Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

May 16 2019 - 8:51AM

Edgar (US Regulatory)

Filed by AT&T Inc.

pursuant to Rule 425 under the Securities Act of 1933

Subject Company: AT&T Inc.

Registration No.:

333-231171

Date: May 16, 2019

For more information, contact:

Name: McCall Butler

AT&T Corporate and Financial

Communications

Phone: (470)

773-5704

Email: mb8191@att.com

For Holders of Old Notes, contact:

Global Bondholder Services Corporation

Phone: (866)

470-3900

(toll free)

(212)

430-3774

(collect)

AT&T INC. ANNOUNCES EARLY PARTICIPATION AND CONSENT RESULTS IN EXCHANGE OFFERS

Dallas, Texas, May

16, 2019

— AT&T Inc. (NYSE: T) (“AT&T”) announced today that, as of 5:00 p.m., New York

City time, on May 15, 2019 (the “Early Participation Date”), the aggregate principal amount of each series of notes listed in the table below (collectively, the “Old Notes”) issued by Warner Media, LLC or Historic TW Inc.

had been validly tendered and not validly withdrawn in connection with AT&T’s previously announced offers to exchange all validly tendered (and not validly withdrawn) and accepted Old Notes of each such series for new notes to be issued by

AT&T (collectively, the “AT&T Notes”), and the related solicitation of consents to amend the indentures governing the Old Notes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series of Old Notes to

be Exchanged

|

|

Issuer

|

|

CUSIP/ISIN No.

|

|

|

Aggregate Principal

Amount Tendered in

the Exchange Offers

as of the Early

Participation Date

|

|

|

Aggregate Principal

Amount of Consents

Received as of the Early

Participation Date

(4)

|

|

|

Percentage of Total

Outstanding

Principal Amount of

such Series of Old

Notes With Respect

to Which Consents

Were

Received

(4)

|

|

|

4.00% Notes due 2022

(1)

|

|

Time Warner

(2)

|

|

|

887317AN5

|

|

|

$

|

444,594,000

|

|

|

$

|

444,594,000

|

|

|

|

88.92

|

%

|

|

3.40% Notes due 2022

(1)

|

|

Time Warner

(2)

|

|

|

887317AQ8

|

|

|

$

|

402,403,000

|

|

|

$

|

402,403,000

|

|

|

|

80.48

|

%

|

|

9.15% Debentures due 2023

(1)

|

|

Historic TW

(3)

|

|

|

887315AM1

|

|

|

$

|

125,918,000

|

|

|

$

|

165,817,000

|

|

|

|

58.85

|

%

|

|

4.05% Notes due 2023

(1)

|

|

Time Warner

(2)

|

|

|

887317AR6

|

|

|

$

|

408,555,000

|

|

|

$

|

408,555,000

|

|

|

|

81.71

|

%

|

|

7.57% Debentures due 2024

(1)

|

|

Historic TW

(3)

|

|

|

887315BH1

|

|

|

$

|

54,168,000

|

|

|

$

|

86,456,000

|

|

|

|

63.52

|

%

|

|

3.55% Notes due 2024

(1)

|

|

Time Warner

(2)

|

|

|

887317AV7

|

|

|

$

|

587,038,000

|

|

|

$

|

587,038,000

|

|

|

|

78.27

|

%

|

|

3.60% Notes due 2025

(1)

|

|

Time Warner

(2)

|

|

|

887317AW5

|

|

|

$

|

1,328,163,000

|

|

|

$

|

1,328,163,000

|

|

|

|

88.54

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.875% Notes due 2026

(1)

|

|

Time Warner

(2)

|

|

|

887317AZ8

|

|

|

$

|

540,604,000

|

|

|

$

|

540,604,000

|

|

|

|

90.10

|

%

|

|

6.85% Debentures due 2026

|

|

Historic TW

(3)

|

|

|

887315BB4

|

|

|

$

|

25,000

|

|

|

$

|

5,233,000

|

|

|

|

24.03

|

%

|

|

2.95% Notes due 2026

(1)

|

|

Time Warner

(2)

|

|

|

887317BA2

|

|

|

$

|

706,862,000

|

|

|

$

|

706,862,000

|

|

|

|

88.36

|

%

|

|

3.80% Notes due 2027

(1)

|

|

Time Warner

(2)

|

|

|

887317BB0

|

|

|

$

|

1,328,590,000

|

|

|

$

|

1,328,590,000

|

|

|

|

88.57

|

%

|

|

6.95% Debentures due 2028

(1)

|

|

Historic TW

(3)

|

|

|

887315BM0

|

|

|

$

|

43,801,000

|

|

|

$

|

87,150,000

|

|

|

|

51.26

|

%

|

|

6 5/8% Debentures due 2029

(1)

|

|

Historic TW

(3)

|

|

|

887315BN8

|

|

|

$

|

190,040,000

|

|

|

$

|

306,063,000

|

|

|

|

76.07

|

%

|

|

7.625% Debentures due 2031

(1)

