SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2021

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its

charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd

Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Manual on Disclosure and Use of Information and Securities

Trading Policy for Ambev S.A.

Ambev S.A.’s (“Ambev” or “Company”)

policies on relations with investors and the market in general have always been based on the principle of transparency, and the Company’s

conduct is guided by the principle of full disclosure of the available information regarding its business activities. Ambev adheres at

all times to the highest standards of compliance with the statutes and regulations applicable to public companies which trade their securities

in Brazil and abroad.

Pursuant to Ruling No. 44/21, the Brazilian Securities and

Exchange Commission (“CVM”) (i) created a scheme of responsibility for the use, communication and disclosure of Material

Acts or Facts of publicly held companies; and (ii) established restrictions to trade securities of publicly held companies by certain

entities or individuals, in specific circumstances. The same ruling also admits the adoption, by publicly held companies, of a securities

trading policy in order to allow Individual Investment Plans – provided regulatory requirements are observed – to be capable

of eliminating a possible presumption of inappropriate use of Privileged Information.

Considering CVM regulation, Ambev Board of Directors consolidated

the Company’s best practices hereof - Manual on Disclosure and Use of Information and Securities Trading Policy (“Manual”),

designed to regulate the conduct of directors persons and legal entities that, on account of their professional relationships, may have

access to inside information related to Ambev. This Manual, therefore, comprises the best practices with regards to disclosure and use

of information (Sections I and II) and to the securities trading with shares issued by Ambev (Section III).

Any questions concerning the applicability of this Manual

shall be addressed to Ambev’s Investor Relations Officer.

Ambev S.A.

Index

1. Purpose and Scope

2. Principles

3. Definitions

Section I

Policy for the Disclosure and Use of Information related to Material Act or

Fact

4. Obligations towards the Investor

Relations Officer

5. Purpose of Disclosure of Material

Act or Fact

6. Definition of Material Act or

Fact

7. Examples of Material Act or Fact

8. Internal Procedures for Communication

and Disclosure of Material Act or Fact

9. Public Meetings with Investors

and Analysts

10. Responsibility for Omission

11. When to Communicate and Disclose

- Terms

12. Who to Communicate to

13. Method of Disclosure

14. Privileged Information and Confidentiality

Duty

15. Nondisclosure as Exception to

the Rule

16. Procedures in Case of Nondisclosure

of a Material Act or Fact by the Company

17. Request to CVM to Maintain Confidentiality

Section II

18. Procedures for Communication

of Information on Trading by Directors and Related Persons

19. Procedures for Communication

and Disclosure of Purchase or Sale of Material Ownership Interest

Section III

Policy on Securities Trading

20. Trading through Accredited Brokers

21. Blackout Periods

22. Restriction to Trading in the

Eminence of a Material Act or Fact

|

|

23.

|

Prohibition on Trading during the Period Preceding the Disclosure of Quarterly or Annual Financial Statement Information

|

24. Exceptions to General Restrictions

on Trading with Securities

25. Restriction on Trading after

Disclosure of Material Act or Fact

|

|

26.

|

Prohibition on Resolution regarding the Purchase or Sale of Shares issued by the Company itself

|

27. Investment Individual Plans

Final Provisions

28. Direct and Indirect Trading

29. Responsibility of the Investor

Relations Officer on monitoring policies

30. Amendment to the Manual

31. Liability of Third Parties

32. Penalties

Schedules

Schedule I – Adhesion Form

Schedule II - Template for the Communication of Information on Negotiations

of Directors and Related Persons

Schedule III - Template for the Communication of Information on the Acquisition

or Sale of Relevant Ownership Interest

|

1. Purpose and

Scope

|

|

The purpose of this Manual, whose defined terms can be found on item 3 below, is to establish high standards of conduct and transparency to be obligatorily followed by the Bound Persons, in order to align the Company’s internal policies with the principle of transparency and the best practices of conduct regarding the use and disclosure of Privileged Information and the Securities trading.

|

|

|

|

|

|

The Bound Persons are required to execute an Adhesion Form, in accordance with the terms of Article 17, Paragraph 1 of CVM Ruling No. 44/21, and in the form attached hereto as Schedule I.

|

|

|

|

|

|

The Company will keep at its headquarters a list of the persons and entities that have executed the Adhesion Form, with their qualification information, position or function, address and registration number with the Brazilian Federal Taxpayers’ Registry or Individual Taxpayers’ Registry. Such list will be available to CVM at all times.

