WASHINGTON FEDERAL 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN AND TRUST

AS OF DECEMBER 31, 2016 AND 2015

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

|

|

|

|

FINANCIAL STATEMENTS AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2016 AND 2015:

|

|

|

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

|

|

|

Note 1 – Description of Plan

|

|

|

|

|

|

Note 2 – Summary of Accounting Policies

|

|

|

|

|

|

Note 3 – Fair Value Measurements

|

|

|

|

|

|

Note 4 – Federal Income Tax Status

|

|

|

|

|

|

Note 5 – Plan Termination

|

|

|

|

|

|

Note 6 – Related Party Transactions

|

|

|

|

|

|

Note 7 – Non-Participant Directed Investments

|

|

|

|

|

|

Note 8 – Risks and Uncertainties

|

|

|

|

|

|

SUPPLEMENTAL SCHEDULE AS OF DECEMBER 31, 2016

|

|

|

|

|

|

Form 5500, Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year)

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees

Washington Federal 401(k) and

Employee Stock Ownership Plan and Trust

We have audited the accompanying statements of net assets available for benefits of the Washington Federal 401(k) and Employee Stock Ownership Plan and Trust (the Plan) as of December 31, 2016 and 2015, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial

statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016 and 2015 and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The supplemental information included in Schedule H, line 4(i) – Schedule of Assets (Held at End of Year) has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA. In our opinion, the supplemental information included in Schedule H, line 4(i) – Schedule of Assets (Held at End of Year) is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Moss Adams LLP

Seattle, Washington

June 23, 2017

WASHINGTON FEDERAL 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN AND TRUST

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

AS OF DECEMBER 31, 2016 AND 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Assets:

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

19,068,330

|

|

|

$

|

14,371,683

|

|

|

Investments, at fair value:

|

|

|

|

|

|

Washington Federal, Inc. common stock

|

|

18,793,057

|

|

|

15,231,187

|

|

|

Mutual funds

|

|

53,283,813

|

|

|

47,089,460

|

|

|

Stable Value Fund

|

|

3,559,645

|

|

|

3,081,236

|

|

|

Certificates of deposit

|

|

17,297,321

|

|

|

29,905,939

|

|

|

Total investments at fair value

|

|

92,933,836

|

|

|

95,307,822

|

|

|

Employer contributions receivable

|

|

6,021,754

|

|

|

—

|

|

|

Net assets available for benefits

|

|

$

|

118,023,920

|

|

|

$

|

109,679,505

|

|

See accompanying notes to the financial statements.

WASHINGTON FEDERAL 401(k) AND EMPLOYEE STOCK OWNERSHIP PLAN AND TRUST

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

FOR THE YEARS ENDED DECEMBER 31, 2016 AND 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Additions:

|

|

|

|

|

|

Net appreciation (depreciation) in fair value of investments

|

|

$

|

8,996,104

|

|

|

$

|

(1,507,722

|

)

|

|

Interest earned on investments

|

|

497,995

|

|

|

773,037

|

|

|

Cash dividends on common stock

|

|

1,829,050

|

|

|

1,914,178

|

|

|

Contributions:

|

|

|

|

|

|

Employer (including Safe Harbor match)

|

|

6,083,559

|

|

|

7,181,743

|

|

|

Participants

|

|

4,199,629

|

|

|

4,519,803

|

|

|

Rollovers

|

|

445,324

|

|

|

1,295,437

|

|

|

Total contributions

|

|

10,728,512

|

|

|

12,996,983

|

|

|

|

|

|

|

|

|

Total additions

|

|

22,051,661

|

|

|

14,176,476

|

|

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

|

Benefits paid to participants

|

|

13,444,890

|

|

|

12,539,315

|

|

|

Fund expenses

|

|

262,356

|

|

|

340,415

|

|

|

Total deductions

|

|

13,707,246

|

|

|

12,879,730

|

|

|

|

|

|

|

|

|

Net change

|

|

8,344,415

|

|

|

1,296,746

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

|

Beginning of the year

|

|

109,679,505

|

|

|

108,382,759

|

|

|

End of the year

|

|

$

|

118,023,920

|

|

|

$

|

109,679,505

|

|

See accompanying notes to the financial statements.

