false000182139300018213932024-05-062024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 6, 2024

| | | | | |

THE AARON'S COMPANY, INC. |

(Exact name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Georgia | | 1-39681 | | 85-2483376 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 400 Galleria Parkway SE | Suite 300 | Atlanta | Georgia | | 30339-3194 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (678) 402-3000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

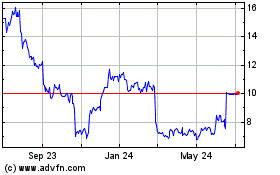

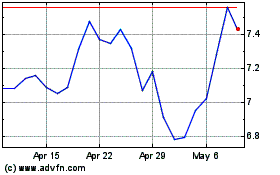

| Common Stock, $0.50 Par Value | AAN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On May 6, 2024, The Aaron's Company, Inc. (the "Company") issued a press release announcing its financial results for the quarter ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

ITEM 7.01. REGULATION FD DISCLOSURE

The Company frequently provides relevant information to its investors via posting to its corporate website. On May 6, 2024, the Company posted an investor presentation entitled "Aaron's Company Overview" on the Company's website at https://investor.aarons.com. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

ITEM 8.01. OTHER EVENTS

On May 6, 2024, the Board of Directors of the Company declared a second quarter cash dividend of $0.125 per share on the Company's common stock. The dividend will be paid on July 3, 2024 to shareholders of record as of the close of business on June 14, 2024. A copy of the press release announcing the dividend is attached hereto as Exhibit 99.3 and is incorporated by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits:

| | | | | |

Exhibit No. | Description |

| |

| |

| |

| |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | THE AARON'S COMPANY, INC. |

| | By: | /s/ C. Kelly Wall |

Date: | May 6, 2024 | | C. Kelly Wall Chief Financial Officer |

The Aaron’s Company, Inc. Reports First Quarter 2024 Financial Results

Reaffirms Revenue and Adjusted EBITDA Outlook

Raises Non-GAAP EPS Outlook

Atlanta, GA, May 6, 2024 — The Aaron’s Company, Inc. (NYSE: AAN) today released its first quarter 2024 financial results. Highlights of those results and the 2024 outlook are included below, in the attached supplement, and at investor.aarons.com.

First Quarter 2024 Consolidated Results:

•Revenues were $511.5 million

•Adjusted EBITDA1 was $22.7 million

•Loss per share was $0.46; Non-GAAP loss per share1 was $0.15

•Reaffirms full year 2024 outlook for revenue and adjusted EBITDA and raises outlook for non-GAAP EPS on lower estimated tax rate

Key Business Highlights2:

•Aaron's Business recurring revenue written increased 2.3% driven by 6.8% growth in lease merchandise deliveries

•E-commerce recurring revenue written increased 94.1% benefiting from new omnichannel lease decisioning and customer acquisition program

•Lease portfolio size ended Q1 down 4.8% year-over-year, a sequential improvement of 220 basis points from the end of Q4 2023

•Same store3 lease portfolio size ended Q1 down 1.4% year-over-year, a sequential improvement of 300 basis points from the end of Q4 2023

•Positive momentum continued into April with lease merchandise deliveries up 18.6% driven by e-commerce growth of 116.3%

•Write-offs were 5.9%; expect full year write-offs in line with guidance of 6% to 7%

•BrandsMart comparable sales decreased 9.4%, a sequential improvement of 460 basis points

•Announced quarterly cash dividend of $0.125 per share to be paid on July 3, 2024

Full Year 2024 Consolidated Outlook:

•Revenues of $2.055 billion to $2.155 billion

•Adjusted EBITDA1 of $105.0 million to $125.0 million

•Non-GAAP Diluted EPS1 of $0.00 to $0.25

The Company will host an earnings conference call tomorrow, May 7, 2024, at 8:30 a.m. ET. Chief Executive Officer Douglas A. Lindsay will host the call along with President Steve Olsen and Chief Financial Officer C. Kelly Wall. A live audio webcast of the conference call and presentation slides may be accessed at investor.aarons.com and the hosting website at https://events.q4inc.com/attendee/241854235. A transcript of the webcast will also be available at investor.aarons.com.

1.Item is a Non-GAAP financial measure. Refer to the "Use of Non-GAAP Financial Information" and supporting reconciliation tables in the attached supplement.

2.Comparisons are to the prior year period unless otherwise noted. Key operating metrics do not include BrandsMart Leasing.

3.With respect to any metric, "same store" includes all stores open for the 15-month period ended March 31, 2024, excluding stores that received lease agreements from other acquired, closed or merged stores.

About The Aaron's Company, Inc.

Headquartered in Atlanta, The Aaron’s Company, Inc. (NYSE: AAN) is a leading, technology-enabled, omnichannel provider of lease-to-own and retail purchase solutions of appliances, electronics, furniture, and other home goods across its brands: Aaron’s, BrandsMart U.S.A., BrandsMart Leasing, and Woodhaven. Aaron’s offers a direct-to-consumer lease-to-own solution through its approximately 1,220 Company-operated and franchised stores in 47 states and Canada, as well as its e-commerce platform. BrandsMart U.S.A. is one of the leading appliance retailers in the country with 11 retail stores in Florida and Georgia, as well as its e-commerce platform. BrandsMart Leasing offers lease-to-own solutions to customers of BrandsMart U.S.A. Woodhaven is the Company's furniture manufacturing division. For more information, visit investor.aarons.com, aarons.com, and brandsmartusa.com.

Contact:

Investor Relations – Call: 678-402-3590, Email: InvestorRelations@aarons.com

Media Relations – Call: 678-402-3591, Email: MediaRelations@aarons.com

The Aaron’s Company, Inc. Reports First Quarter 2024 Financial Results

Reaffirms Revenue and Adjusted EBITDA Outlook

Raises Non-GAAP EPS Outlook

Atlanta, GA, May 6, 2024 — The Aaron's Company, Inc. (NYSE: AAN) today released its first quarter 2024 financial results.

| | | | | |

First Quarter Consolidated Results | •Revenues were $511.5 million •Adjusted EBITDA1 was $22.7 million •Loss per share was $0.46; Non-GAAP loss per share1 was $0.15 •Reaffirms full year 2024 outlook for revenue and adjusted EBITDA and raises outlook for non-GAAP EPS on lower estimated tax rate |

Key Business Highlights2 | •Aaron's Business recurring revenue written increased 2.3% driven by 6.8% growth in lease merchandise deliveries •E-commerce recurring revenue written increased 94.1% benefiting from new omnichannel lease decisioning and customer acquisition program •Lease portfolio size ended Q1 down 4.8% year-over-year, a sequential improvement of 220 basis points from the end of Q4 2023 •Same store3 lease portfolio size ended Q1 down 1.4% year-over-year, a sequential improvement of 300 basis points from the end of Q4 2023 •Positive momentum continued into April with lease merchandise deliveries up 18.6% driven by e-commerce growth of 116.3% •Write-offs were 5.9%; expect full year write-offs in line with guidance of 6% to 7% •BrandsMart comparable sales decreased 9.4%, a sequential improvement of 460 basis points •Announced quarterly cash dividend of $0.125 per share to be paid on July 3, 2024 |

| |

CEO Commentary – “We are seeing strong positive momentum in the business, and our first quarter results were in line with our guidance. Our new omnichannel lease decisioning and customer acquisition program at the Aaron’s Business is driving significant growth in lease merchandise deliveries, and we continue to expect mid-single digit lease portfolio growth by the end of 2024. At BrandsMart, we continue to achieve operational efficiencies, and despite the challenging retail demand environment, comparable sales improved sequentially. We remain focused on our strategic priorities of improving operational performance, streamlining our cost structure, and innovating our business to better serve customers. Our management team and Board remain highly engaged and committed to taking all actions that will deliver additional value for our shareholders." – Douglas Lindsay, The Aaron’s Company CEO

|

1.Item is a Non-GAAP financial measure. Refer to the "Use of Non-GAAP Financial Information" and supporting reconciliation tables below.

2.Comparisons are to the prior year period unless otherwise noted. Key operating metrics do not include BrandsMart Leasing.

3.With respect to any metric, "same store" includes all stores open for the 15-month period ended March 31, 2024, excluding stores that received lease agreements from other acquired, closed or merged stores.

