As filed with the Securities and Exchange

Commission on May 26, 2023

Registration Statement No. 333-271547

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT 1 TO

FORM F-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

RECON TECHNOLOGY, LTD

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

1389 |

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

(Primary Standard Industrial

Classification Code Number) |

(I.R.S. Employer

Identification Number) |

Room 601, Shui’an South Street

Chaoyang District, Beijing, 100012

People’s Republic of China

+86-(10) 8494-5799 — telephone

(Address, including zip

code, and telephone number, including area code, of registrant’s principal executive offices)

CT Corporation System

28 Liberty St.

New York, NY 10005

+1-212-894-8940 — telephone

(Name, address, including

zip code, and telephone number, including area code, of agent for service)

Copies to:

Anthony W. Basch, Esq.

Benming Zhang, Esq.

Kaufman & Canoles, P.C.

Two James Center, 14th Floor

1021 East Cary Street

Richmond, Virginia 23219

+1-804-771-5700 — telephone

+1-888-360-9092

— facsimile

Approximate date of commencement of proposed sale to public: From

time to time after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. x

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ¨

If an emerging growth company that prepares its financial statements

in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

| † |

The term “new or revised financial accounting standard” refers to any update

issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in this prospectus

is not complete and may be changed. The selling shareholders may not sell these securities pursuant to this prospectus until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED May 26, 2023 |

RECON TECHNOLOGY,

LTD

10,002,500 Class A

Ordinary Shares underlying Warrants

This prospectus relates to the resale,

from time to time, by the selling shareholders identified in this prospectus under the caption “Selling Shareholders,” of

up to 10,002,500 Class A shares of our Ordinary Shares (“Ordinary Shares”, “Class A Shares” or “Shares”),

par value $0.0925 per share, issuable upon exercise of warrants currently held by such Selling Shareholders as follows: 10,002,500 Class A

Ordinary Shares issuable upon the exercise of certain Class A Ordinary Share purchase warrants issued on March 15, 2023 (the

“Warrants”). The holders of the Warrants are each referred to herein as a “Selling Shareholder” and collectively

as the “Selling Shareholders.” Each of the Warrants is exercisable for one Class A Ordinary Share at an initial exercise

price of $0.80 per share.

This prospectus

also covers any additional Class A Ordinary Shares that may become issuable upon any anti-dilution adjustment pursuant to the terms

of the Warrants by reason of share splits, share dividends, subsequent equity sale and other events described therein.

The Selling Shareholders

identified in this prospectus, or their respective transferees, pledgees, donees or other successors-in-interest, may offer the Warrant

Shares issuable from time to time upon exercise of the Warrants, through public or private transactions at prevailing market prices,

at prices related to prevailing market prices or at privately negotiated prices. For additional information on the methods of sale for

the Warrant Shares that may be used by the Selling Shareholders, see the section entitled “Plan of Distribution” on page 6. For a list of the Selling Shareholders, see the section entitled “Selling Shareholders” on page 11.

The Selling Shareholders may sell any, all or

none of the securities offered by this prospectus, and we do not know when or in what amount the Selling Shareholders may sell their Warrant

Shares following the effective date of this registration statement.

We are registering the Warrant Shares on behalf

of the Selling Shareholders, to be offered and sold by them from time to time. While we will not receive any proceeds from the sale of

the Warrant Shares, we may receive up to $0.80 per share upon the cash exercise of any of the Warrants. However, we cannot predict whether,

when or in what amounts the Warrants will be exercised, and it is possible that the Warrants may expire and never be exercised, in which

case we would not receive any cash proceeds. We have agreed to bear all of the expenses incurred in connection with the registration of

the Warrant Shares. The Selling Shareholders will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer

managers and similar expenses, if any, incurred for the sale of the Warrant Shares.

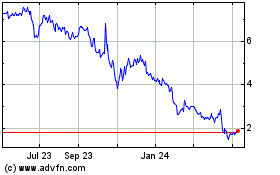

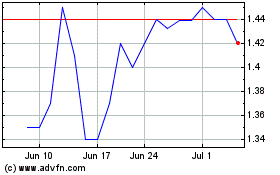

Our Class A Ordinary Shares are listed on

the Nasdaq Capital Market under the symbol “RCON.” On April 27, 2023, the last reported sale price of our Class A

Ordinary Shares on the Nasdaq Capital Market was $0.4043 per share. The applicable prospectus supplement will contain information, where

applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities covered by the prospectus

supplement.

Investing in our Ordinary Shares involves a

high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 9 to read about factors you should consider before buying our Ordinary Shares.

We are a Cayman Islands holding company. We are

not a Chinese operating company, and do not conduct business operations directly in China. All China operations are conducted by our subsidiaries

established in the People’s Republic of China (“PRC” or “China”) and in the Hong Kong Special Administrative

Region of the People’s Republic of China (“HKSAR” or “Hong Kong”), and by our contractual arrangements with

variable interest entities, or “VIEs,” and the VIEs’ subsidiaries located in China. This is an offering of the

Securities of the Cayman Islands holding company, which does not conduct operations. This structure involves unique risks

to investors. The VIE structure provides contractual exposure to foreign investment in Chinese-based companies, pursuant to which U.S.

GAAP accounting rules require us to consolidate such VIEs’ financial results in our financial statements. VIE structures are

generally used where Chinese law prohibits direct foreign investment in the operating companies. Investors may never directly hold equity

interests in the Chinese operating companies. Unless otherwise stated, as used in this prospectus and in the context of describing our

operations and consolidated financial information, “we,” “us,” “Company,” or “our,” refers

to Recon Technology, Ltd, a Cayman Islands exempted limited company, together with our subsidiaries. “Our subsidiaries” refer

to Recon Investment Ltd. and Recon Hengda Technology (Beijing) Co. Ltd., or Recon-IN and Recon-BJ, respectively. “VIEs” refers

to the PRC variable interest entities and their subsidiaries (Nanjing Recon Technology Co., Beijing BHD Petroleum Technology Co., Gan

Su BHD Environmental Technology Co. Ltd, Huang Hua BHD Petroleum Equipment Manufacturing Co. Ltd., and Qing Hai BHD New Energy Technology

Co. Ltd., Future Gas Station (Beijing) Technology, Ltd., or “Nanjing Recon,” “BHD,” “Gan Su BHD,”

“HH BHD,” “Qing Hai BHD,” and “FGS” respectively). You are not investing in Nanjing Recon, BHD, Gan

Su BHD, HH BHD, Qing Hai BHD, or FGS. Instead, we entered into certain contracts (the “VIE Agreements”) dated April 1,

2019, which are used to provide investors exposure to foreign investment in China-based companies where Chinese law prohibits or restricts

direct foreign investment in the operating companies. A wholly foreign-owned entity (“WFOE”) is a limited liability company

based in the People’s Republic of China but wholly owned by foreign investors. In our instance, Recon-BJ is a WFOE wholly owned

by us through our subsidiary, Recon-IN, a Hong Kong limited company. As a result of our direct ownership in the WFOE and the VIE Agreements,

we are regarded as the primary beneficiary of the VIE for accounting purposes.

