Demographics of Joblessness

This recession has hit men harder than it has hit women. However,

over the past year, things seem to be “evening out” between the

genders, and this month both made progress. In March, the

unemployment rate for adult men (over 20) fell to 8.6% from 8.7% in

February and from 9.9% as recently as November. It is down from

10.0% a year ago.

A bit of the decline is an illusion, though, as the participation

rate for men fell from 74.2% a year ago to 73.4% in March,

unchanged from February (for a fuller discussion of the importance

of the participation and employment rates see "Jobs Report

In-Depth, pt. 1"). That is up from 73.2% in January. The employment

rate for men fell to 67.0% from 67.1% in February, but up from

66.8% a year ago.

For women, the unemployment rate fell to 7.7% in March, down from

8.0% in both February and a year ago. The participation rate was

60.0%, unchanged from both February and January, but down from

60.5% a year ago. The employment rate rose to 55.4% from 55.2% in

January, but is still below the 55.7% rate a year ago.

For both sexes, there has been a real year-over-year improvement in

the employment situation, but it is not as big as just looking at

the unemployment rates would indicate.

In the overall big picture, men have fared far worse than women in

this downturn. There are two possible reasons for that. The first

is that the industries that have been particularly hard-hit in this

downturn tend to be far more male dominated than the industries

that have skated though this recession more or less unscathed.

The most glaring example of this would be the construction industry

versus the health care industry (more on the industry breakdowns

below). The second explanation is that, on average, women tend to

still be paid far less than men do, and employers might be more

prone to let their relatively high-priced male employees go first

before their cheaper female employees. The industry effect is

probably the bigger one, but the two are not mutually exclusive and

both might be playing a role.

Joblessness and Teenagers

Teens, regardless of gender, have had a very hard time of it in

this recession. Just go to a

McDonald's (MCD) and

you will see this for yourself. Normally the blemishes you see on

the cashier's face is acne, not wrinkles and age spots as is the

case now.

Things got even worse for teens in March. The teen unemployment

rate rose to 24.5% from 23.9% in February, but is down from 26.0% a

year ago. Things are not quite as bad is they sound (and yes, they

are a disaster, but the monthly changes were not quite as bad as a

0.6% increase would indicate). The participation rate rose to 34.1%

from 33.5% in February, but is still well below the 35.8% rate a

year ago.

The percentage of teens that actually have a job rose to 25.8% from

25.5% in February, but this is down from 26.5% a year ago. While

for the most part the earnings from teen jobs tend to go towards

clothes from

Abercrombie & Fitch (ANF) and

other teen clothing stores, for many it is a significant part of

paying for college. Also when teens work, they learn

important job skills, such as the importance of actually showing

up, and doing so on time. The extremely low levels of teens

working is not a good sign for the future.

Racial Demographics

Not surprisingly, Whites have a lower unemployment rates that do

Blacks or Hispanics. This month, the picture was mixed. The White

unemployment rate fell to 7.9% from 8.0%, and is down from 8.7% a

year ago. It is down from 8.9% in November. The participation rate

rose to 64.6% in March, from 64.5% in February, though it is down

from 64.8% a year ago. The employment rate for Whites rose to 59.5%

from 59.4% in February and from 59.3% in January but is down from

the year-ago level of 59.6%. It thus is likely that the real

employment situation for Whites has improved so far this year.

The unemployment rate for Blacks rose to 15.5% from 15.3% in

February, but is well below the 16.5% level a year ago. Here,

though, the change in the headline unemployment numbers from a year

ago are a bit exaggerated due to changes in the participation rate,

and the month-to-month deterioration is understated.

For the month, the participation rate for Blacks fell to 61.5% from

61.7%, so the monthly deterioration is actually much worse than it

appears. A year ago, the participation rate was 62.6%. The

employment rate for Blacks fell to 51.9% from 52.2% in January, and

is down from 52.3% a year ago. The unemployment rate is 96.2%

higher than for whites, and the employment rate is 12.8% lower

(51.9% vs. 59.5%). The participation rate is just 4.8% lower.

A year ago the participation rate was 3.4% lower and the employment

rate was 12.2% lower. A year ago the unemployment rate for Blacks

was 89.7% higher than the White unemployment rate.

