PHILADELPHIA, Jan. 18 /PRNewswire-FirstCall/ -- Republic First

Bancorp, Inc. (NASDAQ:FRBK) (the "Company"), the holding company

for Republic First Bank (PA), today reported that earnings for 2006

were $10.1 million or $1.04 per diluted share, compared to $8.9

million or $.93* per diluted share, a 14% increase in earnings over

the comparable prior year period. Fourth quarter 2006 earnings

amounted to $2.5 million compared to $2.6 million in the prior year

or $.25 per diluted share, compared to $.27 in the same quarter in

2005. Average loans increased 17% in fourth quarter 2006,

offsetting the impact of a reduction in net interest margin to

3.71% in that quarter compared to 4.16% in the prior year. Loan

demand continues to be strong, and core deposit growth will be

emphasized in 2007, as the primary drivers to increasing income in

2007. The improvement in 2006 earnings reflected the growth in loan

volume. Average loans grew in excess of 21% for full year 2006

compared to 2005. Management believes that overall credit quality

continues to be strong. Total non-performing loans were $6.9

million at December 31, 2006, a reduction of $3.1 million or 30.6%,

from the balance at September 30, 2006. The reduction was due to a

combination of payoffs and a return of loans to full accrual status

in the fourth quarter of 2006. Harry Madonna, Chairman and Chief

Executive Officer, stated, "We are very pleased with the continuing

improvement in earnings of the Company and at the same time

successfully opening two new branches. Earnings growth was due to

the significant increase in commercial loans outstanding. We

anticipate continued growth in earnings with the addition of at

least two new branches each year. We look forward to future

earnings in excess of our peer group, and further increasing

shareholder value." Total shareholders' equity stood at $74.7

million with a book value per share of $7.87 at December 31, 2006,

based on outstanding common shares of approximately 9.5 million.

The Company continues to be well capitalized. Republic First Bank

(PA) is a full-service, state-chartered commercial bank, whose

deposits are insured by the Federal Deposit Insurance Corporation

(FDIC). The Bank provides diversified financial products through

its eleven offices located in Abington, Ardmore, Bala Cynwyd, East

Norriton, Media, and Philadelphia, Pennsylvania and Voorhees, New

Jersey. The Company may from time to time make written or oral

"forward-looking statements," including statements contained in

this release and in the Company's filings with the Securities and

Exchange Commission. These forward- looking statements include

statements with respect to the Company's beliefs, plans,

objectives, goals, expectations, anticipations, estimates, and

intentions that are subject to significant risks and uncertainties

and are subject to change based on various factors, many of which

are beyond the Company's control. The words "may," "could,"

"should," "would," "believe," "anticipate," "estimate," "expect,"

"intend," "plan," and similar expressions are intended to identify

forward-looking statements. All such statements are made in good

faith by the Company pursuant to the "safe harbor" provisions of

the Private Securities Litigation Reform Act of 1995. The Company

does not undertake to update any forward-looking statement, whether

written or oral, that may be made from time to time by or on behalf

of the Company. * Per share and book value amounts were restated to

reflect the 10% stock dividend paid May 17, 2006. Republic First

Bancorp, Inc. Condensed Income Statement (Dollar amounts in

thousands except per share data) (unaudited) Three Months Ended

Twelve Months Ended December 31, December 31, 2006 2005 (1) 2006

2005 (1) Net Interest Income $8,244 $7,772 $34,066 $29,158

Provision for Loan Losses (10) 49 1,364 1,186 Non-interest Income

807 808 3,640 3,614 Non-interest Expenses 5,351 4,593 21,017 18,207

Provision for income taxes 1,225 1,342 5,207 4,486 Net Income

$2,485 $2,596 $10,118 $8,893 Diluted EPS $0.25 $0.27 $1.04 $0.93

Republic First Bancorp, Inc. Condensed Balance Sheet (Dollar

amounts in thousands) (unaudited) December 31, December 31, 2006

2005 Assets Federal Funds Sold and Other Interest Bearing Cash

$63,673 $86,989 Investment Securities 109,176 44,161 Commercial and

Other Loans 799,335 678,086 Allowance for Loan Losses (8,058)

(7,617) Other Assets 44,437 49,236 Total Assets $1,008,563 $850,855

Liabilities and Shareholders' Equity: Transaction Accounts $385,950

$381,931 Time Deposit Accounts 368,823 265,912 FHLB Advances and

Trust Preferred Securities 165,909 130,053 Other Liabilities 13,170

9,282 Shareholders' Equity 74,711 63,677 Total Liabilities and

Shareholders' Equity $1,008,563 $850,855 (1) EPS has been restated

for the 10% stock dividend paid May 17, 2006. Republic First

Bancorp, Inc. December 31, 2006 (unaudited) At or For the At or For

the Three Months Ended Twelve Months Ended December 31, December

31, December 31, December 31, Financial Data: 2006 2005 2006 2005

Return on average assets 1.07 % 1.32 % 1.19 % 1.22 % Return on

average equity 13.43 % 16.60 % 14.59 % 15.22 % Share information:

