Form 8-K - Current report

September 13 2024 - 4:18PM

Edgar (US Regulatory)

DE false 0001283699 0001283699 2024-09-12 2024-09-12 0001283699 tmus:CommonStockParValue0.00001PerShareMember 2024-09-12 2024-09-12 0001283699 tmus:A3.550SeniorNotesDue2029Member 2024-09-12 2024-09-12 0001283699 tmus:A3.700SeniorNotesDue2032Member 2024-09-12 2024-09-12 0001283699 tmus:A3.850SeniorNotesDue2036Member 2024-09-12 2024-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 12, 2024

T-MOBILE US, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| DELAWARE |

|

1-33409 |

|

20-0836269 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 12920 SE 38th Street |

|

|

| Bellevue, Washington |

|

98006-1350 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (425) 378-4000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.00001 par value per share |

|

TMUS |

|

The NASDAQ Stock Market LLC |

| 3.550% Senior Notes due 2029 |

|

TMUS29 |

|

The NASDAQ Stock Market LLC |

| 3.700% Senior Notes due 2032 |

|

TMUS32 |

|

The NASDAQ Stock Market LLC |

| 3.850% Senior Notes due 2036 |

|

TMUS36 |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 — Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 12, 2024, T-Mobile US, Inc. (“T-Mobile” or the “Company”) entered into a compensation letter agreement (the “Letter Agreement”) with Peter Osvaldik, its Executive Vice President and Chief Financial Officer, that provides for his continued employment with the Company. The material terms of the Letter Agreement are described below.

Mr. Osvaldik’s employment under the Letter Agreement will continue until July 2, 2026 (the “Expiration Date”). The Company may extend the term of Mr. Osvaldik’s employment under the Letter Agreement by providing him with written notice no later than 30 days prior to the Expiration Date, and Mr. Osvaldik will have 30 days to accept or decline the offer. If the Company does not provide Mr. Osvaldik with such an extension offer or Mr. Osvaldik does not timely accept such offer, then Mr. Osvaldik’s employment with the Company will terminate on the Expiration Date (a “Non-Extension Termination”).

Pursuant to the Letter Agreement, Mr. Osvaldik is entitled to (i) an annual base salary of no less than $975,000; (ii) an annual short-term cash incentive (“STI”) targeted at no less than 200% of Mr. Osvaldik’s eligible base earnings for the applicable calendar year, payable based on the attainment of pre-established performance goals; and (iii) annual long-term incentive (“LTI”) awards with an aggregate grant-date target value of no less than 250% of the sum of Mr. Osvaldik’s annual base salary and his target STI for the applicable calendar year.

The Letter Agreement provides that if Mr. Osvaldik’s employment terminates due to a Non-Extension Termination, then, subject to his timely execution and non-revocation of a release of claims and continued compliance with applicable restrictive covenants and cooperation obligations, he will be entitled to receive:

| |

• |

|

a lump-sum payment, in cash and/or shares of Company common stock (as determined by the Company), equal to (i) 2.5x the target grant-date value of Mr. Osvaldik’s performance-based LTI award that was granted to him on July 5, 2023 (the “2023 Special PRSU Award”), as disclosed in the Company’s annual Proxy Statement filed with the Securities and Exchange Commission on April 26, 2024 (the “Target Grant-Date Value”), minus (ii) the aggregate dollar value of the portion of the 2023 Special PRSU Award that vests as of July 1, 2026 (determined based on the Company’s closing stock price on such vesting date); provided, that in no event will such payment exceed $10,000,000; |

| |

• |

|

Company-paid health and dental benefit coverage for up to 18 months following such termination; and |

| |

• |

|

continued eligibility for T-Mobile’s employee mobile service discount program. |

If Mr. Osvaldik’s employment is terminated by T-Mobile without “cause” or by Mr. Osvaldik for “good reason” (each as defined in the Letter Agreement) (each, a “qualifying termination”) prior to July 2, 2026, then, subject to his timely execution and non-revocation of a release of claims and continued compliance with applicable restrictive covenants and cooperation obligations, he will be entitled to receive:

| |

• |

|

a lump-sum payment, in cash and/or shares of Company common stock (as determined by the Company), equal to (i) a pro-rated portion of the 2.5x the Target Grant-Date Value (based on the number of days that he was employed during the period beginning on the 2023 Special PRSU Award grant date and ending on the date of the qualifying termination), minus (ii) the aggregate dollar value of the portion of the 2023 Special PRSU Award that vests in connection with Mr. Osvaldik’s qualifying termination pursuant to the Letter Agreement (as described below and determined based on the Company’s closing stock price on such termination date); provided, that in no event will such payment exceed a pro-rated portion of $10,000,000 (based on the number of days that he was employed during the period beginning on the 2023 Special PRSU Award grant date and ending on the date of the qualifying termination); |

| |

• |

|

Company-paid health and dental benefit coverage for up to 18 months following such termination; |

| |

• |

|

continued eligibility for T-Mobile’s employee mobile service discount program; and |

| |

• |

|

if the qualifying termination occurs prior to July 1, 2026, a portion of the 2023 Special PRSU Award will vest, determined by multiplying (x) the total number of shares or units, as applicable, subject to such award that would, absent Mr. Osvaldik’s termination of employment, become earned and vested based on actual performance attained during the performance period ending on the last day of the Company’s fiscal quarter ending immediately prior to the termination date by (y) a fraction, the numerator of which is the number of days between the grant date and the date of such termination, and the denominator of which is the number of days in the full performance period. |

Under the Letter Agreement, upon Mr. Osvaldik’s termination due to a Non-Extension Termination or due to a qualifying termination at any time during the term of the Letter Agreement, Mr. Osvaldik will forfeit any outstanding and unvested LTI awards (after taking into account the accelerated vesting of the 2023 Special PRSU Award noted above), as well as his STI award for the calendar year of termination.

In addition, (i) the incentive compensation provided to Mr. Osvaldik under the Letter Agreement is subject to recovery by the Company in accordance with the Company’s Amended and Restated Executive Incentive Compensation Recoupment Policy or any other Company clawback or recoupment policy; and (ii) to the extent that any payment or benefit received by Mr. Osvaldik pursuant to the Letter Agreement or otherwise would be subject to an excise tax under Internal Revenue Code Section 4999, such payments and/or benefits will be subject to a “best pay cap” reduction if such reduction would result in a greater net after-tax benefit to Mr. Osvaldik than receiving the full amount of such payments.

The foregoing description of the Letter Agreement with Mr. Osvaldik is qualified in its entirety by the full text of the Letter Agreement, a copy of which will be subsequently filed with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

T-MOBILE US, INC. |

|

|

|

|

| September 13, 2024 |

|

|

|

|

|

/s/ Mark Nelson |

|

|

|

|

|

|

Mark Nelson |

|

|

|

|

|

|

Executive Vice President and General Counsel |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmus_CommonStockParValue0.00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmus_A3.550SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmus_A3.700SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmus_A3.850SeniorNotesDue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

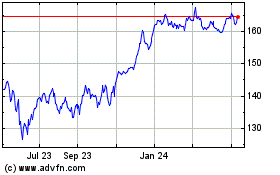

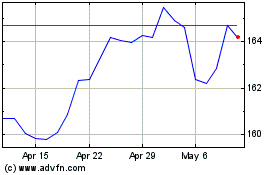

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Aug 2024 to Sep 2024

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Sep 2023 to Sep 2024