluted earnings per share increased

44.4% to $0.26

- Adjusted diluted earnings per share*

increased 36.8% to $0.26

- EBITDA* increased 8.2% to $30.3

million

- Fiscal 2011 EBITDA guidance reaffirmed

at a range of $125.0 million to $128.0 million

David L. Wenner, President and Chief Executive Officer of

B&G Foods, stated, “We are very pleased with the continued

strong momentum in top and bottom line results, even after

factoring in the benefit of the late Easter holiday. We remain

confident that we will deliver full-year results within our

previously announced EBITDA guidance of $125.0 to $128.0 million,

with third quarter price increases and on-going cost reductions

efforts expected to offset the cost increases we will experience in

the second half of 2011.”

Financial Results for the Second Quarter of 2011

Net sales for the second quarter of 2011 increased 6.9% to

$129.4 million from $121.1 million for the second quarter of 2010.

This $8.3 million increase was attributable to an increase in unit

volume of $11.3 million offset by a net decrease in pricing of $1.7

million and an increase in coupon expenses of $1.3 million. Net

sales of the Company’s Don Pepino and Sclafani brands, which were

acquired during the fourth quarter of 2010, contributed $3.5

million to the overall unit volume increase for the second

quarter.

Gross profit for the second quarter of 2011 increased 7.0% to

$42.2 million from $39.4 million in the second quarter of 2010.

Gross profit expressed as a percentage of net sales increased 0.1

percentage points to 32.6% for the second quarter of 2011 from

32.5% in the second quarter of 2010. The increase in gross profit

expressed as a percentage of net sales was primarily attributable

to a sales mix shift to higher margin products. This mix shift

offset the net decrease in pricing and slightly higher input costs.

Operating income increased 8.3% to $26.3 million for the second

quarter of 2011, from $24.3 million in the second quarter of

2010.

Net interest expense for the second quarter of 2011 decreased

$2.6 million or 23.5% to $8.3 million from $10.9 million for the

second quarter of 2010. The decrease in net interest expense for

the second quarter was primarily attributable to the termination of

an interest rate swap causing a reduction in the effective interest

rate on $130.0 million of term loan borrowings from 7.0925% to

2.31% and the elimination of the unfavorable fair market value

adjustment relating to the interest rate swap.

The Company’s reported net income under U.S. generally accepted

accounting principles (GAAP) was $12.6 million, or $0.26 per

diluted share, for the second quarter of 2011, as compared to

reported net income of $8.5 million, or $0.18 per diluted share,

for the second quarter of 2010. The Company’s adjusted net income

for the second quarter of 2011 was $12.9 million, and adjusted

diluted earnings per share was $0.26, as compared to adjusted net

income of $9.4 million and adjusted diluted earnings per share of

$0.19 for the second quarter of 2010.

For the second quarter of 2011, EBITDA increased 8.2% to $30.3

million from $28.0 million for the second quarter of 2010.

Financial Results for the First Two Quarters of 2011

Net sales for the first two quarters of 2011 increased 5.9% to

$260.8 million from $246.3 million for the first two quarters of

2010. This $14.5 million increase was attributable to an increase

in unit volume of $17.2 million offset by a net decrease in pricing

of $1.5 million and an increase in coupon and slotting expenses of

$1.2 million. Net sales of the Company’s Don Pepino and Sclafani

brands, which were acquired during the fourth quarter of 2010,

contributed $7.1 million to the overall unit volume increase for

the first two quarters of 2011.

Gross profit for the first two quarters of 2011 increased 6.9%

to $87.0 million from $81.4 million in the first two quarters of

2010. Gross profit expressed as a percentage of net sales increased

0.3 percentage points to 33.4% in the first two quarters of 2011

from 33.1% in the first two quarters of 2010. The increase in gross

profit expressed as a percentage of net sales was primarily

attributable to a sales mix shift to higher margin products and

slightly reduced input costs offset by a reduction in sales prices

and increased coupon and slotting expenses. Operating income

increased 9.3% to $55.4 million in the first two quarters of 2011,

from $50.7 million in the first two quarters of 2010.

