IFF Beats Earnings; Lags Rev in 1Q - Analyst Blog

May 07 2013 - 4:47AM

Zacks

International Flavors & Fragrances Inc.

(IFF) reported first-quarter 2013 adjusted earnings per share of

$1.19, up 19.0% from a year-ago earnings of $1.00. Results beat the

Zacks Consensus Estimate of $1.13 by 5.3%.

During the quarter, IFF engaged in a restructuring of its

business activities, with the intention to close the Flavors

facility in Knislinge, Sweden and the Fragrances facility in

Jakarta, Indonesia, along with the opening of a

technologically-advanced Flavors manufacturing facility in

Guangzhou, China.

Revenue

Net sales in the reported quarter were approximately $727.8

million, up 2.4% year over year but below the Zacks Consensus

Estimate of $752.0 million. On a constant currency basis, revenue

inched up 3.0% year over year. Adjusted for the discontinuation of

low-margin sales operations of the Flavors segment, sales grew 4.0%

in constant currency.

The company operates in two segments: Flavors and

Fragrances.

In the first quarter, revenue from the Flavors business

increased 1.9% year over year to $356.4 million with a negligible

impact from the foreign currency exchange and accounted for 49.0%

of total revenue. Excluding the impact of the discontinuation,

sales in this segment grew 6.0% in the quarter as compared to the

year-ago quarter.

Revenue from the Fragrances business was roughly 51.0% of total

revenue amounting to $371.5 million, up 3.0% on a constant currency

basis.

From a geographical perspective, revenue from North America

decreased 5.0% year over year, while results from EAME increased by

2.0%, or up 1.0% on a constant currency basis. Revenue from Latin

America increased 9.0% or 11.0% on a constant currency basis and

from Greater Asia revenue was up 6.0% or 8.0% on a constant

currency basis.

Margins

Adjusted gross margin in the first quarter increased by 270

basis points to 42.9% based on lower raw material costs, improved

sales mix and new business wins. Research and development expense,

as a percentage of sales, increased by 5 basis points to settle at

8.1% while selling and administrative expense, as a percentage of

sales, increased by 92 basis points to 15.8%.

Adjusted operating margin in the quarter was 19.1%, increasing

190 basis points from the year-ago quarter.

Balance Sheet

Exiting the first quarter, International Flavors &

Fragrances’ cash and cash equivalents stood at $300.0 million

compared with $324.4 million in the previous quarter. Long-term

debt, net of current portion, was at $915.8 million, up from $881.1

million in the previous quarter.

Cash Flow

In first quarter 2013, cash flow from operating activities was

$18.7 million versus $52.6 million in the previous year quarter.

The company spent $29.9 million on addition of property, plant and

equipment against $28.8 million in the first quarter of 2012.

International Flavors & Fragrances is one of the leading

companies engaged in the creation and manufacturing of fragrance

and flavoring products in the United States and

internationally.

The stock currently carries a Zacks Rank #3 (Hold). Other stocks

to watch out for in the industry are Nu Skin Enterprises

Inc. (NUS) which carries a Zacks Rank #1 (Strong Buy);

while Avon Products Inc. (AVP) and

Methanex Corporation (MEOH) each carry a Zacks

Rank #2 (Buy).

AVON PRODS INC (AVP): Free Stock Analysis Report

INTL F & F (IFF): Free Stock Analysis Report

METHANEX CORP (MEOH): Free Stock Analysis Report

NU SKIN ENTERP (NUS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

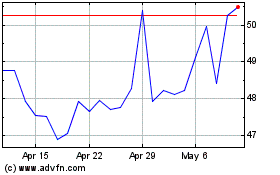

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Jun 2024 to Jul 2024

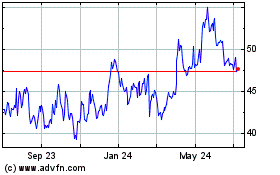

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Jul 2023 to Jul 2024