1

| | | | | | | | | | | | | | | | | | |

($ in Millions, except EPS) | | Q1'24 | Q1'23 | Change | | | | |

| Revenues | | $ | 511.5 | | $ | 554.4 | | (7.7) | % | | | | |

Net (Loss) Earnings | | (14.2) | | 12.8 | | nmf | | | | |

Adjusted EBITDA2 | | 22.7 | | 45.9 | | (50.4) | % | | | | |

Diluted (Loss) Earnings Per Share | | $ | (0.46) | | $ | 0.41 | | nmf | | | | |

Non-GAAP Diluted (Loss) Earnings Per Share2 | | $ | (0.15) | | $ | 0.66 | | (122.7) | % | | | | |

| | | | | | | | | | | | | | | | | | |

Adjusted Free Cash Flow2 | | Q1'24 | Q1'23 | Change | | | | |

Cash (Used in) Provided by Operating Activities | | $ | (18.5) | | $ | 61.0 | | (130.4) | % | | | | |

Adjustments3 | | 6.3 | | 1.8 | | nmf | | | | |

| Capital Expenditures | | (20.9) | | (20.2) | | 3.6 | % | | | | |

Adjusted Free Cash Flow2 | | $ | (33.2) | | $ | 42.5 | | nmf | | | | |

| | | | | | | | | | | | | | | | | | |

| Returns to Shareholders | | Q1'24 | Q1'23 | Change | | | | |

Dividends Declared4 | | $ | 3.8 | | $ | 3.9 | | (0.9) | % | | | | |

Share Repurchases | | $ | — | | $ | — | | nmf | | | | |

Discussion of Consolidated Results - Q1'24 vs. Q1'23:

•The 7.7% decrease in consolidated revenues was primarily due to lower lease revenues and fees at the Aaron's Business and lower retail sales at BrandsMart.

•Net loss included restructuring charges of $7.9 million, intangible amortization expense of $2.5 million, stock compensation expense of $2.7 million, and BrandsMart acquisition-related costs of $0.9 million.

•The decrease in net earnings was primarily due to lower lease revenues and fees at the Aaron's Business, lower retail sales at BrandsMart, and higher other operating expenses and write-offs, partially offset by lower personnel costs.

•The 50.4% decrease in adjusted EBITDA was primarily due to the same factors that impacted net earnings.

•The decrease in adjusted free cash flow was primarily due to purchases of lease merchandise inventory to support the growth in new agreement deliveries at the Aaron’s Business and lower earnings at both business segments.

•As of March 31, 2024, the Company had cash and cash equivalents of $41.0 million and debt of $212.9 million. The Company also ended the quarter with $211.0 million of availability under its $275.0 million revolving credit facility.

1.Year-over-year comparisons may vary due to rounding.

2.Item is a Non-GAAP financial measure. Refer to the "Use of Non-GAAP Financial Information" and supporting reconciliation tables below.

3.Adjustments include cash (used in) provided by operating activities related to acquisition-related transaction costs paid and real estate transaction related proceeds received during the period.

4.Disclosure based upon dividends declared but not paid for the three months ended March 31, 2024 and 2023.

2

| | | | | | | | | | | | | | |

Aaron's Business1 |

| The Aaron’s Business segment includes Aaron's branded Company-operated and franchise-operated stores, the Aarons.com e-commerce platform, Woodhaven, and BrandsMart Leasing. The financial and operating results for the Aaron's Business segment do not include unallocated corporate expenses. |

| | | | | | | | | | | | | | | | | | |

| ($ in Millions) | | Q1'24 | Q1'23 | Change | | | | |

| Revenues | | $ | 381.1 | | $ | 412.1 | | (7.5) | % | | | | |

Lease Portfolio Size2 | | $ | 116.1 | | $ | 121.9 | | (4.8) | % | | | | |

Same Store3 Lease Portfolio Size % Change Year-over-Year | | (1.4) | % | (6.0) | % | 460 | bps | | | | |

Lease Renewal Rate2 | | 87.4 | % | 88.5 | % | (110) | bps | | | | |

| Gross Profit Margin | | 64.2 | % | 63.3 | % | 90 | bps | | | | |

| Earnings Before Income Taxes | | $ | 18.7 | | $ | 35.9 | | (47.8) | % | | | | |

Adjusted EBITDA4 | | $ | 37.7 | | $ | 54.6 | | (30.8) | % | | | | |

Adjusted EBITDA Margin4 | | 9.9 | % | 13.2 | % | (330) | bps | | | | |

Write-Offs %5 | | 5.9 | % | 5.4 | % | 50 | bps | | | | |

| | | | | | | | | | | | | | |

Ending Store Count6 | | Q1'24 | Q1'23 | Change |

| Total Stores | | 1,217 | 1,261 | (44) |

| Company-Operated | | 987 | 1,030 | (43) |

| GenNext (included in Company-Operated) | | 265 | 222 | 43 |

| Franchised | | 230 | 231 | (1) |

Discussion of Aaron's Business Results - Q1'24 vs. Q1'23:

•The 7.5% decrease in revenues was primarily due to a smaller lease portfolio size and a lower lease renewal rate.

•The lease portfolio size began the quarter down 7.0% compared to the beginning of Q1 2023 and ended the quarter down 4.8% compared to the end of Q1 2023; this improvement was due to 6.8% growth in lease merchandise deliveries.

•The same store lease portfolio size began the quarter down 4.4% compared to the beginning of Q1 2023 and ended the quarter down 1.4% compared to the end of Q1 2023, driven by 10.1% growth in same store lease merchandise deliveries.

•The 30.8% decrease in adjusted EBITDA was primarily due to lower revenues and increased investments in advertising, partially offset by actions taken to lower personnel costs.

•The provision for lease merchandise write-offs as a percentage of lease revenues and fees was 5.9%, a 50 basis point increase primarily due to an increasing mix of e-commerce agreements written into the portfolio; write-offs improved sequentially by 60 basis points compared to Q4 2023.

•E-commerce revenues increased 20.8% and represented 24.0% of lease revenues; e-commerce recurring revenue written into the portfolio increased 94.1%.

•Opened 11 GenNext stores, which included three stores in new markets, ending the quarter with 265 stores; GenNext stores accounted for 33.4% of lease revenues and fees and retail sales.

•Lease originations in GenNext stores, open less than one year, continued growing at a rate of more than 20 percentage points higher than our legacy store average.

1.Year-over-year comparisons may vary due to rounding.

2.Key operating metrics do not include BrandsMart Leasing.

3.With respect to any metric, "same store" includes all stores open for the 15-month period ended March 31, 2024, excluding stores that received lease agreements from other acquired, closed or merged stores.

4.Item is a Non-GAAP financial measure. Refer to the "Use of Non-GAAP Financial Information" and supporting reconciliation tables below.

5.Provision for Lease Merchandise Write-offs as a percentage of lease revenues and fees, which includes the impact of intercompany eliminations.

6.The typical layout for a Company-operated Aaron's store is a combination of showroom, customer service and warehouse space. Certain Company-operated Aaron's stores consist solely of a showroom.

3

| | | | | | | | | | | | | | |

BrandsMart1 |

The BrandsMart segment includes BrandsMart U.S.A. retail stores and the brandsmartusa.com e-commerce platform, but does not include BrandsMart Leasing. The financial and operating results for the BrandsMart segment also do not include unallocated corporate expenses. |

| | | | | | | | | | | | | | | | | | |

| ($ in Millions) | | Q1'24 | Q1'23 | Change | | | | |

| Revenues | | $ | 132.5 | | $ | 144.2 | | (8.1) | % | | | | |

Comparable Sales2 | | (9.4) | % | n/a | n/a | | | | |

| Gross Profit Margin | | 22.2 | % | 24.4 | % | (220) | bps | | | | |

(Loss) Before Income Taxes | | $ | (6.4) | | $ | (0.9) | | nmf | | | | |

Adjusted EBITDA3 | | $ | (2.6) | | $ | 2.8 | | nmf | | | | |

Adjusted EBITDA Margin3 | | (2.0) | % | 1.9 | % | (390) | bps | | | | |

Discussion of BrandsMart Results - Q1'24 vs. Q1'23:

•The 8.1% decrease in revenues was primarily due to a 9.4% decrease in comparable sales, driven primarily by ongoing weaker customer traffic and customer trade down to lower priced products across major categories.

•Revenues in Q1 2024 included sales from the new store that recently opened in Augusta, GA.

•E-commerce product sales were 8.7% of product sales, down from 9.2% in the prior year quarter, primarily due to increased trade down to lower priced products and change in category mix.

•The 220 basis point decrease in gross profit margin was primarily due to inventory-related reserve adjustments in Q1 2023.

•The decrease in adjusted EBITDA and adjusted EBITDA margin were due to lower gross profit, higher advertising costs, and operating costs associated with the new store in Augusta, GA, partially offset by actions taken to lower personnel costs.

1.Year-over-year comparisons may vary due to rounding.

2.Comparable sales was calculated by comparing BrandsMart retail and other sales for the comparable period in 2023 for all BrandsMart stores open for the entire 15-month period ended March 31, 2024. Comparable sales includes retail sales generated at BrandsMart stores (including retail sales to BrandsMart Leasing), e-commerce sales initiated on the website or app, warranty revenue, gift card breakage, and sales of merchandise to wholesalers and dealers, as applicable. Comparable sales excludes service center related revenues.

3.Item is a Non-GAAP financial measure. Refer to the "Use of Non-GAAP Financial Information" and supporting reconciliation tables below.