We mainly conduct our business through the VIEs,

Nanjing Recon, BHD and their respective subsidiaries by means of Contractual Arrangements. Because we do not hold equity interests in

the VIEs and their subsidiaries, we are subject to risks due to the uncertainty of the interpretation and application of the PRC laws

and regulations regarding VIEs and the VIE structure, including but not limited to regulatory review of overseas listing of PRC companies

through a special purpose vehicle, and the validity and enforcement of the contractual arrangements with the VIEs. We are also subject

to the risk that the PRC government could disallow the VIE structure, which would likely result in a material change in our operations

and as a result the value of Securities may depreciate significantly or become worthless. At the time of this filing, the Contractual

Agreements have not been tested in a court of law.

For U.S. GAAP purposes, each VIE has its own operating

cash flow. Cash flow between our Company and the VIEs primarily consists of transfers from us to the VIEs for supplemental working capital,

which is mainly used in purchase of materials and payment of operating expenses and investments. In addition, the VIEs occasionally make

payments on our behalf when we experience a cash shortage. For the fiscal years ended June 30, 2022, 2021 and 2020, net cash

transferred from the Company to the VIEs was RMB55,569,342, RMB15,720,667 and RMB5,260,340, respectively. There was no cash transferred

from the VIEs to the Company or fees paid on behalf of the Company by the VIEs during the years ended June 30, 2022, 2021 and 2020.

Neither we nor the VIEs have present plans to distribute earnings or settle amounts owed under the Contractual Agreements. Cash

in the VIEs are expected to be retained for business growth and operation. No dividends or distributions have been declared to pay to

us from our subsidiaries or the VIEs. No dividends or distributions were made to any U.S. investors.

We are also subject to legal and operational risks

associated with being based in and having the majority of the Company’s and VIEs’ operations in China. These risks may result

in a material change in our operations, or a complete hindrance of our ability to offer or continue to offer our securities to investors

and could cause the value of our securities to significantly decline or become worthless. Recently, the PRC government initiated a series

of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal

activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structures,

adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On July 6,

2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued

an announcement to crack down on illegal activities in the securities market and promote the high-quality development of the capital market,

which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and

judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial

application of the PRC securities laws. On July 10, 2021, the PRC State Internet Information Office issued the Measures of Cybersecurity

Review (Revised Draft for Comments, not yet effective), which requires cyberspace operators with personal information of more than 1 million

users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. Furthermore, the Chinese education

sector is going through a series of reforms and new laws and guidelines have been recently promulgated and released to regulate our industry.

As of the date of this prospectus, these new laws and guidelines have not impacted the Company’s ability to conduct its business,

accept foreign investments, or list on a U.S. or other foreign exchange because the Company and the VIEs are not involved in the education

industry and do not maintain data of more than 1 million users; however, there are uncertainties in the interpretation and enforcement

of these new laws and guidelines, which could materially and adversely impact our business and financial outlook.

Our Securities may be prohibited to trade on a

national exchange or “over-the-counter” markets under the Holding Foreign Companies Accountable Act (the “HFCAA Act”)

if the Public Company Accounting Oversight Board (“PCAOB”) is unable to inspect our auditors for three consecutive years beginning

in 2021. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”)

and the U.S. House of Representatives introduced the AHFCAA on December 14, 2021 and referred to the House Committee on Financial

Services. If signed into law, the AHFCAA would amend the HFCAA Act and require the SEC to prohibit an issuer’s securities from trading

on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive

years, thereby reducing the time before our securities may be prohibited from trading or delisted.

Pursuant to the HFCAA, the PCAOB issued a Determination

Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting

firms headquartered in: (1) mainland China of the PRC, and (2) Hong Kong. In addition, the PCAOB’s report identified the

specific registered public accounting firms which are subject to these determinations. Our auditor, Marcum Asias CPA LLP is not subject

to the Determination Report issued on December 16, 2021.

The recent joint statement by the SEC and PCAOB,

proposed rule changes submitted by Nasdaq, and the HFCAA all call for additional and more stringent criteria to be applied to emerging

market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB.

These developments could add uncertainties to our offering.

On August 26, 2022, the PCAOB signed a Statement

of Protocol with the China Securities Regulatory Commission (“CSRC”) and the Ministry of Finance of the PRC, which sets out

specific arrangements on conducting inspections and investigations by both sides over relevant audit firms within the jurisdiction of

both sides, including the audit firms based in mainland China and Hong Kong. This agreement marks an important step towards resolving

the audit oversight issue that concern mutual interests, and sets forth arrangements for both sides to cooperate in conducting inspections

and investigations of relevant audit firms, and specifies the purpose, scope and approach of cooperation, as well as the use of information

and protection of specific types of data. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete

access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate

its previous determinations to the contrary.

On February 17, 2023, the CSRC promulgated

the Trial Measures and five supporting guidelines, which went into effect on March 31, 2023. Pursuant to Article 16 of the Trial Measures,

domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with

the CSRC pursuant to the requirements of the Trial Measures within three working days following its submission of initial public offerings

or listing application. We have been advised by our PRC counsel, Jingtian & Gongcheng, based on their understanding of the Trial

Administrative Measures, that the registration of the Shares underlying the Warrants contemplated by this prospectus does not trigger

the filing procedures with the CSRC because the Company is registering the Warrant Shares on behalf of the Selling Shareholders. However,

the Company will file with the CSRC if any of the Selling Shareholders exercises the Warrants. If a domestic company fails to complete

required filing procedures or conceals any material fact or falsifies any major content in its filing documents, such domestic company

may be subject to administrative penalties, such as an order to rectify, warnings, fines, and its controlling shareholders, actual controllers,

the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and

fines.

Our auditor is currently subject to PCAOB inspections,

and the PCAOB is able to inspect our auditor. Our auditor, Marcum Asia CPAs LLP, is headquartered in Manhattan, New York, and has

been inspected by the PCAOB on a regular basis with the last inspection in June 2018. Our auditor is not headquartered in mainland

China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determination. Notwithstanding the foregoing,

in the future, if there is any regulatory change or step taken by PRC regulators that does not permit Marcum Asia CPAs LLP to provide

audit documentations located in China or Hong Kong to the PCAOB for inspection or investigation, or the PCAOB expands the scope of the

Determination so that we are subject to the HFCAA Act, as the same may be amended, or if the agreement between the PCAOB and the CSRC

on August 26, 2022 does not succeed, you may be deprived of the benefits of such inspection which could result in limitation or restriction

to our access to the U.S. capital markets and trading of our securities, including trading on the national exchange and trading on “over-the-counter”

markets, may be prohibited under the HFCAA Act.

