Old Dominion Freight Line, Inc. (NASDAQ: ODFL) today announced

financial results for the three-month period ended March 31, 2016,

which include the following:

Three Months Ended March

31, %

(In thousands,

except per share amounts)

2016 2015

Chg. Revenue

$ 707,733 $ 696,245

1.6 % Operating income

$ 99,548 $

103,565

(3.9 )% Operating ratio

85.9 %

85.1 % Net income

$ 60,285 $ 62,524

(3.6

)% Basic and diluted earnings per share

$ 0.72

$ 0.73

(1.4 )% Basic and diluted weighted average

shares outstanding

83,983 85,971

(2.3 )%

David S. Congdon, Vice Chairman and Chief Executive Officer of

Old Dominion, commented, “Old Dominion produced solid results for

the first quarter despite an operating environment that continues

to be challenging. Our first-quarter revenue growth of 1.6%

reflects an economy that remained sluggish and the impact of a

23.3% decline in fuel surcharges. In addition, our non-LTL revenue

decreased $8.9 million, or 40.2%, primarily due to the strategic

elimination of certain services in the second half of 2015. While

our revenue growth was not as strong as we would have liked, we

continue to be encouraged by our ability to win market share in

this environment and will remain focused on the consistent

execution of our long-term business strategies. Our primary service

metrics remain strong, with 99% on-time delivery and a 0.37% cargo

claims ratio, and we have the capacity to accommodate our

customers’ current and future needs.

“LTL revenue growth in the first quarter included a 1.2%

increase in LTL tons per day and a 0.3% increase in LTL revenue per

hundredweight. LTL shipments per day increased 4.5%, but overall

tonnage growth was impacted by the decline in weight per shipment.

The pricing environment was relatively stable during the quarter,

as reflected by the 3.8% increase in LTL revenue per hundredweight,

excluding fuel surcharges; however, we have recently noted some

increased price competition. While we recognize that a soft

economic environment can lead to the loss of pricing discipline in

the industry, we have not seen signs of broad-based irrational

pricing.

“The Company’s operating ratio was 85.9% for the first quarter

of 2016, an increase of 80 basis points from our record first

quarter of last year. This increase was primarily a result of an

increase in salaries, wages and benefits due to a 6.7% increase in

the average number of full-time employees and increased benefit

costs. Depreciation was also higher as a result of our long-term

investments in capacity. The combination of the increase in our

operating ratio with slower revenue growth for the quarter resulted

in the slight decline in earnings per diluted share.”

Cash Flow and Use of Capital

Old Dominion’s net cash provided by operating activities was

$168.4 million for the first quarter, a decrease of 2.4% from the

first quarter of 2015. The Company had $7.1 million in cash and

cash equivalents at March 31, 2016, and its debt to total

capitalization was 6.9% compared with 8.8% at the end of the first

quarter of 2015.

Capital expenditures for the first quarter of 2016 were $120.3

million compared with $72.2 million for the first quarter last

year. The Company currently expects capital expenditures for 2016

to total approximately $405 million, which is a $35 million

reduction from the estimate the Company provided in February 2016.

This revised total includes planned expenditures of $170 million

for real estate and service center expansion projects, $200 million

for tractors and trailers and $35 million for technology and other

assets.

Old Dominion repurchased $44.6 million of its common stock

during the first quarter, leaving $35.7 million available for

repurchase under its previously authorized $200 million stock

repurchase program. The Company plans to seek authorization for a

new share repurchase program in the second quarter of 2016.

Summary

Mr. Congdon concluded, “We believe Old Dominion’s exceptional

long-term record of success - and our prospects for future

long-term profitable growth - are based firmly on our ability to

provide our customers with superior on-time, claims-free service at

a fair price. We remain committed to this customer-centric focus,

regardless of the strength of the economic environment or any

headwinds that occasionally impact the LTL industry. Our plan as we

progress through 2016 is to continue to provide best-in-class

service and to remain disciplined in obtaining an appropriate yield

on each of our shipments. Just as importantly, we also plan to

continue our investments in capacity, technology and the education

and training of our outstanding team of employees who make it

possible for us to meet our service commitments. We are confident

that executing on these fundamental elements of our business model

will position Old Dominion to continue its long-term growth in

earnings and shareholder value.”