Net interest expense for the first two quarters of 2011

decreased $5.0 million or 23.2% to $16.5 million from $21.5 million

for in the first two quarters of 2010. The decrease in net interest

expense for the first two quarters was primarily attributable to

the termination of the interest rate swap causing a reduction in

the effective interest rate on $130.0 million of term loan

borrowings from 7.0925% to 2.31% and the elimination of the

unfavorable fair market value adjustment relating to the interest

rate swap.

The Company’s reported net income under U.S. GAAP was $25.9

million, or $0.53 per diluted share, for the first two quarters of

2011, as compared to reported net income of $8.8 million, or $0.18

per diluted share, for the first two quarters of 2010. The

Company’s adjusted net income for the first two quarters of 2011

was $26.1 million, and adjusted diluted earnings per share was

$0.54, as compared to adjusted net income of $19.8 million and

adjusted diluted earnings per share of $0.41 for the first two

quarters of 2010.

For the first two quarters of 2011, EBITDA increased 9.1% to

$63.3 million from $58.0 million for the first two quarters of

2010.

Guidance

EBITDA for fiscal 2011 is expected to be approximately $125.0

million to $128.0 million. Capital expenditures for fiscal 2011 are

expected to be approximately $11.0 million.

Conference Call

B&G Foods will hold a webcast and conference call at 4:30

p.m. ET today, July 26, 2011. The call will be webcast live from

B&G Foods’ website at www.bgfoods.com under “Investor

Relations—Company Overview.” The call can also be accessed live

over the phone by dialing (877) 419-6594 for U.S. callers or (719)

325-4810 for international callers.

A replay of the call will be available one hour after the call

and can be accessed by dialing (877) 870-5176 or

(858) 384-5517 for international callers; the password is

4762334. The replay will be available from July 26, 2011,

through August 3, 2011. Investors may also access a web-based

replay of the call at the Investor Relations section of B&G

Foods’ website, www.bgfoods.com.

About Non-GAAP Financial Measures and Items Affecting

Comparability

“Adjusted net income,” “adjusted diluted earnings per share” and

“EBITDA” (net income before net interest expense, income taxes,

depreciation and amortization and loss on extinguishment of debt)

are “non-GAAP financial measures.” A non-GAAP financial measure is

a numerical measure of financial performance that excludes or

includes amounts so as to be different than the most directly

comparable measure calculated and presented in accordance with GAAP

in B&G Foods’ consolidated balance sheets and related

consolidated statements of operations and cash flows. Non-GAAP

financial measures should not be considered in isolation or as a

substitute for the most directly comparable GAAP measures. The

Company’s non-GAAP financial measures may be different from

non-GAAP financial measures used by other companies.

The Company uses “adjusted net income” and “adjusted diluted

earnings per share,” which are calculated as reported net income

and reported diluted earnings per share adjusted for certain items

that affect comparability. These non-GAAP financial measures

reflect adjustments to reported net income and diluted earnings per

share to eliminate the items identified below. This information is

provided in order to allow investors to make meaningful comparisons

of the Company’s operating performance between periods and to view

the Company’s business from the same perspective as the Company’s

management. Because the Company cannot predict the timing and

amount of charges associated with unrealized gains or losses on the

Company’s interest rate swap and gains or losses on extinguishment

of debt, management does not consider these costs when evaluating

the Company’s performance or when making decisions regarding

allocation of resources.

A reconciliation of EBITDA to net income and to net cash

provided by operating activities is included below for the first

two quarters of 2011 and 2010, along with the components of EBITDA.

Also included below are reconciliations of the non-GAAP terms

adjusted net income and adjusted diluted earnings per share to

reported net income and reported diluted earnings per share.

About B&G Foods, Inc.