4

The Company is raising outlook for non-GAAP diluted EPS, updating its estimated effective tax rate, and reaffirming outlook for revenues, adjusted EBITDA, capital expenditures, and adjusted free cash flow. The revised estimated effective tax rate is approximately 38%, 12% points lower than the prior guidance. Additionally, the expected full year provision for lease merchandise write-offs is unchanged from the previously provided guidance of 6% to 7% of lease revenues and fees.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Current Outlook2 | | Previous Outlook3 |

| Consolidated | | Low | | High | | Low | | High |

| Revenues | | $2,055.0 million | | $2,155.0 million | | $2,055.0 million | | $2,155.0 million |

Net (Loss) Earnings | | $(19.0) million | | $(7.0) million | | $(12.0) million | | $0.0 million |

Adjusted EBITDA | | $105.0 million | | $125.0 million | | $105.0 million | | $125.0 million |

| Diluted EPS | | $(0.40) | | $(0.25) | | $(0.30) | | $(0.05) |

| Non-GAAP Diluted EPS | | $0.00 | | $0.25 | | $(0.10) | | $0.25 |

| Cash Provided by Operating Activities | | $99.0 million | | $114.0 million | | $100.0 million | | $115.0 million |

| Capital Expenditures | | $85.0 million | | $95.0 million | | $85.0 million | | $95.0 million |

| Adjusted Free Cash Flow | | $15.0 million | | $30.0 million | | $15.0 million | | $30.0 million |

| | | | | | | | |

| Aaron’s Business | | | | | | | | |

| Revenues | | $1,460.0 million | | $1,520.0 million | | $1,460.0 million | | $1,520.0 million |

| Earnings Before Income Taxes | | $64.5 million | | $77.5 million | | $64.5 million | | $77.5 million |

| Adjusted EBITDA | | $137.5 million | | $152.5 million | | $137.5 million | | $152.5 million |

| | | | | | | | |

| BrandsMart | | | | | | | | |

| Revenues | | $610.0 million | | $650.0 million | | $610.0 million | | $650.0 million |

Loss Before Income Taxes | | $(9.5) million | | $(5.5) million | | $(9.5) million | | $(5.5) million |

| Adjusted EBITDA | | $7.0 million | | $12.0 million | | $7.0 million | | $12.0 million |

1.See the “Use of Non-GAAP Financial Information” section included in this release. Consolidated totals include unallocated corporate costs and intersegment elimination amounts.

2.The current outlook assumes no significant deterioration in the current retail environment, state of the U.S. economy, or global supply chain, as compared to its current condition.

3.As announced in the Form 8-K filed on February 26, 2024.

| | | | | | | | | | | | | | |

Conference Call and Webcast |

The Company will host an earnings conference call tomorrow, May 7, 2024, at 8:30 a.m. ET. Chief Executive Officer Douglas A. Lindsay will host the call along with President Steve Olsen and Chief Financial Officer C. Kelly Wall. A live audio webcast of the conference call and presentation slides may be accessed at investor.aarons.com and the hosting website at https://events.q4inc.com/attendee/241854235. A transcript of the webcast will also be available at investor.aarons.com.

| | | | | | | | | | | | | | |

About The Aaron's Company, Inc. |

Headquartered in Atlanta, The Aaron’s Company, Inc. (NYSE: AAN) is a leading, technology-enabled, omnichannel provider of lease-to-own and retail purchase solutions of appliances, electronics, furniture, and other home goods across its brands: Aaron’s, BrandsMart U.S.A., BrandsMart Leasing,

and Woodhaven. Aaron’s offers a direct-to-consumer lease-to-own solution through its approximately 1,220 Company-operated and franchised stores in 47 states and Canada, as well as its e-commerce platform. BrandsMart U.S.A. is one of the leading appliance retailers in the country with 11 retail stores in Florida and Georgia, as well as its e-commerce platform. BrandsMart Leasing offers lease-to-own solutions to customers of BrandsMart U.S.A. Woodhaven is the Company's furniture manufacturing division. For more information, visit investor.aarons.com, aarons.com, and brandsmartusa.com.

| | | | | | | | | | | | | | |

Forward-Looking Statements |

Statements in this news release regarding our business that are not historical facts are "forward-looking statements" that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as "believe," "expect," "expectation," "anticipate," "may," "could," "should," "intend," "seek," "estimate," "plan," "target," "project," "likely," "will," "forecast," "future," "outlook," or other similar words, phrases, or expressions. These risks and uncertainties include factors such as (i) changes in the enforcement of existing laws and regulations and the adoption of new laws and regulations that may unfavorably impact our business, and failures to comply with existing or new laws or regulations, including those related to consumer protection, as well as an increased focus on our industry by federal and state regulatory authorities; (ii) our ability to execute on our multi-year strategic plan and achieve the benefits and outcomes we expect, including improving our business, centralizing key processes such as customer lease decisioning and payments, real estate optimization, enhancing our e-commerce platform and digital acquisition channels, enhancing and growing BrandsMart, and optimizing our cost structure; (iii) our ability to attract and retain key personnel; (iv) our ability to manage cybersecurity risks, disruptions or failures in our information technology systems and to protect the security of personal information of our customers and employees; (v) weakening general market and economic conditions, especially as they may affect retail sales, increased interest rates, unemployment and consumer confidence; (vi) the concentration of our stores in certain regions or limited markets; (vii) the current inflationary environment could result in increased labor, raw materials or logistics costs that we are unable to offset or accelerating prices that result in lower lease volumes; (viii) business disruptions due to political and economic instability resulting from global conflicts such as the Russia-Ukraine conflict and related economic sanctions and the conflict in Israel, Palestine and surrounding areas, as well as domestic civil unrest; (ix) any future potential pandemics, as well as related measures taken by governmental or regulatory authorities to combat the pandemic; (x) challenges faced by our business, including commoditization of consumer electronics, our high fixed-cost operating model and the ongoing labor shortage; (xi) increased competition from direct-to-consumer and virtual lease-to-own competitors, as well as from traditional and online retailers and other competitors; (xii) increases in lease merchandise write-offs; (xiii) any failure to realize the benefits expected from the acquisition of BrandsMart, including projected synergies; (xiv) the acquisition of BrandsMart may create risks and uncertainties which could materially and adversely affect our business and results of operations; (xv) our ability to successfully acquire and integrate businesses and to realize the projected results and expected benefits of acquisitions or strategic transactions; (xvi) our ability to maintain or improve market share in the categories in which we operate despite heightened competitive pressure; (xvii) our ability to improve operations and realize cost savings; and (xviii) the other risks and uncertainties discussed under "Risk Factors" in the Company’s most recent Annual Report on Form 10-K and from time to time in other documents that we file with the SEC. Statements in this news release that are "forward-looking" include without limitation statements about: (i) the execution of our key strategic priorities; (ii) the growth and other benefits we expect from executing those priorities; (iii) our financial performance outlook; and (iv) the Company’s goals, plans, expectations, and projections. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this news release.

| | | | | | | | | | | |

| Investor Relations: | InvestorRelations@aarons.com | Media Relations: | MediaRelations@aarons.com |

| Phone: | 678-402-3590 | Phone: | 678-402-3591 |

| | | | | | | | | | | | | | |

CONSOLIDATED STATEMENTS OF (LOSS) EARNINGS |

| | | | | | | | | | | | | |

| | (Unaudited)

Three Months Ended | |

| (In Thousands, except per share amounts) | March 31, | |

| | 2024 | 2023 | | |

| REVENUES: | | | | | |

| Lease Revenues and Fees | | $ | 346,009 | | $ | 373,795 | | | |

| Retail Sales | | 136,929 | | 150,546 | | | |

| Non-Retail Sales | | 22,642 | | 23,935 | | | |

| Franchise Royalties and Other Revenues | | 5,917 | | 6,085 | | | |

| | 511,497 | | 554,361 | | | |

| COSTS OF REVENUES: | | | | | |

| Depreciation of Lease Merchandise and Other Lease Revenue Costs | | 112,540 | | 125,141 | | | |

| Retail Cost of Sales | | 105,962 | | 113,529 | | | |

| Non-Retail Cost of Sales | | 19,112 | | 19,997 | | | |

| | 237,614 | | 258,667 | | | |

| GROSS PROFIT | | 273,883 | | 295,694 | | | |

| OPERATING EXPENSES: | | | | | |

| Personnel Costs | | 125,068 | | 131,445 | | | |

| Other Operating Expenses, Net | | 131,935 | | 124,145 | | | |

| Provision for Lease Merchandise Write-Offs | | 20,507 | | 20,160 | | | |

| Restructuring Expenses, Net | | 7,898 | | 5,289 | | | |

| Separation Costs | | 17 | | 129 | | | |

| Acquisition-Related Costs | | 880 | | 1,848 | | | |

| | 286,305 | | 283,016 | | | |

OPERATING (LOSS) PROFIT | | (12,422) | | 12,678 | | | |

| Interest Expense | | (4,534) | | (4,358) | | | |

| Other Non-Operating Income, Net | | 637 | | 572 | | | |

| (LOSS) EARNINGS BEFORE INCOME TAXES | | (16,319) | | 8,892 | | | |

| INCOME TAX BENEFIT | | (2,138) | | (3,906) | | | |

NET (LOSS) EARNINGS | | $ | (14,181) | | $ | 12,798 | | | |

| | | | | |

| (LOSS) EARNINGS PER SHARE | | $ | (0.46) | | $ | 0.42 | | | |

| (LOSS) EARNINGS PER SHARE ASSUMING DILUTION | | $ | (0.46) | | $ | 0.41 | | | |

| WEIGHTED AVERAGE SHARES OUTSTANDING | | 30,552 | | 30,793 | | | |

WEIGHTED AVERAGE SHARES OUTSTANDING ASSUMING DILUTION | | 30,552 | | 31,239 | | | |

| | | | | | | | | | | | | | |

CONSOLIDATED BALANCE SHEETS |

| | | | | | | | | | | |

| (Unaudited) | | |

| (In Thousands) | March 31, 2024 | | December 31, 2023 |

| | | |

| ASSETS: | | | |

| Cash and Cash Equivalents | $ | 41,036 | | | $ | 59,035 | |

| Accounts Receivable (net of allowances of $7,632 at March 31, 2024 and $9,029 at December 31, 2023) | 35,162 | | | 39,782 | |