Investing in our securities involves a high

degree of risk. See “Risk Factors” on page 9 of this prospectus and in the documents incorporated by reference in this

prospectus, as updated in the applicable prospectus supplement, any related free writing prospectus and other future filings we make with

the Securities and Exchange Commission that are incorporated by reference into this prospectus, for a discussion of the factors you should

consider carefully before deciding to purchase our securities.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus is [___], 2023.

Table of Contents

About

This Prospectus

This prospectus describes the general manner in

which the Selling Shareholders may offer from time to time up to an aggregate of 10,002,500 Class A Ordinary Shares issuable upon

the exercise of the Warrants. You should rely only on the information contained in this prospectus and the related exhibits, any prospectus

supplement or amendment thereto and the documents incorporated by reference, or to which we have referred you, before making your investment

decision. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information. If anyone provides

you with different or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement or amendments thereto

do not constitute an offer to sell, or a solicitation of an offer to purchase, the Warrant Shares offered by this prospectus, any prospectus

supplement or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation

of an offer in such jurisdiction. You should not assume that the information contained in this prospectus, any prospectus supplement or

amendments thereto, as well as information we have previously filed with the U.S. Securities and Exchange Commission (the “SEC”),

is accurate as of any date other than the date on the front cover of the applicable document.

This prospectus is part of a registration statement on Form F-1

that we have filed with the Securities and Exchange Commission, or SEC. It omits some of the information contained in the registration

statement, and reference is made to the full registration statement for further information with regard to us and the securities being

offered by the selling shareholders. Any statement contained in the prospectus concerning the provisions of any document filed as an exhibit

to the registration statement or otherwise filed with the SEC is not necessarily complete, and in each instance, reference is made to

the copy of the document filed. You should review the complete document to evaluate these statements.

You should read this prospectus, any documents that we incorporate

by reference in this prospectus and the information below under the caption “Where You Can Find More Information” and “Incorporation

of Documents By Reference” before making an investment decision. You should rely only on the information contained or incorporated

by reference in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides

you with additional, different or inconsistent information, you should not rely on it.

This prospectus is not an offer to sell these securities and it is

not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information in this prospectus or any

documents we incorporate by reference herein is accurate as of any date other than the date on the front of each document. Our business,

financial condition, results of operations and prospects may have changed since those dates.

This prospectus and the documents that are incorporated by reference

herein contain certain market data and industry statistics and forecasts that are based on studies sponsored by the Company or third parties,

independent industry publications and other publicly available information. Many of these statements involve risks and uncertainties and

are subject to change based on various factors, including those discussed under the caption “Risk Factors” in this prospectus

and under similar captions in the documents that are incorporated by reference herein. Accordingly, investors should not place undue reliance

on this information.

Unless the context otherwise requires, all references

in this prospectus to “Recon,” “we,” “us,” “our,” “the Company” or similar

words refer to Recon Technology, Ltd, a Cayman Island holding company, together with our subsidiaries, Recon Investment Ltd. (“Recon-IN”)

and Recon Hengda Technology (Beijing) Co., Ltd. (“Recon-BJ”). Separately, “VIEs” refers to the PRC variable

interest entities and their subsidiaries (Nanjing Recon Technology Co., Beijing BHD Petroleum Technology Co., and Future Gas Station (Beijing)

Technology, Ltd., or “Nanjing Recon,” “BHD,” and “FGS,” respectively).

Prospectus

Summary

This summary highlights selected information

about us, this offering and information contained in greater detail elsewhere in this prospectus and in the documents incorporated by

reference herein. This summary is not complete and does not contain all of the information that you should consider before investing in

our securities. You should carefully read and consider this entire prospectus and the documents, including financial statements and related

notes, and information incorporated by reference into this prospectus, including the financial statements and “Risk Factors”

in this prospectus, before making an investment decision. If you invest in our securities, you are assuming a high degree of risk.

Overview

We are a Cayman Islands holding company with subsidiaries

established in the People’s Republic of China (“PRC” or “China”) and in the Hong Kong Special Administrative

Region of the People’s Republic of China (“HKSAR” or “Hong Kong”). Our subsidiaries have contractual arrangements

with PRC variable interest entities, or “VIEs,” and the VIEs’ subsidiaries. These VIEs are Chinese companies that provide

hardware, software, and on-site services to companies in the petroleum mining, extraction and sales of refined oil industry in the PRC.

To this end, our company and our subsidiaries, Recon Investment Ltd. (“Recon-IN”) and Recon Hengda Technology (Beijing) Co., Ltd.

(“Recon-BJ”) are contractually engaged with the following PRC VIE companies and their subsidiaries: Beijing BHD Petroleum

Technology Co., Ltd. (“BHD”), Future Gas Station (Beijing) Technology, Ltd. (“FGS”), Nanjing Recon Technology

Co., Ltd. (“Nanjing Recon”), Gan Su BHD Environmental Technology Co. Ltd. (“Gan Su BHD”), Huang Hua BHD Petroleum

Equipment Manufacturing Co. Ltd. (“HH BHD”), and Qing Hai BHD New Energy Technology Co. Ltd. (“Qing Hai BHD”)

(collectively, the “Domestic Companies”), which provide services designed to automate and enhance the extraction of and facilitate

the sale of petroleum products.

We believe that one of the most important advancements in China’s

petroleum industry has been the automation of significant segments of the exploration and extraction process. The Domestic Companies’

automation products and services allow petroleum mining and extraction companies to reduce their labor requirements and improve the productivity

of oilfields. The Domestic Companies’ solutions allow our customers to locate productive oilfields more easily and accurately, improve

control over the extraction process, increase oil yield efficiency in tertiary stage oil recovery, and improve the transportation of crude

oil.

Recent Developments

On April 13, 2023, the Company filed a sticker

supplement modifying, superseding and supplementing certain information contained in our prospectus filed with the SEC dated July 9,

2021, related to the offer and resale of up to an aggregate of 8,814,102 Class A ordinary shares, par value $0.0925 per share issuable

upon exercise of warrants currently held by such Selling Shareholders as follows: 8,814,102 ordinary shares issuable upon exercise of

certain ordinary share purchase warrants issued on June 16, 2021. In connection with the recent registered direct offering and concurrent

private placement, we agreed to reduce the exercise price of the warrants issued by us on June 16, 2021 to $0.80 per share following

the closing on March 17, 2023.

