Arcos Dorados Holdings Inc. (NYSE: ARCO) (“Arcos Dorados” or the

“Company”), Latin America’s largest restaurant chain and the

world’s largest McDonald’s franchisee, today reported unaudited

results for the third quarter ended September 30, 2011.

Third Quarter 2011 Highlights

- Revenues increased by 24.7%

year-over-year, or by 19.8% on a constant currency basis, to US$

984.0 million

- Systemwide comparable sales increased

by 15.7% year-over-year

- 64 net additions of restaurants over

the last 12 months

- Adjusted EBITDA1 increased by 11.5%

year-over-year, or by 2.0% on a constant currency basis, to US$

95.0 million; Net income amounted to US$ 19.6 million

- Trinidad & Tobago becomes 20th

territory, first restaurant is opened

- Debt profile restructured to reduce

cost of funding, more closely match currency exposure and diminish

foreign exchange volatility

- Given recent currency movement,

guidance for 2011 is revised: Revenue growth of between 21-23%,

Adjusted EBITDA1 growth of between 14-16% and Net Income growth of

between 16-18% 2011 (based on current foreign exchange and stock

market levels).

“During the third quarter Arcos Dorados experienced enhanced

systemwide comparable sales both on a year over year and sequential

basis, demonstrating the sustained demand of our consumers

throughout the region. We also continued to reimage and open new

restaurants at an impressive pace in accordance with our plan,

contributing to overall revenue growth. On a store level, strong

growth persists as customers continue to prioritize the McDonald’s

brand, products and customer service,” said Woods Staton, CEO of

Arcos Dorados.

Third Quarter Results

Arcos Dorados’ third quarter revenues increased by 24.7% to US$

984.0 million. On a constant currency basis, revenue growth was

19.8%. The increase was driven by systemwide comparable sales

growth of 15.7% and the net addition of 64 restaurants over the

last 12-month period.

All of the Company’s divisions posted revenue growth, with the

Brazil division growing 24.4% year-over-year. Systemwide comparable

growth of 11.7% was primarily a result of average ticket expansion

through a combination of pricing and product mix changes. NOLAD’s

(Mexico, Panama and Costa Rica) revenues increased by 17.4%

year-over-year, with a systemwide comparable sales increase of

8.6%. SLAD’s (Argentina, Venezuela, Colombia, Chile, Perú, Ecuador,

and Uruguay) revenues grew by 33.9% compared to the third quarter

of 2010, mainly driven by a 31.7% increase in systemwide comparable

sales. The Caribbean division (Puerto Rico, Martinique, Guadeloupe,

Aruba, Curaçao, F. Guiana, Trinidad & Tobago, US Virgin Islands

of St. Thomas and St. Croix) reported revenue growth of 2.6% above

the third quarter of 2010, with a decline in systemwide comparable

sales of 1.9%, impacted primarily by the difficult economic climate

in that region.

Adjusted EBITDA1 for the third quarter of 2011 was US$ 95.0

million, an 11.5% increase over the same period of 2010 (or 2% on a

constant currency basis). Arcos Dorados’ Adjusted EBITDA1 in the

third quarter of 2011 was driven by revenue growth and consolidated

improvements in Food & Paper costs as a percentage of sales,

which included Adjusted EBITDA1 growth in the three major divisions

(Brazil, SLAD, and NOLAD). These improvements were partially offset

by (i) higher payroll expenses; (ii) higher share-based

compensation (primarily related to ongoing CAD and EIP grant) of

approximately US$ 9 million; (iii) higher corporate expenses,

relating to increased payroll resulting mainly from the impact of

inflation significantly above currency devaluation in Argentina,

where the majority of corporate headcount is located as well as

headcount increases consistent with regional growth needs; and (iv)

lower Adjusted EBITDA1 in the Caribbean division.

