Abercrombie Reports Healthy Comps - Analyst Blog

August 09 2011 - 12:11PM

Zacks

Abercrombie & Fitch Co. (ANF), a specialty

retailer of casual apparel, reported preliminary solid sales

results for the second quarter of fiscal 2011. The company

recorded a comparable store sales growth of 9% in the quarter. The

result was aided by strong performance at its existing stores

including the new store in Paris.

In the quarter under review, total company direct-to-consumer

net merchandise sales climbed 28% to $102.1 million and total

company international net sales, including direct-to-consumer net

sales, jumped 74% to $231.9 million. U.S. sales, including

direct-to-consumer sales, climbed 12% to $684.9 million.

Keeping up with the increasing sales graph, total sales for the

quarter shot up 23.0% to $916.8 million from $745.8 million in the

same quarter last year.

Abercrombie's brand names, Abercrombie & Fitch and

Hollister, delivered same-store sales growth of 5.0% and 12.0%,

respectively, while its children's brand, Abercrombie Kids,

witnessed an increase of 7%.

Year-to-date, Abercrombie reported a rise of 9% in comparable

store sales resulting from an increase of 22% in net sales to

$1,753.0 million from $1,434.0 million recorded in the prior-year

period.

Year-to-date, total company direct-to-consumer net merchandise

sales climbed 30% to $207.9 million and total company international

net sales, including direct-to-consumer net sales, jumped 70% to

$427.6 million. U.S. sales, including direct-to-consumer sales,

climbed 12% to $1,326.0 million. Abercrombie's brand names,

Abercrombie & Fitch and Hollister, delivered same-store sales

growth of a respective 6.0% and 12.0%, while its children's brand,

Abercrombie Kids, witnessed an increase of 9%.

Abercrombie operated a total of 1,073 stores. The company

operated 316 Abercrombie & Fitch stores, 179 Abercrombie Kids

stores, 501 Hollister Co. stores and 18 Gilly Hicks stores in the

United States. The company also operated 10 Abercrombie & Fitch

stores, 4 Abercrombie Kids stores, 44 Hollister Co. and 1 Gilly

Hicks store internationally.

Abercrombie operates in a highly fragmented market and competes

with national as well as regional players. Furthermore, apart from

competing with larger retailers such as Gap Inc.

(GPS), Abercrombie is facing increasing competition from

value-priced specialty retailers such as Aeropostale

Inc. (ARO).

Abercrombie's shares maintain a Zacks #2 Rank, which translates

into a short-term Buy rating. Our long-term recommendation on the

stock remains Neutral.

ABERCROMBIE (ANF): Free Stock Analysis Report

AEROPOSTALE INC (ARO): Free Stock Analysis Report

GAP INC (GPS): Free Stock Analysis Report

Zacks Investment Research

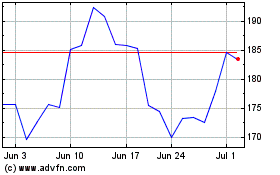

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Oct 2024 to Nov 2024

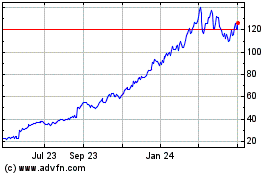

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Nov 2023 to Nov 2024