SAN JOSE, Calif., April 23 /PRNewswire-FirstCall/ -- Sanmina-SCI

Corporation (the "Company") (NASDAQ:SANM), a leading global

Electronics Manufacturing Services (EMS) company, today reported

financial results for its second fiscal quarter ended March 29,

2008. Basis of Presentation On February 19, 2008 the Company

announced the sale of certain assets of its personal computing

business and associated logistics services. As a result of this

sale and certain other anticipated transactions, this line of

business has been treated as a discontinued operation in the

financial statements that accompany this press release. Certain

results for the total company, however, have been provided to

assist the reader in understanding the overall results of the

company relative to the guidance for the second quarter that was

provided by the company on January 23, 2008. As such, the term

"Total Company" as used in this press release includes both

Continued and Discontinued Operations. Second Quarter Fiscal 2008

Highlights: -- TOTAL COMPANY Revenue of $2.4 Billion, guidance WAS

$2.4-2.5 Billion -- Non-GAAP diluted Earnings Per Share of $0.05,

guidance WAS $0.03-$0.05 -- GAAP Diluted Loss Per Share of ($0.05)

-- continuing operations Revenue of $1.82 billion and non-gaap

Diluted earnings per share of $0.03 Total Company -- Versus

Guidance Revenue for the total company, including continuing and

discontinued operations was $2.40 billion for the second quarter

ended March 29, 2008, compared to $2.61 billion in the second

quarter ended March 31, 2007. Revenue in the personal computing

business was down versus the prior quarter related to certain

revenues that were transitioned to a third-party manufacturer

during the quarter in connection with the Company's decision to

exit the business. Non-GAAP net income for the second quarter 2008

was $28.2 million, or $0.05 diluted earnings per share, compared to

$793 thousand, and break-even non-GAAP diluted earnings per share

for the year ago quarter. GAAP net loss was $24.4 million, or $0.05

diluted loss per share compared to a net loss of $26.1 million, or

$0.05 diluted loss per share for the same period a year ago.

Non-GAAP gross profit was $147.8 million, or 6.1 percent of

revenue, compared to $139.2 million, or 5.3 percent of revenue in

the same period a year ago. Non-GAAP operating income for the

quarter was $62.9 million, up $22.7 million compared to $40.2

million for the same time period a year ago (see Non-GAAP Financial

Information). Q2'08 Q2'07 Q2'08 Guidance Total Company Revenue (in

thousands) $2,404,130 $2,611,689 $2.4 - $2.5 B Non-GAAP Gross

Margin(1) 6.1% 5.3% 6.0% - 6.1% Non-GAAP EPS(1) $0.05 $0.00 $0.03 -

$0.05 GAAP EPS (loss) ($0.05) ($0.05) Continuing Operations Revenue

(in thousands) $1,817,431 $1,788,028 Non-GAAP Gross Margin(1) 6.9%

6.4% Non-GAAP EPS (loss)(1) $0.03 ($0.04) GAAP EPS (loss) ($0.08)

($0.09) Continuing Operations - Non-GAAP Results (1) Revenue from

continuing operations for the second quarter was $1.82 billion,

compared to $1.79 billion in the same period a year ago. Net income

was $14.5 million, or $0.03 diluted earnings per share, compared to

a net loss of $19.1 million, or $0.04 diluted loss per share for

the same period a year ago. Gross profit in the second quarter of

fiscal 2008 was $126.1 million, 6.9 percent of revenue, compared to

$114.8 million, 6.4 percent of revenue in the second quarter a year

ago. Operating income was $44.9 million, which equated to an

operating margin of 2.5 percent, up $24.6 million compared to $20.3

million and an operating margin of 1.1 percent in the same period a

year ago. Continuing Operations - GAAP Results Net loss for the

second quarter was $39.9 million, $0.08 diluted loss per share

compared to a net loss $45.9 million, $0.09 diluted loss per share

in the same period a year ago. The loss for the second quarter was

largely attributable to $48.0 million of restructuring charges most

of which was incurred by the company in connection with the

previously announced closure of a manufacturing facility in Western

Europe. Balance Sheet Results In the second quarter ended March 29,

2008, cash and cash equivalents amounted to $861 million, compared

to $941 million in the prior quarter and $664 million in the same

period a year ago. Inventory turns for the continuing operations

were 7.1 and total company turns were 8.9. Jure Sola, Sanmina-SCI's

Chairman and Chief Executive Officer, said, "Overall, the Company

performed according to plan with our core business slightly ahead

of expectations with strength in our defense and aerospace,

industrial, medical and multimedia end markets. With the sale of

our PC business underway, our focus is on driving growth in our

core end markets where we are well positioned with customers.

