Zumiez Stays Neutral - Analyst Blog

December 07 2011 - 10:57AM

Zacks

We have maintained our long-term Neutral recommendation on

Zumiez Inc. (ZUMZ) with a target price of $31.00

per share. Moreover, the quantitative Zacks #1 Rank (short-term

Strong Buy rating) for the company indicates no clear directional

pressure on the stock over the near term.

Zumiez is a mall-based specialty retailer of action-sports

related apparel, footwear, equipment, and accessories. The company

targets the youth, both men and women in the age group of 12 to 24

who seek popular brands that symbolize a lifestyle representing

extreme sports.

Furthermore, the company’s stores are strategically located in

busy areas of the mall, such as food courts, movie theatres and

music/game stores, which are typically frequented by the company’s

target customers.

Moreover, Zumiez is currently in the early phase of its store

expansion program and plans to enlarge its network by opening 44

new stores during fiscal 2011, including its first store in Canada.

Additionally, in the recent years, Zumiez has launched stores

averaging 3,000 square feet, enabling it to offer extended

merchandise without compromising on the store ambience. These

initiatives provide the company with a strong platform to

effectively capitalize on the emerging opportunities.

Additionally, strong merchandising, new stores, effective

ecommerce strategies and better margins define Zumiez’s

performance.

However, Zumiez’s operations are seasonal in nature and

typically generate stronger sales during third and fourth quarters,

which are characterized by the back-to-school and holiday seasons.

As a result, the company is exposed to significant risks if the

seasons fail to deliver expected operating performance.

Above all, the company operates in a highly fragmented specialty

retail sector and faces intense competition from larger

teenage-focused retailers, such as Abercrombie & Fitch

Company (ANF). Furthermore, Zumiez also competes with

large-format sporting goods stores, such as Big 5 Sporting

Goods Corporation (BGFV) and Dick’s Sporting Goods

Inc. (DKS) as well as local snowboard and skate shops.

Being in such a competitive industry, Zumiez may find it difficult

to execute and implement new business strategies.

ABERCROMBIE (ANF): Free Stock Analysis Report

BIG 5 SPORTING (BGFV): Free Stock Analysis Report

DICKS SPRTG GDS (DKS): Free Stock Analysis Report

ZUMIEZ INC (ZUMZ): Free Stock Analysis Report

Zacks Investment Research

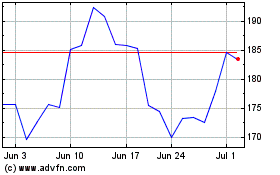

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Oct 2024 to Nov 2024

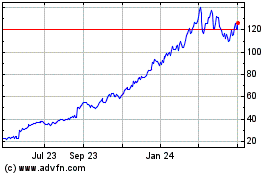

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Nov 2023 to Nov 2024