Amended Securities Registration (section 12(g)) (8-a12g/a)

August 30 2019 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A/A

(Amendment No. 1)

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF

THE SECURITIES EXCHANGE ACT OF 1934

ROCKWELL MEDICAL, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

38-3317208

|

|

(State of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

411 Hackensack Ave., Suite 501

Hackensack, N.J. 07601

|

|

07601

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Securities to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

to be so registered

|

|

Name of each exchange on which

each class is to be registered

|

|

Common Stock, par value $0.0001 per share

|

|

Nasdaq Global Market

|

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c) or (e), check the following box. x

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or (e), check the following box. o

If this form relates to the registration of a class of securities concurrently with a Regulation A offering, check the following box. o

Securities Act registration statement file number to which this form relates: None

Securities to be registered pursuant to Section 12(g) of the Act: None

EXPLANATORY NOTE

This Amendment No. 1 to Form 8-A is being filed in connection with the reincorporation of Rockwell Medical, Inc. (the “Company”) from the State of Michigan to the State of Delaware (the “Reincorporation”) pursuant to a plan of conversion, dated August 28, 2019 (the “Plan of Conversion”). The Reincorporation became effective on August 30, 2019 and was accomplished by the filing of (i) a certificate of conversion with the Bureau of Commercial Services of the Michigan Department of Labor & Economic Growth; (ii) a certificate of conversion with the Secretary of State of the State of Delaware; and (iii) a Certificate of Incorporation with the Secretary of State of the State of Delaware (the “Certificate of Incorporation”). Pursuant to the Plan of Conversion, the Company also adopted new bylaws (the “Bylaws”). The Company hereby amends the following items, exhibits or other portions of its Form 8-A filed on January 23, 1998 with the Securities and Exchange Commission (the “SEC”) regarding the description of common stock as set forth herein.

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 1. Description of Registrant’s Securities to be Registered.

The Company’s authorized capital stock consists of 170,000,000 shares of common stock, $0.0001 par value per share (the “Common Stock”), and 2,000,000 shares of preferred stock, $0.0001 par value per share.

Common Stock

Holders of the Company’s common stock are entitled to one vote per share on all matters submitted to a vote of stockholders and may not cumulate votes for the election of directors. Common stockholders have the right to receive dividends when, as and if declared by the Board of Directors from funds legally available therefor. Holders of common stock have no preemptive rights and have no rights to convert their common stock into any other securities. The common stock is not subject to further calls or assessments by the Company. There are no redemption or sinking fund provisions applicable to the common stock. Upon a liquidation of the Company, the holders of Common Stock shall be eligible to receive any remaining liquidation proceeds or property of the Company, following the satisfaction of amounts due to creditors of the Company and subject to any senior liquidation preferences granted to the holders of preferred stock. All outstanding shares of the Company’s common stock are fully paid and non-assessable.

Preferred Stock

The shares of preferred stock have such rights and preferences as the Company’s Board of Directors shall determine, from time to time. The Board of Directors may divide the Preferred Stock into any number of series and shall fix the designation and number of shares of each such series. The Board of Directors may determine and alter the rights, powers, preferences and privileges, and qualifications, restrictions and limitations thereof, including, but not limited to, voting rights (if any), granted to and imposed upon any wholly unissued series of preferred stock. The Board of Directors (within the limits and restrictions of any resolutions adopted originally fixing the number of shares of any series) may increase or decrease the number of shares of that series; provided, that no such decrease shall reduce the number of shares of such series to a number less than the number of shares of such series then outstanding, plus the number of shares reserved for issuance upon the exercise of outstanding options, rights or warrants or upon the conversion of any outstanding securities issued by the Corporation convertible into shares of such series.

The Common Stock is subject to the express terms of the Company’s preferred stock and any series thereof. The Board of Directors may issue preferred stock with voting, dividend, liquidation and other rights that could adversely affect the relative rights of the holders of the Common Stock.

Anti-Takeover Effects of Certain Provisions of the Company’s Certificate of Incorporation and Bylaws

Certain provisions of the Company’s Certificate of Incorporation and Bylaws, which provisions are summarized in the following paragraphs, may have an anti-takeover effect and may delay, defer or prevent a takeover attempt that a stockholder might consider in its best interest, including those attempts that might result in a premium over the market price for the shares held by stockholders.

Classified Board

The Company’s certificate of incorporation provides that the Company’s Board of Directors will be divided into three classes of directors, with the classes to be as nearly equal in number as possible. As a result, approximately one-third of the Company’s Board of Directors will be elected each year. The Bylaws provide that the number of directors will be fixed from time to time exclusively pursuant to a resolution adopted by the board.

2

Removal of Directors; Vacancies

Under the Delaware General Corporation Law (“DGCL”), and pursuant to the Bylaws, directors serving on a classified board may be removed by the stockholders only for cause. In addition, the Bylaws also provide that any vacancies on the Company’s Board of Directors will be filled only by the affirmative vote of a majority of the remaining directors then in office, even if less than a quorum.

Stockholder Proposals

For director nominations or other business to be properly brought before an annual meeting by a stockholder, such stockholder must generally provide notice to the Company no later than the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s annual meeting. The nominations of persons for election to the Board of Directors and the submission of other business to be considered at a meeting of stockholders are required to be either made or brought by the Board or made or brought by a stockholder of record who complies with specified advance notice procedures set forth in the Bylaws.

Other Terms

The Company has opted out of Section 203 of the DGCL, which is a statute that (if applicable) would have served to make certain types of unfriendly or hostile corporate takeovers, or other non-board approved transactions involving a corporation and one or more of its significant stockholders, more difficult.

Unless the Company selects or consents in writing to the selection of an alternative forum, the sole and exclusive forum for any current or former stockholder (including any current or former beneficial owner) to bring internal corporate claims, to the fullest extent permitted by law, and subject to applicable jurisdictional requirements, shall be the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have jurisdiction, another state court or a federal court located within the State of Delaware).

To the extent not set forth above, the Company hereby incorporates by reference the description of the Common Stock, as set forth in the section entitled “Proposal 3 - Reincorporation of the Company from Michigan to Delaware” in the Company’s definitive Proxy Statement on Schedule 14A, as filed with the SEC on April 30, 2019.

Item 2. Exhibits.

The following exhibits to this Registration Statement on Form 8-A/A are incorporated by reference from the documents specified, which have been filed with the SEC.

3

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereto duly authorized.

|

Dated: August 30, 2019

|

ROCKWELL MEDICAL, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Stuart Paul

|

|

|

|

Stuart Paul

|

|

|

|

Chief Executive Officer

|

4

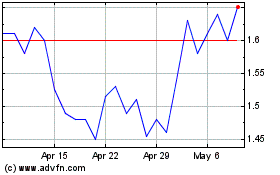

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Sep 2023 to Sep 2024