Despite slowing economic conditions, we remain cautiously

optimistic that our revenue will remain steady in the third quarter

and that our level of profitability will improve." "Today,

Sanmina-SCI is better positioned to build solid, long-term

relationships with its customers by providing leading-edge

technologies in each of our select end-markets. We believe we have

an industry advantage with our engineering design and manufacturing

offerings that will allow us to successfully penetrate those

markets where we can present the greatest benefits to our

customers," Sola concluded. Third Quarter Fiscal 2008 Outlook The

Company provides the following guidance with respect to the third

fiscal quarter ending June 28, 2008: Continuing Operations --

Revenue for continuing operations is expected to be in the range of

$1.775 billion to $1.875 billion -- Non-GAAP diluted earnings per

share for continuing operations is expected to be between $0.03 to

$0.05 Total Company -- Non-GAAP diluted earnings per share for the

total company is expected to be between $0.03 to $0.06 -- Non-GAAP

diluted earnings per share for the discontinued operations is

expected to be between $0.00 to $0.01 (1) Non-GAAP Financial

Information In the commentary set forth above, we present the

following non-GAAP financial measures: gross profit, gross margin,

operating income, operating margin, net income and earnings per

share. In computing each of these non-GAAP financial measures, we

exclude charges or gains relating to: stock-based compensation

expenses, restructuring costs (including employee severance and

benefits costs and charges related to excess facilities and

assets), integration costs (consisting of costs associated with the

integration of acquired businesses into our operations), impairment

charges for goodwill and intangible assets, amortization expense

and other infrequent or unusual items, to the extent material or

which we consider to be of a non-operational nature in the

applicable period. We have furnished these non-GAAP financial

measures because we believe they provide useful supplemental

information to investors in that they eliminate certain financial

items that are of a non-recurring, unusual or infrequent nature or

are not related to the Company's regular, ongoing business. Our

management also uses this information internally for forecasting,

budgeting and other analytical purposes. Therefore, the non-GAAP

financial measures enable investors to analyze the core financial

and operating performance of our Company and to facilitate

period-to-period comparisons and analysis of operating trends. A

reconciliation from GAAP to non-GAAP results is contained in the

attached financial summary and is available on the Investor

Relations section of our website at http://www.sanmina-sci.com/.

Sanmina-SCI provides earnings guidance only on a non-GAAP basis due

to the inherent uncertainties associated with forecasting the

timing and amount of restructuring, impairment and other unusual

and infrequent items. The non-GAAP financial information presented

in this release may vary from non-GAAP financial measures used by

other companies. In addition, non-GAAP financial information should

not be viewed as a substitute for financial data prepared in

accordance with GAAP. Company Conference Call Information

Sanmina-SCI will be holding a conference call regarding this

announcement on Wednesday, April 23, 2008 at 5:00 p.m. ET (2:00

p.m. PT). The access numbers are: domestic 877-273-6760 and

international 706-634-6605. The conference will be broadcast live

over the Internet. Log on to the live webcast at

http://www.sanmina-sci.com/. Additional information in the form of

a slide presentation is available by logging onto Sanmina-SCI's

website at http://www.sanmina-sci.com/. A replay of today's

conference call will be available for 48-hours. The access numbers

are: domestic 800-642-1687 and international 706-645-9291, access

code is 39937381. About Sanmina-SCI Sanmina-SCI Corporation

(NASDAQ:SANM) is a leading electronics contract manufacturer

serving the fastest-growing segments of the global electronics

manufacturing services (EMS) market. Recognized as a technology

leader, Sanmina-SCI provides end-to-end manufacturing solutions,

delivering superior quality and support to large OEMs primarily in

the communications, defense and aerospace, industrial and medical

instrumentation, computer technology and multimedia sectors.