The Adjusted EBITDA1 margin as a percentage of total revenues

was 9.7% for the quarter, down 1.1 percentage points compared to

the third quarter of 2010. Overall, the Company’s business remained

strong at the restaurant level, with continued gains in food and

paper efficiencies pressured by the growth in G&A consistent

with the overall expansion of the Company.

Net income attributable to the Company was US$ 19.6 million in

the third quarter of 2011, down from the US$ 29.1 million reported

in the third quarter of 2010. The Company’s improved operating

income was offset by higher net interest expense, which included

previously disclosed one-time charges (US$ 13.9 million) for the

redemption of 2019 Senior Notes, (please refer to “Debt

Restructuring”) and by foreign currency exchange charges of US$

20.9 million principally related to the impact on balance sheet

accounts of the Brazilian currency depreciation from R$1.56 on June

30, 2011 to R$1.87 on September 30, 2011, on (i) debt in the

Brazilian subsidiary of US$ 70 million in a currency (US dollar)

different from the subsidiary’s functional currency (Brazilian

reais) and (ii) a net receivable denominated in Brazilian reais of

R$73.6 million at the holding company level, where the functional

currency is the US dollar. These charges are non-cash accounting

charges. These effects were partially compensated by a gain from

derivative instruments of US$ 4.7 million in the quarter which

mainly included (i) a gain for the mark-to-market of existing

coupon-only cross currency swaps to hedge interest payments, (ii) a

charge of US$ 2.7 million corresponding to the mark-to-market of

derivative instruments until July, 2011, and which were settled

during the same month and (iii) a US$ 2.7 million one-off charge

for the unwinding of said derivative instruments in July, 2011

(please refer to “Debt Restructuring”).

Income tax expense for the period totaled US$ 9.5 million,

resulting in an effective tax rate of 32.3% for the quarter.

The Company reported basic earnings per share (EPS) of US$ 0.09

in the third quarter of 2011, compared to US$ 0.12 in the third

quarter of 2010. The decrease was a result of lower net income,

partially offset by lower weighted-average number of outstanding

shares (please refer to Axis Split-off and IPO explanations in

previous releases).

Balance Sheet & Cash Flow Highlights

Cash and cash equivalents were US$ 251.1 million at September

30, 2011. The Company’s total financial debt (including derivative

instruments) was US$ 547.9 million, which included US$ 306.5

million corresponding to the accounting balance of the 2019 USD

Notes and R$ 400 million BRL 2016 Notes issued in July, 2011. Net

debt (total financial debt less cash and cash equivalents) was US$

296.8 million and the Net Debt/Adjusted EBITDA1 ratio was 0.9x at

September 30, 2011. Cash generated from operating activities was

US$ 90.7 million in the third quarter of 2011, in line with the

same period last year. In addition, during July 2011, the Company

restructured a portion of its debt, by which it (i) collected

proceeds of R$400 million related to the BRL bond issuance, (ii)

redeemed a portion of its outstanding 2019 USD Notes for US$ 152

million (equivalent to US$ 141.4 million of the principal amount),

(iii) paid US$ 91.6 million for unwinding the majority of the then

outstanding derivative instruments related to a notional amount of

US$ 200 million, and (iv) paid a dividend of US$ 12.5 million.

Capital expenditures (CapEx) for the period were US$ 78.1 million,

with the funds mainly being utilized for restaurant openings and

re-imagings during the quarter.

Nine Months 2011

For the nine months ended September 30, 2011, the Company’s

revenues grew by 25.5% (18% on a constant currency basis) to US$

2,699.1 million, with revenue growth in all divisions.

Additionally, adjusted EBITDA1 reached US$ 235.2 million, an

increase of 17.3% compared to one year ago, which was driven by

growth in the Brazil, SLAD, and NOLAD divisions. The Company has

managed overall operating costs, while G&A grew in anticipation

of the expansion of new units. Year-to-date consolidated net income

amounted to US$ 69.3 million, increasing by 6.8% over the first

nine month period in 2010. Additionally, total CapEx amounted to

US$ 182.5 million for the period, compared to US$ 84.7 million in

the first nine months of 2010.