|

|

Time Warner

(2)

|

|

|

00184AAC9

|

|

|

$

|

177,235,000

|

|

|

$

|

291,302,000

|

|

|

|

58.67

|

%

|

|

7.700% Debentures due 2032

(1)

|

|

Time Warner

(2)

|

|

|

00184AAG0

|

|

|

$

|

133,645,000

|

|

|

$

|

230,033,000

|

|

|

|

56.45

|

%

|

|

8.30% Discount Debentures due 2036

|

|

Historic TW

(3)

|

|

|

887315AZ2

|

|

|

$

|

694,000

|

|

|

$

|

1,331,000

|

|

|

|

0.84

|

%

|

|

6.50% Debentures due 2036

(1)

|

|

Time Warner

(2)

|

|

|

887317AD7

|

|

|

$

|

160,252,000

|

|

|

$

|

301,668,000

|

|

|

|

76.89

|

%

|

|

6.200% Debentures due 2040

(1)

|

|

Time Warner

(2)

|

|

|

887317AE5

|

|

|

$

|

322,477,000

|

|

|

$

|

322,477,000

|

|

|

|

90.36

|

%

|

|

6.10% Debentures due 2040

(1)

|

|

Time Warner

(2)

|

|

|

887317AH8

|

|

|

$

|

385,429,000

|

|

|

$

|

385,429,000

|

|

|

|

83.88

|

%

|

|

6.25% Debentures due 2041

(1)

|

|

Time Warner

(2)

|

|

|

887317AL9

|

|

|

$

|

516,768,000

|

|

|

$

|

516,768,000

|

|

|

|

86.79

|

%

|

|

5.375% Debentures due 2041

(1)

|

|

Time Warner

(2)

|

|

|

887317AM7

|

|

|

$

|

446,957,000

|

|

|

$

|

446,957,000

|

|

|

|

89.39

|

%

|

|

4.90% Debentures due 2042

(1)

|

|

Time Warner

(2)

|

|

|

887317AP0

|

|

|

$

|

388,500,000

|

|

|

$

|

388,500,000

|

|

|

|

77.70

|

%

|

|

5.35% Debentures due 2043

(1)

|

|

Time Warner

(2)

|

|

|

887317AS4

|

|

|

$

|

436,339,000

|

|

|

$

|

436,339,000

|

|

|

|

87.27

|

%

|

|

4.65% Debentures due 2044

(1)

|

|

Time Warner

(2)

|

|

|

887317AU9

|

|

|

$

|

470,637,000

|

|

|

$

|

470,637,000

|

|

|

|

78.44

|

%

|

|

4.85% Debentures due 2045

(1)

|

|

Time Warner

(2)

|

|

|

887317AX3

|

|

|

$

|

795,686,000

|

|

|

$

|

795,686,000

|

|

|

|

88.41

|

%

|

|

1.95% Notes due 2023

(1)

|

|

Time Warner

(2)

|

|

|

XS1266734349

|

|

|

€

|

523,296,000

|

|

|

€

|

523,296,000

|

|

|

|

74.76

|

%

|

|

(1)

|

The requisite consents for adopting the proposed amendments to the applicable indenture were received for this

series of Old Notes. Consents received in the Exchange Offers (as defined below) and in the previously announced offers by AT&T to purchase for cash (the “Concurrent Cash Tender Offers”) certain series of the Old Notes have been

combined.

|

|

(2)

|

References to Time Warner refer to Warner Media, LLC, the successor in interest to Time Warner Inc.

|

|

(3)

|

References to Historic TW refer to Historic TW Inc., the successor in interest to Time Warner Companies Inc.

|

|

(4)

|

Reflects consents received with respect to the applicable series of Old Notes in the Exchange Offers plus, if

applicable, consents received with respect to the applicable series of Old Notes in Concurrent Cash Tender Offers.

|

Solely with respect

to the 6.85% Debentures due 2026 and the 8.30% Discount Debentures due 2036, in each case issued by Historic TW (the “Extended Consent Revocation Deadline Notes”), AT&T also announced it has extended the deadline to revoke consents to

amend the indentures governing the Extended Consent Revocation Deadline Notes (the “Consent Revocation Deadline”) from 5:00 p.m., New York City time, on May 15, 2019 to the earlier of (1) the date on which the supplemental

indenture reflecting the proposed amendments is executed with respect to applicable series of Extended Consent Revocation Deadline Notes and (2) 9:00 a.m., New York City time, on May 31, 2019 (such date, with respect to each applicable

series of Extended Consent Revocation Deadline Notes, the “Extended Consent Revocation Deadline”). Holders of Extended Consent Revocation Deadline Notes will not be given prior notice that a supplemental indenture is being executed with

respect to any series of Extended Consent Revocation Deadline Notes, and such holders will not be able to revoke a consent that was delivered with a validly tendered Extended Consent Revocation Deadline Note after the execution of the supplemental

indenture with respect to that series of Extended Consent Revocation Deadline Notes.

