B&G Foods, Inc. (NYSE: BGS) today announced financial

results for the 13 and 39 weeks ended October 2, 2010 (third

quarter and first three quarters of 2010).

Third Quarter Highlights

- Adjusted diluted earnings per share*

increased 42.9% to $0.20 from $0.14 in prior year quarter

- EBITDA* increased 17.0% year-over-year

to $28.9 million from $24.7 million

- Net sales increased 1.0% to $125.1

million from $123.9 million

- Fiscal 2010 EBITDA guidance increased

to range of $113.0 to $115.0 million

David L. Wenner, President and Chief Executive Officer of

B&G Foods, stated, “We are very pleased with the strong margin

improvement seen this quarter — the result of our efforts to

improve sales mix and reduce cost. The dramatic improvement in

EBITDA and earnings per share is a continuation of the 2010 trends

in our business. We are also encouraged by the firming of sales

despite the negative effects of promotional restructuring and

changes in distribution. Accordingly, we are raising our guidance

for the third straight quarter.”

Financial Results for the Third Quarter of 2010

Net sales for the third quarter of 2010 increased 1.0% to $125.1

million from $123.9 million for the 13 weeks ended October 3,

2009 (third quarter of 2009). This $1.2 million increase was

attributable to sales price and unit volume increases of $0.4

million and $0.3 million, respectively, and a reduction in coupons

and slotting expenses of $0.5 million.

Gross profit for the third quarter of 2010 increased 8.2% to

$39.2 million from $36.2 million in the third quarter of 2009.

Gross profit expressed as a percentage of net sales increased 2.1

percentage points to 31.3% for the third quarter of 2010 from 29.2%

in the third quarter of 2009. The increase in gross profit

expressed as a percentage of net sales was attributable to

increased sales prices and a reduction in coupons and slotting,

which accounted for 0.5 percentage points. The remaining 1.6

percentage points is attributable to decreases in commodity and

ingredient costs and a sales mix shift to higher margin products,

slightly offset by higher packaging and fuel surcharge costs.

Operating income increased 19.6% to $25.1 million for the third

quarter of 2010, from $21.0 million in the third quarter of

2009.

Net interest expense for the third quarter of 2010 decreased

$3.3 million or 23.8% from $13.6 million in the third quarter of

2009 to $10.3 million in the third quarter of 2010. The decrease in

net interest expense in the third quarter was primarily

attributable to the refinancing we completed during the second half

of 2009 and first quarter of 2010 that reduced our long-term debt

and the effective interest rate on our long-term debt from 9.6% in

the third quarter of 2009 to 7.9% in the third quarter of 2010.

The Company’s adjusted net income* for the third quarter of 2010

was $9.8 million, and adjusted diluted earnings per share was

$0.20, as compared to adjusted net income of $5.2 million and

adjusted diluted earnings per share of $0.14, for the third quarter

of 2009. Under U.S. Generally Accepted Accounting Principles

(GAAP), the Company’s reported net income was $9.3 million, or

$0.19 per diluted share, for the third quarter of 2010, as compared

to reported net income of $4.2 million, or $0.11 per diluted share,

for the third quarter of 2009.

For the third quarter of 2010, EBITDA increased 17.0% to $28.9

million from $24.7 million for the third quarter of 2009.

Financial Results for the First Three Quarters of

2010

Net sales for the first three quarters of 2010 increased 1.7% to

$371.5 million from $365.4 million in the comparable period of

2009. This $6.1 million increase was attributable to sales price

and unit volume increases of $3.9 million and $2.9 million,

respectively, partially offset by an increase in coupon expenses of

$0.7 million.

Gross profit for the first three quarters of 2010 increased 7.8%

to $120.6 million from $111.8 million in the comparable period of

last year. Gross profit expressed as a percentage of net sales

increased 1.9 percentage points to 32.5% in the first three

quarters of 2010 from 30.6% in the comparable period of fiscal

2009. The increase in gross profit expressed as a percentage of net

sales was attributable to increased sales prices net of increased

coupon expenses, which accounted for 0.6 percentage points. The

remaining 1.3 percentage points was primarily attributable to

decreases in commodity and ingredient costs and a sales mix shift

to higher margin products, slightly offset by an increase in

packaging and fuel surcharge costs. Operating income increased

13.7% to $75.8 million during the first three quarters of 2010,

compared to $66.7 million in the comparable period of fiscal

2009.