Quarter Highlights & Recent Developments

Revised Guidance 2011:

Although the Company is experiencing strong market momentum at

the restaurant level, recent currency volatility, especially in the

Brazil division, could impact consolidated fourth quarter results.

As a result, and based on the current foreign exchange rate for the

Brazilian reais (R$1.71/ US$1.00) for the remainder of 2011, along

with the current quoted market price of the Company’s shares

(US$22.89 per share), the Company expects consolidated revenues to

grow by 21-23% and growth in Adjusted EBITDA of 14-16% compared

with 2010. Additionally, the Company estimates an increase in net

income of 16-18% in 2011.

Similarly, the capital expenditures plan continues and the

Company expects an important number of restaurant openings during

the fourth quarter 2011.

Dividend

On October 5, 2011, the Company paid a cash dividend of US$ 12.5

million or US$ 0.0597 per share of outstanding Class A and Class B

shares to shareholders of record at September 27, 2011.

Debt Restructuring

In July 2011, the Company concluded a series of transactions to

restructure its debt profile: On July 13, 2011, the Company issued

5-year R$ 400 million BRL-denominated Senior Unsecured Notes at a

rate of 10.25% (US$ equivalent of approximately $255.1 million).

The Notes mature on July 13, 2016. Subsequently, on July 18, 2011,

the Company redeemed a portion (31.42% or $141.4 million) of its

outstanding 7.50% Senior Notes due in 2019 at a redemption price

equal to 107.50%, plus accrued and unpaid interest. Finally, in

July 2011, the Company cancelled certain derivative instruments in

the amount of US$ 91.6 million.

As a result of the aforementioned transactions, the Company was

able to:

i. reduce its cost of funding generating future

savings of approximately 300-400 basis points per year without

significantly changing its gross debt position; ii. maintain an

adequate level of US Dollar exposure in its debt structure in

accordance with its financial policies; and iii. significantly

reduce the foreign exchange volatility on its Income Statement

related to the use of derivatives

In the third quarter of 2011, the Company recognized one-time

charges before taxes associated with the senior notes redemption as

well as the unwinding of its derivative instruments, of US$ 16.6

million.

Secondary Offering

On October 19, 2011, the Company completed a secondary public

offering of 44,457,958 Class A shares (including over-allotment),

listed on the New York Stock Exchange at a price of US$ 22.00 per

share. The selling shareholders received the net proceeds from the

offering and included DLJ South American Partners L.P., DLJSAP

Restco Co-Investments LLC, Capital International Private Equity

Fund V, L.P., CGPE V, L.P. and Gavea Investment AD, L.P. The

Company’s controlling shareholder did not sell any shares in the

offering.

Addition of new master franchise

territory; Trinidad & Tobago

On September 30, 2011, Arcos Dorados opened its first restaurant

in Trinidad & Tobago. The Company was granted an additional

exclusive master franchise right from the McDonald’s Corporation

for the territory. The country has an estimated population of 1.23

million; an estimated GDP of US$ 20.6 billion in 2010, and per

capita income in 2009 of US$ 20,000. (Source: World Economic Fund -

April 2010) This is an attractive opportunity for the Company and

extends its presence to a total of 20 countries.

Definitions:

Systemwide comparable sales growth

refers to the change, measured in constant currency, in our

Company-operated and franchised restaurant sales in one period from

a comparable period for restaurants that have been open for

thirteen months or longer. While sales by our franchisees are not

recorded as revenues by us, we believe the information is important

in understanding our financial performance because these sales are

the basis on which we calculate and record franchised revenues, and

are indicative of the financial health of our franchisee base.

Constant currency basis refers to

amounts calculated using the same exchange rate over the periods

under comparison to remove the effects of currency fluctuations

from this trend analysis.