Old Dominion will hold a conference call to discuss this release

today at 10:00 a.m. Eastern Time. Investors will have the

opportunity to listen to the conference call live over the Internet

by going to www.odfl.com. Please log on at least 15 minutes early

to register, download and install any necessary audio software. For

those who cannot listen to the live broadcast, a replay will be

available at this website shortly after the call through May 28,

2016. A telephonic replay will also be available through May 6,

2016 at (719) 457-0820, Confirmation Number 3664816.

Forward-looking statements in this news release are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. We caution the reader that such

forward-looking statements involve risks and uncertainties that

could cause actual events and results to be materially different

from those expressed or implied herein, including, but not limited

to, the following: (1) the competitive environment with respect to

industry capacity and pricing, including the use of fuel

surcharges, such that our total overall pricing is sufficient to

cover our operating expenses; (2) our ability to collect fuel

surcharges and the effectiveness of those fuel surcharges in

mitigating the impact of fluctuating prices for diesel fuel and

other petroleum-based products; (3) the negative impact of any

unionization, or the passage of legislation or regulations that

could facilitate unionization, of our employees; (4) the challenges

associated with executing our growth strategy, including the

inability to successfully consummate and integrate any

acquisitions; (5) changes in our goals and strategies, which are

subject to change at any time at our discretion; (6) various

economic factors such as economic recessions and downturns in

customers' business cycles and shipping requirements; (7) increases

in driver compensation or difficulties attracting and retaining

qualified drivers to meet freight demand; (8) our exposure to

claims related to cargo loss and damage, property damage, personal

injury, workers' compensation, group health and group dental,

including increased premiums, adverse loss development, increased

self-insured retention levels and claims in excess of insured

coverage levels; (9) cost increases associated with employee

benefits, including compliance obligations associated with the

Patient Protection and Affordable Care Act; (10) the availability

and cost of capital for our significant ongoing cash requirements;

(11) the availability and cost of new equipment and replacement

parts, including regulatory changes and supply constraints that

could impact the cost of these assets; (12) decreases in demand

for, and the value of, used equipment; (13) the availability and

cost of diesel fuel; (14) the costs and potential liabilities

related to compliance with, or violations of, existing or future

governmental laws and regulations, including environmental laws,

engine emissions standards, hours-of-service for our drivers,

driver fitness requirements and new safety standards for drivers

and equipment; (15) the costs and potential liabilities related to

various legal proceedings and claims that have arisen in the

ordinary course of our business, some of which include class-action

allegations; (16) the costs and potential liabilities related to

governmental proceedings; (17) the costs and potential liabilities

related to our international business operations and relationships;

(18) the costs and potential adverse impact of compliance with, or

violations of, current and future rules issued by the Department of

Transportation, the Federal Motor Carrier Safety Administration,

including its Compliance, Safety, Accountability initiative, and

other regulatory agencies; (19) seasonal trends in the

less-than-truckload industry, including harsh weather conditions;

(20) our dependence on key employees; (21) the concentration of our

stock ownership with the Congdon family; (22) the costs and

potential adverse impact associated with future changes in

accounting standards or practices; (23) potential costs associated

with cyber incidents and other risks, including system failure,

security breach, disruption by malware or other damage; (24) the

impact of potential disruptions to our information technology

systems or our service center network; (25) damage to our

reputation from the misuse of social media; (26) the costs and

potential adverse impact of compliance with anti-terrorism measures

on our business; (27) dilution to existing shareholders caused by

any issuance of additional equity; and (28) other risks and

uncertainties described in our most recent Annual Report on Form

10-K and other filings with the Securities and Exchange Commission.

Our forward-looking statements are based upon our beliefs and

assumptions using information available at the time the statements

are made. We caution the reader not to place undue reliance on our

forward-looking statements (i) as these statements are neither a

prediction nor a guarantee of future events or circumstances and

(ii) the assumptions, beliefs, expectations and projections about

future events may differ materially from actual results. We

undertake no obligation to publicly update any forward-looking

statement to reflect developments occurring after the statement is

made, except as otherwise required by law.

Old Dominion Freight Line, Inc. is a leading,

less-than-truckload (“LTL”), union-free motor carrier providing

regional, inter-regional and national LTL services, which include

ground and air expedited transportation and consumer household

pickup and delivery through a single integrated organization. In

addition to its core LTL services, the Company offers a broad range

of value-added services including container drayage, truckload

brokerage, supply chain consulting and warehousing.