|

|

2. Principles

|

|

All persons subject to this Manual shall conduct themselves in keeping with the values of good faith, loyalty and accuracy, as well as to the general principles set forth herein.

|

|

|

|

|

|

All efforts towards market efficiency must aim at assuring that competition among investors for optimal returns be based on analysis and interpretation of disclosed information and never on the privileged access to such information.

|

|

|

|

|

|

The persons subject to this Manual must bear in mind that transparent, accurate and timely information is the main tool available to the investing public, particularly to the shareholders of the Company, for ensuring necessary equitable treatment.

|

|

|

|

|

|

The Company’s relation with participants and opinion makers of the securities market must be consistent and transparent.

|

|

|

|

|

|

|

The persons subject to the provisions of this Manual are

obliged to ensure that disclosure of information regarding the financial standing of the Company is correct, complete and continuous,

developed by the competent Director incumbent with such duties, and that such information includes data regarding changes in the equity

interests such persons hold in the Company’s capital stock, as provided in this Manual and in applicable regulations.

Except for purposes of asset protection, the persons subject

to this Manual should not carry out transactions with securities issued by the Company, or referenced thereto, (i) in the short term and

with a purely speculative purpose; or (ii) where a position is maintained directly or indirectly sold in the Company's shares.

|

|

3. Definitions

|

|

The terms and expressions listed below will have the following meanings when used in this Manual:

|

|

|

|

|

|

“Accredited Brokers”

|

|

the securities brokers accredited by the Company to trade its Securities on behalf of the Bound Persons.

|

|

|

|

|

|

“Adhesion Form”

|

|

an Adhesion Form to this Manual, to be executed by the Bound Persons pursuant to Section 17, Paragraph 1 of CVM Ruling No. 44 in the format included on Schedule I.

|

|

|

|

|

|

“Affiliated Companies”

|

|

the companies in which the Company holds a substantial interest (article 243, paragraph 1, of the Brazilian Corporation Law)

|

|

|

|

|

|

“Bound Persons”

|

|

(i) the Directors, members of the Fiscal Council and the members of other Technical or Consulting Bodies of the Company; (ii) employees of the Controlling, Tax, Legal, Treasury, Investors’ Relations, Mergers and Acquisitions and New Business and Internal Audit Management Departments; (iii) employees and executives with access to Material Information; (iv) any person who, by virtue of its title, function or position within the Controlling Person, the Controlled Companies and the Affiliated Companies has knowledge of information related to a Material Act or Fact with respect to the Company; and (v) the Controlling Shareholders.

|

|

|

|

|

|

“Brazilian Corporation Law”

|

|

Law No. 6,404/76, dated as of December 15, 1976, as amended.

|

|

|

|

|

|

“Controlled Companies”

|

|

the companies in which the Company holds, either directly or through other subsidiaries, an ownership interest that entitles the Company to prevail in corporate resolutions, on a permanent basis, and that confers to the Company the power to elect the majority of its directors.

|

|

|

|

|

|

“Controlling Shareholders” or “Controlling Person”

|

|

the shareholder or group of shareholders bound by a shareholders’ agreement or under common control that exercise the controlling power over Ambev, in accordance with the terms of the Brazilian Corporation Law.

|

|

|

|

|

|

“CVM Ruling No. 44/21”

|

|

CVM Ruling No. 44, dated as of August 23rd, 2021, including subsequent amendments, provides for the disclosure and use of information related to Material Acts or Facts regarding to publicly-held companies, as well as on the trading of securities issued by a publicly-held company in the eminence of a material fact still undisclosed to the market, among other matters.

|

|

|

|

|

|

“Directors”

|

|

The sitting and alternate members of the board of directors and the executive officers of Ambev.

|

|

|

|

|

|

“Employees and Executives with access to Material Information”

|

|

the employees and executives of the Company, who have access to any Privileged Information on account of their title, function or position in the Company.

|

|

|

|

|

|

“Fiscal Council Members ”

|

|

the members of the Fiscal Council of the Company, whether sitting or alternate, elected by the shareholders’ meeting.

|

|

|

|

|

|

“Former Directors and Managers”

|

|

former members of the board of directors and former executive officers that have withdrawn from the management of the Company.

|

|

|

|

|

|

“Investor Relations Officer”

|

|

the executive officer of the Company responsible for providing information to the investing public, CVM, SEC, as the case may be, and the Stock Exchange or entities of the organized over-the-counter market, as well as for updating the Company’s registration.

