Sanmina-SCI Announces Early Results and the Pricing Terms in Connection With Its Previously Announced Tender Offer

February 14 2006 - 8:30AM

PR Newswire (US)

SAN JOSE, Calif., Feb. 14 /PRNewswire-FirstCall/ -- Sanmina-SCI

Corporation (NASDAQ:SANM) (the "Company") announced today the

pricing terms of its previously announced tender offer and consent

solicitation (the "Offer") for its 10.375% Senior Secured Notes due

2010 (CUSIP Nos. 800907AF4 and 800907AE7) (the "Notes") pursuant to

the Offer to Purchase and Consent Solicitation Statement dated

January 31, 2006 (the "Offer to Purchase"). In addition, the

Company announced today that as of 5:00 p.m., New York City time,

on February 13, 2006 (the "Consent Payment Deadline"), which was

the deadline for holders to tender their Notes in order to receive

the consent payment in connection with the Offer, it had received

tenders and consents from holders of approximately $721.5 million

in aggregate principal amount of the Notes, representing

approximately 96.2% of the outstanding Notes. The total

consideration for each $1,000 principal amount of Notes validly

tendered and not withdrawn prior to the Consent Payment Deadline is

$1,094.52, which includes a consent payment of $30.00 per $1,000

principal amount of Notes. The total consideration was determined

by reference to a fixed spread of 50 basis points over the yield of

the 3% U.S. Treasury Note due December 31, 2006, which was

calculated at 2:00 p.m., New York City time, on February 13, 2006.

The reference yield and tender offer yield are 4.765% and 5.265%,

respectively. Holders whose Notes are validly tendered and not

withdrawn on or before the Consent Payment Deadline and are

accepted for purchase by the Company will receive accrued and

unpaid interest on the Notes up to, but not including, the initial

payment date for the Offer, which is expected to be on February 15,

2006. Holders whose Notes are validly tendered after the Consent

Payment Deadline, but on or prior to 5:00 p.m., New York City time,

on February 28, 2006 (the "Expiration Date") and accepted for

purchase by the Company will receive the tender offer consideration

of $1,064.52 per $1,000 principal amount of Notes tendered, but

will not receive the consent payment, and will receive accrued and

unpaid interest on the Notes up to, but not including, the final

payment date for the Offer, which is expected to be on or about

March 1, 2006. The supplemental indenture effecting the proposed

amendments to the indenture governing the Notes will be executed on

February 14, 2006. Adoption of the proposed amendments required the

consent of holders of at least a majority of the aggregate

principal amount of the outstanding Notes. The proposed amendments,

however, will become operative only when the validly tendered Notes

are accepted for purchase by the Company pursuant to the terms of

the Offer. In accordance with the terms of the Offer, tendered

Notes may no longer be withdrawn and delivered consents may not be

revoked, unless the Company makes a material change to the terms of

the Offer or is otherwise required by law to permit withdrawal or

revocation. The Offer remains open and is scheduled to expire on

the Expiration Date, unless extended or earlier terminated. The

tender offer and consent solicitation are subject to the

satisfaction of certain conditions, including the receipt of

sufficient financing to consummate the tender offer and consent

solicitation on terms satisfactory to the Company and certain other

customary conditions. The complete terms and conditions of the

tender offer and consent solicitation are described in the Offer to

Purchase, copies of which may be obtained by contacting D. F. King

and Co., Inc., the depositary and information agent for the Offer,

at 212-269-5550 (collect) or 800-659-5550 (U.S. toll-free). The

Company has engaged Banc of America Securities LLC to act as the

exclusive dealer manager and solicitation agent in connection with

the Offer. Questions regarding the Offer may be directed to Banc of

America Securities LLC, High Yield Special Products, at

888-292-0070 (US toll-free) and 704-388-9217 (collect). This press

release does not constitute an offer to sell or a solicitation of

an offer to buy any Securities, nor shall there be any sale of any

Securities in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

This announcement is also not an offer to purchase, a solicitation

of an offer to purchase or a solicitation of consents with respect

to any securities. The tender offer and consent solicitation are

being made solely by the Offer to Purchase and Consent Solicitation

Statement dated January 31, 2006. SANMF FCMN Contact:

paige.bombino@sanmina-sci.com DATASOURCE: Sanmina-SCI Corporation

CONTACT: Paige Bombino, Investor Relations of Sanmina-SCI,

+1-408-964-3610 Web site: http://www.sanmina-sci.com/

Copyright

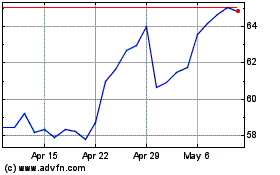

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From May 2024 to Jun 2024

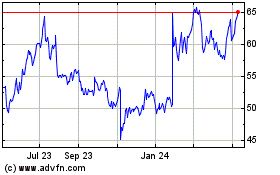

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From Jun 2023 to Jun 2024