B&G Foods and its subsidiaries manufacture, sell and

distribute a diversified portfolio of high-quality, shelf-stable

foods across the United States, Canada and Puerto Rico. B&G

Foods’ products include hot cereals, fruit spreads, canned meats

and beans, spices, seasonings, hot sauces, wine vinegar, maple

syrup, molasses, salad dressings, Mexican-style sauces, taco shells

and kits, salsas, pickles, peppers and other specialty food

products. B&G Foods competes in the retail grocery, food

service, specialty, private label, club and mass merchandiser

channels of distribution. Based in Parsippany, New Jersey, B&G

Foods’ products are marketed under many recognized brands,

including Ac’cent, B&G, B&M, Brer Rabbit, Cream of

Rice, Cream of Wheat, Don Pepino, Emeril’s, Grandma’s Molasses,

Joan of Arc, Las Palmas,

Maple Grove Farms of Vermont, Ortega, Polaner,

Red Devil, Regina, Sa-són, Sclafani, Trappey’s, Underwood, Vermont

Maid and Wright’s.

Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact constitute “forward-looking statements.”

The forward-looking statements contained in this press release

include, without limitation, statements related to B&G Foods’

expectations regarding cost, the Company’s ability to successfully

implement sales price increases and cost reduction efforts, and

EBITDA and capital expenditures for fiscal 2011. Such

forward-looking statements involve known and unknown risks,

uncertainties and other unknown factors that could cause the actual

results of B&G Foods to be materially different from the

historical results or from any future results expressed or implied

by such forward-looking statements. In addition to statements that

explicitly describe such risks and uncertainties readers are urged

to consider statements labeled with the terms “believes,” “belief,”

“expects,” “projects,” “intends,” “anticipates” or “plans” to be

uncertain and forward-looking. The forward-looking statements

contained herein are also subject generally to other risks and

uncertainties that are described from time to time in B&G

Foods’ filings with the Securities and Exchange Commission,

including under Item 1A, “Risk Factors” in the Company’s Annual

Report on Form 10-K for fiscal 2010 filed on March 1, 2011.

B&G Foods undertakes no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

* Please see “About Non-GAAP Financial Measures and Items

Affecting Comparability” below for definitions of the terms

adjusted net income, adjusted diluted earnings per share and

EBITDA, as well as information concerning certain items affecting

comparability and reconciliations of the non-GAAP terms adjusted

net income, adjusted diluted earnings per share and EBITDA to the

most comparable GAAP financial measures.

B&G Foods, Inc. and Subsidiaries

Consolidated Balance Sheets (In thousands, except share

and per share data) (Unaudited) Assets

July 2, 2011 January 1, 2011 Current assets:

Cash and cash equivalents $ 101,531 $ 98,738 Trade accounts

receivable, net 30,070 34,445 Inventories 89,905 74,563 Prepaid

expenses 1,724 1,715 Income tax receivable 4,410 171 Deferred

income taxes 1,514 5,439 Total current

assets 229,154 215,071 Property, plant and equipment, net of

accumulated depreciation of $85,571 and $80,862

60,198

60,812

Goodwill 253,744 253,744 Other intangibles, net 328,725 332,001

Other assets 9,409 10,095 Total assets

$ 881,230 $ 871,723

Liabilities and

Stockholders’ Equity Current liabilities: Trade accounts

payable $ 23,535 $ 15,531 Accrued expenses 25,733 25,584 Interest

rate swap — 12,012 Dividends payable 10,063

8,099 Total current liabilities 59,331 61,226

Long-term debt 477,908 477,748 Other liabilities 1,810 4,232

Deferred income taxes 104,534 97,932

Total liabilities 643,583 641,138 Commitments and contingencies

Stockholders’ equity: Preferred stock, $0.01 par value per share.

Authorized 1,000,000 shares; no shares issued or outstanding — —

Common stock, $0.01 par value per share. Authorized 125,000,000

shares; 47,918,033 and 47,639,924 shares issued and outstanding as

of July 2, 2011 and January 1, 2011 479 476 Additional paid-in

capital 182,398 201,770 Accumulated other comprehensive loss (6,475

) (7,002 ) Retained earnings 61,245 35,341

Total stockholders’ equity 237,647

230,585 Total liabilities and stockholders’ equity $ 881,230

$ 871,723

B&G Foods, Inc.

and Subsidiaries Consolidated Statements of Operations

(In thousands, except per share data) (Unaudited)