|

|

|

|

|

|

“Privileged Information” or “Material Information”

|

|

all material information related to the Company that may have a significant impact on the quoted prices of the Securities that is still undisclosed to the investing public.

|

|

|

|

|

|

“Related Persons”

|

|

the persons having the following ties with the Directors, members of the Fiscal Council and members of the Technical or Consulting Bodies of the Company: (i) a spouse, not legally divorce; (ii) a partner (companheiro em união estável); (iii) any dependent reported in the annual income tax return; and (iv) the companies directly or indirectly controlled by the Directors and similar persons, or by Related Persons, as mentioned on items (i) to (iii) above.

|

|

|

|

|

|

“SEC”

|

|

the Securities and Exchange Commission.

|

|

|

|

|

|

“Securities”

|

|

Any shares, debentures, subscription receipts and subscription rights, promissory notes, put or call options, and indices and derivatives of any kind whatsoever, or any other collective investment instruments or agreements issued by the Company or referenced to them that are legally deemed as securities.

|

|

|

|

|

|

“Stock Exchange”

|

|

the stock exchanges or over-the-counter markets on which the Securities are traded, whether in Brazil or abroad.

|

|

|

|

|

|

“Technical or Consulting Bodies”

|

|

the bodies of the Company created by provisions of its bylaws

or by the board of directors, and entrusted with technical duties or for serving as consultants to the Company’s directors.

|

Section I

Policies on Disclosure and Use of Information related

to Material Act or Fact

|

4. Obligations towards the Investor Relations Officer

|

|

CVM Ruling No. 44/21 created a system that assigns responsibility for the use, communication and disclosure of Material Acts or Facts related to public companies. In this regard, the Investor Relations Officer is the primary responsible for the communication and disclosure of Material Acts or Events.

|

|

|

|

|

|

In order to ensure that the Investor Relations Officer will be able to comply with its duties, certain obligations have been created for certain persons linked to the Company, requiring them to communicate to the Investor Relations Officer any Material Act or Fact of their knowledge, so as to permit the Investor Relations Officer to take action accordingly.

|

|

5. Purpose of Disclosure of Material Act or Fact

|

|

The disclosure of a Material Act or Fact seeks to provide investors with the information they need to make investment decisions, in a timely, efficient and reasonable manner while preserving maximum symmetry with respect to the dissemination of information. This prevents persons having access to privileged information to use such information in the securities market for their own benefit or for the benefit of third parties, to the detriment of investors in general, the market or the Company itself.

|

|

6. Definition of Material Act or Fact

|

|

A “Material Act or Fact” within the meaning

of article 155, Paragraph 1, of the Brazilian Corporation Law and article 2nd of CVM Ruling No. 44/21 is: (a) any decision

by the Controlling Shareholder(s), and any resolution by the shareholders’ meeting or the management bodies of the Company; or (b)

any other political, administrative, technical, commercial, economic or financial act or fact occurring or relating to the business of

the Company that may have (“a” or “b”) a significant effect on:

(i)

the quoted price of the Securities;

(ii)

the decision of investors to purchase, sell or hold such Securities;

or

(iii)

the decision of investors to exercise any rights inherent to

the holding of such Securities.

|

|

7. Examples of Material Act or Fact

|

|

The article 2nd of the CVM Ruling No. 44/21 provides a non-exhaustive list of examples of Material Acts or Facts, which does not need to be repeated herein. In any case, the materiality of events pertaining to a Material Act or Fact must be analyzed in the context of the normal course of business and dimensions of the Company, as well as in the context of the information previously disclosed, and not in abstract, so as to avoid trivialization of the disclosure of Material Acts or Facts to the detriment of the quality of the analysis, by the market, of the Company’s prospects.

|

|

8. Internal Procedures for Communication and Disclosure of Material Act or Fact

|

|

All information on Material Acts or Facts of the Company will be centralized in the Investor Relations Officer, who is the person responsible for disclosure and communication of Material Acts or Facts.

|

|

|

|

|

|

The Bound Persons must communicate all Material Acts or Facts of their knowledge to the Investor Relations Officer, who, in the terms of this Manual, is the person responsible for its disclosure to the appropriate bodies and release to the press.