The Consent Revocation Deadline for all other series of Old Notes

(other than the Extended Consent Revocation Deadline Notes) has not been extended and occurred on 5:00 p.m., New York City time, on May 15, 2019. As a result, consents to amend the indentures governing the Old Notes that have been validly

delivered in connection with any Old Notes (other than the Extended Consent Revocation Deadline Notes) may no longer be revoked.

The exchange offers and

consent solicitations (together, the “Exchange Offers”) are being made pursuant to the terms and conditions set forth in AT&T’s prospectus, dated as of May 13, 2019 (the “Prospectus”), which forms a part of the

Registration Statement (as defined below), and, with respect to the U.S. dollar-denominated Old Notes (the “Old U.S. Notes”), the related Letter of Transmittal and Consent (the “Letter of Transmittal”). The Exchange Offers will

expire at 9:00 a.m., New York City time, on May 31, 2019.

A Registration Statement on Form

S-4

(File

No. 333-231171)

(the “Registration Statement”) relating to the issuance of the AT&T Notes was filed with the Securities and Exchange Commission (“SEC”) on May 2, 2019 (as amended by

Amendment No. 1 to the Registration Statement filed with the SEC on May 13, 2019) and declared effective by the SEC on May 13, 2019.

Questions concerning the terms of the Exchange Offers for the Old U.S. Notes should be directed to the

following dealer managers:

|

|

|

|

|

|

|

BofA Merrill Lynch

214 North Tryon Street, 21st Floor

Charlotte, North Carolina 28255

Attention: Liability Management Group

Collect: (980)

683-3215

Toll-Free: (888)

292-0070

|

|

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Attention: Liability Management Group

Collect: (212)

250-2955

Toll-Free: (866)

627-0391

|

|

J.P. Morgan

383 Madison Avenue

New York, New

York 10179

Attention: Liability Management Desk

Collect: (212)

834-3424

Toll-Free: (866)

834-4666

|

Questions concerning the terms of the Exchange Offer for the Old Euro Notes should be directed to the following dealer

managers:

|

|

|

|

|

|

Merrill Lynch International

|

|

Deutsche Bank

|

|

J.P. Morgan

|

|

2 King Edward Street

London EC1A 1HQ

United Kingdom

Attention: Liability Management Group

Toll: +44 (0) 20 7996 5420

|

|

Winchester House

1 Great Winchester Street

London

EC2N 2DB

United Kingdom

Attention: Liability Management Group

Phone: +44 20 7545 8011

|

|

383 Madison Avenue

New York, New York 10179

Attention:

Liability Management Desk

Collect: (212)

834-3424

Toll-Free: (866)

834-4666

|

Questions concerning tender procedures for the Old Notes and requests for additional copies of the Prospectus and the Letter

of Transmittal should be directed to the exchange agent and information agent:

|

|

|

|

|

|

|

|

|

Global Bondholder Services Corporation

|

|

|

|

|

|

|

By Facsimile (Eligible Institutions Only)

:

(212) 430-3775

or

(212)

430-3779

|

|

By

E-Mail:

contact@gbsc-usa.com

|

|

By Mail or Hand

:

65 Broadway—Suite 404

New York, New York 10006

|

This press release shall not constitute an offer to sell or a solicitation of an offer to buy any of the securities described

herein and is also not a solicitation of the related consents. The Exchange Offers may be made solely pursuant to the terms and conditions described in the Prospectus, the Letter of Transmittal and the other related materials.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities nor will there be any sale of these securities

in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

MiFID II professionals / ECPs-only / No PRIIPs KID – Manufacturer target market (MiFID II product governance) is eligible counterparties and professional

clients only (all distribution channels). No PRIIPs key information document (KID) has been prepared as not available to retail in EEA.

This press

release is directed only at: (i) persons who are outside the United Kingdom; (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the

“Order”); or (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant

persons”). This press release must not be acted on or relied on by persons who are not relevant persons. Any investment activity to which this press release relates is reserved for relevant persons only and may only be engaged in by relevant

persons.

###

CAUTIONARY LANGUAGE

CONCERNING FORWARD-LOOKING STATEMENTS

Information set forth in this news release contains forward-looking statements that are subject to risks and

uncertainties, and actual results may differ materially. A discussion of factors that may affect future results is contained in AT&T’s filings with the Securities and Exchange Commission and in the Registration Statement related to the

Exchange Offers. AT&T disclaims any obligation to update or revise statements contained in this news release based on new information or otherwise.

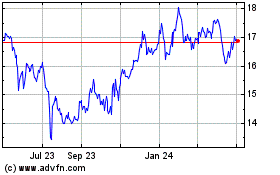

AT&T (NYSE:T)

Historical Stock Chart

From Aug 2024 to Sep 2024

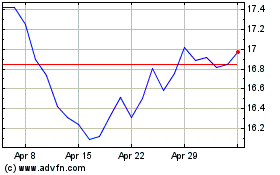

AT&T (NYSE:T)

Historical Stock Chart

From Sep 2023 to Sep 2024