Net interest expense for the first three quarters of 2010

decreased $8.1 million or 20.4% from $40.0 million in the first

three quarters of 2009 to $31.9 million for the first three

quarters of 2010. The decrease in net interest expense in the first

three quarters of 2010 was primarily attributable to the

refinancing we completed during the second half of 2009 and first

quarter of 2010 that reduced our long-term debt and the effective

interest rate on our long-term debt from 9.8% in the first three

quarters of 2009 to 8.1% in the first three quarters of 2010.

The Company’s adjusted net income* for the first three quarters

of 2010 was $29.6 million, and adjusted diluted earnings per share

was $0.61, as compared to adjusted net income of $17.2 million and

adjusted diluted earnings per share of $0.47, for the comparable

period of fiscal 2009. Under GAAP, the Company’s reported net

income was $18.1 million, or $0.37 per diluted share, for the first

three quarters of 2010, as compared to reported net income of $16.1

million, or $0.44 per diluted share, for the comparable period of

fiscal 2009.

For the first three quarters of 2010, EBITDA increased 12.2% to

$86.9 million from $77.5 million for the comparable period of

fiscal 2009.

Guidance

For the third consecutive quarter, B&G Foods increased its

full-year fiscal 2010 performance expectations. The Company now

expects EBITDA for fiscal 2010 to be approximately $113.0 to $115.0

million instead of the previously anticipated $109.0 to $112.0

million. B&G Foods continues to expect to make capital

expenditures of approximately $11.0 million in the aggregate during

fiscal 2010.

Changes to Board Committee Composition

Following the previously announced appointments of Charles F.

Marcy and Cheryl M. Palmer to the Board of Directors on October 12,

2010, the Board subsequently approved changes to the composition of

the Compensation Committee and the Nominating and Governance

Committee on October 19, 2010. No changes were made to the

composition of the Audit Committee. The current composition of the

committees is as follows: Compensation Committee – Alfred Poe

(Chairman), Cynthia T. Jamison and Mr. Marcy; Nominating and

Governance Committee – Dennis M. Mullen (Chairman), Mr. Marcy and

Ms. Palmer; and Audit Committee – Ms. Jamison, Mr. Mullen and Mr.

Poe.

Conference Call

B&G Foods will hold a webcast and conference call at 4:30

p.m. ET today, October 26, 2010. The call will be webcast live from

B&G Foods’ website at www.bgfoods.com under “Investor

Relations—Company Overview.” The call can also be accessed live

over the phone by dialing (877) 780-3381 or for international

callers by dialing (719) 325-2180.

A replay of the call will be available one hour after the call

and can be accessed by dialing (877) 870-5176 or (858) 384-5517 for

international callers. The password is 2104633. The replay will be

available from October 26, 2010 through November 2, 2010. Investors

may also access a web-based replay of the call at the Investor

Relations section of B&G Foods’ website, www.bgfoods.com.

About Non-GAAP Financial Measures and Items Affecting

Comparability

“Adjusted net income,” “adjusted diluted earnings per share” and

“EBITDA” (net income before net interest expense, income taxes,

depreciation and amortization and loss on extinguishment of debt)

are “non-GAAP financial measures.” A non-GAAP financial measure is

a numerical measure of financial performance that excludes or

includes amounts so as to be different than the most directly

comparable measure calculated and presented in accordance with GAAP

in B&G Foods’ consolidated balance sheets and related

consolidated statements of operations and cash flows. Non-GAAP

financial measures should not be considered in isolation or as a

substitute for the most directly comparable GAAP measures. The

Company’s non-GAAP financial measures may be different from

non-GAAP financial measures used by other companies.

The Company uses “adjusted net income” and “adjusted diluted

earnings per share,” which are calculated as reported net income

and reported diluted earnings per share adjusted for certain items

that affect comparability. These non-GAAP financial measures

reflect adjustments to reported net income and diluted earnings per

share to eliminate the items identified below. This information is

provided in order to allow investors to make meaningful comparisons

of the Company’s operating performance between periods and to view

the Company’s business from the same perspective as the Company’s

management. Because the Company cannot predict the timing and

amount of charges associated with unrealized gains or losses on the

Company’s interest rate swap and gains or losses on extinguishment

of debt, management does not consider these costs when evaluating

the Company’s performance or when making decisions regarding

allocation of resources.