|

|

9. Public Meetings with Investors and Analysts

|

|

The meetings with class entities, investors, analysts or to a selected audience either in Brazil or abroad regarding matters that may constitute Privileged Information must be attended by the Chairman or the Co-Chairmen of the Board of Directors, as the case may be, the Chief Executive Officer, or the Investor Relations Officer, or another person appointed for such purpose. Otherwise, the contents of such meetings, to the extent that it constitutes Privileged Information, shall be reported to the Investor Relations Officer, in order for such Privileged Information to be previously or simultaneously disclosed to the market.

|

|

|

|

|

|

10. Responsibility for Omission

|

|

The Bound Persons who have personal knowledge of a Material Act or Fact are required to communicate such Material Act or Fact to the Investor Relations Officer. If after such communication (and where no decision has been made to maintain confidentiality, under the terms of article 6 of the CVM Ruling No. 44/21) the Bound Persons notice the Investor Relations Officer has failed to fulfill its duty to communicate and disclose such information, they will only be released from responsibility if they promptly communicate the Material Act or Fact in question to CVM.

|

|

11. When to Communicate and Disclose - Terms

|

|

Whenever possible, disclosure of a Material Act or Fact will be made before the opening or after the closing of trading on the Stock Exchanges in Brazil or abroad, but preferably after the close of these trading sessions.

|

|

|

|

|

|

As for the terms for communicating and disclosing information, the Investor Relations Officer shall also comply with the following:

|

|

|

|

|

|

(i) communicate

and disclose a Material Act or Fact occurring or relating to the Company’s business promptly after its occurrence;

(ii) communicate

and disclose a Material Act or Fact previously or simultaneously to the entire market, through any given means of communication, including

disclosure of information to the press or at meetings held with class entities, investors, analysts or selected audience in Brazil or

abroad; and

(iii) evaluate

the need to request to the Brazilian and foreign Stock Exchanges, always simultaneously, the suspension of the Securities trading for

the time required for proper dissemination of the Privileged Information, in case it is imperative the disclosure of a Material Act or

Event be made during trading hours.

|

|

12. Who to Communicate to

|

|

Information on a Material Act or Fact must be communicated

simultaneously to:

|

|

|

(i)

CVM;

(ii)

SEC; and

(iii)

the Stock Exchanges.

|

|

13. Method of Disclosure

|

|

Disclosure of a Material Act or Fact involving the Company shall be made through publication on the website of Valor Econômico newspaper on the internet, that shall make available to the public, free of charge, such Material Act or Fact in its entirety at “www.valor.com.br/fatosrelevantes".

|

|

|

|

|

|

The Material Act or Fact shall

also be disclosed at the Company´s investors’ relations website “http://ri.ambev.com.br”,

and through the CVM’s electronic system available at its website “http://www.cvm.gov.br”

and if required, to the stock exchanges where securities issued by the Company are traded.

The Investor Relations

Officer may determine the additional disclosure of Material Act or Fact through publication

on newspapers of wide-circulation normally used by the Company. Such publication may be made in summary form, provided that it indicates

the addresses on the internet where the complete information is available to all investors, at least to the same extent as disclosed

to CVM, the Stock Exchanges and SEC.

|

|

14. Privileged Information and Confidentiality Duty

|

|

The Bound Persons, as well as persons by virtue of their title, function or position within the Controlling Person, the Controlled Companies and the Affiliated Companies have the duty to (i) maintain confidential the information related to a Material Act or Fact to which they have had privileged access, up until its disclosure to the market, and (ii) make sure their subordinates and relying third parties act likewise, being jointly and severally responsible, with such persons, for any breach of the confidentiality duty.

|

|

|

|

|

|

For guidance purposes, in case of doubt as to the relevance of any Privileged Information, the Investor Relations Officer shall be contacted to clarify any questions.

|

|

15. Nondisclosure as Exception to the Rule

|

|

The general rule regarding Material Acts or Facts is that they must be promptly communicated and disclosed. In any case, not communicating and disclosing a Material Act or Fact constitutes an exception that shall be subject to specific analysis.

|

|

|

|

|

|

However, there are exceptional cases where indistinct disclosure of Privileged Information constituting a Material Act or Fact could jeopardize the Company’s legitimate interest.

|

|

16. Procedures in Case of Nondisclosure of a Material Act or Fact by the Company

|

|

In such cases, nondisclosure of a Material Act or Fact related to the Company will be subject to the decision of the Controlling Shareholders or the Directors, as a case may be.

