Titanium Metals Reports In line - Analyst Blog

March 01 2012 - 3:30AM

Zacks

Titanium Metals

Corporation (TIE) reported net earnings of $28.6 million

or 16 cents per share in the fourth quarter of 2011, in line with

the Zacks Consensus Estimate. However, the results were ahead of

the prior-year earnings of $23.3 million or 13 cents per share.

In fiscal 2011, net earnings were

$114.0 million or 64 cents per share, up significantly from $80.6

million or 45 cents per share in fiscal 2010.

Revenues

Quarterly revenues of $258.7

million increased 19.1% year over year. However, the results missed

the Zacks Consensus Estimate of $276 million. The year-over-year

increase was driven by a rise in sales volumes for both melted and

mill products, primarily reflecting improved demand for titanium

products in the commercial aerospace sector as well as increased

shipments of industrial products.

In fiscal 2011, net sales were

$1,045.2 million versus $857.2 million in fiscal 2010.

Costs and

Margins

Cost of sales increased 20.8% over

the prior-year quarter to $201.3 million. As a percentage of sales,

costs increased 77.8% in the reported quarter from 76.7% in the

year-ago quarter. For the fourth quarter of 2011, gross profit was

$57.4 million compared with $50.6 million in the fourth quarter of

2010, reflecting higher sales volume.

Selling, general, and

administrative expense also increased 5.3% year over year to $15.9

million.

Operating income in the reported

quarter increased by 31.3% year over year to $44.5 million. Higher

sales volume, including the impact of the increase in sales of

industrial products, contributed to improved operating income

versus the prior year.

Shipments

Melted product shipments of 1,325

metric tons decreased 8.6% from last year’s shipments of 1,450

metric tons. Average selling price increased from $20.95 per

kilogram to $23.05 per kilogram. However, milled products shipments

of 3,985 metric tons surged 25.5% year over year from 3,175 metric

tons and product prices moved down to $52.60 per kilogram from

$54.15 per kilogram in the fourth quarter of 2010.

Outlook

Titanium Metals witnessed increased

demand in mill products through the year. The company’s commercial

aerospace customers significantly increased their purchasing

activity due to build rates for legacy and next generation models

and replenishment and growth of inventory to support the

anticipated increase in future aircraft deliveries.

The company expects demand to

remain strong for the remainder of the year and 2012, in line with

the industry’s estimated timelines for fleet replacement and

aircraft production.

Delaware-based Titanium Metals is

the leading worldwide producer of titanium metal products.

Titanium Metals has been successful

over the last several years in establishing significant flexibility

and cost advantages in its entire manufacturing process.

During the fourth quarter of 2011,

Titanium Metals acquired certain assets, intellectual property and

know-how in order to enhance its production capacities and

capabilities while extending its product technology.

To meet the growing demand for

complex, high-temperature alloys utilized more extensively in new

generation aircraft engines, the company has commissioned the

addition of a plasma cold hearth melt furnace at its facility in

Morgantown, Pennsylvania, which is expected to be completed in

2013.

We believe the company’s fiscal

discipline and industry experience has allowed it to manage its

production rates and costs effectively while investing capital

conservatively and maintaining a strong, debt-free balance

sheet. The company’s financial strength and operating

flexibility position it well to take advantage of opportunities for

strengthening and expanding its presence in key markets.

The company competes with

Allegheny Technologies Inc. (ATI) and RTI

International Metals, Inc. (RTI).

We maintain our Neutral

recommendation on Titanium. Currently, it holds a Zacks #3 Rank

(Hold).

ALLEGHENY TECH (ATI): Free Stock Analysis Report

RTI INTL METALS (RTI): Free Stock Analysis Report

TITANIUM METALS (TIE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

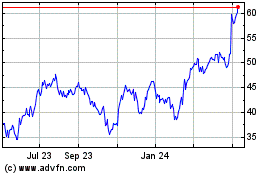

ATI (NYSE:ATI)

Historical Stock Chart

From Sep 2024 to Oct 2024

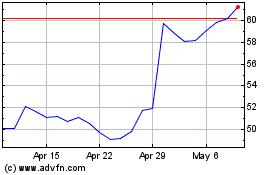

ATI (NYSE:ATI)

Historical Stock Chart

From Oct 2023 to Oct 2024