On March 15, 2023, the Company and certain

institutional investors (the “Purchasers”) entered into that certain securities purchase agreement (the “Purchase Agreement”),

pursuant to which the Company agreed to sell to such Purchasers an aggregate of 8,827,500 Class A ordinary shares, par value $0.0925

per share (the “Ordinary Shares”) and 1,175,000 pre-funded warrants (the “Pre-Funded Warrants”) to purchase ordinary

shares in a registered direct offering, and warrants to purchase up to 10,002,500 Class A Ordinary Shares (the “Warrants”)

in a concurrent private placement, for gross proceeds of approximately $8.0 million (the “Offering”) before deducting the

placement agent’s fees and other estimated offering expenses. In connection with the Private Placement, we are registering the resale

of our Ordinary Shares issuable upon the exercise of the Warrants. The sale and offering of the Shares and the Pre-Funded Warrants

were effected as a takedown off the Company’s shelf registration statement on Form F-3 (File No. 333-268657) (the “Registration

Statement”). The Warrants and ordinary shares underlying the Warrants were offered pursuant to an exemption from the registration

requirements of Section 5 of the Securities Act of 1933, as amended, contained in Section 4(a)(2) thereof and/or Regulation

D promulgated thereunder.

Corporate Information

Our principal executive offices are located at

Room 601, 1 Shui’an South Street, Chaoyang District, Beijing, 100012, People’s Republic of China. Our telephone number at

this address is +86 (10) 8494-5799. Our Class A Ordinary Shares are traded on the NASDAQ Capital Market under the symbol “RCON.”

Our Internet website, www.recon.cn, provides a variety of information

about our Company. We do not incorporate by reference into this prospectus the information on, or accessible through, our website, and

you should not consider it as part of this prospectus. Our annual reports on Form 20-F and current reports on Form 6-K filed

with the SEC are available, as soon as practicable after filing, at the investors’ page on our corporate website, or by a direct

link to its filings on the SEC’s free website.

The Offering

This prospectus relates to the offer and resale

by the Selling Shareholders of an aggregate of 10,002,500 Warrant Shares issuable upon the exercise of the Warrants. All of the Warrant

Shares, when sold, will be sold by the Selling Shareholders. The Selling Shareholders may sell the Warrant Shares from time to time at

prevailing market prices or at privately negotiated prices.

| Shares offered by the selling shareholders: |

|

10,002,500 Class A Ordinary Shares. |

| Shares Outstanding Prior to Completion of Offering: |

|

38,528,218 (excluding (i) 1,175,000 ordinary shares issuable to investors upon exercise of the Pre-Funded Warrants offered in this offering; (ii) 10,002,500 ordinary shares issuable to investors upon exercise of the Warrants offered in the concurrent private placement; (iii) 2,547,444 ordinary shares issuable upon vesting of restricted shares to certain directors, employees, officers, and consultants; and (iii) 80,000 ordinary shares issuable upon the exercise of outstanding options and vesting of restricted shares under the Company’s incentive plan.) |

| Terms of this offering: |

|

The selling shareholders, including their transferees, donees, pledgees, assignees and successors-in-interest, may sell, transfer or otherwise dispose of any or all of Ordinary Shares offered by this prospectus from time to time on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. The Ordinary Shares may be sold at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price or at negotiated prices. |

| Use of proceeds |

|

While we will not receive any

proceeds from the sale of the Warrant Shares offered by this prospectus by the Selling Shareholders, we may receive cash proceeds of

up to $8,002,000 from the cash exercise of the Warrants, as each of the Warrants has an exercise price of $0.80 per share and such

Warrants are exercisable into an aggregate of 10,002,500 Ordinary Shares. |

| Nasdaq Capital Market Symbol: |

|

RCON |

| Risk Factors: |

|

An investment in the Ordinary Shares offered under this prospectus is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section on page 9 and other information in this prospectus for a discussion of risks. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations. |

Risk

Factors

Before you make a decision to invest in our securities,

you should consider carefully the risks described below. If any of the following events actually occur, our business, operating results,

prospects or financial condition could be materially and adversely affected. This could cause the trading price of our Ordinary Shares

to decline and you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional risks

not presently known to us or that we currently deem immaterial may also significantly impair our business operations and could result

in a complete loss of your investment.

You should also carefully consider the risk factors

set forth under “Risk Factors” described in our most recent annual report on Form 20-F, filed on October 28, 2022, together with all other information contained or incorporated by reference in this prospectus and any applicable prospectus supplement

and in any related free writing prospectus in connection with a specific offering, before making an investment decision. Each of the risk

factors could materially and adversely affect our business, operating results, financial condition and prospects, as well as the value

of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment.

Risks Related to an Investment in Our Securities

and this Offering

The sale of a substantial amount of our

ordinary shares, including resale of the ordinary shares issuable upon the exercise of the warrants held by the selling shareholders in

the public market could adversely affect the prevailing market price of our ordinary shares.

We are registering for resale 10,002,500 Ordinary

Shares issuable upon the exercise of warrants held by the selling shareholders. Sales of substantial amounts of shares of our ordinary

shares in the public market, or the perception that such sales might occur, could adversely affect the market price of our ordinary shares,

and the market value of our other securities. We cannot predict if and when selling shareholders may sell such shares in the public markets.

Furthermore, in the future, we may issue additional ordinary shares or other equity or debt securities convertible into ordinary shares.

Any such issuance could result in substantial dilution to our existing shareholders and could cause our stock price to decline.

There has been and may continue to be significant

volatility in the volume and price of our ordinary shares on the Nasdaq Capital Market.

The market price of our ordinary shares has been

and may continue to be highly volatile. Factors, including changes in the Chinese petroleum and energy industry, changes in the Chinese

economy, potential infringement of our intellectual property, competition, concerns about our financial position, operations results,

litigation, government regulation, developments or disputes relating to agreements, patents or proprietary rights, may have a significant

impact on the market volume and price of our stock. Unusual trading volume in our shares occurs from time to time.

If we fail to satisfy applicable listing

standards, our ordinary shares may be delisted from the Nasdaq Capital Market.

On April 27, 2023, we received a letter from the

Listings Qualifications Department of The Nasdaq Capital Market (“Nasdaq”) notifying us that the minimum closing bid price

per share for our Ordinary Shares was below $1.00 for a period of 30 consecutive business days and that the Registrant did not meet the

minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2). This current report is filed pursuant to Nasdaq Listing Rule

5810(b). The Nasdaq notification letter does not result in the immediate delisting of our Ordinary Shares, and the shares have continued

to trade uninterrupted under the symbol “RCON.”

Pursuant to Nasdaq Listing Rule 5810(c)(3)(A),

we have a compliance period of one hundred eighty (180) calendar days, or until October 24, 2023 (the “Compliance Period”),

to regain compliance with Nasdaq’s minimum bid price requirement. If at any time during the Compliance Period, the closing bid price

per share of the our Ordinary Shares is at least $1.00 for a minimum of ten (10) consecutive business days, Nasdaq will provide us with

a written confirmation of compliance and the matter will be closed.