|

|

|

|

|

|

Should the Material Act or Fact in question relate to transactions that directly involve the Controlling Shareholders and such Controlling Shareholders decide not to disclose it, then they shall inform the Company’s Investor Relations Officer of such decision.

|

|

|

|

|

|

Even when the Directors and the Controlling Shareholders have made a decision not to disclose a Material Act or Fact, you are required to promptly disclose such Material Act or Fact, either directly or through the Investor Relations Officer, in case the information is out of control or in case of unusual fluctuations of the quotes, prices or trading amounts of the Securities.

|

|

17. Request to CVM to Maintain Confidentiality

|

|

The Directors and the Controlling Shareholders may submit to CVM their decision to maintain confidential a Material Act or Fact exceptionally, because if disclosed, would in their judgment pose a manifest risk to the legitimate interests of the Company.

|

Section II

|

18. Procedures for Communication of Information on

Trading by Directors and Related Persons

|

|

|

|

|

The Directors, the Fiscal Council Members and the members of Technical or Consulting Bodies of the Company will be required to communicate the ownership of the securities of the Company, or of its Controlling Persons or Controlled Companies, in the latter two cases only if regarding public companies - or derivatives or any other securities referenced to them - whether held by them, directly, or by Related Persons, as well as any changes in such holdings.

|

|

|

|

|

|

|

Such communication will be made as per the model found in Schedule II and forwarded to the Investor Relations Officer, and by the latter to the CVM and the Stock Exchanges, as per CVM stipulations. The information required by the provisions on trading made by the Company itself, its controlled and affiliated companies must also be forwarded.

|

|

|

|

|

|

Such communication to the Company must be made (i) in the first business day immediately after taking office, and (ii) within no more than five (5) days after each trading.

|

|

|

|

|

19. Procedures for Communication and Disclosure of

Purchase or Sale of Material Ownership Interest

|

|

|

|

|

A material trade or series of trades refers to those through which the direct or indirect ownership interest of persons subject to the obligation is above or below the levels of five percent (5%), ten percent (10%), fifteen percent (15%) and so on successively, for a given type or class of shares representing the Company's share capital, including, pursuant to the rules for calculation stipulated in the law, derivatives referenced to these shares and the acquisition of rights on these securities

|

|

|

|

|

|

The direct or indirect Controlling Shareholders as well as the shareholders who elect members to the Board of Directors or the Fiscal Council of the Company, as well as any natural or legal person or group of persons acting jointly or representing the same interest, must notify the Company - immediately on reaching the abovementioned levels of ownership interest - the details of material trades carried out, as required by CVM, using the format on Schedule TIII, and the Investor Relations Officer shall transmit them to CVM and to the Stock Exchanges if applicable, and shall update the corresponding field of the Company's Reference Form.

|

|

|

|

|

|

If there is a change or intention to alter the corporate control or the management structure of the Company, or in case of a purchase that gives rise to a tender offer obligation, the purchaser shall also disclose the information referred to on items I to V of the caput of article 12 of CVM Ruling No. 44/21, doing so through the channels referred to on item 13 above.

|

Section III

Policy on Securities Trading

|

20. Trading through Accredited Brokers

21. Blackout Periods

|

|

In order to ensure that appropriate standards will be observed when trading Securities of the Company and of the publicly-held Controlled Companies, a system is hereby adopted whereby all such trading by the Company itself and the Bound Persons will be conducted through Accredited Brokers only.

|

|

|

|

|

|

The Bound Persons shall refrain from directly or indirectly trade their shares during all periods determined as a non-trading period by the Investor Relations Officer, through the issuance of a communication in such regard (each a “Blackout Period”). The Investor Relations Officer will not be required to provide a reason for his decision to determine a Blackout Period, which shall be maintained confidential by the recipients.

|

|

|

|

|

|

The same obligations apply to the direct or indirect Controlling Shareholders, the Controlled Companies and those persons who, by virtue of their title, function or position within the Controlling Person, the Controlled Companies and the Affiliated Companies, have knowledge of information regarding Material Acts or Facts involving the Company.

|

|

22. Restriction to Trading in the Eminence of a Material Act or Fact

|

|

Except by the exceptions stipulated on item 24 of this Manual, the Company and Bound Persons are prohibited to trade Securities:

|

|

|

|

|

|

(i)

before disclosing a Material Act or Fact regarding the

Company’s business. This prohibition is equally applicable and the unlawful characterization will be presumed, pursuant to Article

13, §1 of the CVM Resolution No. 44/21 to:

a)

any person who knows information related to the Company's Material

Fact and knows that this information has not yet been disclosed to the market, especially those who are a party to commercial, professional

or confidential relations with the Company, such as independent auditors, stock analysts, consultants and institutions that integrates

the Securities distribution system; and

b)

Former Directors and Managers, when leaving their Company management

positions prior to disclosure of Material Acts or Facts originated during their term of office, until: (b.i) three (3) months after the

date of their leaving; or (b.ii) the Material Fact's public disclosure.

