B&G Foods Declares Regular Quarterly Dividend

May 06 2009 - 8:30AM

Business Wire

B&G Foods, Inc. (NYSE: BGS, BGF), a manufacturer and

distributor of high quality, shelf-stable foods, announced today

that its Board of Directors has declared a regular quarterly cash

dividend of $0.17 per share of Class A common stock, payable on

July 30, 2009 to holders of record as of June 30, 2009.

Cash payments to holders of the Company�s Enhanced Income

Securities (EISs), which will include the quarterly cash dividend

payment of $0.17 per share on the underlying Class A common stock

and an interest payment of $0.2145 per EIS on the underlying

12%�senior subordinated notes to holders of record as of June 30,

2009, will aggregate $0.3845 per EIS.

The Company also announced that its Board of Directors has

approved an increase to B&G Foods� previously authorized stock

and debt repurchase program. The terms of the expanded program

permits B&G Foods to repurchase up to an aggregate of $25.0

million of the Company�s Class A common stock and/or 8% senior

notes through May 3, 2010. The Company�s existing stock and debt

repurchase program had previously authorized the repurchase of up

to $10.0 million of the Company�s Class A common stock and/or 8%

senior notes. Since the program�s inception in October 2008, the

Company has repurchased 763,931 shares of Class A common stock at

an aggregate price of $3.5 million.

David L. Wenner, President and Chief Executive Officer of

B&G Foods, stated, �The declaration of a 19th consecutive

quarterly dividend and the increase to our stock and debt

repurchase program emphasizes the confidence that management and

the Board of Directors has in the Company�s prospects for the

future and our continued ability to generate strong cash flows. We

continue to believe that at current market prices, repurchasing our

Class A common stock and/or senior notes represents an attractive

investment opportunity and is an excellent use of our excess cash

from operations to increase stockholder value.�

Under the authorization, the Company may purchase shares of

Class A common stock and/or senior notes from time to time in the

open market or in privately negotiated transactions in compliance

with the applicable rules and regulations of the Securities and

Exchange Commission. The timing and amount of such repurchases, if

any, will be at the discretion of management, and will depend on

available cash, market conditions and other considerations.

Therefore, there can be no assurance as to the number of shares

that will be repurchased under the stock and debt repurchase

program, or the aggregate dollar amount of the shares or principal

amount of senior notes, if any, repurchased. The Company may

suspend or discontinue the program at any time without prior

notice. Any shares repurchased pursuant to the program will be

retired. Likewise, any senior notes repurchased will be

cancelled.

As of May 1, 2009, the Company currently has 36,033,057 shares

of Class A common stock outstanding, 18,118,944 of which trade

separately and 17,914,113 of which trade as part of EISs. The

Company currently has $240.0 million of senior notes outstanding.

In general, the Company�s credit agreement prohibits the Company

from repurchasing its 12% senior subordinated notes.

About B&G Foods, Inc.

B&G Foods and its subsidiaries manufacture, sell and

distribute a diversified portfolio of high-quality, shelf-stable

foods across the United States, Canada and Puerto Rico. B&G

Foods� products include hot�cereals, fruit spreads, canned meats

and beans, spices, seasonings, marinades, hot sauces, wine vinegar,

maple syrup, molasses, salad dressings, Mexican-style sauces, taco

shells and kits, salsas, pickles, peppers and other specialty food

products. B&G Foods competes in the retail grocery, food

service, specialty, private label, club and mass merchandiser

channels of distribution. Based in Parsippany, New Jersey, B&G

Foods� products are marketed under many recognized brands,

including Ac�cent, B&G, B&M, Brer Rabbit, Cream of Rice,

Cream of Wheat, Emeril�s, Grandma�s Molasses, Joan of Arc, Las

Palmas, Maple Grove Farms of Vermont, Ortega, Polaner, Red Devil,

Regina, Sa-s�n, Trappey�s, Underwood, Vermont�Maid and

Wright�s.

Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact constitute �forward-looking statements.�

The forward-looking statements contained in this press release

include without limitation statements related to the Company�s

ability to generate sufficient cash flow to continue paying

dividends, the Company�s belief that the stock and debt repurchase

program is an excellent use of the Company�s excess cash from

operations to increase stockholder value, the Company�s plan to

repurchase shares of Class A common stock and/or senior notes, and

the future prospects of the Company. Such forward-looking

statements involve known and unknown risks, uncertainties and other

unknown factors that could cause the actual results of B&G

Foods to be materially different from the historical results or

from any future results expressed or implied by such

forward-looking statements. In addition to statements that

explicitly describe such risks and uncertainties readers are urged

to consider statements labeled with the terms �believes,� �belief,�

�expects,� �intends,� �anticipates� or �plans� to be uncertain and

forward-looking. The forward-looking statements contained herein

are also subject generally to other risks and uncertainties that

are described from time to time in B&G Foods� filings with the

Securities and Exchange Commission, including under Item 1A, �Risk

Factors� in our Annual Report on Form 10-K for fiscal 2008 filed on

March 5, 2009. We undertake no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

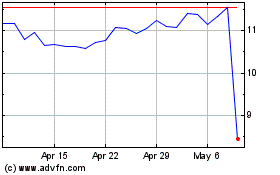

B and G Foods (NYSE:BGS)

Historical Stock Chart

From May 2024 to Jun 2024

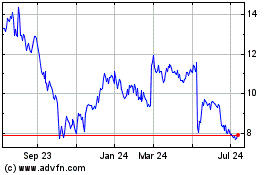

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Jun 2023 to Jun 2024