In the event the Registrant does not regain compliance

by October 24, 2023, the Registrant may be eligible for an additional 180 calendar day grace period. To qualify, the Registrant will be

required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for

Nasdaq, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the deficiency

during the second compliance period, including by effecting a reverse stock split, if necessary. If the Registrant chooses to implement

a reverse stock split, it must complete the split no later than ten (10) business days prior to the expiration of the second compliance

period.

We intend to regain compliance with Nasdaq’s

minimum bid price requirement during the Compliance Period. There can be no assurances, however, that we will be successful in satisfying

the Minimum-Bid Price Requirement or the continued listing requirement for market value of publicly held shares and all other initial

listing standards for Nasdaq. It is possible that we will fail to comply with the continued listing requirement of Nasdaq Marketplace

Rule 5550(a)(2) again or any other listing requirements. If so, and Nasdaq may delist our shares if we cannot regain compliance timely.

Delisting could also have other negative results, including the potential

loss of confidence by employees, the loss of institutional investor interest and fewer business development opportunities. If our shares

is delisted by the Nasdaq the price of our ordinary shares decline.

Risks Related to Doing Business In China

Additional compliance procedures may

be required in connection with this offering, due to the promulgation of the new filing-based administrative rules for overseas offering

and listing by domestic companies in China, which could significantly limit or completely hinder our ability to offer or continue to

offer our Ordinary Shares to investors and could cause the value of our Ordinary Shares to significantly decline or become worthless.

On February 17, 2023, the CSRC promulgated

the Trial Measures and five supporting guidelines, which went into effect on March 31, 2023. Pursuant to Article 16 of the Trial Measures,

domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with

the CSRC pursuant to the requirements of the Trial Measures within three working days following its submission of initial public offerings

or listing application. Where an issuer offers securities in the same overseas market after overseas initial public offerings or listing,

it shall complete filing procedures with the CSRC within three working days after completion of offering. The required filing materials

with the CSRC in relation to the offering in the same overseas market include (without limitation): (i) record-filing reports and

related undertakings; and (ii) PRC legal opinions issued by domestic law firms (with related undertakings).

Pursuant to the Trial Administrative Measures,

we have to file with the CSRC with respect to this offering, and the CSRC will conclude the filing procedures and publish the filing

results on the CSRC website within twenty working days after receiving the filing documents, if the filing documents are complete and

in compliance with stipulated requirements. However, during the filing process, the CSRC may request the Company to supply additional

documents or may consult with competent authorities, the time for which will not be counted in the twenty working days. This prospectus

involves the registration of the Shares underlying the Warrants which were issued on March 17, 2023 to certain Selling Shareholders.

The Company registered the Warrant Shares on behalf of the Selling Shareholders. Therefore, we believe that such registration does not

fall under the Trial Administrative Measures of an issuer offering securities. However, the Company will file with the CSRC if any of

the Selling Shareholders exercises the Warrants. Any failure or perceived failure of the Company to fully comply with the filing requirements

could significantly limit or completely hinder our ability to offer or continue to offer securities to investors, cause significant disruption

to our business operations, and severely damage our reputation, which could materially and adversely affect our financial condition and

results of operations and could cause the value of our securities to significantly decline or be worthless.

Special

Note Regarding Forward-Looking Statements

This prospectus contains forward-looking statements. All statements

contained in this prospectus other than statements of historical fact, including statements regarding our future results of operations

and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The

words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” and similar expressions are intended to identify forward-looking statements. We have based

these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may

affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives,

and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those

described in the “Risk Factors” section. Moreover, we operate in a very competitive and rapidly changing environment. New

risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors

on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and

trends discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied

in the forward-looking statements.

You should not rely upon forward-looking statements as predictions

of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe

that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance, or achievements. We do not undertake to update any of these forward-looking statements after the date of this prospectus

or to conform these statements to actual results or revised expectations, other than required by the federal securities laws or other

applicable laws.

Use of

Proceeds

The Selling Shareholders will receive all of the

proceeds from the sale of Warrant Shares under this prospectus. We will not receive any proceeds from these sales. To the extent that

we receive proceeds from the exercise of the Warrants, we will use those proceeds to pay for the expenses of this offering and for working

capital and other general corporate purposes. The Selling Shareholders will pay any agent’s commissions and expenses they incur

for brokerage, accounting, tax or legal services or any other expenses that they incur in disposing of the Warrant Shares. We will bear

all other costs, fees and expenses incurred in effecting the registration of the Warrant Shares covered by this prospectus and any prospectus

supplement. These may include, without limitation, all registration and filing fees, SEC filing fees and expenses of compliance with state

securities or “blue sky” laws.

See “Plan of Distribution” elsewhere

in this prospectus for more information.

Capitalization

The following table sets forth our capitalization

as of December 31, 2022. The information in this table should be read in conjunction with and is qualified by reference to the financial

information thereto and other financial information incorporated by reference into this prospectus.

| | |

December 31, 2022 | |

| | |

(a) Actual | | |

(b) Pro Forma(1) | |

| | |

US$ | | |

US$ | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Indebtedness | |

| | |

| |

| Short-term Debt | |

| 7,473,545 | | |

| 7,473,545 | |

| Long-term Debt | |

| 6,362,816 | | |

| 6,362,816 | |

| Total indebtedness | |

| 13,836,361 | | |

| 13,836,361 | |

| Equity | |

| | | |

| | |

| Class A ordinary shares, $0.0925 U.S. dollar par value, 150,000,000 shares authorized; 29,700,718 shares and 29,700,718 shares issued and outstanding as of June 30, 2022 and December 31, 2022, respectively(2) | |

| 2,609,581 | | |

| 3,534,812 | |

| Class B ordinary shares, $0.0925 U.S. dollar par value, 20,000,000 shares authorized; 4,100,000 shares and 4,100,000 shares issued and outstanding as of June 30, 2022 and December 31, 2022, respectively | |

| 349,144 | | |

| 349,144 | |

| Additional paid-in capital(2) | |

| 72,791,843 | | |

| 79,868,612 | |

| Statutory reserves | |

| 601,442 | | |

| 601,442 | |

| Accumulated deficit | |

| (20,461,555 | ) | |

| (20,461,555 | ) |

| Accumulated other comprehensive gain | |

| 3,040,048 | | |

| 3,040,048 | |

| Non-controlling interests | |

| (1,122,484 | ) | |

| (1,122,484 | ) |

| Total equity | |

| 57,808,019 | | |

| 65,810,019 | |

| Total Liabilities and Equity | |

| 71,644,380 | | |

| 79,646,380 |

| |

(1) |

Gives effect to completion of the offering and to reflect the application of the proceeds. |

| |

(2) |

Pro forma additional paid in capital reflects the net proceeds we assume to receive

from cash exercise of the Warrants. We assume to receive approximately $8,002,000 million (gross proceeds from cash exercise of the Warrants). |

Selling

Shareholders

The Warrant Shares being offered by the Selling

Shareholders are those issuable upon the exercise of the Warrants. For additional information regarding the issuance of these securities,

see “Recent Developments” on page 7 of this prospectus. We are registering the Warrant Shares issuable upon exercise

of the Warrants in order to permit the Selling Shareholders to offer such shares for resale from time to time. Except for the ownership

of the Warrants, the transactions contemplated pursuant to the SPA, and as disclosed in this section under “Material Relationships

with Selling Shareholders”, none of the Selling Shareholders have had any material relationship with us within the past three years.

