TECO ENERGY (TE) - Profit Tracks

February 28 2012 - 7:00PM

Zacks

Since inception in 1988, the S&P 500 has outperformed the Zacks

#5 Rank List - Stocks to Sell Now by 80% annually (+2% versus

+10%). While the rest of Wall Street continued to tout stocks

during the market declines of the last few years, Zacks told

investors which stocks to sell or avoid.

Here is a synopsis of why GAS and TE have a Zacks Rank of #5

(Strong Sell) and should most likely be sold or avoided for the

next one to three months. Note that a #5 Strong Sell rating is

applied to 5% of all the stocks in the Zacks Rank universe:

AGL Resources Inc. (GAS) announced fourth-quarter profit

of 87 cents per share on February 22 that missed analysts?

expectations by 5.43%. The Zacks Consensus Estimate for the current

year slid to $2.87 per share from $3.05 per share in the last 30

days as next year?s estimate dipped 10 cents per share to $3.13 per

share in that time span.

TECO Energy, Inc. (TE) posted a fourth-quarter profit of

25 cents per share on February 2, which came in 3 cents wider than

the average forecast. The Zacks Consensus Estimate for the full

year fell to $1.34 per share from $1.39 per share over the past

month. For 2013, analysts expect a profit of $1.42 per share,

compared to last month?s projection for a profit of $1.46 per

share.

Here is a synopsis of why ATI and CLF have a Zacks Rank of 4

(Sell) and should also most likely be sold or avoided for the next

one to three months. Note that a #4 Sell rating is applied to 15%

of all the stocks ranked by Zacks;

Allegheny Technologies Incorporated?s (ATI)

fourth-quarter profit of 31 cents per share, posted on January 25,

lagged analysts? projections by 42.59%. Estimate for current year

slid 10 cents per share to $2.84 per share over a month as next

year?s estimate dipped 1 cent per share to $4.12 per share in that

time span.

Cliffs Natural Resources Inc (CLF) reported a

fourth-quarter profit of $1.42 per share on February 15 that fell

7.79% short of the Zacks Consensus Estimate. The full-year average

forecast is currently $9.61 per share, compared with last month?s

projection of $10.38 per share. Next year?s forecast dropped to

$11.72 per share from $12.44 per share in the same period.

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CLIFFS NATURAL (CLF): Free Stock Analysis Report

AGL RESOURCES (GAS): Free Stock Analysis Report

TECO ENERGY (TE): Free Stock Analysis Report

To read this article on Zacks.com click here.

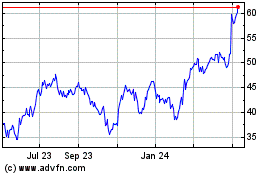

ATI (NYSE:ATI)

Historical Stock Chart

From Oct 2024 to Nov 2024

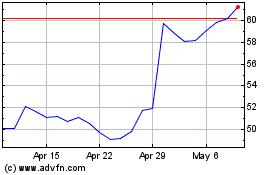

ATI (NYSE:ATI)

Historical Stock Chart

From Nov 2023 to Nov 2024