| Lease Merchandise (net of accumulated depreciation and allowances of $406,430 at March 31, 2024 and $411,641 at December 31, 2023) | 629,581 | | | 622,262 | |

| Merchandise Inventories, Net | 83,012 | | | 90,172 | |

| Property, Plant and Equipment, Net | 265,479 | | | 269,833 | |

| Operating Lease Right-of-Use Assets | 453,276 | | | 465,824 | |

| Goodwill | 55,750 | | | 55,750 | |

| Other Intangibles, Net | 105,662 | | | 108,158 | |

| Income Tax Receivable | 7,853 | | | 10,363 | |

| Prepaid Expenses and Other Assets | 108,804 | | | 105,397 | |

| Total Assets | $ | 1,785,615 | | | $ | 1,826,576 | |

| LIABILITIES & SHAREHOLDERS’ EQUITY: | | | |

| Accounts Payable and Accrued Expenses | $ | 267,267 | | | $ | 292,175 | |

| Deferred Tax Liabilities | 79,859 | | | 83,217 | |

| Customer Deposits and Advance Payments | 63,716 | | | 68,391 | |

| Operating Lease Liabilities | 491,324 | | | 502,692 | |

| Debt | 212,913 | | | 193,963 | |

| Total Liabilities | 1,115,079 | | | 1,140,438 | |

| | | |

| SHAREHOLDERS' EQUITY: | | | |

| Common Stock, Par Value $0.50 Per Share: Authorized: 112,500,000 Shares at March 31, 2024 and December 31, 2023; Shares Issued: 37,094,782 at March 31, 2024 and 36,656,650 at December 31, 2023 | 18,547 | | | 18,328 | |

| Additional Paid-in Capital | 753,253 | | | 750,751 | |

| Retained Earnings | 48,092 | | | 66,202 | |

| Accumulated Other Comprehensive Loss | (318) | | | (1,355) | |

| 819,574 | | | 833,926 | |

| Treasury Shares at Cost: 6,469,234 Shares at March 31, 2024 and 6,295,216 Shares at December 31, 2023 | (149,038) | | | (147,788) | |

| Total Shareholders’ Equity | 670,536 | | | 686,138 | |

| Total Liabilities & Shareholders’ Equity | $ | 1,785,615 | | | $ | 1,826,576 | |

| | | | | | | | | | | | | | |

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (In Thousands) Unaudited | 2024 | | 2023 | | |

| OPERATING ACTIVITIES: | | | | | |

| Net (Loss) Earnings | $ | (14,181) | | | $ | 12,798 | | | |

Adjustments to Reconcile Net (Loss) Earnings to Cash (Used in) Provided by Operating Activities: | | | | | |

| Depreciation of Lease Merchandise | 110,726 | | | 123,291 | | | |

| Other Depreciation and Amortization | 23,036 | | | 22,570 | | | |

| Provision for Lease Merchandise Write-Offs | 20,507 | | | 20,160 | | | |

| Accounts Receivable Provision | 8,842 | | | 6,908 | | | |

| Stock-Based Compensation | 2,721 | | | 2,922 | | | |

| Deferred Income Taxes | (4,547) | | | (5,985) | | | |

| Impairment of Assets | 3,310 | | | 914 | | | |

| Non-Cash Lease Expense | 30,348 | | | 30,042 | | | |

| Other Changes, Net | (3,358) | | | (900) | | | |

| Changes in Operating Assets and Liabilities: | | | | | |

| Lease Merchandise | (141,078) | | | (116,820) | | | |

| Merchandise Inventories | 7,160 | | | 9,801 | | | |

| Accounts Receivable | (4,223) | | | 1,016 | | | |

| Prepaid Expenses and Other Assets | (241) | | | 1,346 | | | |

| Income Tax Receivable | 2,510 | | | 1,907 | | | |

| Operating Lease Right-of-Use Assets and Liabilities | (30,886) | | | (30,350) | | | |

| Accounts Payable and Accrued Expenses | (24,511) | | | (18,470) | | | |

| Customer Deposits and Advance Payments | (4,675) | | | (190) | | | |

| Cash (Used in) Provided by Operating Activities | (18,540) | | | 60,960 | | | |

| INVESTING ACTIVITIES: | | | | | |

| Purchases of Property, Plant, and Equipment | (20,941) | | | (20,209) | | | |

| Proceeds from Dispositions of Property, Plant, and Equipment | 6,640 | | | 2,149 | | | |

| Proceeds from Other Investing-Related Activities | 1,644 | | | — | | | |

| Cash Used in Investing Activities | (12,657) | | | (18,060) | | | |

| FINANCING ACTIVITIES: | | | | | |

| Repayments on Swing Line Loans, Net | — | | | (19,250) | | | |

| Proceeds from Revolver and Term Loan | 21,094 | | | 31,094 | | | |

| Repayments on Revolver and Term Loan | (2,188) | | | (32,187) | | | |

| Dividends Paid | (3,791) | | | (3,442) | | | |

| Shares Withheld for Tax Payments | (1,250) | | | (2,539) | | | |

| Debt Modification Costs | (641) | | | — | | | |

| Cash Provided by (Used in) Financing Activities | 13,224 | | | (26,324) | | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | (26) | | | (25) | | | |

| (Decrease) Increase in Cash, Cash Equivalents, and Restricted Cash | (17,999) | | | 16,551 | | | |

| Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | 60,660 | | | 29,341 | | | |

| Cash and Cash Equivalents at End of Period: | | | | | |

| Cash and Cash Equivalents | 41,036 | | | 44,267 | | | |

| Restricted Cash included in Prepaid Expenses and Other Assets | 1,625 | | | 1,625 | | | |

| Total Cash, Cash Equivalents, and Restricted Cash at End of Period | $ | 42,661 | | | $ | 45,892 | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | |

QUARTERLY REVENUES BY SEGMENT |

| | | | | | | | | | | | | | |

| (Unaudited) |

| Three Months Ended |

| (In Thousands) | March 31, 2024 |

| Aaron’s Business | BrandsMart | Elimination of Intersegment Revenues1 | Total |

| Lease Revenues and Fees | $ | 346,009 | | $ | — | | $ | — | | $ | 346,009 | |

| Retail Sales | 6,487 | | 132,523 | | (2,081) | | 136,929 | |

| Non-Retail Sales | 22,642 | | — | | — | | 22,642 | |

| Franchise Royalties and Fees | 5,729 | | — | | — | | 5,729 | |

| Other | 188 | | — | | — | | 188 | |

| Total Revenues | $ | 381,055 | | $ | 132,523 | | $ | (2,081) | | $ | 511,497 | |

| | | | | | | | | | | | | | | |

| (Unaudited) | |

| Three Months Ended | |

| (In Thousands) | March 31, 2023 | |

| Aaron’s Business | BrandsMart | Elimination of Intersegment Revenues1 | Total | |

| Lease Revenues and Fees | $ | 373,795 | | $ | — | | $ | — | | $ | 373,795 | | |

| Retail Sales | 8,318 | | 144,158 | | (1,930) | | 150,546 | | |

| Non-Retail Sales | 23,935 | | — | | — | | 23,935 | | |

| Franchise Royalties and Fees | 5,898 | | — | | — | | 5,898 | | |

| Other | 187 | | — | | — | | 187 | | |

| Total Revenues | $ | 412,133 | | $ | 144,158 | | $ | (1,930) | | $ | 554,361 | | |

1.Intersegment sales between BrandsMart and the Aaron's Business pertaining to BrandsMart Leasing, are recognized at retail prices. Since the intersegment profit affects sales, cost of goods sold, depreciation and inventory valuation, they are adjusted when intersegment profit is eliminated in consolidation.

11

| | | | | | | | | | | | | | |

USE OF NON-GAAP FINANCIAL INFORMATION |

Non-GAAP net earnings, non-GAAP diluted earnings per share, adjusted free cash flow, net debt, EBITDA and adjusted EBITDA are supplemental measures of our performance that are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”). Non-GAAP net earnings and non-GAAP diluted earnings per share for 2024 exclude certain charges including amortization expense resulting from acquisitions, restructuring charges, separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company, acquisition-related costs, and debt modification costs associated with the debt amendment entered into on February 23, 2024. Non-GAAP net earnings and non-GAAP diluted earnings per share for 2023 exclude certain charges including amortization expense resulting from acquisitions, restructuring charges and separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company and acquisition-related costs, which are tax-effected using estimated tax rates which are commensurate with non-GAAP pre-tax earnings, can be found in the Reconciliation of Net Earnings and Earnings Per Share Assuming Dilution to non-GAAP Net Earnings and non-GAAP Earnings Per Share Assuming Dilution table in this news release.

