Airgas' Earnings a Penny Ahead - Analyst Blog

May 02 2013 - 12:50PM

Zacks

Airgas Inc. (ARG) posted adjusted earnings of

$1.14 a share in fourth-quarter 2013 (ended Mar 31, 2013), up 3%

from $1.11 earned in the year-ago quarter and a penny ahead of the

Zacks Consensus Estimate.

The results came in below management's guidance of $1.18 - $1.24 a

share. This did not come as a surprise as Airgas had hinted at a

fourth quarter guidance miss in March due to disappointing organic

sales growth in the Distribution segment arising from weak volume

in both gases and hardgoods, such as welding gear. Including

restructuring charges and other one-time items, earnings per share

in the quarter stood at $1.14 compared with $1.11 in the year-ago

quarter.

Revenues

Revenues in the reported quarter edged up 1.8% year over year to

$1,262 million, falling short of the Zacks Consensus Estimate of

$1,267 million. Acquisitions aided sales growth by 2% while organic

growth was flat. Gas and rent increased 4%, offset by a 5% decline

in hardgoods.

Cost and Margins

Costs of goods sold remained flat at $572 million in the quarter.

Selling, distribution and administrative expenses amounted to $462

million, up 3% year over year. Adjusted operating income was $154

million in the quarter versus $152 million in the year-ago quarter.

Adjusted operating margin in the reported quarter was 12.2%, flat

year over year.

Fiscal 2013 Performance

Airgas posted adjusted earnings of $4.35 a share, up 6% from $4.11

earned in fiscal 2012 and in line with the Zacks Consensus

Estimate. Adjusted earnings fell shy of the company’s guidance of

earnings in the range of $4.40 to $4.46 per share. Including

restructuring charges and other one-time items, earnings per share

in fiscal 2013 were $4.35 compared with $4.00 in the prior year.

Revenues increased 4.5% to $4.96 billion, in line with the Zacks

Consensus Estimate.

Financial Position

Cash, as of Mar 31, 2013, increased to $86.4 million from $44.7

million as of Mar 31, 2012. Free cash flow during fiscal 2013 went

up to $298 million from $262 million in fiscal 2012. Cash flow from

operations for fiscal 2013 was $550 million versus $506 million in

the prior year.

During the quarter, Airgas repurchased 3.82 million shares for a

total amount of $378 million at an average price of $98.89 per

share. In fiscal 2013, Airgas acquired 18 businesses with aggregate

annual revenues of more than $95 million.

Outlook

Management expects adjusted earnings per share (excluding one-time

items) for the first quarter of fiscal 2014 to increase 1% to 6% to

$1.14 to $1.20. For fiscal 2014, Airgas projects earnings in the

range of $5.00 to $5.35, reflecting 15% to 23% annual growth.

Airgas apprehends that results will bear the brunt of the current

slow business conditions in the first half of fiscal 2014 and then

improve in the latter half. This will lead to low-to-mid

single-digit organic sales growth for the full year, with gas and

rent outpacing hardgoods.

Airgas’ refrigerants business is going to face challenges in 2014

as the Environmental Protection Agency recently issued a ruling

allowing for an increase in the production of R-22 in calendar year

2013. However, compliance with the Montreal Protocol necessitates a

significant step-down in R-22 production in calendar year 2015,

reinforcing Airgas’ position as an industry leader in the

reclamation and distribution of recycled refrigerant products. Due

to this one-year hurdle, Airgas’s earnings will be affected in 2014

by the negative impact from refrigerants, as prices and sales

volumes of R-22 have both come under pressure following the EPA’s

ruling.

Pa.-based Airgas, through its subsidiaries, distributes industrial,

medical and specialty gases as a well as hardgoods in the U.S.

Airgas currently retains a short-term Zacks Rank #3 (Hold). Stocks

worth considering in the same industry are Celanese

Corporation (CE), Methanex Corporation

(MEOH) and WD-40 Company (WDFC), which hold a

Zacks Rank #2 (Buy), and are favorable options for investors.

AIRGAS INC (ARG): Free Stock Analysis Report

CELANESE CP-A (CE): Free Stock Analysis Report

METHANEX CORP (MEOH): Free Stock Analysis Report

WD 40 CO (WDFC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

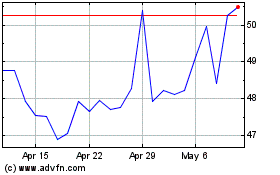

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Jul 2024 to Aug 2024

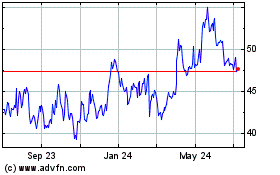

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Aug 2023 to Aug 2024