The following table sets forth certain information

with respect to each Selling Shareholder, including (i) the Ordinary Shares beneficially owned by the Selling Shareholder prior to

this offering, (ii) the number of Warrant Shares being offered by the Selling Shareholder pursuant to this prospectus and (iii) the

Selling Shareholders’ beneficial ownership after completion of this offering. The registration of the Warrant Shares issuable to

the Selling Shareholders upon the exercise of the Warrants does not necessarily mean that the Selling Shareholders will sell all or any

of such shares, but the number of Ordinary Shares and percentages set forth in the final two columns below assume that all Warrant Shares

being offered by the Selling Shareholders are sold. The final two columns also assume the exercise of all of the Warrants held by the

Selling Shareholders as of April 27, 2023, without regard to any limitations on exercise described in this prospectus or in the Warrants.

See “Plan of Distribution.”

The table is based on information supplied to

us by the Selling Shareholders, with beneficial ownership and percentage ownership determined in accordance with the rules and regulations

of the SEC, and includes voting or investment power with respect to Ordinary Shares. This information does not necessarily indicate beneficial

ownership for any other purpose. In computing the number of Ordinary Shares beneficially owned by a Selling Shareholder and the percentage

ownership of that Selling Shareholder, Ordinary Shares subject to warrants held by that Selling Shareholder that are exercisable for Ordinary

Shares within 60 days after April 27, 2023, are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes

of computing the percentage ownership of any other shareholder.

This prospectus covers the resale of up to an

aggregate of 10,002,500 Warrant Shares that may be sold or otherwise disposed of by the Selling Shareholders. Such shares are issuable

to the Selling Shareholders upon the exercise of the Warrants. The Warrants are immediately exercisable at an initial exercise price of

$0.80 per share on the date of their issuance and expire five and a half (5.5) years from the date on which they became exercisable. See

“Registered Direct Offering and Concurrent Private Placement” in this prospectus for further details relating to the Warrant

Shares and the Warrants.

| |

|

Number of

Ordinary

Shares

Beneficially

Owned

Prior to

Offering(1) |

|

|

Maximum

Number of

Ordinary

Shares

to be Sold

Pursuant to

this

Prospectus(2) |

|

|

Number of

Ordinary

Shares

Beneficially

Owned

After

Offering(3) |

|

|

Percentage

Beneficially

Owned

After

Offering(3) |

|

| Sabby Volatility Warrant Master Fund, Ltd.(4) |

|

|

13,678,646 |

|

|

|

4,875,000 |

|

|

|

8,803,646 |

|

|

|

4.99 |

% |

| Alto Opportunity Master Fund SPC – Segregated Master Portfolio B(5) |

|

|

1,718,546 |

|

|

|

675,000 |

|

|

|

1,043,546 |

|

|

|

2.71 |

% |

| L1 Capital Global Opportunities Master Fund(6) |

|

|

760,000 |

|

|

|

440,000 |

|

|

|

320,000 |

|

|

|

* |

|

| Empery Asset Master, Ltd.(7) |

|

|

709,463 |

|

|

|

396,712 |

|

|

|

312,751 |

|

|

|

* |

|

| Empery Tax Efficient, LP(8) |

|

|

203,781 |

|

|

|

119,610 |

|

|

|

84,171 |

|

|

|

* |

|

| Empery Tax Efficient III, LP(9) |

|

|

255,025 |

|

|

|

171,178 |

|

|

|

83,847 |

|

|

|

* |

|

| Hudson Bay Master Fund Ltd.(10) |

|

|

1,150,000 |

|

|

|

675,000 |

|

|

|

475,000 |

|

|

|

1.23 |

% |

| Armistice Capital Muster Fund Ltd.(11) |

|

|

4,850,000 |

|

|

|

2,650,000 |

|

|

|

2,200,000 |

|

|

|

4.99 |

% |

| TOTAL |

|

|

23,325,461 |

|

|

|

10,002,500 |

|

|

|

13,322,961 |

|

|

|

- |

|

| * |

Less than one percent

|

| |

|

| (1) |

All of the Warrants that are exercisable for the Warrant Shares offered hereby contain certain beneficial ownership limitations, which provide that a holder of the Warrants will not have the right to exercise any portion of its Warrants if such holder, together with its affiliates, would beneficially own in excess of 4.99% or 9.99%, as applicable, of the number of Ordinary Shares outstanding immediately after giving effect to such exercise, provided that upon at least 61 days’ prior notice to us, a holder may increase or decrease such limitation up to a maximum of 9.99% of the number of Ordinary Shares outstanding (each such limitation, a “Beneficial Ownership Limitation”). However, for purposes of determining beneficial ownership prior to the offering, we have included all Warrant Shares and shares underlying any other warrants. As a result, the number of Ordinary Shares reflected in this column as beneficially owned by each Selling Shareholder includes (a) any outstanding Ordinary Shares held by such Selling Shareholder, and (b) if any, the number of Ordinary Shares subject to the Warrants exercisable for the Warrant Shares offered hereby and any other warrants that may be held by such Selling Shareholder, in each case which such Selling Shareholder has the right to acquire as of April 27, 2023 or within 60 days thereafter. |

| |

|

| (2) |

Represents the total number of Warrant Shares owned by each of the Selling Shareholders, assuming full exercise of the Warrants offered hereby. |

| |

|

| (3) |

Assumes the Selling Shareholder sells all of the Ordinary Shares being offered by this prospectus. |

| |

|

| (4) |

Consists of (i) 3,625,946 Ordinary Shares, (ii) Warrants to purchase

up to 4,000,000 Ordinary Shares with an exercise price of $0.80 per share with the beneficial ownership not to exceed 4.99% and warrants

to purchase up to 4,875,000 Ordinary Shares with an exercise price of $0.80 per share with the beneficial ownership not to exceed 4.99%;