Sanmina-SCI has facilities strategically located in key regions

throughout the world. Information about Sanmina-SCI is available at

http://www.sanmina-sci.com/. Sanmina-SCI Safe Harbor Statement The

foregoing, including the discussion regarding the Company's

expectations of future revenue, profitability and operating expense

levels, contains certain forward-looking statements that involve

risks and uncertainties that could cause actual results to differ

materially from those projected in this press release, including

adverse conditions in the electronics industry, particularly in the

principal industry sectors served by the Company, changes in

customer requirements and in the volume of sales to principal

customers adversely affecting revenue and profitability, the

ability of Sanmina-SCI to effectively assimilate acquired

businesses and achieve the anticipated benefits of its acquisitions

and competition negatively impacting the Company's pricing. The

Company's actual results of operations may differ significantly

from those contemplated by such forward-looking statements as a

result of these and other factors, including factors set forth in

the Company's fiscal year 2007 Annual Report on Form 10-K and the

other reports, including quarterly reports on Form 10-Q and current

reports on Form 8-K, that the Company files with the Securities

Exchange Commission. Sanmina-SCI Corporation Condensed Consolidated

Balance Sheets (In thousands) (GAAP) March 29, September 29, 2008

2007 (Unaudited) ASSETS Current assets: Cash and cash equivalents

$860,550 $933,424 Accounts receivable, net 1,225,755 1,218,375

Inventories 949,922 1,059,856 Prepaid expenses and other current

assets 137,253 167,038 Assets held for sale 114,574 36,764 Total

current assets 3,288,054 3,415,457 Property, plant and equipment,

net 596,756 609,394 Goodwill 512,635 510,669 Other non-current

assets 138,814 134,435 Total assets $4,536,259 $4,669,955

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts

payable $1,407,473 $1,450,705 Accrued liabilities 217,932 203,941

Accrued payroll and related benefits 146,450 142,436 Liabilities

held for sale 1,248 -- Total current liabilities 1,773,103

1,797,082 Long-term liabilities: Long-term debt 1,490,540 1,588,072

Other 118,669 111,654 Total long-term liabilities 1,609,209

1,699,726 Total stockholders' equity: 1,153,947 1,173,147 Total

liabilities and stockholders' equity $4,536,259 $4,669,955

Condensed Consolidated Statements of Operations (In thousands,

except per share amounts) (GAAP) (Unaudited) Three Months Ended Six

Months Ended March 29, March 31, March 29, March 31, 2008 2007 2008

2007 Net sales $1,817,431 $1,788,028 $3,595,571 $3,710,590 Cost of

sales 1,692,786 1,674,533 3,341,997 3,455,508 Gross profit 124,645

113,495 253,574 255,082 Operating expenses: Selling, general and

administrative 79,336 89,062 168,414 180,407 Research and

development 4,253 8,971 8,859 17,933 Amortization of intangible

assets 1,650 1,611 3,300 3,261 Restructuring costs 48,019 17,479

54,798 22,181 Total operating expenses 133,258 117,123 235,371

223,782 Operating income / (loss) (8,613) (3,628) 18,203 31,300

Interest income 5,229 8,671 11,446 19,571 Interest expense (31,611)

(45,780) (66,974) (89,111) Other income (expense), net 4,272 (553)

(368) 10,408 Interest and other expense, net (22,110) (37,662)

(55,896) (59,132) Loss from continuing operations before income

taxes (30,723) (41,290) (37,693) (27,832) Provision for income

taxes 9,214 4,637 11,697 13,371 Net loss from continuing operations

(39,937) (45,927) (49,390) (41,203) Net income from discontinued

operations, net of tax 15,523 19,795 32,892 43,320 Net income

(loss) $(24,414) $(26,132) $(16,498) $2,117 Basic income (loss) per

share from: Continuing operations $(0.08) $(0.09) $(0.09) $(0.08)

Discontinued operations $0.03 $0.04 $0.06 $0.08 Net income $(0.05)

$(0.05) $(0.03) $0.00 Diluted income (loss) per share from:

Continuing operations $(0.08) $(0.09) $(0.09) $(0.08) Discontinued

operations $0.03 $0.04 $0.06 $0.08 Net income $(0.05) $(0.05)

$(0.03) $0.00 Weighted-average shares used in computing per share

amounts: Basic 530,747 527,101 530,200 527,106 Diluted-net loss

530,747 527,101 530,200 527,106 Diluted-net income 530,895 528,842

530,428 528,570 Sanmina-SCI Corporation Reconciliation of GAAP to

Non-GAAP Measures (in thousands, except per share amounts)