The EBITDA and adjusted EBITDA figures presented in this news release are calculated as the Company’s earnings before interest expense, depreciation on property, plant and equipment, amortization of intangible assets and income taxes. Adjusted EBITDA also excludes the other adjustments described in the calculation of non-GAAP net earnings above. Adjusted EBITDA margin is defined as adjusted EBITDA as a percentage of revenue. The amounts for these pre-tax non-GAAP adjustments can be found in the Quarterly EBITDA table in this news release.

Management believes that non-GAAP net earnings, non-GAAP diluted earnings per share, EBITDA and adjusted EBITDA provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry as well as by our management in assessing both consolidated and business unit performance.

Non-GAAP net earnings and non-GAAP diluted earnings per share provide management and investors with an understanding of the results from the primary operations of our business by excluding the effects of certain items that generally arise from larger, one-time transactions that are not reflective of the ordinary earnings activity of our operations. This measure may be useful to an investor in evaluating the underlying operating performance of our business.

EBITDA and adjusted EBITDA also provide management and investors with an understanding of one aspect of earnings before the impact of investing and financing charges and income taxes. These measures may be useful to an investor in evaluating our operating performance and liquidity because the measures:

•Are widely used by investors to measure a company’s operating performance without regard to items excluded from the calculation of such measure, which can vary substantially from company to company depending upon accounting methods, book value of assets, capital structure and the method by which assets were acquired, among other factors.

•Are a financial measurement that is used by rating agencies, lenders and other parties to evaluate our creditworthiness.

•Are used by our management for various purposes, including as a measure of performance of our operating entities and as a basis for strategic planning and forecasting.

The adjusted free cash flow figures presented in this news release are calculated as the Company’s cash flows provided by operating activities, adjusted for acquisition-related transaction costs and proceeds from real estate transactions, less capital expenditures. Net debt represents total debt less cash and cash equivalents. Management believes that adjusted free cash flow and net debt are important measures of liquidity, provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry as well as by our management team in assessing liquidity.

Non-GAAP financial measures, however, should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company’s GAAP basis net earnings and diluted earnings per share, the Company’s GAAP revenues and earnings before income taxes and GAAP cash provided by operating activities, which are also presented in the news release. Further, we caution investors that amounts presented in accordance with our definitions of non-GAAP net earnings, non-GAAP diluted earnings per share, EBITDA, adjusted EBITDA and adjusted free cash flow may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate these measures in the same manner.

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION NON-GAAP NET (LOSS) EARNINGS AND NON-GAAP (LOSS) EARNINGS PER SHARE ASSUMING DILUTION |

| | | | | | | | | | | |

| (Unaudited)

Three Months Ended | | |

| (In Thousands, except per share amounts) | March 31, | | |

| 2024 | 2023 | | | |

Net (Loss) Earnings | $ | (14,181) | | $ | 12,798 | | | | |

| Income Taxes | (2,138) | | (3,906) | | | | |

(Loss) Earnings Before Income Taxes | $ | (16,319) | | $ | 8,892 | | | | |

| Acquisition-Related Intangible Amortization Expense | 2,496 | | 2,646 | | | | |

| Restructuring Expenses, Net | 7,898 | | 5,289 | | | | |

| Separation Costs | 17 | | 129 | | | | |

| Acquisition-Related Costs | 880 | | 1,848 | | | | |

Debt Modification Costs | 563 | | — | | | | |

Non-GAAP (Loss) Earnings Before Income Taxes | (4,465) | | 18,804 | | | | |

| | | | | |

| Income taxes, calculated using a non-GAAP Effective Tax Rate | 46 | | (1,670) | | | | |

Non-GAAP Net (Loss) Earnings | $ | (4,511) | | $ | 20,474 | | | | |

| | | | | |

| | | | | |

| (Loss) Earnings Per Share Assuming Dilution | $ | (0.46) | | $ | 0.41 | | | | |

| Acquisition-Related Intangible Amortization Expense | 0.08 | | 0.08 | | | | |

| Restructuring Expenses, Net | 0.26 | | 0.17 | | | | |

| Acquisition-Related Costs | 0.03 | | 0.06 | | | | |

Debt Modification Costs | 0.02 | | — | | | | |

| Tax Effect of Non-GAAP adjustments | (0.07) | | (0.07) | | | | |

Non-GAAP (Loss) Earnings Per Share Assuming Dilution1 | $ | (0.15) | | $ | 0.66 | | | | |

| | | | | |

Weighted Average Shares Outstanding Assuming Dilution2 | 30,552 | | 31,239 | | | | |

1.In some cases, the sum of individual EPS amounts may not equal total non-GAAP EPS calculations due to rounding.

2.For the three months ended March 31, 2024 and 2023, the GAAP Weighted Average Shares Outstanding Assuming Dilution were 30,552 and 31,239. There was no dilutive effect applied to the 30,552 Q1 2024 amount due to the net GAAP loss incurred in the period. The Non-GAAP Weighted Average Shares Outstanding Assuming Dilution were 30,552 and 31,239 during those same periods.

14

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION QUARTERLY ADJUSTED EBITDA BY SEGMENT |

| | | | | | | | | | | | | | | | | |

| (Unaudited) |

| (In Thousands) | Three Months Ended March 31, 2024 |

| Aaron’s Business | BrandsMart | Unallocated Corporate | Elimination1 | Total |

Net Loss | | | | | $ | (14,181) | |

| Income Taxes | | | | | (2,138) | |

Earnings (Loss) Before Income Taxes | $ | 18,734 | | $ | (6,421) | | $ | (28,520) | | $ | (112) | | $ | (16,319) | |

| Interest Expense | — | | — | | 4,534 | | — | | 4,534 | |

| Depreciation | 18,730 | | 1,607 | | 203 | | — | | 20,540 | |

| Amortization | 270 | | 2,226 | | — | | — | | 2,496 | |

| EBITDA | $ | 37,734 | | $ | (2,588) | | $ | (23,783) | | $ | (112) | | $ | 11,251 | |

| Separation Costs | — | | — | | 17 | | — | | 17 | |

| Restructuring Expenses, Net | — | | — | | 7,898 | | — | | 7,898 | |

| Acquisition-Related Costs | — | | — | | 880 | | — | | 880 | |

| Stock-Based Compensation | — | | — | | 2,703 | | — | | 2,703 | |

| Adjusted EBITDA | $ | 37,734 | | $ | (2,588) | | $ | (12,285) | | $ | (112) | | $ | 22,749 | |

| | | | | | | | | | | | | | | | | |

| (Unaudited) |

| Three Months Ended March 31, 2023 |

| Aaron’s Business | BrandsMart | Unallocated Corporate | Elimination1 | Total |

Net Earnings | | | | | $ | 12,798 | |

| Income Taxes | | | | | (3,906) | |

Earnings (Loss) Before Income Taxes | $ | 35,859 | | $ | (888) | | $ | (25,971) | | $ | (108) | | $ | 8,892 | |

| Interest Expense | — | | — | | 4,358 | | — | | 4,358 | |

| Depreciation | 18,283 | | 1,419 | | 222 | | — | | 19,924 | |

| Amortization | 420 | | 2,226 | | — | | — | | 2,646 | |

| EBITDA | $ | 54,562 | | $ | 2,757 | | $ | (21,391) | | $ | (108) | | $ | 35,820 | |

| Separation Costs | — | | — | | 129 | | — | | 129 | |

| Restructuring Expenses, Net | — | | — | | 5,289 | | — | | 5,289 | |

| Acquisition-Related Costs | — | | — | | 1,848 | | — | | 1,848 | |

| Stock-Based Compensation | — | | — | | 2,792 | | — | | 2,792 | |

| Adjusted EBITDA | $ | 54,562 | | $ | 2,757 | | $ | (11,333) | | $ | (108) | | $ | 45,878 | |

1.Intersegment sales between BrandsMart and the Aaron's Business pertaining to BrandsMart Leasing are recognized at retail prices. Since the intersegment profit affects sales, cost of goods sold, depreciation and inventory valuation, they are adjusted when intersegment profit is eliminated in consolidation.