About Arcos Dorados

Arcos Dorados is the world’s largest McDonald’s franchisee in

terms of systemwide sales and number of restaurants, operating the

largest quick service restaurant (“QSR”) chain in Latin America and

the Caribbean. It has the exclusive right to own, operate and grant

franchises of McDonald’s restaurants in 20 Latin American and

Caribbean countries and territories, including Argentina, Aruba,

Brazil, Chile, Colombia, Costa Rica, Curaçao, Ecuador, French

Guyana, Guadeloupe, Martinique, Mexico, Panama, Peru, Puerto Rico,

St. Croix, St. Thomas, Trinidad & Tobago, Uruguay and

Venezuela. The Company operates or franchises 1,755

McDonald’s-branded restaurants with over 80,000 employees serving

approximately 4 million customers a day, as of December 2010.

Recognized as one of the best companies to work for in Latin

America, Arcos Dorados is traded on the New York Stock Exchange

(NYSE: ARCO). To learn more about the Company, please visit the

Investors section of our website: www.arcosdorados.com.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements. The

forward-looking statements contained herein include statements

about the Company’s business prospects, its ability to attract

customers, its affordable platform, its expectation for revenue

generation and its outlook for 2011. These statements are subject

to the general risks inherent in Arcos Dorados' business. These

expectations may or may not be realized. Some of these expectations

may be based upon assumptions or judgments that prove to be

incorrect. In addition, Arcos Dorados' business and operations

involve numerous risks and uncertainties, many of which are beyond

the control of Arcos Dorados, which could result in Arcos Dorados'

expectations not being realized or otherwise materially affect the

financial condition, results of operations and cash flows of Arcos

Dorados. Additional information relating to the uncertainties

affecting Arcos Dorados' business is contained in its filings with

the Securities and Exchange Commission. The forward-looking

statements are made only as of the date hereof, and Arcos Dorados

does not undertake any obligation to (and expressly disclaims any

obligation to) update any forward-looking statements to reflect

events or circumstances after the date such statements were made,

or to reflect the occurrence of unanticipated events.

Use of Non-GAAP Financial Measures(1)

In addition to financial measures prepared in accordance with

the general accepted accounting principles (GAAP), within this

press release and the accompanying tables, we use a financial

measure titled ‘Adjusted EBITDA’. We use Adjusted EBITDA to

facilitate operating performance comparisons from period to period.

Adjusted EBITDA is defined as our operating income plus

depreciation and amortization plus/minus the following losses/gains

included within other operating expenses, net and within general

and administrative expenses in our statement of income:

compensation expense related to a special award granted to our

chief executive officer, incremental compensation expense related

to our 2008 long-term incentive plan, gains from sale of property

and equipment, write-off of property and equipment, contract

termination losses, and impairment of long-lived assets and

goodwill, and stock-based compensation and bonuses incurred in

connection with the Company’s initial public listing.

Third Quarter 2011 Consolidated Results

(Unaudited)

(In thousands of U.S. dollars, except per

share data)

For Three Months ended September

30, 2011 2010 REVENUES Sales by

Company-operated restaurants 943,166 756,405 Revenues from

franchised restaurants 40,837 32,480

Total Revenues 984,003

788,885 OPERATING COSTS AND EXPENSES

Company-operated restaurant expenses: Food and paper (328,173 )

(269,562 ) Payroll and employee benefits (189,371 ) (148,249 )

Occupancy and other operating expenses (242,345 ) (190,241 )

Royalty fees (45,732 ) (36,657 ) Franchised restaurants - occupancy

expenses (13,252 ) (10,978 ) General and administrative expenses

(89,403 ) (58,636 ) Other operating income/(expenses), net

(1,466 ) (5,840 )

Total operating costs and expenses

(909,742 ) (720,163 )

Operating income 74,261

68,722 Net interest expense (27,996 ) (9,925 ) Gain

(loss) from derivative instruments 4,675 (14,154 ) Foreign currency

exchange results (20,909 ) 6,128 Other non-operating expenses, net

(725 ) (82 )

Income before income taxes

29,306 50,689 Income tax expense

(9,476 ) (21,443 )

Net income

19,830 29,246 Less: net (income)

attributable to non-controlling interests (248 ) (123

)

Net income attributable to Arcos Dorados Holdings Inc.