(iii) Pre-Funded Warrants to purchase up to 1,175,000 Ordinary Shares with the beneficial ownership not to exceed 9.99%; and (iv) Call

options to purchase up to 2,700 Ordinary Shares at a strike price of $2.50 and expiring on January 19, 2024. Sabby Management, LLC serves

as the investment manager of Sabby Volatility Warrant Master Fund, Ltd., or Sabby. Hal Mintz is the manager of Sabby Management,

LLC and has voting and investment control of the securities held by Sabby Volatility Warrant Master Fund, Ltd. Each of Sabby Management,

LLC and Hal Mintz disclaims beneficial ownership over the securities beneficially owned by Sabby Volatility Warrant Master Fund, Ltd.,

except to the extent of their respective pecuniary interest therein. |

| (5) |

Consists of (i) Warrants to purchase up to 475,000 Ordinary Shares

with an exercise price of $0.80 per share and warrants to purchase up to 675,000 Ordinary Shares with an exercise price of $0.80 per share

and (ii) 568,546 Ordinary Shares. Ayrton Capital LLC, the investment manager to Alto Opportunity Master Fund, SPC - Segregated Master

Portfolio B, has discretionary authority to vote and dispose of the shares held by Alto Opportunity Master Fund, SPC - Segregated Master

Portfolio B and may be deemed to be the beneficial owner of these shares. Waqas Khatri, in his capacity as Managing Member of Ayrton Capital

LLC, may also be deemed to have investment discretion and voting power over the shares held by Alto Opportunity Master Fund, SPC - Segregated

Master Portfolio B. Ayrton Capital LLC and Mr. Khatri each disclaim any beneficial ownership of these shares. |

| |

|

| (6) |

Consists of Warrants to purchase up to 320,000

Ordinary Shares with an exercise price of $0.80 per share and warrants to purchase up to 440,000 Ordinary Shares with an exercise price

of $0.80 per share. The address for L1 Capital Global Opportunities Master Fund (“L1”) is 161A Shedden Road, 1 Artillery Court,

PO Box 10085, Grand Cayman KY1-1001, Cayman Islands, and its control person is David Feldman.

|

| (7) |

Consists of Warrants to purchase up to 312,751

Ordinary Shares with an exercise price of $0.80 per share and warrants to purchase up to 396,712 Ordinary Shares with an exercise price

of $0.80 per share. Empery Asset Management LP, the authorized agent of Empery Asset Master Ltd ("EAM"), has discretionary authority

to vote and dispose of the shares held by EAM and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane,

in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power

over the shares held by EAM. EAM, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

|

| (8) |

Consists of Warrants to purchase up to 84,171 Ordinary Shares with an exercise price of $0.80 per share and warrants to purchase up to 119,610 Ordinary Shares with an exercise price of $0.80 per share. Empery Asset Management LP, the authorized agent of Empery Tax Efficient, LP ("ETE"), has discretionary authority to vote and dispose of the shares held by ETE and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE. ETE, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. |

| |

|

| (9) |

Consists of Warrants to purchase up to 83,847

Ordinary Shares with an exercise price of $0.80 per share and warrants to purchase up to 171,178 Ordinary Shares with an exercise price

of $0.80 per share. Empery Asset Management LP, the authorized agent of Empery Tax Efficient III, LP ("ETE III"), has discretionary

authority to vote and dispose of the shares held by ETE III and may be deemed to be the beneficial owner of these shares. Martin Hoe and

Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and

voting power over the shares held by ETE III. ETE III, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

|

| (10) |

Consists

of Warrants to purchase up to 475,000 Ordinary Shares with an exercise price of $0.80 per share with the beneficial ownership not

to exceed 4.99% and warrants to purchase up to 675,000 Ordinary Shares with an exercise price of $0.80 per share. Hudson Bay Capital Management

LP, the investment manager of Hudson Bay Master Fund Ltd., has voting and investment power over these securities. Sander Gerber is the

managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay Master

Fund Ltd. and Sander Gerber disclaims beneficial ownership over these securities.

|

| (11) |

Consists of Warrants to purchase up to 2,200,000 Ordinary Shares with

an exercise price of $0.80 per share with the beneficial ownership not to exceed 4.99% and warrants to purchase up to 2,650,000 Ordinary

Shares with an exercise price of $0.80 per share with the beneficial ownership not to exceed 4.99% (collectively, the “Common Warrants”).

All of the warrants are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”),

and may be deemed to be indirectly beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment

manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice Capital and Steven Boyd

disclaim beneficial ownership of the securities except to the extent of their respective pecuniary interests therein. The Common Warrants

are subject to a beneficial ownership limitation of 4.99%, which such limitation restricts the Selling Stockholder from exercising that

portion of the warrants that would result in the Selling Stockholder and its affiliates owning, after exercise, a number of Ordinary Shares

in excess of the beneficial ownership limitation. The amounts in the table do not give effect to the beneficial ownership limitations.

The address of the Master Fund is c/o Armistice Capital, LLC, 510 Madison Ave, 7th Floor, New York, NY 10022. |

Material Relationships with Selling Shareholders

In addition to the transaction described above

in “Recent Developments,” we have had the following material relationships with

the Selling Shareholders in the last three (3) years:

On June 16, 2021, we closed (i) a registered

direct offering, of an aggregate of 6,014,102 Ordinary Shares and pre-funded warrants (the “Pre-Funded Warrants”) to purchase

2,800,000 Ordinary Shares in lieu of the Ordinary Shares and (ii) a concurrent private placement of Warrants, with a term of 5.5

years, which are exercisable for an aggregate of up to 8,814,102 Ordinary Shares at an exercise price of $6.24 per share, subject to

customary adjustments thereunder, for gross proceeds of approximately $5.8 million, before deducting underwriting discounts and commissions

and estimated offering expenses. The Pre-Funded Warrants became exercisable beginning on June 16, 2021 at an exercise price of $0.01

per share. The net proceeds from this offering are being used for working capital and general corporate purposes. This offering was conducted

pursuant to securities purchase agreement (the “SPA”), dated June 14, 2021, by and between us and each of the Selling

Shareholders, as well as a placement agency agreement, dated June 14, 2021, between us and Maxim Group LLC, the placement agent

for such offering.

On May 21, 2020, the Company and each of

L1, Hudson Bay, Intracoastal and another institutional investor entered into certain securities purchase agreement, pursuant to

which the Company agreed to sell to those selling shareholders an aggregate of 911,112 Ordinary Shares in a registered direct offering

and warrants (the “Original Warrants”) to purchase up to 911,112 Ordinary Shares in a concurrent private placement, for gross

proceeds of approximately $2.1 million (the “May Offering”). The May Offering closed on May 26, 2020, upon

the satisfaction of all closing conditions.

