Q2 Revenues $288.9 million, Up 70.3% Year Over Year HAVANT, United

Kingdom, June 21 /PRNewswire-FirstCall/ -- Xyratex Ltd

(NASDAQ:XRTX), a leading provider of modular enterprise class data

storage subsystems and storage process technology, today announced

results for the second fiscal quarter ended May 31, 2006. Revenues

for the second quarter were $288.9 million, an increase of 70.3%

compared to revenues of $169.6 million for the same period last

year. For the second quarter, GAAP net income was $24.6 million, or

$0.83 per diluted share, compared to GAAP net income of $11.1

million, or $0.38 per diluted share, in the same period last year.

Non-GAAP net income increased 95.7% to $25.5 million, or a diluted

earnings per share of $0.85, compared to non-GAAP net income of

$13.0 million, or $0.45 per diluted share, in the same quarter a

year ago. A reconciliation between net income on a GAAP basis and

net income on a non-GAAP basis is provided in a table immediately

following the "Unaudited Condensed Consolidated Statements of Cash

Flows", below. Gross profit margin in the second quarter was 21.5%,

compared to 22% in the same period last year, primarily due to

factors affecting the margin of our Storage and Network Systems

products, particularly RoHS (Restriction on certain Hazardous

Substances) compliance, transfer of the Networking Ethernet X-Card

business to Napatech, and customer and product mix. Revenues from

sales of our Storage and Network Systems products were $153.7

million as compared to $100.6 million in the second quarter last

year, an increase of 53%. Gross profit margin in the Storage and

Network Systems business was 13.3% as compared to 16% in the second

quarter last year. Revenues from sales of our Storage

Infrastructure products were $135.1 million as compared to $69.0

million in the second quarter last year, an increase of 96%. Gross

profit margin in the Storage Infrastructure business was 30.9%,

essentially unchanged from 30.7% in the second quarter last year.

"Xyratex had an outstanding quarter with record revenue and

earnings. We executed very well and were able to meet the strong

demand from our customers, while continuing to invest in

technologies and resources that will position us for growth going

forward," said Steve Barber, CEO of Xyratex. "Our priorities for

the remainder of 2006 include strategic investment in new growth

opportunities, improving our margin structure in our Storage and

Networking Systems business and securing new customers. We feel we

are well positioned to capitalize on the positive industry dynamics

that are creating significant demand for our storage products."

Business Highlights * We announced availability and volume

shipments of the F5402E 4Gb FC-SAS/SATA RAID system and SATA II

drive support in the 4Gb RS-1602-F4 SBOD. The F5402E is the

industry's first OEM product to offer a single, integrated 4Gb RAID

system with FC connectivity and SAS/SATA drives. The F5402E enables

OEMs and Solution Integrators to create both primary and secondary

data environments in one solution; providing maximum flexibility in

a cost-effective, ultra-high performance solution with the

scalability and functionality necessary for today's most rigorous

applications. * We announced the appointment of industry veteran

John Casalaspi as senior vice president of worldwide sales for the

Storage and Network Systems division. * We secured a new design win

with Autodesk Inc., as well as with a number of other Tier 2 and

Tier 3 customers. We also broadened our relationships with

Compellent Technologies, Gateway and Omneon Video Networks. * We

were granted an extension to our beneficial tax status in Malaysia

until 2012, which we anticipate will enable us to maintain our

current tax rate. Business Outlook The following statements are

based on current expectations. These statements are

forward-looking, and actual results may differ materially. These

statements do not include the potential impact of any future

acquisitions or divestitures. * Revenue in the third quarter of

2006 is projected to be in the range $233 to $248 million. * Fully

diluted earnings per share is anticipated to be between $0.37 and

$0.47 on a GAAP basis in the third quarter. On a non-GAAP basis,

fully diluted earnings per share is anticipated to be between $0.44

and $0.54. Non-GAAP earnings per share excludes non-cash equity

compensation, amortization of intangible assets and related

taxation expense. Conference Call/Webcast Information The company

will host a conference call to discuss its results at 2:00 p.m.

