US Regulators Take Aim At Trades Made In Error

February 16 2012 - 5:02PM

Dow Jones News

U.S. regulators are preparing to clamp down on firms that send

so-called rogue orders into the stock market, citing concerns that

an erroneous trade could ricochet across exchanges and ensnare

investors.

Such trades are usually caused by data-input errors, and their

frequency has fallen in recent years as markets have adopted more

computer-driven strategies and exchanges have increased

surveillance efforts to stamp them out.

However, electronic trading's split-second pace and increasingly

interconnected nature has spurred regulators to take a closer look

at the potential spillover effect of stock orders submitted far

from the prevailing market price.

A major concern is the impact of a big error in an automated

strategy set up to buy and sell component shares of a benchmark

index such as the Standard & Poor's 500, which authorities fear

could influence other electronic traders' strategies and erupt into

a market-moving event.

"It could take on a life of its own," said Thomas Gira,

executive vice president of market regulation for the Financial

Industry Regulatory Authority, or Finra.

"The velocity of the market has picked up," said Gira in an

interview. "When trading was slower, people still made mistakes,

but now there's potential for a programming error or computing

issue to spit out quotes in a rapid-fire manner and give rise to

[problematic] situations."

Getting caught on the other side of a trade that is deemed in

error and cancelled by exchange officials can also be a headache

for individual investors, who may have jumped at a price that

appeared a good deal, or used proceeds from such a trade to buy

other stocks.

Exchange operators deem transactions entered at prices wildly

off the going market rate to be "clearly erroneous" and eligible to

be voided upon request, and regulators in the past have

occasionally sanctioned traders for such mistakes.

Finra is now weighing tougher measures including enforcement

actions as officials examine 20 to 30 cases of erroneous trades

executed in recent months, deploying new rules passed last summer

by the Securities and Exchange Commission that require tighter

credit and risk controls over traders' activity. Gira said Finra is

watching out for serial or egregious offenders.

Following the May 2010 "flash crash," when investors protested

after exchanges cancelled thousands of trades, U.S. stock market

operators drew up new market-wide standards for when transactions

should be voided, which helped bring down the number of errors. The

introduction last year of rules governing the way traders gain

access to domestic stock markets are expected to further reduce

mistakes.

"It's in everybody's best interest for these things to be

minimized," said David D'Amico, head of operations for Direct Edge,

which runs two electronic stock exchanges. He said his markets now

see fewer than 10 erroneous trading episodes per month.

But regulations set up to ensure investors receive the most

competitive prices on share trades have increased the potential for

trade errors to reverberate across multiple markets. About

two-thirds of mistaken trades involve orders that are carried out

on more than one stock exchange, with the firm placing the order

sometimes not knowing where all of its business was transacted.

The high speed of electronic trading combined with strategies

set up to react to minute price movements and the incorporation of

leveraged securities like exchange-traded funds carries further

potential to magnify mistakes, said Bernard McSherry, a senior vice

president with brokerage firm Cuttone & Co. and an assistant

professor of finance at New Jersey City University.

"The market has put in place these self-reinforcing loops that

can amplify errors and create new problems," said McSherry, who

started as a stock broker in the 1970s. "Both people and machines

are not infallible, but the question is how you design

protections."

-By Jacob Bunge, Dow Jones Newswires; 312 750 4117;

jacob.bunge@dowjones.com

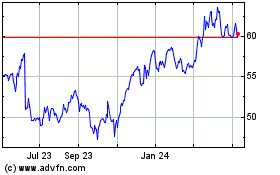

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Apr 2024 to May 2024

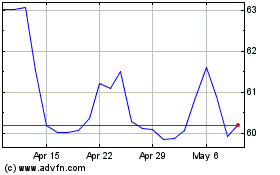

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From May 2023 to May 2024