For Hispanics, the unemployment rate in February fell to 11.3% from

11.6 last month, from 11.9% in January and down from 12.5% last

year. The monthly improvement is understated as the participation

rate rose to 66.4% from 66.1% in February. Part of the

year-over-year improvement, though, is an illusion as the

participation rate is down from the 67.9% level last year.

The employment rate rose to 58.9% from 58.4% last month and 59.1%

in January. A year ago the Hispanic employment rate was 59.4%. The

participation rate by Hispanics is actually 2.8% higher than for

Whites, but a year ago it was 4.8% higher than for Whites. The

employment rate is 1.0% lower, while a year ago it was 0.3% lower

than for Whites. Over the last year, the unemployment rate has

moved from being 43.7% higher than the White unemployment rate to

43.0% higher than for Whites.

Stay in School

The unemployment rate for high school dropouts fell to 13.7% from

13.9% in February and from 14.2% in January. It is down from the

year-ago level of 14.4%. Again, the monthly improvement is actually

better than it appears, but the year-over-year decline is partly an

illusion. The participation rate amongst the drop outs rose to

46.1% from 45.5% last month and from 45.1% in January but is down

from the 46.3% level of a year ago.

The percentage of high school dropouts actually employed rose to

39.8% from 39.2% last month and from 37.2% January, and is up

slightly from 39.7% a year ago. I should note here that the numbers

by level of education refer to people over age 24, and so are not

directly comparable to some of the other numbers. The overall

unemployment rate for people over 24 years old was 7.4%, down from

7.6% in February and January and down from 8.3% a year ago.

Just finishing high school or getting your GED substantially

increases your odds of having a job. The unemployment rate

for high school grads (with no college) was unchanged at 9.5% but

up from 9.4% In January. It is down from the 10.8% rate a year ago.

In all three months, the level was still far below that for

dropouts. This month, the unemployment rate for dropouts was 44.2%

higher than for those who at least finished high school.

The participation rate for high school grads was fell to 60.0% from

60.3% last month. A year ago it was 61.7%. Thus, the improvement

from last year is somewhat of an illusion, and month to month,

things actually deteriorated, rather than stayed unchanged as the

unemployment rate alone would indicate. The employment rate for

high school grads fell to 54.4% from 54.6% in January and is down

from 55.0% a year ago. Note that the participation rate and the

employment rate are much higher for high school grads than for

dropouts.

Those who went to college but did not finish, or only got an

Associates Degree, had an unemployment rate of 7.4%, down from 7.8%

in February, and down from 8.3% a year ago. The improvement here is

actually better than it appears. The participation rate for

Associate Degree holders rose to 69.7% from 69.5% in February but

is down from 70.9% a year ago. The employment rate rose to 64.4%

from 64.1% in February but is down from the 65.1% level of a year

ago.

For those who stay in school to get their BA (or higher) the

unemployment rate rose to 4.4% from 4.3% in February, and is down a

tick from 4.8% a year ago. The participation rate was

unchanged at 76.9% after rising from 76.4% in January and is up

slightly from 74.3% from a year ago. The percentage of

college grads with jobs fell to 73.5% from 73.6% in January but is

above the 73.4% level of a year ago.

The next graph (from this source) is unfortunately not updated with

the March data, but shows the long-term history of unemployment by

level of education. While the level of unemployment is always

higher the less education one has, the relatively uneducated really

get hit hard when the economy turns south.

The unemployment rate for people 20-24, those who are just entering

the full-time workforce, was 16.4% -- unchanged from last month,

and down from 18.2% a year ago. This year-over-year decline is good

news. If these people cannot get jobs, they tend to remain living

with Mom and Dad. This slows the rate of household formation, and

hence the demand for housing. That makes it difficult for the

economy to absorb the huge housing inventory overhang.

Normally housing is the locomotive that pulls the economy out of

recessions. That locomotive is still derailed, and it is the

principal reason that this recovery has been so sluggish. The

improvement in the unemployment rate for these folks is good news,

but the level is still extremely problematic. The unemployment rate

for those a bit older, the 25 to 34 year old cohort, which is the

prime age for first-time home ownership, fell to 9.3% from 9.5%

last month and down from 11.1% a year ago.