A reconciliation of EBITDA to net income and to net cash

provided by operating activities is included below for the third

and first three quarters of 2010 and 2009, along with the

components of EBITDA. Also included below are reconciliations of

the non-GAAP terms adjusted net income and adjusted diluted

earnings per share to reported net income and reported diluted

earnings per share.

About B&G Foods, Inc.

B&G Foods and its subsidiaries manufacture, sell and

distribute a diversified portfolio of high-quality, shelf-stable

foods across the United States, Canada and Puerto Rico. B&G

Foods’ products include hot cereals, fruit spreads, canned meats

and beans, spices, seasonings, marinades, hot sauces, wine vinegar,

maple syrup, molasses, salad dressings, Mexican-style sauces, taco

shells and kits, salsas, pickles, peppers and other specialty food

products. B&G Foods competes in the retail grocery, food

service, specialty, private label, club and mass merchandiser

channels of distribution. Based in Parsippany, New Jersey, B&G

Foods’ products are marketed under many recognized brands,

including Ac’cent, B&G, B&M, Brer Rabbit, Cream of

Rice, Cream of Wheat, Emeril’s, Grandma’s Molasses, Joan of Arc,

Las Palmas, Maple Grove Farms of Vermont,

Ortega, Polaner, Red Devil, Regina, Sa-són, Trappey’s, Underwood,

Vermont Maid and Wright’s.

Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact constitute “forward-looking statements.”

The forward-looking statements contained in this press release

include, without limitation, statements related to our expectations

regarding EBITDA and capital expenditures for fiscal 2010. Such

forward-looking statements involve known and unknown risks,

uncertainties and other unknown factors that could cause the actual

results of B&G Foods to be materially different from the

historical results or from any future results expressed or implied

by such forward-looking statements. In addition to statements that

explicitly describe such risks and uncertainties readers are urged

to consider statements labeled with the terms “believes,” “belief,”

“expects,” “projects,” “intends,” “anticipates” or “plans” to be

uncertain and forward-looking. The forward-looking statements

contained herein are also subject generally to other risks and

uncertainties that are described from time to time in B&G

Foods’ filings with the Securities and Exchange Commission,

including under Item 1A, “Risk Factors” in our Annual Report on

Form 10-K for fiscal 2009 filed on March 1, 2010. B&G Foods

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

B&G Foods, Inc. and Subsidiaries

Consolidated Balance Sheets (In thousands, except share

and per share data) (Unaudited) Assets

October 2, 2010 January 2, 2010 Current assets: Cash

and cash equivalents $ 87,525 $ 39,930 Trade accounts receivable,

less allowance for doubtful accounts and discounts of $610 in 2010

and $631 in 2009 31,842 34,488 Inventories 89,355 86,134 Prepaid

expenses 1,881 2,523 Income tax receivable 1,166 864 Deferred

income taxes 1,671 1,981 Total current

assets 213,440 165,920 Property, plant and equipment, net of

accumulated depreciation of $78,543 in 2010 and $72,217 in 2009

54,425 53,598 Goodwill 253,353 253,353 Trademarks 227,220 227,220

Customer relationship intangibles, net 105,030 109,868 Net deferred

debt financing costs and other assets 9,396

6,935 Total assets $ 862,864 $ 816,894

Liabilities and Stockholders’ Equity Current

liabilities: Trade accounts payable $ 26,613 $ 22,574 Accrued

expenses 18,859 18,326 Dividends payable 8,098

8,052 Total current liabilities 53,570 48,952

Long-term debt

477,668

439,541

Other liabilities

19,422

19,265

Deferred income taxes

90,548

83,528

Total liabilities

641,208

591,286

Commitments and contingencies Stockholders’ equity: Preferred

stock, $0.01 par value per share. Authorized 1,000,000 shares; no

shares issued or outstanding — — Common stock, $0.01 par value per

share. Authorized — 125,000,000 and 100,000,000 shares; 47,635,640

and 47,367,292 issued and outstanding as of October 2, 2010 and

January 2, 2010 476 474 Additional paid-in capital 208,539 231,549

Accumulated other comprehensive loss (8,422 ) (9,377 ) Retained

earnings 21,063 2,962 Total

stockholders’ equity 221,656 225,608

Total liabilities and stockholders’ equity $ 862,864 $

816,894

B&G Foods, Inc. and

Subsidiaries Consolidated Statements of Operations

(In thousands, except per share data) (Unaudited)