PT/5:00 p.m. ET on Wednesday, June 21, 2006. The conference call

can be accessed online via the company's website

http://www.xyratex.com/investors, or by telephone as follows:

United States (800) 591-6944 Outside the United States (617)

614-4910 Passcode 59935802 A replay will be available via the

company's website http://www.xyratex.com/investors, or can be

accessed by telephone through June 28, 2006 as follows: United

States (888) 286-8010 Outside the United States (617) 801-6888

Passcode 89480798 Safe Harbor Statement This press release contains

forward-looking statements. These statements relate to future

events or our future financial performance, including our projected

revenue and fully diluted earnings per share data (on a GAAP and

non-GAAP basis) for the third quarter. These statements are only

predictions and involve known and unknown risks, uncertainties and

other factors that may cause our actual results, levels of

activity, performance or achievements to differ materially from any

future results, levels of activity, performance or achievements

expressed or implied by these forward-looking statements. Factors

that might cause such a difference include our inability to compete

successfully in the competitive and rapidly changing marketplace in

which we operate, failure to retain key employees, cancellation or

delay of projects and adverse general economic conditions in the

United States and internationally. These risks and other factors

include those listed under "Risk Factors" and elsewhere in our

Annual Report on Form 20-F as filed with the Securities and

Exchange Commission (File No. 000-50799). In some cases, you can

identify forward-looking statements by terminology such as "may,"

"will," "should," "expects," "intends," "plans," "anticipates,"

"believes," "estimates," "predicts," "potential," "continue," or

the negative of these terms or other comparable terminology.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

About Xyratex Xyratex is a leading provider of modular enterprise

class data storage subsystems and storage process technology. The

company designs and manufactures enabling technology that provides

OEM and disk drive manufacturer customers with data storage

products to support high-performance storage and data communication

networks. Xyratex has over 20 years of experience in research and

development relating to disk drives, storage systems and high-speed

communication protocols. Founded in 1994 in a management buy-out

from IBM, and with its headquarters in the UK, Xyratex has an

established global base with R&D and operational facilities in

Europe, the United States and South East Asia. For more

information, visit http://www.xyratex.com/. XYRATEX LTD UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS Three Months Ended

Six Months Ended May 31, May 31, May 31, May 31, 2006 2005 2006

2005 (US dollars in thousands, except per share amounts) Revenues:

Storage and Network Systems $153,738 $100,591 $282,568 $189,422

Storage Infrastructure 135,144 69,013 196,831 122,705 Total

revenues 288,882 169,604 479,399 312,127 Cost of revenues 226,853

132,353 379,801 245,193 Gross profit: Storage and Network Systems

20,504 16,081 40,015 30,250 Storage Infrastructure 41,778 21,170

59,944 36,684 Equity compensation (253) -- (361) -- Total gross

profit 62,029 37,251 99,598 66,934 Operating expenses: Research and

development 19,402 12,858 35,864 23,420 Selling, general and

administrative 15,955 9,105 28,818 17,700 Amortization of

intangible assets 1,185 328 2,375 726 In process research and

development -- 2,230 -- 2,230 Total operating expenses 36,542

24,521 67,057 44,076 Operating income 25,487 12,730 32,541 22,858

Other income 1,965 -- 1,965 -- Interest income, net 233 320 438 669

Income before income taxes 27,685 13,050 34,944 23,527 Provision

for income taxes 3,109 2,000 3,931 3,034 Net income 24,576 11,050

31,013 20,493 Net earnings per share: Basic $0.86 $0.39 $1.08 $0.73

Diluted $0.83 $0.38 $1.05 $0.71 Weighted average common shares (in

thousands), used in computing net earnings per share: Basic 28,670

28,372 28,589 28,246 Diluted 29,739 29,089 29,511 28,993 XYRATEX

LTD UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS May 31,

November 30, 2006 2005 (US dollars and amounts in thousands) ASSETS

Current assets: Cash and cash equivalents $47,356 $41,240 Accounts

receivable, net 113,238 82,449 Inventories 123,579 71,543 Prepaid

expenses 2,452 2,244 Deferred income taxes 8,093 6,480 Other

current assets 6,650 3,236 Total current assets 301,368 207,192

Property, plant and equipment, net 32,207 25,643 Intangible assets,

net 53,551 50,904 Deferred income taxes 11,170 17,551 Total assets

$398,296 $301,290 LIABILITIES AND SHAREHOLDERS' EQUITY Current

liabilities: Accounts payable $122,985 $79,927 Acquisition note

payable 3,000 3,000 Short-term borrowings 4,000 4,000 Employee

compensation and benefits payable 12,338 13,620 Deferred revenue

27,362 16,434 Income taxes payable 606 421 Other accrued

liabilities 21,475 15,506 Total current liabilities 191,766 132,908

Long-term debt 5,000 7,000 Total liabilities 196,766 139,908

Shareholders' equity Common shares of Xyratex Ltd (in thousands),

par value $0.01 per share 70,000 authorized, 28,723 and 28,437

issued and outstanding 287 284 Additional paid-in capital 340,032

333,886 Accumulated other comprehensive income (loss) 1,630 (1,356)