15

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION

ADJUSTED FREE CASH FLOW |

| | | | | | | | |

| (Unaudited) |

| Three Months Ended |

| March 31, |

| (In Thousands) | 2024 | 2023 |

Cash (Used in) Provided by Operating Activities | $ | (18,540) | | $ | 60,960 | |

| Proceeds from Real Estate Transactions | 5,464 | | 1,078 | |

| Acquisition-Related Transaction Costs | 806 | | 717 | |

| Capital Expenditures | (20,941) | | (20,209) | |

| Adjusted Free Cash Flow | $ | (33,211) | | $ | 42,546 | |

| | |

| | |

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION NET DEBT |

| | | | | | | | |

| (In Thousands) | March 31, 2024 | December 31, 2023 |

| Debt | $ | 212,913 | | $ | 193,963 | |

| Cash and Cash Equivalents | (41,036) | | (59,035) | |

| Net Debt | $ | 171,877 | | $ | 134,928 | |

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION 2024 CURRENT OUTLOOK FOR ADJUSTED EBITDA |

| | | | | | | | | | | |

| Fiscal Year 2024 Ranges |

(In Thousands) | Aaron’s Business | BrandsMart | Consolidated Total |

Projected Net (Loss) Earnings | | | $(19,000) - $(7,000) |

| Income Taxes | | | (1,000) - 3,000 |

Projected Earnings (Loss) Before Income Taxes | 64,500 - 77,500 | (9,500) - (5,500) | (20,000) - (4,000) |

| Interest Expense | — | — | 16,000 - 17,000 |

| Depreciation and Amortization | 73,000 - 75,000 | 16,500 - 17,500 | 89,500 - 92,500 |

| Projected EBITDA | 137,500 - 152,500 | 7,000 - 12,000 | 85,500 - 105,500 |

| Stock-Based Compensation | — | — | 10,500 |

Other Adjustments1 | — | — | 9,000 |

| | | |

| Projected Adjusted EBITDA | $137,500 - $152,500 | $7,000 - $12,000 | $105,000 - $125,000 |

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION 2024 CURRENT OUTLOOK FOR EARNINGS PER SHARE ASSUMING DILUTION |

| | | | | | | | |

| Fiscal Year 2024 Range |

| Low | High |

Projected (Loss) Earnings Per Share Assuming Dilution | $ | (0.40) | | $ | (0.25) | |

Sum of Other Adjustments2 | 0.40 | | 0.50 | |

Projected Non-GAAP Earnings Per Share Assuming Dilution | $ | 0.00 | | $ | 0.25 | |

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION 2024 CURRENT OUTLOOK FOR ADJUSTED FREE CASH FLOW |

| | | | | | | |

| | | Fiscal Year 2024 Ranges |

(In Thousands) | | | Consolidated Total |

| Cash Provided by Operating Activities | | | $99,000 - $114,000 |

| Proceeds from Real Estate Transactions | | | 0 - 10,000 |

Acquisition-Related Transaction Costs | | | 1,000 |

| Capital Expenditures | | | (85,000) - (95,000) |

| Adjusted Free Cash Flow | | | $15,000 - $30,000 |

| | | |

| | | |

1.Includes non-GAAP charges related to restructuring charges, separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company and acquisition-related costs.

2.Includes non-GAAP charges related to restructuring charges, separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company, acquisition-related costs, debt modification costs associated with the debt amendment entered into on February 23, 2024, and intangible amortization expense resulting from acquisitions.

17

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION 2024 PREVIOUS OUTLOOK FOR ADJUSTED EBITDA |

| | | | | | | | | | | |

| Fiscal Year 2024 Ranges |

| (In Thousands) | Aaron’s Business | BrandsMart | Consolidated Total |

Projected Net (Loss) Earnings | | | $(12,000) - $0 |

| Income Taxes | | | 0 - 4,000 |

Projected Earnings (Loss) Before Income Taxes | 64,500 - 77,500 | (9,500) - (5,500) | (12,000) - 4,000 |

| Interest Expense | — | — | 15,000 - 16,000 |

| Depreciation and Amortization | 73,000 - 75,000 | 16,500 - 17,500 | 89,500 - 92,500 |

| Projected EBITDA | 137,500 - 152,500 | 7,000 - 12,000 | 92,500 - 112,500 |

| Stock-Based Compensation | — | — | 12,500 |

| Projected Adjusted EBITDA | $137,500 - $152,500 | $7,000 - $12,000 | $105,000 - $125,000 |

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION 2024 PREVIOUS OUTLOOK FOR EARNINGS PER SHARE ASSUMING DILUTION |

| | | | | | | | |

| Fiscal Year 2024 Range |

| Low | High |

Projected (Loss) Earnings Per Share Assuming Dilution | $ | (0.30) | | $ | (0.05) | |

Sum of Other Adjustments1 | 0.20 | | 0.30 | |

Projected Non-GAAP (Loss) Earnings Per Share Assuming Dilution | $ | (0.10) | | $ | 0.25 | |

| | | | | | | | | | | | | | |

NON-GAAP FINANCIAL INFORMATION AND RECONCILIATION 2024 PREVIOUS OUTLOOK FOR ADJUSTED FREE CASH FLOW |

| | | | | | | |

| | | Fiscal Year 2024 Ranges |

| (In Thousands) | | | Consolidated Total |

| Cash Provided by Operating Activities | | | $100,000 - $115,000 |

| Proceeds from Real Estate Transactions | | | 0 - 10,000 |

| Capital Expenditures | | | (85,000) - (95,000) |

| Adjusted Free Cash Flow | | | $15,000 - $30,000 |

| | | |

| | | |

1.Includes intangible amortization expense resulting from acquisitions.

18

0 Q1 2024 Earnings Results May 6, 2024 Exhibit 99.2

Special Note Regarding Forward-Looking Information Statements in this presentation regarding our business that are not historical facts are "forward-looking statements" that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as "believe," "expect," "expectation," "anticipate," "may," "could," "should," "intend," "seek," "estimate," "plan," "target," "project," "likely," "will," "forecast," "future," "outlook," or other similar words, phrases, or expressions. These risks and uncertainties include factors such as (i) changes in the enforcement of existing laws and regulations and the adoption of new laws and regulations that may unfavorably impact our business, and failures to comply with existing or new laws or regulations, including those related to consumer protection, as well as an increased focus on our industry by federal and state regulatory authorities; (ii) our ability to execute on our multi-year strategic plan and achieve the benefits and outcomes we expect, including improving our business, centralizing key processes such as customer lease decisioning and payments, real estate optimization, enhancing our e-commerce platform and digital acquisition channels, enhancing and growing BrandsMart, and optimizing our cost structure; (iii) our ability to attract and retain key personnel; (iv) our ability to manage cybersecurity risks, disruptions or failures in our information technology systems and to protect the security of personal information of our customers and employees; (v) weakening general market and economic conditions, especially as they may affect retail sales, increased interest rates, unemployment and consumer confidence; (vi) the concentration of our stores in certain regions or limited markets; (vii) the current inflationary environment could result in increased labor, raw materials or logistics costs that we are unable to offset or accelerating prices that result in lower lease volumes; (viii) business disruptions due to political and economic instability resulting from global conflicts such as the Russia-Ukraine conflict and related economic sanctions and the conflict in Israel, Palestine and surrounding areas, as well as domestic civil unrest; (ix) any future potential pandemics, as well as related measures taken by governmental or regulatory authorities to combat the pandemic; (x) challenges faced by our business, including commoditization of consumer electronics, our high fixed-cost operating model and the ongoing labor shortage; (xi) increased competition from direct-to-consumer and virtual lease-to-own competitors, as well as from traditional and online retailers and other competitors; (xii) increases in lease merchandise write-offs; (xiii) any failure to realize the benefits expected from the acquisition of BrandsMart, including projected synergies; (xiv) the acquisition of BrandsMart may create risks and uncertainties which could materially and adversely affect our business and results of operations; (xv) our ability to successfully acquire and integrate businesses and to realize the projected results and expected benefits of acquisitions or strategic transactions; (xvi) our ability to maintain or improve market share in the categories in which we operate despite heightened competitive pressure; (xvii) our ability to improve operations and realize cost savings; and (xviii) the other risks and uncertainties discussed under "Risk Factors" in the Company’s most recent Annual Report on Form 10-K and from time to time in other documents that we file with the SEC. Statements in this presentation that are "forward-looking" include without limitation statements about: (i) the execution of our key strategic priorities; (ii) the growth and other benefits we expect from executing those priorities; (iii) our financial performance outlook; and (iv) the Company’s goals, plans, expectations, and projections. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this presentation. 1

“We are seeing strong positive momentum in the business, and our first quarter results were in line with our guidance. Our new omnichannel lease decisioning and customer acquisition program at the Aaron’s Business is driving significant growth in lease merchandise deliveries, and we continue to expect mid-single digit lease portfolio growth by the end of 2024. At BrandsMart, we continue to achieve operational efficiencies, and despite the challenging retail demand environment, comparable sales improved sequentially. We remain focused on our strategic priorities of improving operational performance, streamlining our cost structure, and innovating our business to better serve customers. Our management team and Board remain highly engaged and committed to taking all actions that will deliver additional value for our shareholders." Douglas Lindsay CEO, The Aaron’s Company, Inc. CEO Comments 2

Key Themes 3 ▪ Delivered first quarter consolidated revenues and adjusted earnings in line with expectations, with operational improvements leading to positive momentum in the business ▪ Aaron's Business recurring revenue written increased 2.3% driven by 6.8% growth in lease merchandise deliveries ▪ E-commerce recurring revenue written increased 94.1% benefiting from new omnichannel lease decisioning and customer acquisition program ▪ Lease portfolio size ended Q1 down 4.8% YoY after starting the year down 7%; same store lease portfolio size ended Q1 down only 1.4% YoY after starting the year down 4.4% ▪ Positive momentum continued into Q2 with April lease merchandise deliveries up 18.6% YoY driven by e-commerce growth of 116.3% ▪ Write-offs were 5.9%; expect full year write-offs in line with guidance of 6% to 7% ▪ BrandsMart comparable sales decreased 9.4%, a sequential improvement of 460 basis points ▪ Reaffirms full year 2024 outlook for revenue and adjusted EBITDA and raises outlook for non-GAAP EPS on lower estimated tax rate