19,582 29,123

Earnings per share information ($ per share):

Basic net income per common share attributable to Arcos Dorados

Holdings Inc.

$ 0.09 $ 0.12

Weighted-average number of common shares outstanding-Basic

209,529,412 241,882,966

Adjusted EBITDA Reconciliation Operating income 74,261

68,722 Depreciation and amortization 18,089 14,111 Other net

operating charges excluded 2,662 2,381

Adjusted EBITDA 95,012

85,214 Adjusted EBITDA Margin as % of total

revenues 9.7 % 10.8 %

Nine Months 2011 Consolidated Results

(Unaudited)

(In thousands of U.S. dollars, except per

share data)

For Nine Months ended September

30, 2011 2010 REVENUES Sales by

Company-operated restaurants 2,586,560 2,063,509 Revenues from

franchised restaurants 112,589 87,187

Total Revenues 2,699,149

2,150,696 OPERATING COSTS AND EXPENSES

Company-operated restaurant expenses: Food and paper (908,343 )

(733,061 ) Payroll and employee benefits (517,077 ) (406,222 )

Occupancy and other operating expenses (684,999 ) (548,834 )

Royalty fees (125,687 ) (100,627 ) Franchised restaurants -

occupancy expenses (37,645 ) (30,259 ) General and administrative

expenses (253,848 ) (163,776 ) Other operating income/(expenses),

net (604 ) (13,962 )

Total operating costs and

expenses (2,528,203 )

(1,996,741 ) Operating income

170,946 153,955 Net interest

expense (48,195 ) (29,562 ) Loss from derivative instruments (7,550

) (22,144 ) Foreign currency exchange results (19,045 ) 3,018 Other

non-operating expenses, net (1,908 ) (2,000 )

Income before income taxes 94,248

103,267 Income tax expense (24,422 )

(38,316 )

Net income 69,826

64,951 Less: net (income) attributable to

non-controlling interests (519 ) (84 )

Net income

attributable to Arcos Dorados Holdings Inc.

69,307 64,867 Earnings

per share information ($ per share): Basic net

income per common share attributable to Arcos Dorados Holdings Inc.

$ 0.32 $ 0.27

Weighted-average number of common shares outstanding-Basic

217,405,469 241,882,966

Adjusted

EBITDA Reconciliation Operating income 170,946 153,955

Depreciation and amortization 49,212 42,479 Other net operating

charges excluded 15,048 4,117

Adjusted EBITDA 235,206

200,551 Adjusted EBITDA Margin as % of total

revenues 8.7 % 9.3 %

Third Quarter and Nine Months 2011

Results by Division (Unaudited)

(In thousands of U.S. dollars)

For Three Months ended % Increase

For 9 Months ended % Increase September 30,

/ September 30, / 2011

2010 (Decrease) 2011

2010 (Decrease)

Revenues

Brazil 507,683 407,956 24% 1,399,746

1,126,476 24% Caribbean 67,963 66,233 3% 200,019 193,618 3% NOLAD

93,681 79,765 17% 265,424 221,229 20% SLAD 314,676

234,931 34% 833,960 609,373

37%

TOTAL 984,003 788,885

25% 2,699,149

2,150,696 26%

Adjusted EBITDA

(1)