Accumulated deficit (140,419) (171,432) Total shareholders' equity

201,530 161,382 Total liabilities and shareholders' equity $398,296

$301,290 XYRATEX LTD UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS Six Months Ended May 31, May 31, 2006 2005 (US dollars

in thousands) Cash flows from operating activities: Net income from

continuing operations $31,011 $20,493 Adjustments to reconcile net

income to net cash used in operating activities: Depreciation 4,421

3,166 Amortization of intangible assets 2,375 726 Non-cash equity

compensation 3,324 381 Bonus paid by trust -- 144 Other income -

disposal of product line (1,965) -- Changes in assets and

liabilities, net of impact of acquisitions and divestitures

Accounts receivable (30,789) (15,291) Inventories (52,036) (18,696)

Prepaid expenses and other current assets (1,219) (1,658) Accounts

payable 43,058 21,715 Employee compensation and benefits payable

(1,282) 284 Deferred revenue 10,928 1,069 Income taxes payable 185

(160) Deferred income taxes 4,388 4,104 Other accrued liabilities

5,097 (1,364) Net cash provided by operating activities 17,496

14,913 Cash flows from investing activities: Investments in

property, plant and equipment (10,985) (4,524) Disposal of product

line 1,965 -- Acquisition of business, net of cash received (3,185)

(5,131) Net cash used in investing activities (12,205) (9,655) Cash

flows from financing activities: Net payments of long-term

borrowings (2,000) (2,000) Payment of acquisition note payable --

(2,000) Proceeds from issuance of shares 2,825 1,842 Net cash

provided by (used in) financing activities 825 (2,158) Change in

cash and cash equivalents 6,116 3,100 Cash and cash equivalents at

beginning of period 41,240 63,495 Cash and cash equivalents at end

of period $47,356 $66,595 XYRATEX LTD UNAUDITED RECONCILIATION OF

GAAP NET INCOME FROM CONTINUING OPERATIONS TO NON-GAAP NET INCOME

Three Months Ended GAAP Non-GAAP Non-GAAP May 31, Adjustment May

31, 2006 (a) 2006 (US dollars in thousands, except per share

amounts) Revenues: Storage and Network Systems $153,738 $153,738

Storage Infrastructure 135,144 135,144 Total revenues 288,882

288,882 Cost of revenues 226,853 (253) 226,600 Gross profit:

Storage and Network Systems 20,504 20,504 Storage Infrastructure

41,778 41,778 Equity compensation (253) 253 -- Total gross profit

62,029 62,282 Operating expenses: Research and development 19,402

(534) 18,868 Selling, general and administrative 15,955 (1,168)