Thirteen Weeks Ended Thirty-nine Weeks Ended

October 2, 2010 October 3, 2009 October 2, 2010

October 3, 2009 Net sales $ 125,144 $ 123,871 $ 371,471 $

365,408 Cost of goods sold 85,960 87,647

250,861 253,569 Gross profit 39,184 36,224 120,610

111,839 Operating expenses: Sales, marketing and

distribution expenses 9,901 10,659 32,022 32,575 General and

administrative expenses 2,534 2,936 7,928 7,753 Amortization

expense—customer relationships 1,613 1,613

4,838 4,838 Operating income 25,136 21,016 75,822 66,673

Other expenses: Interest expense, net 10,335 13,570 31,855

39,996 Loss on extinguishment of debt — 674

15,224 674 Income before income tax expense 14,801 6,772

28,743 26,003 Income tax expense 5,519 2,611

10,642 9,900 Net income $ 9,282 $ 4,161 18,101

16,103 Weighted average common shares outstanding: Basic

47,636 37,790 47,563 36,644 Diluted 48,601 37,973 48,349 36,644

Earnings per common share: Basic $ 0.19 $ 0.11 $ 0.38 $ 0.44

Diluted $ 0.19 $ 0.11 $ 0.37 $ 0.44 Cash dividends declared

per common share $ 0.17 $ 0.17 $ 0.51 $ 0.51

B&G Foods, Inc. and Subsidiaries Reconciliation of

EBITDA to Net Income and to Net Cash Provided by Operating

Activities (In thousands) (Unaudited)

Thirteen Weeks Ended Thirty-nine Weeks Ended

October 2, 2010 October 3, 2009 October 2,

2010 October 3, 2009 (Dollars in thousands) Net

income $ 9,282 $ 4,161 $ 18,101 $ 16,103 Income tax expense 5,519

2,611 10,642 9,900 Interest expense, net(1) 10,335 13,570 31,855

39,996 Depreciation and amortization 3,761 3,677 11,118 10,847 Loss

on extinguishment of debt(2) — 674

15,224 674 EBITDA(3) 28,897 24,693

86,940 77,520 Income tax expense (5,519 ) (2,611 ) (10,642 ) (9,900

) Interest expense, net (10,335 ) (13,570 ) (31,855 ) (39,996 )

Deferred income taxes 2,825 3,348 5,584 9,295 Amortization of

deferred financing costs and bond discount 500 610 1,515 2,222

Unrealized loss (gain) on interest rate swap 471 631 1,820 (108 )

Reclassification to net interest expense for interest rate swap 423

424 1,270 1,270 Share-based compensation expense 943 1,471 2,413

3,273 Excess tax benefits from share-based compensation — — (330 )

— Changes in assets and liabilities (559 ) 1,973

4,426 (9,275 ) Net cash provided by

operating activities $ 17,646 $ 16,969 $ 61,141

$ 34,301

(1) Net interest expense in the third quarter and first

three quarters of 2010 and 2009 includes costs relating to the

unrealized loss on our interest rate swap subsequent to our

determination that the swap was no longer an effective hedge for

accounting purposes, due to Lehman’s bankruptcy filing in September

2008 and a reclassification of amounts recorded in accumulated

other comprehensive loss related to the swap. See our Quarterly

Report on Form 10-Q filed with the SEC on October 26, 2010 for

additional details. (2) Loss on extinguishment of debt for

the first three quarters of 2010 includes $15.2 million of costs

relating to our repurchase and redemption of $69.5 million

aggregate principal amount of senior subordinated notes and $240.0

million aggregate principal amount of senior notes, including $10.7

million for the payment of a repurchase premium and a non-cash

charge of $4.5 million for the write-off of unamortized deferred

debt financing costs associated with the notes repurchased. Loss on

extinguishment of debt for the first three quarters of 2009

included $0.7 million of costs relating to our repurchase of senior

subordinated notes during the third quarter of 2009, including $0.4

million for the payment of a repurchase premium and a non-cash

charge of $0.3 million for the write-off of unamortized deferred

financing costs associated with the notes repurchased. (3)