Brazil 80,625 64,827 24% 209,191 164,068 28% Caribbean 1,762 6,134

-71% 8,044 15,665 -49% NOLAD 6,961 5,869 19% 14,829 10,071 47% SLAD

36,296 25,313 43% 79,229

58,055 36%

TOTAL 95,012

85,214 11% 235,206

200,551 17%

Total Restaurants (eop) &

Systemwide Comparable Sales Growth

Total Restaurants*

Comp. Sales 3Q11vs. 3Q10

(%)

Brazil 627 11.7% Caribbean 144 (1.9)% NOLAD 473 8.6% SLAD

533 31.7% TOTAL 1,777 15.7%

* Considers company-operated and

franchised restaurants at period-end

Summarized Consolidated Balance

Sheet

(In thousands of U.S. dollars)

As of, As of,

September 30,2011

(Unaudited)

December 31,2010

ASSETS Current assets Cash and cash

equivalents 251,129 208,099 Accounts and notes receivable, net

72,762 79,821 Other current assets (1) 203,692 264,435

Total

current assets 527,583 552,355

Non-current assets Property and equipment, net 954,253

911,730 Net intangible assets and goodwill 52,629 47,264 Deferred

income taxes 171,149 190,764 Other non-current assets (2) 67,683

82,153

Total non-current assets 1,245,714

1,231,911 Total assets 1,773,297

1,784,266 LIABILITIES AND EQUITY Current

liabilities Accounts payable 120,146 186,700 Taxes payable (3)

113,629 124,677 Accrued payroll and other liabilities 225,281

211,231 Other current liabilities (4) 19,442 24,631 Financial debt

(5) 20,585 57,909

Total current liabilities 499,083

605,148 Non-current liabilities Accrued

payroll and other liabilities 53,624 53,475 Provision for

contingencies 40,198 63,940 Financial debt (5) 527,346 506,130

Deferred income taxes 6,228 6,378

Total non-current

liabilities 627,396 629,923 Total

liabilities 1,126,479 1,235,071 Equity

Class A shares of common stock 351,654 226,528 Class B shares of

common stock 132,915 151,018 Additional paid-in capital 2,843

(2,468) Retained earnings 303,055 271,387 Accumulated other

comprehensive loss (145,170) (98,664)

Total Arcos Dorados

Holdings Inc shareholders’ equity 645,297 547,801

Non-controlling interest in subsidiaries 1,521 1,394

Total Equity 646,818 549,195

Total liabilities and Equity 1,773,297

1,784,266 (1) Includes "Other receivables",

"Inventories", "Prepaid expenses and other current assets" and

"Deferred income taxes". (2) Includes "Miscellaneous", "Collateral

deposits" and "McDonald´s Corporation´ indemnification for

contingencies". (3) Includes "Income taxes payable" and "Other

taxes payable". (4) Includes "Royalties payable to McDonald´s

Corporation" and "Interest payable". (5) Includes "Short-term

debt", "Long-term debt" and "Derivative instruments"

Consolidated Financial Ratios

(In thousands of U.S. dollars, except

ratios)

As of As

of September 30, 2011 December 31,

(Unaudited) 2010 Cash

& cash equivalents 251,129 208,099 Total Financial Debt (i)

547,931 564,039 Net Financial Debt (ii) 296,802 355,940 Total

Financial Debt / LTM Adjusted EBITDA ratio 1.6 1.9 Net Financial

Debt / LTM Adjusted EBITDA ratio 0.9 1.2

_________________________

(i) Total financial debt includes short-term debt, long-term

debt and derivative instruments (ii)

Total financial debt less cash and cash

equivalents

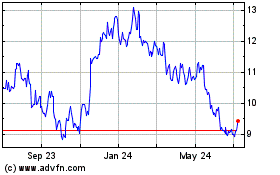

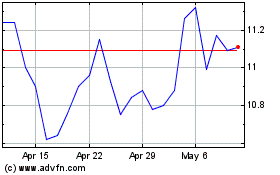

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Apr 2024 to May 2024

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From May 2023 to May 2024