(Unaudited) Three Months Ended Six Months Ended March 29, March 31,

March 29, March 31, 2008 2007 2008 2007 GAAP Revenue - continuing

operations 1,817,431 1,788,028 3,595,571 3,710,590 GAAP Revenue -

discontinued operations 586,699 823,661 1,341,485 1,679,889 GAAP

Revenue - total company $2,404,130 $2,611,689 $4,937,056 $5,390,479

GAAP Gross Profit - continuing operations $124,645 $113,495

$253,574 $255,082 GAAP gross margin 6.9% 6.3% 7.1% 6.9% Adjustments

- continuing operations: Stock compensation expense (1) 1,581 1,117

3,281 2,077 Amortization of intangible assets 233 221 504 442 Stock

option investigation and integration (408) - (408) - Non-GAAP Gross

Profit - continuing operations $126,051 $114,833 $256,951 $257,601

Non-GAAP gross margin - continuing operations 6.9% 6.4% 7.1% 6.9%

GAAP Gross Profit - discontinued operations 21,641 24,225 45,758

51,317 Adjustments - discontinued operations: Stock compensation

expense (1) 129 97 249 178 Non-GAAP Gross Profit - total company

$147,821 $139,155 $302,958 $309,096 Non-GAAP gross margin - total

company 6.1% 5.3% 6.1% 5.7% GAAP operating income (loss) -

continuing operations $(8,613) $(3,628) $18,203 $31,300 GAAP

operating margin - continuing operations -0.5% -0.2% 0.5% 0.8%

Adjustments - continuing operations: Stock compensation expense (1)

3,738 3,319 7,015 5,873 Amortization of intangible assets 1,883

1,832 3,804 3,703 Stock option investigation and integration (165)

1,271 2,098 5,645 Restructuring costs 48,019 17,479 54,798 22,181

Non-GAAP operating income - continuing operations $44,862 $20,273

$85,918 $68,702 Non-GAAP operating margin - continuing operations

2.5% 1.1% 2.4% 1.9% GAAP operating income (loss) - discontinued

operations 17,329 18,323 36,807 41,928 Adjustments - discontinued

operations: Stock compensation expense (1) 140 101 269 185

Restructuring costs 554 1,468 1,071 (19) Non-GAAP operating income

- total company $62,885 $40,165 $124,065 $110,796 Non-GAAP

operating margin - total company 2.6% 1.5% 2.5% 2.1% GAAP net

income (loss) - continuing operations $(39,937) $(45,927) $(49,390)

$(41,203) Adjustments - continuing operations: Operating income

adjustments (see above) 53,475 23,901 67,715 37,402 Gain on sale of

surplus real estate -- -- -- (6,840) Loss on redemption of debt (2)

-- -- 2,237 -- Tax effect of above items 915 2,927 (1,004) 3,992

Non-GAAP net income (loss) - continuing operations 14,453 (19,099)

19,558 (6,649) GAAP net income - discontinued operations 15,523

19,795 32,892 43,320 Adjustments - discontinued operations:

Operating income adjustments (see above) 694 1,569 1,340 166 Tax

effect of above items (2,494) (1,472) (4,576) (1,392) Non-GAAP net

income (loss) - total company 28,176 793 49,214 35,445 Non-GAAP

Earnings (loss) Per Share - continuing operations: Basic $0.03

$(0.04) $0.04 $(0.01) Diluted $0.03 $(0.04) $0.04 $(0.01) Non-GAAP

Earnings (loss) Per Share - total company: Basic $0.05 $0.00 $0.09

$0.07 Diluted $0.05 $0.00 $0.09 $0.07 Weighted-average shares used

in computing Non-GAAP earnings per share amounts: Basic 530,747

527,101 530,200 527,106 Diluted 530,895 528,842 530,428 528,570 (1)

Stock compensation expense for the three and six months ended March

29, 2008 and March 31, 2007 was as follows: Three Months Ended Six

Months Ended March 29, March 31, March 29, March 31, 2008 2007 2008

2007 Cost of sales $1,581 $1,117 $3,281 $2,077 Selling, general and

administrative 2,077 2,101 3,557 3,600 Research and development 80

101 177 196 Stock compensation expense - continuing operations

$3,738 $3,319 $7,015 $5,873 Discontinued operations 140 101 270 185

Stcok compensation expense - total company $3,878 $3,420 $7,285

$6,058 (2) Write-off of prepaid financing fees related to debt that

was repaid prior to maturity. DATASOURCE: Sanmina-SCI Corporation

CONTACT: Paige Bombino, Investor Relations of Sanmina-SCI

Corporation, +1-408-964-3610 Web site: http://www.sanmina-sci.com/

Copyright

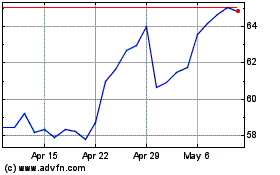

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From May 2024 to Jun 2024

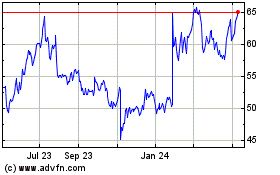

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From Jun 2023 to Jun 2024