4 Q1 Highlights

Consolidated Q1 2024 Results of Operations1 5 Three Months Ended March 31, Variance ($ in Thousands, except per share) 2024 2023 $ % or bps Revenues Consolidated $ 511,497 $ 554,361 $ (42,864) (7.7) % Aaron's Business 381,055 412,133 (31,078) (7.5) % BrandsMart 132,523 144,158 (11,635) (8.1) % Gross Profit Consolidated $ 273,883 $ 295,694 $ (21,811) (7.4) % Aaron's Business 244,631 260,706 (16,075) (6.2) % BrandsMart 29,476 35,135 (5,659) (16.1) % Gross Profit Margin % Consolidated 53.5% 53.3% -- 20 bps Aaron's Business 64.2% 63.3% -- 90 bps BrandsMart 22.2% 24.4% -- (220) bps Net (Loss) Earnings Consolidated $ (14,181) $ 12,798 $ (26,979) nmf Adjusted EBITDA2 Consolidated $ 22,749 $ 45,878 $ (23,129) (50.4) % Aaron's Business 37,734 54,562 (16,828) (30.8) % BrandsMart (2,588) 2,757 (5,345) nmf Adjusted EBITDA Margin % Consolidated 4.4% 8.3% -- (390) bps Aaron's Business 9.9% 13.2% -- (330) bps BrandsMart (2.0)% 1.9% -- (390) bps (Loss) Earnings Per Share Diluted (Loss) Earnings Per Share $ (0.46) $ 0.41 $ (0.87) nmf Non-GAAP Diluted (Loss) Earnings Per Share2 $ (0.15) $ 0.66 $ (0.81) (122.7) % Cash Flow Cash (Used In) Provided by Operating Activities $ (18,540) $ 60,960 $ (79,500) (130.4) % Adjusted Free Cash Flow2 $ (33,211) $ 42,546 $ (75,757) nmf 1. Consolidated totals include unallocated corporate costs and intersegment elimination amounts 2. Non-GAAP reconciliations of adjusted EBITDA, EPS, and adjusted free cash flow are included in the Appendix

The Aaron’s Company – Consolidated Q1 Highlights1 6 Revenues Adjusted EBITDA Non-GAAP Diluted EPS Adjusted Free Cash Flow • Revenues decreased YoY primarily due to lower lease revenues and fees at the Aaron's Business and lower retail sales at BrandsMart • Adjusted EBITDA and adjusted EBITDA margin decreased YoY primarily due to lower revenues at both business segments and higher other operating expenses and write-offs ‒ Partially offset by lower personnel costs in both business segments • Non-GAAP diluted EPS decreased YoY as a result of lower consolidated earnings • Adjusted free cash flow decreased YoY primarily due to purchases of lease merchandise inventory to support the growth in new agreement deliveries at the Aaron’s Business and lower earnings at both business segments Highlights $554.4M $511.5M Q1 2023 Q1 2024 -7.7% $45.9M $22.7M Q1 2023 Q1 2024 -50.4% $0.66 -$0.15 Q1 2023 Q1 2024 $42.5M -$33.2M Q1 2023 Q1 2024 Margin % 8.3% 4.4% 1. Non-GAAP reconciliations of adjusted EBITDA, EPS, and adjusted free cash flow are included in the Appendix

Aaron’s Business Q1 Highlights 7 Revenues Adjusted EBITDA1 Lease Portfolio Size Lease Renewal Rate • Revenues decreased YoY primarily due to a smaller lease portfolio size and lower lease renewal rate; the lower lease renewal rate primarily resulted from an increasing mix of e-commerce agreements written into the portfolio ‒ E-commerce revenues increased 20.8% YoY, representing 24.0% of lease revenues • Provision for lease merchandise write- offs2 was 5.9% as compared to 5.4% in the prior year quarter, primarily due to an increasing mix of e-commerce agreements written into the portfolio • Adjusted EBITDA and adjusted EBITDA margin decreased YoY, primarily due to lower revenues and increased investments in advertising, partially offset by actions taken to lower personnel costs Highlights $412.1M $381.1M Q1 2023 Q1 2024 -7.5% $54.6M $37.7M Q1 2023 Q1 2024 -30.8% $121.9M $116.1M Q1 2023 Q1 2024 -4.8% 88.5% 87.4% Q1 2023 Q1 2024 -110 bps Margin % 13.2% 9.9% 1. Adjusted EBITDA does not include unallocated corporate expenses; non-GAAP reconciliations are included in the Appendix 2. Provision for lease merchandise write-offs as a percentage of lease revenues and fees, which includes the impact of intercompany eliminations

Aaron’s Business Q1 Highlights – Lease Portfolio Size 8 Ending Lease Portfolio Size Total & Same Store1 Ending Lease Portfolio Size YoY • The ending lease portfolio size began Q1 2024 down 7.0% YoY and ended the quarter down 4.8% YoY ‒ This improvement was driven by 6.8% YoY growth in lease merchandise deliveries • The same store lease portfolio size began Q1 2024 down 4.4% YoY and ended the quarter down only 1.4% YoY ‒ This improvement was driven by 10.1% growth in same store lease merchandise deliveries • This momentum has continued into Q2 ‒ April lease merchandise deliveries increased 18.6% YoY (22.0% on same store basis) ‒ Lease portfolio size ended April down 3.7% YoY (down 0.2% on same store basis) Highlights $126.5M $121.9M $119.6M $116.4M $117.7M $116.1M Q4 ’22 Q1 ’23 Q2 ’23 Q3 ’23 Q4 ’23 Q1 ’24 -4.8% -7.2% -7.5% -8.6% -7.5% -7.0% -4.8% -6.1% -6.0% -6.6% -5.1% -4.4% -1.4% Q4 ’22 Q1 ’23 Q2 ’23 Q3 ’23 Q4 ’23 Q1 ’24 Total Lease Portfolio Size Same Store Lease Portfolio Size 1. With respect to any metric, "same store" includes all stores open for the 15-month period at the end of each quarter, excluding stores that received lease agreements from other acquired, closed or merged stores

Aaron’s Business Q1 Highlights – E-commerce & GenNext Store Strategy 9 % of Lease Revenues 17.9% 24.0% Q1 2023 Q1 2024 +20.8% 26.7% 33.4% Q1 2023 Q1 2024 Q1 2023 Q1 2024 +94.1% 211 254 11 Q1 2023 11 Q1 2024 222 265 Opened in the Quarter Q1’24 Initial Count Q1’23 Initial Count E-commerce Highlights GenNext Store Highlights Recurring Revenue Written1 Revenues % of Revenues2 GenNext Store Count 1. Monthly recurring revenue written into the portfolio resulting from new lease agreements 2. As a percent of lease and retail revenues; excludes GenNext stores open less than one month

Aaron’s Business Q1 Highlights – Non-Renewal Rates & Write-offs1 10 32+ Day Non-Renewal Rate2 Lease Merchandise Write-offs3 1. Based on open stores at the end of the respective period 2. Customers 32+ days non-renewed (i.e., customer did not make renewal payment or return product) at the end of the applicable quarter divided by the customer count at the beginning of the quarter-end month 3. Provision for lease merchandise write-offs as a percentage of lease revenues and fees, the largest component of which is charge-offs, which includes the impact of intercompany eliminations • 32+ day non-renewal rate increased 60 bps YoY from Q1 2023 (2.2% vs. 1.6%) ‒ Sequential improvement of 50 bps from Q4 2023 (2.2% vs. 2.7%) • Lease merchandise write-offs increased 50 bps YoY from Q1 2023 (5.9% vs. 5.4%) ‒ Sequential improvement of 60 bps from Q4 2023 (5.9% vs. 6.5%) • Expect lower renewal rate and higher write-offs in 2024 as a result of increasing mix of e-commerce agreements Highlights 2.4% 2.9% 2.7% 1.6% 2.5% 2.6% 2.7% 2.2% 1.0 1.5 2.0 2.5 3.0 Q2 Q3 Q4 Q1 5.7% 7.5% 7.1% 5.4%5.4% 6.1% 6.5% 5.9% 4.0 5.0 6.0 7.0 8.0 Q2 Q3 Q4 Q1 2022-2023 2023-2024 2022-2023 2023-2024