(ii)

whenever an option or proxy for the purchase or sale of

shares of the capital stock of the Company, by the Company itself or its Controlled Companies, Affiliated Companies or another company

under common control is in effect or has been granted; and

(iii)

from the moment studies or analyzes started relating to

incorporation operations, total or partial spin-off, merger, transformation, any form of corporate reorganization, business combination,

change in the Company's control (including through the execution, amendment or termination of a shareholders' agreement), decision to

cancel the Company's registration as a publicly-held company or change the environment or trading segment of its shares.

(iv)

from the moment studies or analyzes started relating to

the request for a judicial or extrajudicial reorganization and bankruptcy, carried out by the Company itself.

|

|

|

|

|

|

The restriction referred to in item (ii) above will apply

to transactions involving shares of the Company made by the Bound Persons, exclusively on the dates on which the Company itself trades

or informs the Accredited Brokers that it will trade with shares of its capital stock. In this regard, the Accredited Brokers are directed

by the Investor Relations Officer of the Company not to record trading made on such dates.

|

|

23. Prohibition on Trading during the Period Preceding the Disclosure of Quarterly

or Annual Financial Statement Information

|

|

The Company and the Bound Persons may not trade during the fifteen (15) day period preceding disclosure or publication, as the case may be, of:

|

|

|

(i) the quarterly information of the Company (ITR); and

|

|

|

(ii) the standardized financial

statements of the Company (DFP).

The above restriction is independent of the assessment as to the existence of

Material Information pending disclosure or intention in relation to the negotiation.

|

|

|

|

|

|

The same restriction applies to the period of fifteen (15) days preceding any early disclosure of financial information.

|

|

|

|

|

|

The Accredited Brokers will be directed by the Company, not to record trading carried out by the persons mentioned above during the fifteen (15) day period preceding disclosure or publication of such periodical information or financial statements of the Company.

|

|

24. Exceptions to General Restrictions on Trading with Securities

|

|

The prohibition mentioned on item 22 (i) above shall not

apply to private transactions in treasury shares related to the exercise of stock options under a stock option plan approved by a shareholders’

meeting of the Company, or to grants of stock to members of the management, employees, or service providers as part of compensation previously

approved by a shareholders’ meeting.

|

|

|

The trading restrictions stipulated on item 22 (i), (ii)

and (iii) above shall not apply to the Bound Persons when covered by Individual Investment Plans as provided on item 27 below, nor shall

the restriction stipulated on item 23 above be applicable if the additional requirements described therein are fulfilled.

The trading restrictions provided for in item 23 above are

not applicable to:

(i) trading involving fixed income securities, when performed

through operations with commitments combinations of repurchase by the seller and resale by the buyer, for settlement on a pre-established

date, prior or equal to the maturity of the securities object of the transaction, carried out with profitability or remuneration parameters

predefined;

(ii) operations aimed at fulfilling assumed obligations

before the start of the blackout period arising from securities lending, exercise of stock options or sale by third parties and forward

purchase and sale contracts; and

(iii) negotiations carried out by financial institutions

and legal entities that are part of its economic group, provided it is performed in the normal course of its business and within parameters

pre-established in this Manual.

|

|

25. Restriction on Trading after Disclosure of Material Act or Fact

|

|

In the events set forth on item 22 (i) and (iii) above, even after the disclosure of a Material Act or Fact, the prohibition of Securities trading shall continue to prevail, in the event that it may - in the Company's judgment - interfere in the business conditions of the Company`s shares, in a manner to cause damage to the Company itself or to its shareholders, and such additional restriction must be informed by the Investor Relations Officer.

|

|

26. Prohibition on Resolution regarding the Purchase or Sale of Shares issued by the Company itself

|

|

The Board of Directors of the Company may not approve a

purchase or sale of shares of the capital stock of the Company itself before the following information has been made public by way of

publication of a Material Act or Fact:

(i)

execution of any agreement or contract for the purpose

of transferring the controlling interest of the Company (including through the execution, amendment or termination of a shareholders'

agreement); or

(ii)

granting of an option or proxy for the purpose of transferring

the controlling interest of the Company; or

(iii)

incorporation operations, total or partial spin-off, merger,

transformation, any form of corporate reorganization, business combination, change in the Company's control (including through the execution,

amendment or termination of a shareholders' agreement), decision to cancel the Company's registration as a publicly-held company or change

the environment or trading segment of its shares, from the moment studies or analyzes related to such operations are initiated.