Book value per share $7.87 $6.79 (1) $7.87 $6.79 (1) Actual shares

outstanding at period end, net of treasury shares (250,555)

9,496,000 9,379,000 (1) 9,496,000 9,379,000 (1) Average diluted

shares outstanding 9,744,000 9,588,000 (1) 9,721,000 9,577,000 (1)

(1) EPS has been restated for the 10% stock dividend paid May 17,

2006. Republic First Bancorp, Inc. December 31, 2006 (Dollars in

thousands) (unaudited) Credit Quality Ratios: December 31, December

31, 2006 2005 Non-accrual and loans accruing, but past due 90 days

or more $6,916 $3,423 Restructured loans - - Total non-performing

loans 6,916 3,423 Other real estate owned 572 137 Total

non-performing assets $7,488 $3,560 Non-performing loans as a

percentage of total loans 0.87% 0.50% Nonperforming assets as a

percentage of total assets 0.74% 0.42% Allowance for loan losses to

total loans 1.01% 1.12% Allowance for loan losses to total

non-performing loans 116.51% 222.52% Republic First Bancorp, Inc.

December 31, 2006 (Dollars in thousands) (unaudited)

Quarter-to-Date Average Balance Sheet Three months ended Three

months ended December 31, 2006 December 31, 2005 Average Average

Average Yield/ Average Yield/ Balance Interest Cost Balance

Interest Cost Interest-Earning Assets: Commercial and other loans

$770,473 $15,481 7.97 % $658,405 $11,984 7.22 % Investment

securities 83,524 1,209 5.79 62,441 622 3.98 Federal funds sold

28,390 391 5.46 20,864 215 4.09 Total interest- earning assets

882,387 17,081 7.68 741,710 12,821 6.86 Other assets 37,410 41,329

Total assets $919,797 $17,081 $783,039 $12,821 Interest-bearing

liabilities: Interest-bearing deposits $658,955 $7,502 4.52 %

$521,017 $3,912 2.98 % Borrowed funds 94,561 1,335 5.60 101,163

1,137 4.46 Interest-bearing liabilities 753,516 8,837 4.65 622,180

5,049 3.22 Non-interest and interest-bearing funding 833,141 8,837

4.21 712,829 5,049 2.81 Other liabilities: 13,263 8,183 Total

liabilities 846,404 721,012 Shareholders' equity 73,393 62,027

Total liabilities & shareholders' equity $919,797 $783,039 Net

interest income $8,244 $7,772 Net interest margin 3.71 % 4.16 %

Republic First Bancorp, Inc. December 31, 2006 (Dollars in

thousands ) (unaudited) Year-to-Date Average Balance Sheet Twelve

months ended Twelve months ended December 31, 2006 December 31,

2005 Average Average Average Yield/ Average Yield/ Balance Interest

Cost Balance Interest Cost Interest-Earning Assets: Commercial and

other loans $728,754 $58,254 7.99 % $602,031 $42,331 7.03 %

Investment securities 57,163 3,200 5.60 51,285 1,972 3.85 Federal

funds sold 25,884 1,291 4.99 36,587 1,078 2.95 Total interest-

earning assets 811,801 62,745 7.73 689,903 45,381 6.58 Other assets

36,985 41,239 Total assets $848,786 $62,745 $731,142 $45,381

Interest-bearing liabilities: Interest-bearing deposits $597,637

$23,783 3.98 % $499,876 $13,147 2.63 % Borrowed funds 88,609 4,896

5.53 75,875 3,076 4.05 Interest-bearing liabilities 686,246 28,679

4.18 575,751 16,223 2.82 Non-interest and interest-bearing funding

768,479 28,679 3.73 664,453 16,223 2.44 Other liabilities: 10,981

8,242 Total liabilities 779,460 672,695 Shareholders' equity 69,326

58,447 Total liabilities & shareholders' equity $848,786

$731,142 Net interest income $34,066 $29,158 Net interest margin

4.20 % 4.23 % DATASOURCE: Republic First Bancorp, Inc. CONTACT:

Paul Frenkiel, CFO, Republic First Bancorp, +1-215-735-4422 ext.

5255

Copyright

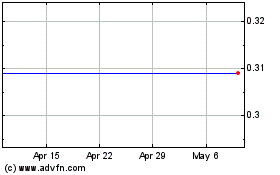

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2024 to Jun 2024

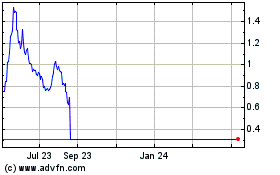

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2023 to Jun 2024