14,787 Amortization of intangible assets 1,185 (1,185) -- Total

operating expenses 36,542 33,655 Operating income 25,487 28,627

Other income 1,965 (1,965) -- Interest income, net 233 233 Income

before income taxes 27,685 28,860 Provision for income taxes 3,109

255 3,364 Net income 24,576 25,496 Net earnings per share: Basic

$0.86 $0.89 Diluted $0.83 $0.85 Weighted average common shares (in

thousands), used in computing net earnings per share: Basic 28,670

28,670 Diluted 29,739 373 30,112 XYRATEX LTD UNAUDITED

RECONCILIATION OF GAAP NET INCOME FROM CONTINUING OPERATIONS TO

NON-GAAP NET INCOME Six Months Ended GAAP Non-GAAP Non-GAAP May 31,

Adjustment May 31, 2006 (a) 2006 (US dollars in thousands, except

per share amounts) Revenues: Storage and Network Systems $282,568

$282,568 Storage Infrastructure 196,831 196,831 Total revenues

479,399 479,399 Cost of revenues 379,801 (361) 379,440 Gross

profit: Storage and Network Systems 40,015 40,015 Storage

Infrastructure 59,944 59,944 Equity compensation (361) 361 -- Total

gross profit 99,598 99,959 Operating expenses: Research and

development 35,864 (819) 35,045 Selling, general and administrative

28,818 (2,144) 26,674 Amortization of intangible assets 2,375

(2,375) -- Total operating expenses 67,057 61,719 Operating income

32,541 38,240 Other income 1,965 (1,965) -- Interest income, net

438 438 Income before income taxes 34,944 38,678 Provision for

income taxes 3,931 953 4,884 Net income 31,013 33,794 Net earnings

per share: Basic $1.08 $1.18 Diluted $1.05 $1.13 Weighted average

common shares (in thousands), used in computing net earnings per

share: Basic 28,589 28,589 Diluted 29,511 305 29,816 XYRATEX LTD

UNAUDITED RECONCILIATION OF GAAP NET INCOME FROM CONTINUING

OPERATIONS TO NON-GAAP NET INCOME Three Months Ended GAAP Non-GAAP

Non-GAAP May 31, Adjustment May 31, 2005 (a) 2005 (US dollars in

thousands, except per share amounts) Revenues: Storage and Network

Systems $100,591 $100,591 Storage Infrastructure 69,013 69,013

Total revenues 169,604 169,604 Cost of revenues 132,353 132,353

Gross profit: Storage and Network Systems 16,081 16,081 Storage

Infrastructure 21,170 21,170 Total gross profit 37,251 37,251

Operating expenses: Research and development 12,858 12,858 Selling,

general and administrative 9,105 (191) 8,914 Amortization of

intangible assets 328 (328) -- In process research and development

2,230 (2,230) -- Total operating expenses 24,521 21,772 Operating

income 12,730 15,479 Interest income, net 320 320 Income before

income taxes 13,050 15,799 Provision for income taxes 2,000 767

2,767 Net income 11,050 13,032 Net earnings per share: Basic $0.39

$0.46 Diluted $0.38 $0.45 Weighted average common shares (in

thousands), used in computing net earnings per share: Basic 28,372

28,372 Diluted 29,089 29,089 XYRATEX LTD UNAUDITED RECONCILIATION

OF GAAP NET INCOME FROM CONTINUING OPERATIONS TO NON-GAAP NET

INCOME Six Months Ended GAAP Non-GAAP Non-GAAP May 31, Adjustment

May 31, 2005 (a) 2005 (US dollars in thousands, except per share

amounts) Revenues: Storage and Network Systems $189,422 $189,422

Storage Infrastructure 122,705 122,705 Total revenues 312,127

312,127 Cost of revenues 245,193 245,193 Gross profit: Storage and

Network Systems 30,250 30,250 Storage Infrastructure 36,684 36,684

Total gross profit 66,934 66,934 Operating expenses: Research and

development 23,420 23,420 Selling, general and administrative

17,700 (381) 17,319 Amortization of intangible assets 726 (726) --

In process research and development 2,230 (2,230) -- Total

operating expenses 44,076 40,739 Operating income 22,858 26,195

Interest income, net 669 669 Income before income taxes 23,527

26,864 Provision for income taxes 3,034 887 3,921 Net income 20,493

22,943 Net earnings per share: Basic $0.73 $0.81 Diluted $0.71

$0.79 Weighted average common shares (in thousands), used in

computing net earnings per share: Basic 28,246 28,246 Diluted

28,993 28,993 (a) Non-GAAP Adjustment for the three and six month

periods ended May 31, 2006 and May 31, 2005 includes non-cash

amortization of intangible assets and non-cash equity compensation

expense. Non-GAAP Adjustment for the three and six month periods

ended May 31, 2006 also includes income from the sale of a product

line. Non-GAAP Adjustment for the three and six month periods ended

May 31, 2005 also includes in-process research and development

expense. The Non-GAAP Adjustment for these periods also include the

related tax effects. We believe these Non-GAAP measures are useful

to investors because they provide an alternative method of

measuring the operating performance of our business by excluding

certain expenses, gains and losses which we believe are not

indicative of our core operating results DATASOURCE: Xyratex Ltd

CONTACT: Brad Driver of Xyratex Investor Relations,

+1-408-325-7260, ; or Curtis Chan of Chan & Associates, Inc.,

+1-714-447-4993, , for Xyratex Public Relations Web site:

http://www.xyratex.com/

Copyright

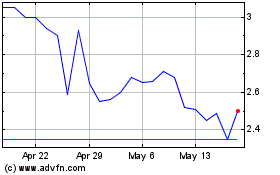

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Jun 2024 to Jul 2024

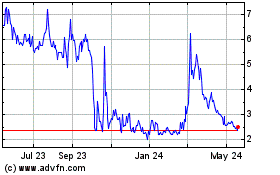

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Jul 2023 to Jul 2024