(iv)

request for judicial or extrajudicial reorganization and

bankruptcy, carried out by the Company itself, from the moment studies or analyzes are initiated relating to such requests.

If a fact falling within any of the aforementioned situations

occurs after the approval of a plan for the repurchase of its own shares, the Company will immediately suspend transactions involving

its shares until disclosure of the respective Material Act or Fact.

|

|

|

|

|

|

27. Individual Investment Plans

|

|

As mentioned on item 24 above, Individual Investment Plans

may allow Bound Persons to trade Securities during the prohibited periods stipulated on item 22, (i), (ii), (iii) and (iv) above, provided

that:

(i)

they are formally notified in writing to the Investor Relations

Officer prior to any trading;

(ii)

they irrevocably and irreversibly determine the dates and

amounts of trades to be made by the participants; they are allowed to use algorithms and formulas which, once applied to a specific case,

determine whether the trades will be made or not and, if they will be made, on which dates and which financial amounts will be involved;

(iii)

they are verifiable, including with respect to its institution

and the implementation of any changes in its content;

(iv)

stipulate a minimum period of three (3) months for the

plan itself, or any of its changes and cancellation to produce effect;

(v)

there is no more than one Individual Investment Plan simultaneously

in effect for each Bound Person; and

(vi)

no trades are made that annul or mitigate the economic

effects of transaction to be determined by the investment plan.

In addition, Individual Investment Plans may allow Bound

Persons to trade the Company's shares during the periods stipulated on item 23 above, provided that, in addition to the above requirements:

|

|

|

|

|

|

(i) the Company has approved a schedule determining the specific dates for disclosure of the ITR and DFP forms; and

|

|

|

|

|

|

|

|

(ii) it requires its participants to revert to the

Company any losses avoided or gains made from Securities trading arising from any changes to the dates of disclosure of the ITR and DFP

forms, ascertained according to reasonable criteria specified on the plan.

At six-month intervals or more often, the Company’s

Board of Directors shall verify the trades made by Bound Persons to the Individual Investment Plans formalized by them, in cases where

these plans are used to allow trading during a prohibited trading period, subject to the other requirements described herein.

|

Final Provisions

|

28. Direct and Indirect Trading

|

|

The prohibitions on trading and requirements concerning notifications set forth on this Manual apply to trades carried out either directly or indirectly by the Bound Persons, even when the trades by such persons or entities are conducted through:

|

|

|

(i) a company controlled by them;

|

|

|

(ii) third parties with whom a fiduciary agreement or a portfolio or stock management agreement has been entered into.

|

|

|

|

|

|

Trading made by an investment fund of which the Bound Person

is a quotaholder will not be deemed an indirect trading, provided that:

|

|

|

(i) the

investment funds are not exclusive; and

|

|

|

(ii) the decisions to trade made by the manager of the investment fund cannot be influenced by the quotaholders.

|

|

|

|

|

|

29. Responsibility of the Investor Relations Officer monitoring policies

|

|

The Investor Relations Officer is responsible for enforcing and monitoring the policies on this Manual, including (i) the disclosure and use of information, and (ii) Securities trading as well as the Individual Investment Plans.

|

|

|

|

|

30. Amendment to the Manual

|

|

This Manual was approved by the Board of Directors of the Company on March 1st, 2013, and amendments to this Manual were approved by the Board of Directors of the Company on August 27th, 2014; March 28th, 2016; May 15th, 2019 and October 14th, 2021. Any new amendment to or revision shall be submitted to the Board of Directors of the Company and notified to CVM and the Stock Exchanges together with a copy of the resolution and the full contents of the documents that govern the Manual and are part of it.

|

|

|

|

|

|

31. Liability of Third Parties

|

|

The provisions of this Manual will not rebut liability of third parties under applicable rules and regulations, that are not directly linked to the Company but have knowledge of a Material Act or Fact and trade Securities.

