U.S. Ethanol Production Continues to Skyrocket as Exports Surge

February 22 2012 - 8:20AM

Marketwired

Shares of ethanol producers have performed well in 2012 as demand

continues to grow. A new report from Pike Research estimates that

production of biologically-based fuels -- such as ethanol and

biodiesel -- will increase from $82.7 billion in 2011 to $185.3

billion by 2021. Pike Research expects the Americas (the two

largest producers of ethanol in the world are the U.S. followed by

Brazil) to account for 71 percent of total global biofuels

production for most of the 2012-2021 period. Five Star Equities

examines the outlook for companies in the ethanol industry and

provides equity research on BioFuel Energy Corporation (NASDAQ:

BIOF) and Archer Daniels Midland Company (NYSE: ADM). Access to the

full company reports can be found at:

www.fivestarequities.com/BIOF

www.fivestarequities.com/ADM

According to a U.S. energy sector report from EIC Consult,

ethanol production will continue to increase this year, with the

U.S. exporting ethanol in greater amounts. EIC DataStream indicates

that there are 42 future and active biofuel projects in the

U.S.

According to the Washington, D.C.-based Renewable Fuels

Association (RFA), 1.1 billion gallons of ethanol -- worth about

$2.5 billion -- were exported to other nations, three times more

than was exported in 2010. Exports accounted for 8.6 percent of

U.S. ethanol production in 2011, according to the RFA, up from 3

percent in 2010 and 1 percent in 2009.

Five Star Equities releases regular market updates on the

ethanol industry so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.fivestarequities.com and

get exclusive access to our numerous stock reports and industry

newsletters.

According to the RFA, the major importer of U.S. ethanol was

Brazil, with 33 per cent of the ethanol exports for the year

heading to the South American giant. According to Ethanol Producer

Magazine, Brazil has had a high demand for ethanol and low

supplies, due to a variety of factors. Brazil's sugarcane season

officially ends in March, but a Jan. 16 press release from UNICA,

the Brazilian Sugarcane Industry Association, revealed that 2011

ethanol production from April to December was down 18.74 percent

from the same time period in 2010.

Brazilian imports could drop sizably in the coming years,

however, as the RFA recently called for an investigation into news

that the Brazilian state of Sao Paulo planned to impose a 25

percent tax on all imported ethanol. "Because ethanol produced in

Sao Paulo is tax exempt, ethanol imported into Sao Paulo from the

United States and other areas is at a substantial economic

disadvantage," wrote RFA President and CEO Bob Dinneen.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.fivestarequities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

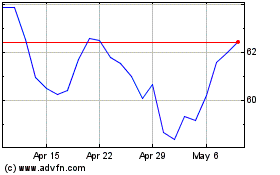

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2024 to May 2024

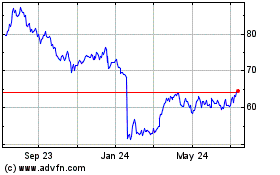

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From May 2023 to May 2024