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2016 AND 2015 AND FOR THE YEARS THEN ENDED

NOTE 1–DESCRIPTION OF PLAN

The following description of the Washington Federal (the “Company”) 401(k) and Employee Stock Ownership Plan and Trust (the “Plan”), provides only general information. Participants should refer to the Plan agreement for a more complete description of the Plan’s provisions.

General

-

The Plan is a defined contribution profit sharing plan for employee retirement and is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”). Prior to January 1, 2016, each full-time employee became a participant in the Plan effective on his or her date of employment while part-time employees completing at least 1,000 hours of service during the calendar year participated in the Plan.

Effective January 1, 2016, new employees become eligible to participate in the Plan upon completion of one year of service. Such eligible employees become a participant in the Plan on the first day of the calendar quarter (January 1, April 1, July 1 or October 1) coincident with or following the completion of the one year of service requirement. The Plan defines “year of service” as a 12-month period in which the eligible employee works at least 1,000 hours of service and the first eligibility service period starts on the first day of employment. After the first 12-month eligibility service period, if the Plan needs to measure another eligibility service period (e.g., if the employee does not complete 1,000 hours of service in the first 12-month period), the Plan will measure the eligibility service period on a Plan Year basis.

The Plan is a profit sharing plan which includes an Employee Stock Ownership Plan (“ESOP”) component and a cash deferral arrangement under Section 401(k) of the Internal Revenue Code. Under the ESOP, participants may elect to have all or part of their vested account balances, including voluntary contributions and earnings thereon, invested in Washington Federal, Inc. common stock (“Company common stock”). Effective January 1, 2010, no new transfers into the ESOP fund were allowed.

Contributions

-

Under provisions of the Plan, all participants may make voluntary after-tax contributions of their considered earnings as defined by the Plan. In addition, participants may make pre-tax contributions up to the statutory limits of $18,000 for both 2016 and 2015, plus a “catch-up” amount of $6,000 for both 2016 and 2015 for those who have attained age 50 or over at the end of the calendar year to their 401(k) deferral contributions account. All new employees are automatically enrolled, unless they opt out, for a 1% participant contribution to their 401(k) account, specifically directed to the “Moderate Model”, which is one of the 5 model portfolios available for participants to invest in. Each model portfolio invests, in varying percentages, in the mutual funds shown in the “Schedule of Assets (Held at End of Year)” attached at the end of these financial statements. The Plan includes a “safe harbor” feature which provides for a matching contribution equal to 100% of an employee’s 401(k) elective deferral, not exceeding 4% of their compensation for the Plan Year. Company profit sharing contributions to the Plan are determined by the Board of Directors based on the Company’s net operating income. Contributions are allocated to the Company profit sharing account of each participant in the same proportion that each participant’s eligible compensation for the period bear to the total eligible compensation of all such participants for such period. The annual addition from contributions to an individual participant’s account in this Plan cannot exceed the lesser of 100% of a participant’s compensation or $53,000 for both 2016 and 2015. Company profit sharing contributions totaled 7% of participants’ eligible compensation for the years ended December 31, 2016 and 2015.

Effective January 1, 2016, in order to be eligible to receive an allocation of the Employer’s profit sharing contribution for the Plan Year, a participant must complete 1,000 hours of service during the Plan Year and be employed on the last day of the Plan Year (December 31st).

Participant Accounts

-

Each participant’s account is credited with the participant’s contribution and allocations of (a) the Company’s profit sharing contribution and (b) Plan earnings. Allocations are based on participant

earnings and account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the vested amount of the participant’s account(s).

Investment Options

-

The Plan has established five accounts to which contributions may be directed and three investment options:

a.