|

|

|

|

|

32. Penalties

|

|

Without prejudice to other penalties provided by law, failure to comply with the provisions of this Manual will subject the offender to disciplinary sanctions in accordance with the internal regulations of the Company, including, without limitation, as the case may be: (i) warning, suspension or dismissal with cause, in accordance with the seriousness of the offense; and (ii) termination of the agreement executed with the Company, provided, further, the Company will be entitled to demand, in any case and only if dully owed, full indemnification for any losses eventually sustained by the Company, arising, either directly or indirectly, from such failure to comply.

|

Schedule I

ADHESION FORM

to the Manual on Disclosure and Use of Information and

Securities Trading Policy for Ambev S.A.

By this instrument, [insert name and identification details],

residing and domiciled at [address], registered with the [Individual Taxpayers’ Registry] under No. [insert number] and bearer of

Identification Card [indicate whether an RG or RNE] No. [insert number and issuing agency] (“Declarer”) in [his/her]

capacity as [indicate title, function or relationship with the company] of Ambev S.A., a corporation headquartered at the City

of São Paulo, State of São Paulo, at Rua Dr. Renato Paes de Barros, 1,017, 4th floor, registered with the Brazilian

Federal Taxpayers’ Registry (CNPJ) under No. 07.526.557/0001-00 (“Company”), hereby declares to have full knowledge

of the rules set forth in the Manual on Disclosure and Use of Information and Securities Trading Policy for Ambev S.A. (the “Manual”),

a copy of which [he/she] has received, and which regulates the internal policies regarding the use and disclosure of Material Information

and securities trading (as provided on the Manual), and hereby undertakes to conduct [himself/herself] at all times in compliance with

such rules. The Declarer executes this Adhesion Form in two (2) counterparts of like form and substance, in the presence of the two (2)

undersigned witnesses.

[insert place and date of execution]

[insert name of Declarer]

|

Witnesses:

|

|

|

|

|

|

1.

|

2.

|

|

Name:

|

Name:

|

|

RG:

|

RG:

|

|

CPF:

|

CPF:

|

Schedule II

|

Trading in Securities of the Company or Publicly Listed Companies that control it or are controlled by it:

|

|

Period: [month/year]

|

|

Name of Purchaser or Seller

|

|

|

|

Identification Details

|

CNPJ/CPF

|

|

Date of Trade

|

|

|

Issuing Company

|

|

|

Type of trade and form of acquisition or disposal

|

|

|

Type of Security

|

|

|

Total Amount

|

|

|

Amount by Type or Class (shares)

|

|

|

Characteristics (other securities)

|

|

|

Price

|

|

|

Broker Used

|

|

|

Position before trading

|

|

|

Position after trading

|

|

|

Other Material Information

|

|

|

|

|

|

Schedule III

|

Purchase or Sale of Material Ownership Interest

|

|

Period: [month/year]

|

|

Name of Purchaser/Seller

|

|

Identification Details

|

CNPJ/CPF

|

|

Date of Trade

|

|

|

Issuing Company

|

|

|

Type of Transaction

|

|

|

Type of Security

|

|

|

Intended Amount

|

|

|

Amount per Type or Class

|

|

|

Price

|

|

|

Broker Used

|

|

|

Purpose of Interest

|

|

|

Number of shares and other securities and derivatives referenced to these shares for physical or financial settlement, specifying quantity and class

|

|

|

Indication of any agreement or contract regulating the exercise of voting rights or purchase and sale of securities issued by the Company

|

|

|

Other Material Information

|

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 20, 2021

|

|

|

|

|

|

AMBEV S.A.

|

|

|

|

|

|

|

By:

|

/s/ Lucas Machado Lira

|

|

|

Lucas Machado Lira

Chief Financial and Investor Relations Officer

|

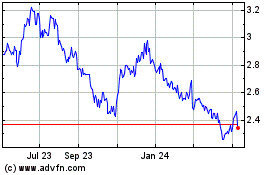

Ambev (NYSE:ABEV)

Historical Stock Chart

From Aug 2024 to Sep 2024

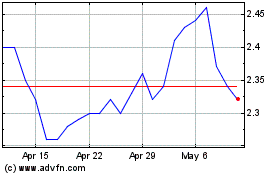

Ambev (NYSE:ABEV)

Historical Stock Chart

From Sep 2023 to Sep 2024