Thirteen Weeks Ended Twenty-six Weeks Ended

July 2, 2011 July 3, 2010 July 2, 2011

July 3, 2010 Net sales $ 129,453 $ 121,145 $

260,858 $ 246,327 Cost of goods sold 87,284 81,747

173,822 164,901 Gross profit 42,169 39,398 87,036

81,426 Operating expenses: Selling, general and

administrative expenses 14,194 13,463 28,344 27,515 Amortization

expense 1,637 1,612 3,276 3,225

Operating income 26,338 24,323 55,416 50,686 Other expenses:

Interest expense, net 8,341 10,898 16,531 21,520 Loss on

extinguishment of debt — — — 15,224

Income before income tax expense 17,997 13,425 38,885 13,942 Income

tax expense 5,398 4,932 12,981 5,123

Net income $ 12,599 $ 8,493 25,904 8,819

Weighted average shares outstanding: Basic 47,906 47,625 47,944

47,526 Diluted 48,637 48,450 48,668 48,197 Earnings per

share: Basic $ 0.26 $ 0.18 $ 0.54 $ 0.19 Diluted $ 0.26 $ 0.18 $

0.53 $ 0.18 Cash dividends declared per share $ 0.21 $ 0.17

$ 0.38 $ 0.34

B&G Foods, Inc. and

Subsidiaries Reconciliation of EBITDA to Net Income and to

Net Cash Provided by Operating Activities (In thousands)

