B&G Foods Announces Tax Treatment of Common Stock Dividends Paid in 2010

January 21 2011 - 5:52PM

Business Wire

B&G Foods, Inc. (NYSE: BGS) today explained the tax

treatment for dividends paid in 2010 on the Company’s common stock.

Holders are urged to check their 2010 tax statements received from

brokerage firms in order to ensure that the cash distribution

information reported on such statements conforms to the information

reported herein.

Additional information concerning the tax treatment of dividends

paid in 2010 is posted to the Investor Relations section of B&G

Foods’ website, www.bgfoods.com, under the heading “Investor FAQ.”

Holders are also urged to consult their own tax advisors to

determine their individual tax treatment.

In 2010, B&G Foods distributed $0.6800 per share of common

stock (CUSIP # 05508R 10 6). Based on U.S. federal income tax laws,

B&G Foods has determined that of such distributions, 53.6% (or

$0.3648 per share) will be treated as a taxable dividend and 46.4%

(or $0.3152 per share) will be treated as a return of capital.

Generally, the portion of the distribution on the common stock that

is treated as a return of capital should reduce the tax basis in

the shares of common stock up to a holder’s adjusted basis in the

common stock, with any excess treated as capital gains.

The table below summarizes the tax treatment for dividends paid

in 2010 on the Company’s common stock.

Declaration

Record

Payment

Total Per

Share

2010

Taxable

2010 Return

of

Date

Date

Date

Distribution

Dividend

Capital

10/14/2009

12/31/2009 2/1/2010 $0.1700

$0.0912 $0.0788 2/23/2010

3/31/2010 4/30/2010 $0.1700

$0.0912 $0.0788 5/18/2010

6/30/2010 7/30/2010 $0.1700

$0.0912 $0.0788 7/26/2010

9/30/2010 11/1/2010 $0.1700

$0.0912 $0.0788

2010 Totals

$0.6800 $0.3648

$0.3152

About B&G Foods, Inc.

B&G Foods and its subsidiaries manufacture, sell and

distribute a diversified portfolio of high-quality, shelf-stable

foods across the United States, Canada and Puerto Rico. B&G

Foods’ products include hot cereals, fruit spreads, canned meats

and beans, spices, seasonings, marinades, hot sauces, wine vinegar,

maple syrup, molasses, salad dressings, Mexican-style sauces, taco

shells and kits, salsas, pickles, peppers and other specialty food

products. B&G Foods competes in the retail grocery, food

service, specialty, private label, club and mass merchandiser

channels of distribution. Based in Parsippany, New Jersey, B&G

Foods’ products are marketed under many recognized brands,

including Ac’cent, B&G, B&M, Brer Rabbit, Cream of

Rice, Cream of Wheat, Don Pepino, Emeril’s, Grandma’s Molasses,

Joan of Arc, Las Palmas,

Maple Grove Farms of Vermont, Ortega, Polaner,

Red Devil, Regina, Sa-són, Sclafani, Trappey’s, Underwood, Vermont

Maid and Wright’s.

IRS Circular 230 Disclosure

The discussion contained in this press release as to tax matters

is not intended or written to be used, and cannot be used, for the

purpose of avoiding United States federal income tax penalties.

Such discussion is written to support the promotion or marketing of

the transactions or matters addressed in this press release. Each

taxpayer should seek advice based on the taxpayer’s particular

circumstances from an independent tax advisor.

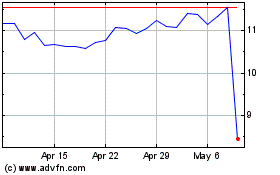

B and G Foods (NYSE:BGS)

Historical Stock Chart

From May 2024 to Jun 2024

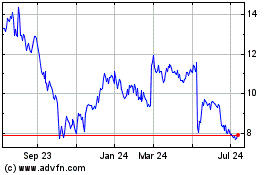

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Jun 2023 to Jun 2024