On June 26, 2020, the Company and each of

L1, Hudson Bay, Intracoastal and another institutional investor entered into certain securities purchase agreement, pursuant to

which the Company agreed to sell to those selling shareholders an aggregate of 1,680,000 Ordinary Shares per share in a registered direct

offering, amended warrants (the “Amended Warrants”) to purchase up to 911,112 Ordinary Shares and new warrants to purchase

up to 1,680,000 Ordinary Shares in a concurrent private placement, for gross proceeds of $2.1 million (the “June Offering”).

The Amended Warrants superseded and replaced in its entirety the Original Warrants issued on May 26, 2020. The June Offering

closed on June 30, 2020, upon the satisfaction of all closing conditions.

Plan

of Distribution

The Selling Shareholders and any of their respective

pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on any trading

market, stock exchange or other trading facility on which the securities are traded or in private transactions. These sales may be at

fixed or negotiated prices. The Selling Shareholders may use any one or more of the following methods when selling securities:

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits

purchasers; |

| |

|

|

| |

● |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately negotiated transactions; |

| |

|

|

| |

● |

settlement of short sales; |

| |

|

|

| |

● |

in transactions through broker-dealers that agree with the Selling Shareholders to sell a specified

number of such securities at a stipulated price per security; |

| |

|

|

| |

● |

through the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| |

|

|

| |

● |

a combination of any such methods of sale; or |

| |

|

|

| |

● |

any other method permitted pursuant to applicable law. |

The Selling Shareholders may also sell securities

under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Shareholders

may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Shareholders

(or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except

as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission

in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

In connection with the sale of the securities

covered hereby, the Selling Shareholders may enter into hedging transactions with broker-dealers or other financial institutions, which

may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Shareholders may

also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers

that in turn may sell these securities. The Selling Shareholders may also enter into option or other transactions with broker-dealers

or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other

financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may

resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Shareholders and any broker-dealers or agents that are

involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection

with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities

purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. We are requesting that each Selling

Shareholder inform us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to

distribute the securities. We will pay certain fees and expenses incurred by us incident to the registration of the securities.

Because the Selling Shareholders may be deemed

to be an “underwriter” within the meaning of the Securities Act, they will be subject to the prospectus delivery requirements

of the Securities Act, including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale

pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus. We are requesting

that each Selling Shareholder confirm that there is no underwriter or coordinating broker acting in connection with the proposed sale

of the resale securities by the Selling Shareholder.

We intend to keep this prospectus effective until

the earlier of (i) the date on which the securities may be resold by the Selling Shareholders without registration and without regard

to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance with the current

public information requirement under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all

of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar

effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state

securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered

or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is

complied with.

Under applicable rules and regulations under

the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities

with respect to the Ordinary Shares for the applicable restricted period, as defined in Regulation M, prior to the commencement of the

distribution. In addition, the Selling Shareholders will be subject to applicable provisions of the Exchange Act and the rules and

regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Ordinary Shares by the Selling

Shareholders or any other person. We will make copies of this prospectus available to the Selling Shareholders and are informing the

Selling Shareholders of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

Description

of Securities

We (Recon Technology, Ltd) are a Cayman Islands

exempted company with limited liability duly registered with the Cayman Islands Registrar of Companies. Our affairs are governed by our

Third Amended and Restated Memorandum and Articles of Association, the Companies Act (as revised) of the Cayman Islands, which is referred

to as the Companies Act below, and the laws of the Cayman Islands. Our corporate purposes are unrestricted and we have the authority

to carry out any object not prohibited by any law as provided by Section 7(4) of the Companies Act.

Our authorized share capital consists of 150,000,000

Class A Ordinary Shares of a nominal or par value of US$0.0925 each and 20,000,000 Class B Ordinary Shares of a nominal or

par value of US$0.0925 each. As of the date of this prospectus, 38,528,218 Class A ordinary shares and 5,600,000 Class B ordinary

shares are issued and outstanding. We have issued and outstanding 80,000 options from our share option pool.

Ordinary Shares

Holders of ordinary shares are entitled to cast

one vote for each share on all matters submitted to a vote of shareholders, including the election of directors and auditor. The holders

of ordinary shares are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of funds

legally available therefor and subject to any preference of any then authorized and issued preferred shares. Such holders do not have

any preemptive rights to subscribe for additional shares. All holders of ordinary shares are entitled to share ratably in any assets

for distribution to shareholders upon the liquidation, dissolution or winding up of the Company, subject to any preference of any then

authorized and issued preferred shares. All outstanding ordinary shares are fully paid and non-assessable.

On April 5, 2021, at the 2021 annual meeting,

to implement a dual class structure, our shareholders approved (i) a special resolution that the authorized share capital of the

Company be amended from US$1,850,000, divided into 20,000,000 ordinary shares of a nominal or par value of US$0.0925 each, to US$15,725,000,

divided into 150,000,000 Class A ordinary shares of a nominal or par value of US$0.0925 each and 20,000,000 Class B ordinary

shares of a nominal or par value of US$0.0925 each, and (ii) a special resolution that the Third Amended and Restated Memorandum

and Articles of Association of the Company to substitute the Second Amended and Restated Memorandum and Articles of Association. On April 7,

2021, we filed the Third Amended and Restated Memorandum and Articles of Association with the Registrar of Companies of the Cayman Islands.

Our Class A ordinary shares began to trade on the NASDAQ Capital Market on April 12, 2021 under the same symbol, “RCON.”

Preferred Shares

Pursuant to our Articles and Cayman Islands law,

our Company may by Special Resolution establish one or more series of preferred shares having such number of shares, designations, relative

voting rights, dividend rates, liquidation and other rights, preferences, powers and limitations as may be fixed by the Special Resolution.

Any preferred shares issued will include restrictions on voting and transfer intended to avoid having us constitute a “controlled

foreign corporation” for United States federal income tax purposes. Such rights, preferences, powers and limitations as may be

established could have the effect of discouraging an attempt to obtain control of us. The issuance of preferred shares could also adversely

affect the voting power of the holders of the ordinary shares deny shareholders the receipt of a premium on their ordinary shares in

the event of a tender or other offer for the ordinary shares and have a depressive effect on the market price of the ordinary shares.

Under the Third Amended and Restated Memorandum

and Articles of Association of the Company, the number of Class B Ordinary Shares held by a holder will be automatically and immediately

converted into an equal and corresponding number of Class A Ordinary Shares upon any direct or indirect sale, transfer, assignment

or disposition of such number of Class B Ordinary Shares by the holder. Furthermore, Class A Ordinary Shares are not convertible

into Class B Ordinary Shares under any circumstances. Finally, except for voting rights and conversion rights as set forth in the