Accounts-

|

|

|

|

•

|

Voluntary contributions account: After-tax contributions of a participant

|

|

|

|

|

•

|

401(k) deferral contributions account: Tax-deferred (pre-tax) contributions of a participant

|

|

|

|

|

•

|

Company Safe Harbor Matching Contribution Account: Company contribution equal to 100% of an employee’s 401(k) elective deferral, not exceeding 4% of their eligible compensation for the Plan Year

|

|

|

|

|

•

|

Rollover contributions account: Tax-deferred contributions rolled over from qualified plans of a participant’s previous employer(s)

|

|

|

|

|

•

|

Company profit sharing account: Contributions authorized by the Board of Directors and paid by the Company to the participant’s account initially invested in the plan pooled investments and provides participants the ability to transfer fully vested amounts to various mutual funds monthly

|

b.

Investments

-

|

|

|

|

•

|

Company common stock fund (ESOP fund): Funds transferred to the ESOP fund as authorized by the participant and invested in Company common stock (no new transfers to the ESOP fund were allowed after 2009)

|

|

|

|

|

•

|

Plan pooled investments: Funds invested primarily in certificates of deposit and cash management mutual funds as directed by the trustees

|

|

|

|

|

•

|

Mutual funds/Stable Value Fund: Diverse menu of participant-directed mutual funds/Stable Value Fund offered through The Newport Group (the Plan’s record-keeper)

|

ESOP Fund

-

Once a participant’s vested balance is transferred to the ESOP fund, at least 51% of the balance must be invested in Company common stock. Amounts not invested in Company common stock are invested in cash or cash equivalents. At any time, a participant may sell Company common stock held in the ESOP fund, subject to the 51% requirement mentioned above. Cash may be transferred from the ESOP fund to the corresponding accounts from which the funds were originally transferred. Participants may elect to have cash dividends paid on Company common stock distributed to them or retained in the ESOP fund. Effective January 1, 2010, no new transfers into the ESOP fund were allowed.

Vesting

-

Participants are immediately vested in their own contributions to their voluntary contribution accounts and to their 401(k) deferral contribution accounts. Withdrawals made upon termination are subject to vesting restrictions, which limit withdrawal of Company profit sharing account contributions if the participant has completed less than six years of continuous service. Participants who have completed six or more years of service are fully vested in Company profit sharing contributions to their accounts. Participants also become fully vested in Company profit sharing contributions upon death, total and permanent disability, or retirement on the normal or deferred retirement date. A continuous year of service consists of a minimum of 1,000 hours of employment during a calendar year.

The Plan provides employees with the following vesting schedule with regard to Company profit sharing contributions:

|

|

|

|

|

|

|

Service Year Completed

|

|

Percentage Vested

|

|

|

|

|

|

1

|

|

—%

|

|

2

|

|

20%

|

|

3

|

|

40%

|

|

4

|

|

60%

|

|

5

|

|

80%

|

|

6 or more

|

|

100%

|

The employer match contribution is considered fully vested at time of match.

Forfeitures

-

Participants have a nonforfeitable interest in their vested account balances upon termination from the Plan. Unvested account balances are subject to forfeiture and are used to reduce future employer contributions to the Plan. If participants re-enter the Plan before incurring five consecutive one-year breaks in service, the forfeited amounts shall be restored upon repayment of any amounts previously distributed to the participants. As of December 31, 2016 and 2015, forfeited nonvested accounts totaled $16,143 and $6,518, respectively. Forfeited nonvested amounts of $800,439 and $1,132,141 were used to reduce Company contributions in accordance with Plan provisions in 2016 and 2015, respectively.

Benefits

-

In accordance with the terms of the Plan, a participant, upon either retirement, termination, death, or disability, may elect alternative methods of benefit payments, including:

|

|

|

|

•

|

One lump-sum distribution

|

|

|

|

|

•

|

Purchase of an annuity contract selected by the participant and approved by the trustees

|

|

|

|

|

•

|

Any other method of distribution not extending the payment period beyond the joint life expectancy of the participant and his or her designated beneficiary, as approved by the trustees

|

In the event of employee termination, the vested portion of the participant’s share is to be distributed as soon as practicable.