OLD DOMINION FREIGHT LINE, INC. Statements of

Operations

First Quarter

(In thousands,

except per share amounts)

2016 2015 Revenue $ 707,733

100.0 % $ 696,245 100.0 %

Operating expenses: Salaries, wages & benefits 400,869

56.6 % 368,442 52.9 % Operating supplies & expenses 75,372 10.6

% 88,049 12.6 % General supplies & expenses 21,142 3.0 % 21,292

3.1 % Operating taxes & licenses 23,188 3.3 % 22,274 3.2 %

Insurance & claims 10,244 1.5 % 10,042 1.4 % Communications

& utilities 7,005 1.0 % 6,775 1.0 % Depreciation &

amortization 44,772 6.3 % 38,788 5.6 % Purchased transportation

18,496 2.6 % 30,148 4.3 % Building and office equipment rents 2,273

0.3 % 2,278 0.3 % Miscellaneous expenses, net 4,824

0.7 % 4,592 0.7 % Total

operating expenses 608,185 85.9 % 592,680

85.1 % Operating income 99,548 14.1 %

103,565 14.9 % Non-operating expense (income): Interest

expense 1,183 0.2 % 1,569 0.2 % Interest income (16 ) (0.0 )% (71 )

(0.0 )% Other expense, net 516 0.1 % 237

0.1 % Income before income taxes 97,865

13.8 % 101,830 14.6 % Provision for income taxes 37,580

5.3 % 39,306 5.6 %

Net income $ 60,285

8.5 % $ 62,524

9.0 % Earnings per share: Basic and

Diluted $ 0.72 $ 0.73

Weighted average outstanding

shares: Basic and Diluted 83,983 85,971

OLD

DOMINION FREIGHT LINE, INC. Operating Statistics

First Quarter 2016 2015

% Chg. Work days 64 63 1.6 % Operating ratio

85.9 % 85.1 % LTL intercity miles (1) 140,816 129,467 8.8 % LTL

tons (1) 1,924 1,872 2.8 % LTL tonnage per day (1) 30.06 29.71 1.2

% LTL shipments (1) 2,489 2,344 6.2 % LTL revenue per intercity

mile $ 4.95 $ 5.23 (5.4 )% LTL revenue per hundredweight $ 18.14 $

18.08 0.3 % LTL revenue per hundredweight, excluding fuel

surcharges $ 16.54 $ 15.94 3.8 % LTL revenue per shipment $ 280.33

$ 288.83 (2.9 )% LTL revenue per shipment, excluding fuel

surcharges $ 255.72 $ 254.75 0.4 % LTL weight per shipment (lbs.)

1,546 1,598 (3.3 )% Average length of haul (miles) 935 928 0.8 %

(1) - In thousands Note: Our LTL operating

statistics exclude certain transportation and logistics services

where pricing is generally not determined by weight. These

statistics also exclude adjustments to revenue for undelivered

freight required for financial statement purposes in accordance

with our revenue recognition policy.

OLD DOMINION

FREIGHT LINE, INC. Balance Sheets

March 31, December 31,

(In

thousands)

2016 2015 Cash and cash equivalents $ 7,133 $ 11,472

Other current assets 348,491 370,258 Total current assets

355,624 381,730 Net property and equipment 2,098,158 2,023,448

Other assets 61,658 61,326 Total assets $ 2,515,440 $

2,466,504 Current maturities of long-term debt $ 25,596 $

26,488 Other current liabilities 297,627 258,914 Total

current liabilities 323,223 285,402 Long-term debt 99,726 107,317

Other non-current liabilities 392,215 389,148 Total

liabilities 815,164 781,867 Equity 1,700,276 1,684,637 Total

liabilities & equity $ 2,515,440 $ 2,466,504

Note: The financial and operating statistics in this press

release are unaudited.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160428005299/en/

Old Dominion Freight Line, Inc.Adam Satterfield,

336-822-5721Senior Vice President, Finance and Chief Financial

Officer

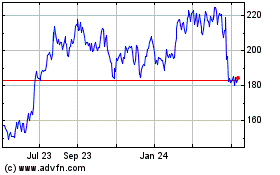

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Dec 2024 to Jan 2025

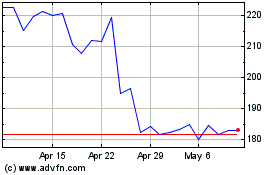

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Jan 2024 to Jan 2025