Lowering the unemployment rate amongst these people will be a key

to resolving the housing problem. We are making progress, but still

have a long way to go. Several studies have shown that not being

able to get a job right after finishing school hurts people not

only short term, but the effects lasts their entire working

career.

Where the Jobs Are (and Are Not)

The private sector actually added more than the total number of

jobs again this month. State and local governments laid off 14,000

workers, and have trimmed their payrolls by 282,000 over the last

year. Actually it is mostly at the local government level

where the declines are occurring. Local government employment

was down by 14,000 on the month, and is down by 259,000 from a year

ago. The number of state employees was unchanged on the month and

is actually down by 23,000 over the last

year.

In looking at the effectiveness of the stimulus program from the

Federal government one should keep in mind the massive

anti-stimulus effect of budget cuts and tax increases (mostly

budget cuts) at the State and Local levels of government. Federal

Government employment was up 1,000 for the month but is down by

74,000 over the past year (partially due to the hiring of temporary

Census workers last year).

There were sharp downward revisions to the February numbers for

State and Local employment. The number of State level employees

fell by 17,000 in February, not the 12,000 we were told last month,

and the number of Local government employees getting pink slips was

30,000, not 18,000.

Within local government, education jobs were down by 9,200 for the

month and are down by 151,400 over the last year. State level

education jobs (mostly professors at state universities and

community colleges) fell by 1,100 for the month and are down 29,500

from a year ago.

Given the huge disparity in the unemployment rate between the

uneducated and the highly educated that I discussed above, one has

to seriously question the wisdom of laying off so many K-12

teachers. Seriously, people worry about the burden that we are

putting on our Children due to the increase in the Federal debt.

Just how do we expect them to bear that burden if most of them are

illiterate and innumerate? How are we going to compete in the

future against countries that actually think it is a good thing to

educate their future workforce?

The private sector added 230,000 jobs, on top of an increase of

240,000 jobs in February (revised up from 222,000). That was a huge

improvement from an addition of 68,000 (revised up from 63,000)

jobs in January. The improvement was also better than that of

December, when 167,000 private sector jobs were added. It seems

likely that the January number was artificially depressed by the

awful weather. Thus it was not really as bad as it looked, but

conversely, February is probably not quite as strong as it

appears.

The average of the last three months of 188,000 is probably a

better representation of the real underlying growth rate of private

sector jobs. That’s good -- but hardly great -- especially coming

out of a deep recession. The March number was nicely above the

consensus expectations of 203,000 private jobs gained.

The upward revisions to previous months have been happening

regularly for several months now. That makes it likely that when

the April jobs report comes out, the March numbers will also be

revised higher. I would not be surprised if the February numbers

are also revised up again next month as well.

This is the 16th straight month that the private sector has added

jobs, with a total increase of 1.656 million over the last year. In

a normal year, that would be a great showing, but we lost over 8

million jobs in the Great Recession, so we still have our work cut

out for us.

Goods Producing Sector

Within the private sector, the goods producing sector gained 31,000

jobs, on top of a gain of 73,000 in January (revised up from

70,000). Over the last year, employment in the goods producing

sector is up 238,000. The construction industry lost 1,000 jobs

after gaining 37,000 (revised down from 33,000) last month. Since

construction takes place outdoors, it is one area where the weather

effects are most apparent.

The construction industry has been particularly hard-hit in this

downturn, accounting for about 30% of all the jobs lost, even

though at the start of the recession it accounted for less than 6%

of the total jobs in the country. As these jobs generally do not

require a lot of formal education, the demolition of construction

helps explain why the unemployment situation is so dire for those

who never went to college. As a male dominated industry, it also

helps explain why this recession has been so much tougher on men

than it has been on women.

Employment in Construction peaked before the rest of the economy,

in April 2006. Since then we have lost 2.212 million construction

jobs. Most of the decline though happened after the overall private

sector jobs peaked in December 2007, and since then Construction

jobs are down by 2.171 million, or 28.3%. Since the peak, overall

private sector employment is down by 7.034 million. In other words,

this one industry is directly responsible for 30.9% of all job

losses since the end of 2007, even though it was responsible for

just 6.47% of all private sector jobs in December 2007.