(Unaudited) Thirteen Weeks Ended Twenty-six

Weeks Ended July 2, 2011 July 3, 2010

July 2, 2011 July 3, 2010 Net income $

12,599 $ 8,493 $ 25,904 $ 8,819 Income tax expense 5,398 4,932

12,981 5,123 Interest expense, net (1) 8,341 10,898 16,531 21,520

Depreciation and amortization 3,972 3,698 7,926 7,357 Loss on

extinguishment of debt (2) — — —

15,224 EBITDA (3) 30,310 28,021 63,342 58,043

Income tax expense (5,398 ) (4,932 ) (12,981 ) (5,123 ) Interest

expense, net (8,341 ) (10,898 ) (16,531 ) (21,520 ) Deferred income

taxes 1,724 2,652 10,120 2,759 Amortization of deferred financing

costs and bond discount 500 500 1,000 1,015 Unrealized loss on

interest rate swap — 1,046 — 1,349 Realized gain on interest rate

swap — — (612 ) — Reclassification to net interest expense for

interest rate swap 424 424 847 847 Share-based compensation expense

1,157 1,007 1,872 1,470 Excess tax benefits from share-based

compensation — — (1,117 ) (330 ) Changes in assets and liabilities

(5,861 ) 3,799 (19,759 ) 4,985

Net cash provided by operating activities $ 14,515 $

21,619 $ 26,181 $ 43,495 (1) Net

interest expense in the first two quarters of 2011 includes a

benefit relating to the realized gain on an interest rate swap, and

in the second quarter and first two quarters of 2011, a charge for

the reclassification of the amount recorded in accumulated other

comprehensive loss related to the swap. Net interest expense in

second quarter and first two quarters of 2010 includes a charge

relating to the unrealized loss on the interest rate swap and a

charge for the reclassification of the amount recorded in

accumulated other comprehensive loss related to the swap. See

B&G Foods’ Quarterly Report on Form 10-Q filed with the SEC on

July 26, 2011 for additional details. (2) During the first

two quarter of 2011, we did not extinguish any debt. Loss on

extinguishment of debt for the first two quarters of 2010 includes

costs relating to our repurchase of senior notes and senior

subordinated notes during the first quarter of 2010, including the

repurchase premium and the write-off of deferred debt financing

costs. See our Quarterly Report on Form 10-Q filed with the SEC on

July 26, 2011 for additional details. (3) EBITDA is a

non-GAAP financial measure used by management to measure operating

performance. A non-GAAP financial measure is defined as a numerical

measure of our financial performance that excludes or includes

amounts so as to be different than the most directly comparable

measure calculated and presented in accordance with GAAP in our

consolidated balance sheets and related consolidated statements of

operations, changes in stockholders’ equity and comprehensive

income, and cash flows. We define EBITDA as net income before net

interest expense, income taxes, depreciation and amortization and

loss on extinguishment of debt. Management believes that it is

useful to eliminate net interest expense, income taxes,

depreciation and amortization and loss on extinguishment of debt

because it allows management to focus on what it deems to be a more

reliable indicator of ongoing operating performance and our ability

to generate cash flow from operations. We use EBITDA in our

business operations, among other things, to evaluate our operating

performance, develop budgets and measure our performance against

those budgets, determine employee bonuses and evaluate our cash

flows in terms of cash needs. We also present EBITDA because we

believe it is a useful indicator of our historical debt capacity

and ability to service debt and because covenants in our credit

facility and our senior notes indenture contain ratios based on

this measure. As a result, internal management reports used during

monthly operating reviews feature the EBITDA metric. However,

management uses this metric in conjunction with traditional GAAP

operating performance and liquidity measures as part of its overall

assessment of company performance and liquidity and therefore does

not place undue reliance on this measure as its only measure of

operating performance and liquidity. EBITDA is not a

recognized term under GAAP and does not purport to be an

alternative to operating income or net income as an indicator of

operating performance or any other GAAP measure. EBITDA is not a

complete net cash flow measure because EBITDA is a measure of

liquidity that does not include reductions for cash payments for an

entity’s obligation to service its debt, fund its working capital,

capital expenditures and acquisitions and pay its income taxes and

dividends. Rather, EBITDA is a potential indicator of an entity’s

ability to fund these cash requirements. EBITDA is not a complete

measure of an entity’s profitability because it does not include

costs and expenses for depreciation and amortization, interest and

related expenses, loss on extinguishment of debt and income taxes.

Because not all companies use identical calculations, this

presentation of EBITDA may not be comparable to other similarly

titled measures of other companies. However, EBITDA can still be

useful in evaluating our performance against our peer companies

because management believes this measure provides users with

valuable insight into key components of GAAP amounts.

B&G Foods, Inc. and Subsidiaries Items

Affecting Comparability — Reconciliation of Adjusted Information to

GAAP Information (In thousands) (Unaudited)

Thirteen Weeks Ended Twenty-six Weeks Ended

July 2, 2011 July 3, 2010 July 2, 2011

July 3, 2010 Reported net income $ 12,599 $ 8,493 $

25,904 $ 8,819 Loss on extinguishment of debt, net of tax(1) — — —

9,591

Non-cash adjustments on interest rate

swap, net of tax(2)

271

926

150

1,383

Adjusted net income $ 12,870 $ 9,419 $ 26,054 $ 19,793 Adjusted

diluted earnings per share $ 0.26 $ 0.19 $ 0.54 $ 0.41

(1) During the first two quarters of 2011, B&G Foods did

not extinguish any debt. Loss on extinguishment of debt for the

first two quarters of 2010 includes costs relating to the Company’s

repurchase and redemption of $69.5 million aggregate principal

amount of senior subordinated notes and $240.0 million aggregate

principal amount of senior notes during the first quarter of 2010.

See B&G Foods’ Quarterly Report on Form 10-Q filed with the SEC

on July 26, 2011 for additional details. (2) The first two

quarters of 2011 includes a realized gain on interest rate swap and

in the second quarter and first two quarters of 2011, a

reclassification from accumulated other comprehensive loss to

interest expense, net on interest rate swap. The second quarter and

first two quarters of 2010 includes an unrealized loss on interest

rate swap and a reclassification from accumulated other

comprehensive loss to interest expense, net on interest rate swap.

See B&G Foods’ Quarterly Report on Form 10-Q filed with the SEC

on July 26, 2011 for additional details.

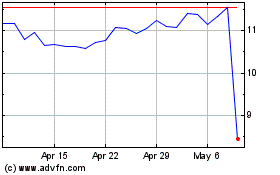

B and G Foods (NYSE:BGS)

Historical Stock Chart

From May 2024 to Jun 2024

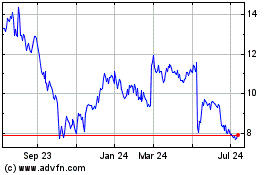

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Jun 2023 to Jun 2024