EBITDA is a measure used by management to measure operating

performance. We define EBITDA as net income before net interest

expense, income taxes, depreciation and amortization and loss on

extinguishment of debt. Management believes that it is useful to

eliminate net interest expense, income taxes, depreciation and

amortization and loss on extinguishment of debt because it allows

management to focus on what it deems to be a more reliable

indicator of ongoing operating performance and our ability to

generate cash flow from operations. We use EBITDA in our business

operations, among other things, to evaluate our operating

performance, develop budgets and measure our performance against

those budgets, determine employee bonuses and evaluate our cash

flows in terms of cash needs. We also present EBITDA because we

believe it is a useful indicator of our historical debt capacity

and ability to service debt and because covenants in our credit

facility and our senior notes indenture contain ratios based on

this measure. As a result, internal management reports used during

monthly operating reviews feature the EBITDA metric. However,

management uses this metric in conjunction with traditional GAAP

operating performance and liquidity measures as part of its overall

assessment of company performance and liquidity and therefore does

not place undue reliance on this measure as its only measure of

operating performance and liquidity. EBITDA is not a

recognized term under GAAP and does not purport to be an

alternative to operating income or net income as an indicator of

operating performance or any other GAAP measure. EBITDA is not a

complete net cash flow measure because EBITDA is a measure of

liquidity that does not include reductions for cash payments for an

entity’s obligation to service its debt, fund its working capital,

capital expenditures and acquisitions, if any, and pay its income

taxes and dividends. Rather, EBITDA is a potential indicator of an

entity’s ability to fund these cash requirements. EBITDA also is

not a complete measure of an entity’s profitability because it does

not include costs and expenses for depreciation and amortization,

loss on extinguishment of debt, interest and related expenses and

income taxes. Because not all companies use identical calculations,

this presentation of EBITDA may not be comparable to other

similarly titled measures of other companies. However, EBITDA can

still be useful in evaluating our performance against our peer

companies because management believes this measure provides users

with valuable insight into key components of GAAP amounts.

B&G Foods, Inc. and Subsidiaries Items

Affecting Comparability — Reconciliation of Adjusted Information to

GAAP Information (In thousands) (Unaudited)

Thirteen Weeks Ended Thirty-nine Weeks Ended

October 2, 2010 October 3, 2009 October 2,

2010 October 3, 2009 Reported net income $ 9,282

$ 4,161 $ 18,101 $ 16,103 Loss on extinguishment of debt, net of

tax(1) — 419 9,591 419 Non-cash adjustments on interest rate

swap,net of tax(2) 563 655 1,947 722

Adjusted net income $ 9,845 $ 5,235 $ 29,639 $ 17,244 Adjusted

diluted EPS – Common stock $ 0.20 $ 0.14 $ 0.61 $ 0.47

(1) Loss on extinguishment of debt for the first three

quarters of 2010 includes $15.2 million of costs relating to our

repurchase and redemption of $69.5 million aggregate principal

amount of senior subordinated notes and $240.0 million aggregate

principal amount of senior notes, including $10.7 million for the

payment of a repurchase premium and a non-cash charge of $4.5

million for the write-off of unamortized deferred debt financing

costs associated with the notes repurchased. Loss on extinguishment

of debt for the first three quarters of 2009 included $0.7 million

of costs relating to our repurchase of senior subordinated notes

during the third quarter of 2009, including $0.4 million for the

payment of a repurchase premium and a non-cash charge of $0.3

million for the write-off of unamortized deferred financing costs

associated with the notes repurchased. (2) Includes an

unrealized loss (gain) on interest rate swap and a reclassification

from accumulated other comprehensive loss to interest expense, net

on interest rate swap. The counterparty of the Company’s interest

rate swap is an affiliate of Lehman Brothers. Following the

bankruptcy of Lehman Brothers, we determined that the interest rate

swap was no longer an effective hedge for accounting purposes. *

Please see “About Non-GAAP Financial Measures and Items

Affecting Comparability” below for definitions of the terms EBITDA,

adjusted net income and adjusted diluted earnings per share as well

as information concerning certain items affecting comparability and

reconciliations of the non-GAAP terms EBITDA, adjusted net income

and adjusted diluted earnings per share to the most comparable GAAP

financial measures.

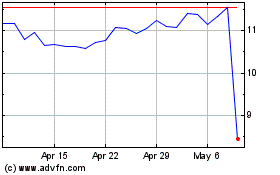

B and G Foods (NYSE:BGS)

Historical Stock Chart

From May 2024 to Jun 2024

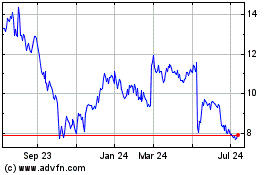

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Jun 2023 to Jun 2024