BrandsMart Q1 Highlights 11 Revenues Gross Profit Adjusted EBITDA2 Product Mix3 • Revenues and comparable sales decreased YoY driven primarily by ongoing weaker customer traffic, customer trade down to lower priced products, and credit tightening with private label credit card provider ‒ Average transaction value decreased 3.6% YoY ‒ E-commerce product sales were 8.7% of total product sales ‒ Revenues in Q1 2024 included sales from the new store in Augusta, GA • Gross profit margin % decreased YoY primarily due to inventory-related reserve adjustments in Q1 2023 • Adjusted EBITDA and adjusted EBITDA margin % decreased YoY primarily due to lower gross profit, higher advertising costs, and operating costs associated with the new store in Augusta, GA, partially offset by actions taken to lower personnel costs Highlights $144.2M $132.5M Q1 2023 Q1 2024 -8.1% $2.8M -$2.6M Q1 2023 Q1 2024 Margin % 1.9% (2.0%) $35.1M $29.5M Q1 2023 Q1 2024 -16.1% Margin % 24.4% 22.2% 1. Results prior to the April 1, 2022 acquisition are not included; therefore, Comparable Sales results are not available 2. Adjusted EBITDA does not include unallocated corporate expenses; non-GAAP reconciliations are included in the Appendix 3. Based on merchandise product sales posted in Q1 2024; excludes warranty, installation, delivery, and other service revenues 56%33% 7% Major Appliances Electronics 4% Furniture & Mattresses Other Comparable Sales YoY n/a1 (9.4%)

12 Balance Sheet and Outlook

$252.0 million2 $3.8 million3$212.9 million Balance Sheet and Shareholder Returns Debt (As of 3/31/24) Liquidity (As of 3/31/24) Shareholder Returns 13 1. Non-GAAP reconciliation of net debt is included in the Appendix 2. As of March 31, 2024, the Company had $41.0 million of cash and $211.0 million of availability under its $275.0 million Revolving Facility 3. For the three months ended March 31, 2024, the Company paid $3.8 million in dividends $41.0 million Cash and Cash Equivalents (As of 3/31/24) As of March 31, 2024, the Company’s net debt1 balance was $171.9 million, favorable to internal expectations On May 6th, the Company announced a quarterly cash dividend of $0.125 per share to be paid on July 3, 2024

Updated 2024 Outlook1 14 Current Outlook2 Previous Outlook3 Low High Low High Revenues $2,055.0 million $2,155.0 million $2,055.0 million $2,155.0 million Net (Loss) Earnings $(19.0) million $(7.0) million $(12.0) million $0.0 million Adjusted EBITDA $105.0 million $125.0 million $105.0 million $125.0 million Diluted EPS $(0.40) $(0.25) $(0.30) $(0.05) Non-GAAP Diluted EPS $0.00 $0.25 $(0.10) $0.25 Cash Provided by Operating Activities $99.0 million $114.0 million $100.0 million $115.0 million Capital Expenditures $85.0 million $95.0 million $85.0 million $95.0 million Adjusted Free Cash Flow $15.0 million $30.0 million $15.0 million $30.0 million Revenues $1,460.0 million $1,520.0 million $1,460.0 million $1,520.0 million Earnings Before Income Taxes $64.5 million $77.5 million $64.5 million $77.5 million Adjusted EBITDA $137.5 million $152.5 million $137.5 million $152.5 million Revenues $610.0 million $650.0 million $610.0 million $650.0 million Loss Before Income Taxes $(9.5) million $(5.5) million $(9.5) million $(5.5) million Adjusted EBITDA $7.0 million $12.0 million $7.0 million $12.0 million Consolidated Aaron’s Business BrandsMart 1. See the “Use of Non-GAAP Financial Information” section included in the Appendix; Consolidated totals include unallocated corporate costs and intersegment elimination amounts 2. The current outlook assumes no significant deterioration in the current retail environment, state of the U.S. economy, or global supply chain, as compared to its current condition 3. As announced in the Form 8-K filed on February 26, 2024 The Company is raising outlook for non-GAAP diluted EPS, updating its estimated effective tax rate, and reaffirming outlook for revenues, adjusted EBITDA, capital expenditures, and adjusted free cash flow. The revised estimated effective tax rate is approximately 38%, 12% points lower than the prior guidance. Additionally, the expected full year provision for lease merchandise write-offs is unchanged from the previously provided guidance of 6% to 7% of lease revenues and fees.

Overview of Capital Allocation Strategy 15 ▪ Invest in Aaron’s and BrandsMart Growth Initiatives ▪ Maintain Conservative Leverage Profile (1.0x – 1.5x Net Debt-to-Adjusted EBITDA) ▪ Return Capital to Shareholders through Dividends and Share Repurchases ▪ Evaluate Acquisitions on an Opportunistic Basis 1 2 3 4

Key Takeaways 16 • New omnichannel lease decisioning and customer acquisition program is generating strong momentum in the Aaron’s Business • Significant growth in e-commerce lease merchandise deliveries and recurring revenue written expected to drive mid-single digit growth in lease portfolio size by end of 2024 • Anticipated year-over-year growth in same store lease portfolio size is expected to benefit earnings in second half of 2024 and into 2025 • BrandsMart comparable sales continues to improve each quarter and is expected to improve as demand increases in the second half of the year • Strong financial foundation and healthy balance sheet • Management team and Board remain committed to taking all actions to deliver value for shareholders

17 Appendix

18 Company Store Count By Ownership Type Company-Operated Aaron’s Stores by Type As of March 31, 2024 2023 Company-operated Aaron’s Stores1 987 1,030 GenNext (included in Company-Operated) 265 222 Franchisee-operated Aaron’s Stores 230 231 BrandsMart U.S.A. Stores2 11 10 Systemwide Stores 1,228 1,271 As of March 31, 2024 GenNext Legacy Total Store 189 568 757 Hub 62 53 115 Showroom 14 101 115 Total 265 722 987 1. The typical layout for a Company-operated Aaron's store is a combination of showroom, customer service and warehouse space, generally comprising 6,000 to 15,000 square feet. Certain Company- operated Aaron's stores consist solely of a showroom. 2. BrandsMart U.S.A. stores average approximately 96,000 square feet.

Use of Non-GAAP Financial Information Non-GAAP net earnings, non-GAAP diluted earnings per share, adjusted free cash flow, net debt, EBITDA and adjusted EBITDA are supplemental measures of our performance that are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”). Non-GAAP net earnings and non-GAAP diluted earnings per share for 2024 exclude certain charges including amortization expense resulting from acquisitions, restructuring charges, separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company, acquisition-related costs, and debt modification costs associated with the debt amendment entered into on February 23, 2024. Non-GAAP net earnings and non-GAAP diluted earnings per share for 2023 exclude certain charges including amortization expense resulting from acquisitions, restructuring charges and separation costs associated with the separation and distribution transaction that resulted in our spin-off into a separate publicly-traded company and acquisition-related costs, which are tax-effected using estimated tax rates which are commensurate with non-GAAP pre-tax earnings, can be found in the Reconciliation of Net Earnings and Earnings Per Share Assuming Dilution to non-GAAP Net Earnings and non-GAAP Earnings Per Share Assuming Dilution table in this presentation. The EBITDA and adjusted EBITDA figures presented in this presentation are calculated as the Company’s earnings before interest expense, depreciation on property, plant and equipment, amortization of intangible assets and income taxes. Adjusted EBITDA also excludes the other adjustments described in the calculation of non-GAAP net earnings above. Adjusted EBITDA margin is defined as adjusted EBITDA as a percentage of revenue. The amounts for these pre-tax non-GAAP adjustments can be found in the Quarterly EBITDA table in this presentation. Management believes that non-GAAP net earnings, non-GAAP diluted earnings per share, EBITDA and adjusted EBITDA provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry as well as by our management in assessing both consolidated and business unit performance. Non-GAAP net earnings and non-GAAP diluted earnings per share provide management and investors with an understanding of the results from the primary operations of our business by excluding the effects of certain items that generally arise from larger, one-time transactions that are not reflective of the ordinary earnings activity of our operations. This measure may be useful to an investor in evaluating the underlying operating performance of our business. EBITDA and adjusted EBITDA also provide management and investors with an understanding of one aspect of earnings before the impact of investing and financing charges and income taxes. These measures may be useful to an investor in evaluating our operating performance and liquidity because the measures: • Are widely used by investors to measure a company’s operating performance without regard to items excluded from the calculation of such measure, which can vary substantially from company to company depending upon accounting methods, book value of assets, capital structure and the method by which assets were acquired, among other factors. • Are a financial measurement that is used by rating agencies, lenders and other parties to evaluate our creditworthiness. • Are used by our management for various purposes, including as a measure of performance of our operating entities and as a basis for strategic planning and forecasting. The adjusted free cash flow figures presented in this presentation are calculated as the Company’s cash flows provided by operating activities, adjusted for acquisition-related transaction costs and proceeds from real estate transactions, less capital expenditures. Net debt represents total debt less cash and cash equivalents. Management believes that adjusted free cash flow and net debt are important measures of liquidity, provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry as well as by our management team in assessing liquidity. Non-GAAP financial measures, however, should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company’s GAAP basis net earnings and diluted earnings per share, the Company’s GAAP revenues and earnings before income taxes and GAAP cash provided by operating activities, which are also presented in the presentation. Further, we caution investors that amounts presented in accordance with our definitions of non-GAAP net earnings, non-GAAP diluted earnings per share, EBITDA, adjusted EBITDA and adjusted free cash flow may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate these measures in the same manner. 19