Zacks Sell List Highlights: Power Integrations, Sanmina-SCI, K12 and Abercrombie & Fitch - Press Releases

December 29 2011 - 3:30AM

Zacks

For Immediate Release

Chicago, IL – December 29, 2011 – Zacks.com releases details on

a group of stocks that are currently members of the exclusive Zacks

#5 Rank List – Stocks to Sell Now. These stocks are currently rated

as a Zacks Rank #5 (Strong Sell): Power Integrations,

Inc. ( POWI) and Sanmina-SCI Corporation

( SANM). Further, Zacks announced #4 Rankings (Sell) on two other

widely held stocks: K12 Inc. ( LRN) and

Abercrombie & Fitch Co. ( ANF).

To see the full Zacks #5 Rank List - Stocks to Sell Now visit:

http://at.zacks.com/?id=92

Since inception in 1988, the S&P 500 has outperformed the

Zacks #5 Rank List of Stocks to Sell Now by 80% annually (+2% vs.

+10%). While the rest of Wall Street continued to tout stocks

during the market declines of the last few years, Zacks told

investors which stocks to sell or avoid.

Here is a synopsis of why POWI and SANM have a Zacks Rank of #5

(Strong Sell) and should most likely be sold or avoided for the

next one to three months. Note that a #5 Strong Sell rating is

applied to 5% of all the stocks in the Zacks Rank universe:

Power Integrations, Inc. ( POWI) announced

third-quarter profit of 26 cents per share on November 3 that

missed analysts’ expectations by 13.33%. The Zacks Consensus

Estimate for the current year slid to $1.14 per share from $1.33

per share in the last 60 days as next year’s estimate dipped 46

cents per share to $1.32 per share in that time span.

Sanmina-SCI Corporation ( SANM) posted a

fourth-quarter profit of 32 cents per share on November 1, which

came in 5 cents wider than the average forecast. The Zacks

Consensus Estimate for the full year fell to $1.28 per share from

$1.51 per share over the past two months. For 2013, analysts expect

a profit of $1.51 per share, compared to last two month’s

projection for a profit of $1.66 per share.

Here is a synopsis of why LRN and ANF have a Zacks Rank of 4

(Sell) and should also most likely be sold or avoided for the next

one to three months. Note that a #4 Sell rating is applied to 15%

of all the stocks ranked by Zacks;

K12 Inc. ( LRN) first-quarter profit of 18

cents per share, posted on November 15, lagged analysts’

projections by 28%. Estimate for current year slid 6 cents per

share to 62 cents per share over a month as next year’s estimate

dipped 6 cents per share to $1.08 per share in that time span.

Abercrombie & Fitch Co. ( ANF) reported a

third-quarter profit of 57 cents per share on November 16 that fell

21.92% short of the Zacks Consensus Estimate. The full-year average

forecast is currently $2.79 per share, compared with last two

month’s projection of $3.28 per share. Next year’s forecast dropped

to $4.32 per share from $4.71 per share in the same period.

Truly taking advantage of the Zacks Rank requires the

understanding of how it works. The free special report;

“Zacks Rank Guide: Harnessing the Power of Earnings Estimate

Revisions” is available to provide this insightful background.

Download a free copy now to prosper in the years to come at

http://at.zacks.com/?id=93

About the Zacks Rank

Since 1988, the Zacks Rank has proven that "Earnings estimate

revisions are the most powerful force impacting stock prices."

Since inception in 1988, #1 Rank Stocks have generated an average

annual return of +28%. During the 2000-2002 bear market, Zacks #1

Rank stocks gained +43.8%, while the S&P 500 tumbled -37.6%.

Also note that the Zacks Rank system has just as many Strong Sell

recommendations (Rank #5) as Strong Buy recommendations (Rank #1).

Since 1988, Zacks Rank #5 stocks have significantly underperformed

the S&P 500 (2.8% versus +9.7%). Thus, the Zacks Rank system

allows investors to truly manage portfolio trading effectively.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Zacks “Profit from the Pros” e-mail newsletter offers continuous

coverage of Zacks Rank Buy stocks and highlights those stocks

poised to outperform the market. Subscribe to this free newsletter

today by visiting http://at.zacks.com/?id=94

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Len Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short,

it's your steady flow of Profitable ideas GUARANTEED to be worth

your time! Register for your free subscription to Profit from the

Pros at http://at.zacks.com/?id=95

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/ZacksInvestmentResearch

Zacks Investment Research is under common control with

affiliated entities (including a broker-dealer and an investment

adviser), which may engage in transactions involving the foregoing

securities for the clients of such affiliates.

Disclaimer: Past performance does not guarantee future

results. Investors should always research companies and

securities before making any investments. Nothing herein should be

construed as an offer or solicitation to buy or sell any

security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

ABERCROMBIE (ANF): Free Stock Analysis Report

K12 INC (LRN): Free Stock Analysis Report

POWER INTGRATIO (POWI): Free Stock Analysis Report

SANMINA-SCI CP (SANM): Free Stock Analysis Report

To read this article on Zacks.com click here.

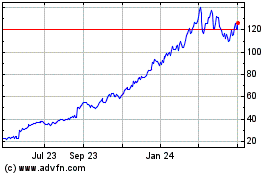

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From May 2024 to Jun 2024

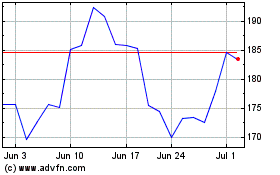

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jun 2023 to Jun 2024