Participant Loans

-

The Plan does not allow participants to withdraw funds from their accounts as participant loans.

Administrative Expenses

-

Each participant pays an annual fee of $60 plus a share of any additional Plan expenses, based on the participant’s portion of the Plan assets. Additional Plan expenses could include fees paid to auditors, investment advisors, attorneys, etc. Plan expenses and record keeping fees paid in 2016 were $262,356 and $340,415 for 2015.

NOTE 2–SUMMARY OF ACCOUNTING POLICIES

Basis of Accounting -

The financial statements of the Plan have been prepared on the accrual basis of accounting. Plan assets exclude those funds used to purchase annuities.

Use of Estimates

-

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Income Recognition

-

Interest income is recorded as earned on the accrual basis. Dividend income is recorded on the ex‑dividend date. Net appreciation or depreciation of investments represents the change in fair value from the beginning to the end of the Plan’s fiscal year or from date of purchase to the end of the Plan’s fiscal year, if purchased during the current year, plus realized gains and losses. Purchases and sales of securities are reflected on a trade-date basis.

Payment of Benefits

-

Benefits are recorded when paid.

New Accounting Standards

-

The Plan did not adopt any new guidance during 2016.

NOTE 3–FAIR VALUE MEASUREMENTS

U.S. GAAP defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. U.S. GAAP also establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value:

Level 1:

Quoted prices (unadjusted) for identical assets or liabilities in active exchange markets that the entity has the ability to access as of the measurement date.

Level 2:

Quoted prices in markets that are not considered to be active or financial instruments without quoted market prices, but for which all significant inputs are observable, either directly or indirectly.

Level 3:

Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

The investments in Company common stock and the mutual funds investment option are stated at fair value, which is based on closing prices as of the last trading day of the Plan year for those securities that are actively traded. The certificates of deposit are stated at cost plus accrued interest, an amount that approximates fair value.

Stable Value Fund - A stable value fund that is composed primarily of fully benefit-responsive investment contracts that is carried at the net asset value (as a practical expedient), an amount that approximates fair value. The NAV practical expedient would not be used if it is determined to be probable that the Plan would sell the investment for an amount different from the reported net asset value. Participant transactions (purchases and sales) may occur daily. If the plan initiates a full redemption of the trust, the issuer reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner.

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Washington Federal, Inc. common stock

|

|

$

|

18,793,057

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

18,793,057

|

|

|

Mutual funds

|

|

53,283,813

|

|

|

—

|

|

|

—

|

|

|

53,283,813

|

|

|

Certificates of deposit

|

|

—

|

|

|

17,297,321

|

|

|

—

|

|

|

17,297,321

|

|

|

Total investments in the fair value hierarchy

|

|

$

|

72,076,870

|

|

|

$

|

17,297,321

|

|

|

$

|

—

|

|

|

$

|

89,374,191

|

|

|

|

|

|

|

|

|

|

|

|

|

Stable Value Fund measured at NAV (practical expedient)

|

|

|

|

|

|

|

|

$

|

3,559,645

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments at fair value

|

|

|

|

|

|

|

|

$

|

92,933,836

|

|

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Washington Federal, Inc. common stock

|

|

$

|

15,231,187

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

15,231,187

|

|

|

Mutual funds

|

|

47,089,460

|

|

|

—

|

|

|

—

|

|

|

47,089,460

|

|

|

Certificates of deposit

|

|

—

|

|

|

29,905,939

|

|

|

—

|

|

|

29,905,939

|

|

|

Total investments in the fair value hierarchy

|

|

$

|

62,320,647

|

|

|

$

|

29,905,939

|

|

|

$

|

—

|

|

|

$

|

92,226,586

|

|

|

|

|

|

|

|

|

|

|

|

|

Stable Value Fund measured at NAV (practical expedient)

|

|

|

|

|

|

|

|

$

|

3,081,236

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments at fair value

|

|

|

|

|

|

|

|

$

|

95,307,822

|

|

Transfers Between Levels

- The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. In such instances, the transfer is reported at the beginning of the reporting period.