Manufacturing gained 17,000 jobs, on top of 32,000 gained in

January. Manufacturing employment has been in a secular decline for

about 30 years, but it has actually fared pretty well over the last

year or so. The peak in manufacturing jobs was way back in July of

1979 at 19.531 million. By the time the Great Recession started in

December 2007, the number of manufacturing jobs was already down to

13.740 million.

The low in manufacturing jobs was in December 2009 at 11.456

million, and since then we have gained back 211,000 of those jobs.

Still, relative to the start of the Great Recession, manufacturing

jobs are down by 2.073 million, representing 29.5% of all job

losses from the peak.

The service sector gained 199,000 jobs in the month, up from an

increase of 167,000 in February (revised from a gain of 152,000)

but down from a gain of 163,000 in October (revised from 146,000).

Relative to a year ago, private service sector jobs are up by 1.418

million, but are still off by 3.251 million from the start of the

Great Recession.

One of the biggest contributors to service sector jobs, as always,

was the health care industry, which added 44,500 jobs. The health

care industry has not had a single down month in terms of

employment in the entire downturn. The health care industry has a

far higher proportion of women working in it than does the economy

as a whole, and this is a big part of the reason that the

unemployment rate for women is so much lower than that for men.

Temp Jobs Growing

Of particular interest is the increase in temporary workers. Those

jobs increased by 28,800 in March after rising 22,700 (revised from

15,500) in February. It is not that being a temp is the greatest or

highest paying job in the world that makes them of particular

interest. It is because they are a good leading indicator of future

employment trends.

When during a downturn an employer first sees a pick up in demand,

he will not know if it is just a temporary blip, or the start of a

real recovery. Thus he is going to be hesitant to take the time and

expense of bringing on new workers who will just have to be laid

off it if does turn out to be just a blip. The first thing she is

going to do is work the existing workforce harder. This is

particularly if hours have been previously cut back due to slow

demand.

The upward trend in the average work week is a very good sign in

that regard, in addition to the fact that working more hours means

more income, and thus more spending by hourly employees. The second

thing an employer will do when faced with an increase in demand is

going to be to call a temp agency. Only when the employer is

reasonably sure that the upturn is for real and will last will he

figure that it is worth bringing on a full-time permanent

employee.

However, temp jobs have been trending higher since August 2009, and

one would think that we would be starting to see those translating

into permanent jobs at a faster rate at this point. That disconnect

could be pointing to some sort of structural shift in the

employment market, but it is too early to say. Since 8/09, the

number of Temps is up by 512,200 or 29.3%, but is still 14.5% below

the level at the start of the Great Recession.

The number of people working part time for economic reasons -- in

other words, because that is all they could find, or because their

previously full-time job has had its hours cut back, rose to 8.433

million, up 93,000 from February but down 579,000 from a year ago.

That is also a good sign.

It can be seen in the decline of the “underemployment rate” (U-6

for you wonks out there) which fell to 15.7% from 15.9% last month

and from 16.1% in January and down from 16.8% a year ago. That is

still a very high rate. After all, if you are used to working 40

hours a week, but have been cut back to just 20 hours a week, you

might not be unemployed, but economically you are still

struggling. It is not that part time jobs are going away. The

number of people who were working part time because that is what

they want to do increased by 197,000 for the month, and is up

83,000 from a year ago.

(NOTE: Part 3 of this article will be published later

today.)

ABERCROMBIE (ANF): Free Stock Analysis Report

MCDONALDS CORP (MCD): Free Stock Analysis Report

Zacks Investment Research

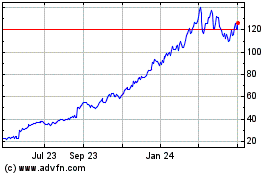

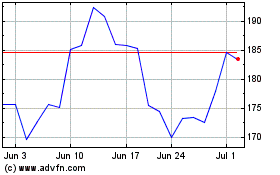

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Nov 2023 to Nov 2024