We evaluate the significance of transfers between levels based upon the nature of the financial instrument and size of the transfer relative to total net assets available for benefits. For the years ended, December 31, 2016 and 2015, there were no transfers between levels.

NOTE 4–FEDERAL INCOME TAX STATUS

The Internal Revenue Service has determined and informed the Company by a letter dated September 20, 2013, that the Plan is designed in accordance with applicable sections of the Internal Revenue Code. The Plan has been amended since receiving the determination letter. The Plan Administrator believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the Internal Revenue Code, therefore, no provision for income tax has been included in the Plan’s financial statements.

NOTE 5–PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants will become 100% vested in their accounts.

NOTE 6–RELATED PARTY TRANSACTIONS

Certain Plan investments are held at Washington Federal, the Plan’s sponsor. As such, these investments which are comprised of Washington Federal stock, qualify as party-in-interest transactions as defined by ERISA.

NOTE 7–NONPARTICIPANT-DIRECTED INVESTMENTS

As the plan pooled investments include both participant-directed and nonparticipant-directed contributions, and the amounts are not separable, the disclosures include the entire balance of the plan pooled investments. Information about the net assets and the significant components of the change in net assets relating to plan pooled investments is as follows as of and for the years ended December 31:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Net assets:

|

|

|

|

|

|

Certificates of deposit

|

|

$

|

17,297,321

|

|

|

$

|

29,905,939

|

|

|

|

|

|

|

|

|

|

|

$

|

17,297,321

|

|

|

$

|

29,905,939

|

|

|

|

|

|

|

|

|

Changes in net assets:

|

|

|

|

|

|

Contributions

|

|

$

|

2,724,582

|

|

|

$

|

3,998,341

|

|

|

Interest earned on investments

|

|

497,995

|

|

|

773,037

|

|

|

Net (depreciation) on investments

|

|

(87,468

|

)

|

|

(183,679

|

)

|

|

Benefits paid to participants

|

|

(6,881,213

|

)

|

|

(4,868,399

|

)

|

|

Transfers (to) participant-directed investments

|

|

(8,862,514

|

)

|

|

(5,178,812

|

)

|

|

|

|

|

|

|

|

|

|

$

|

(12,608,618

|

)

|

|

$

|

(5,459,512

|

)

|

NOTE 8–RISKS AND UNCERTAINTIES

The Plan invests in various investment securities. Investment securities are exposed to various risks, such as interest rate, market volatility and credit risks. It is reasonably possible, given the level of risk associated with investment securities, which changes in the near term could materially affect a participant’s account balance and the amounts reported in the financial statements.

Washington Federal 401(k) and Stock Ownership Plan

EIN: 91-0135860; Plan No: 001

FORM 5500, Schedule H, Line 4i - Schedule of Assets (Held As of December 31, 2016)

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b) Issuer, identity of borrower, lessor, or similar party

|

(c) Description of investment, Including maturity date, rate of interest, collateral, and par or maturity value

|

(d) Cost

|

(e) Fair value

|

|

|

|

|

|

|

|

*

|

Washington Federal, Inc.

|

547,105 units of common stock

|

**

|

$

|

18,793,057

|

|

|

|

|

|

|

|

|

|

Mutual funds:

|

|

|

|

|

|

American Century Disc Growth-Is

|

Large-Cap Growth

|

**

|

5,033,012

|

|

|

|

American Century M/C Val Inv

|

Mid-Cap Value

|

**

|

2,772,861

|

|

|

|

DFA Emerging Markets Small Cap

|

Small-Cap Growth

|

**

|

1,134,696

|

|

|

|

DFA US Small Cap

|

Small-Cap Blend

|

**

|

770,496

|

|

|

|

Dodge & Cox Intl Stock

|

International Large-Cap Blend

|

**

|

1,820,779

|

|

|

|

Fidelity International Index Fund Investor

|

International Blend

|

**

|

905,911

|

|

|

|

Ivy High Income I

|

High Current Yield

|

**

|

1,647,332

|

|

|

|

Ivy Global Growth I

|

International Large-Cap Growth

|

**

|

1,672,463

|

|

|

|

JPMorgan Small Cap Value Fund R6

|

Small-Cap Value

|

**

|

2,223,609

|

|

|

|

T Rowe Price Small Stock

|

Small-Cap Growth

|

**

|

1,396,596

|

|

|

|

Vanguard Total Bond Index Adm

|

Intermediate Aggregate Bond

|

**

|

889,535

|

|

|

|

MassMutual Select Mid Cap Growth

|

Mid-Cap Blend

|

**

|

3,205,656

|

|

|

|

Morgan Stanley Money Market

|

Institutional Money Market

|

**

|

241

|

|

|

|

Vanguard Mid Cap Index Adm

|

Mid-Cap Blend

|

**

|

964,800

|

|

|

|

Prudential Total Return Bd-Q

|

Aggregate Bond

|

**

|

10,437,353

|

|

|

|

Vanguard 500 Index Adm

|

Large-Cap Blend

|

**

|

10,824,953

|

|

|

|

Nuveen Real Estate Securities A

|

Real Estate

|

**

|

1,694,534

|

|

|

|

Voya Corporate Leaders Trust Series B

|

Large-Cap Value

|

**

|

4,920,164

|

|

|

|

Vanguard Short-Term Bond Index Adm

|

Short Term Bond

|

**

|

968,822

|

|

|

|

|

|

|

|

|

|

|

|

|

53,283,813

|

|

|

|

|

|

|

|

|

|

Wilmington Trust Metlife Stable Value Fund

|

Stable Value Fund

|

**

|

3,559,645

|

|

|

|

|

|

|

|

|

|

Certificates of deposit:

|

|

|

|

|

|

BMW Bank

|

0.80%, March 27, 2017 (0.80%)

|

1,000,000

|

|

1,000,000

|

|

|

|

Capital One Bank CD

|

0.60%, November 10, 2024 (0.60%)

|

5,000,000

|

|

5,000,000

|

|

|

|

BMW Bank

|

1.00%, January 17, 2017 (1.00%)

|

500,000

|

|

500,000

|

|

|

|

USAA CD

|

0.86%, February 11, 2017 (0.86%)

|

5,297,321

|

|

5,297,321

|

|

|

|

Synovous Bank GA

|

0.85%, March 16, 2017 (0.85%)

|

1,000,000

|

|

1,000,000

|

|

|

|

First Niagara Bank NY

|

0.80%, May 1, 2017 (0.80%)

|

1,500,000

|

|

1,500,000

|

|

|

|

Ally Bank

|

0.90%, October 2, 2017 (0.90%)

|

1,000,000

|

|

1,000,000

|

|

|

|

Key Bank CD

|

5.834%, October 19, 2017 (5.834%)

|

2,000,000

|

|

2,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17,297,321

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

92,933,836

|

|

|

|

|

|

|

|

|

*

|

Party-in-Interest

|

|

**

|

Cost information is not required for participant-directed investments and therefore is not included.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 23, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Washington Federal 401(k) and Employee Stock Ownership Plan

|

|

|

|

|

|

|

|

/s/ Robert Zirk

|

|

|

|

Robert Zirk

|

|

|

|

Pension Trustee

|

|

|

|

|

|

|

|

|

|

|

|

INDEX OF EXHIBITS

|

|

|

|

|

Exhibit No.

|

Exhibit Description

|

|

23.1

|

Consent of Independent Registered Public Accounting Firm

|

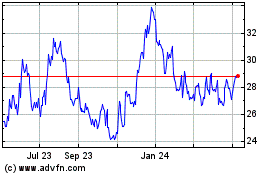

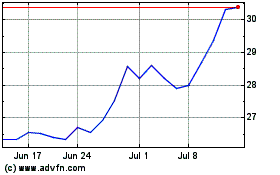

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Oct 2024 to Nov 2024

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Nov 2023 to Nov 2024