As filed with the Securities and Exchange Commission on July 25, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KALA BIO, INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

27-0604595

(I.R.S. Employer

Identification Number)

|

|

1167 Massachusetts Avenue

Arlington, MA 02476

(781) 996-5252

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Mark Iwicki

Chief Executive Officer

KALA BIO, Inc.

1167 Massachusetts Avenue

Arlington, MA 02476

(781) 996-5252

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Stuart M. Falber

Scott N. Lunin

Andrea Sorrentino

Wilmer Cutler Pickering Hale and Dorr LLP

60 State Street

Boston, MA 02109

Telephone: (617) 526-6000

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

|

|

|

☐

|

|

|

Accelerated filer

|

|

|

☐

|

|

| |

Non-accelerated filer

|

|

|

☒

|

|

|

Smaller reporting company

|

|

|

☒

|

|

| |

|

|

|

|

|

|

Emerging growth company

|

|

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders named in this prospectus are not soliciting offers to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to completion, dated July 25, 2024

PROSPECTUS

3,519,514 Shares

Common Stock

This prospectus relates to the resale from time to time of up to 3,519,514 shares of common stock, par value $0.001 per share, of KALA BIO, Inc. by the selling stockholders listed on page 8, including their donees, pledgees, transferees or other successors-in-interest, which shares consist of (i) 1,197,314 outstanding shares of our common stock held by the selling stockholders, (ii) 292,800 shares of our common stock issuable upon the conversion of outstanding shares of Series F Convertible Non-Redeemable Preferred Stock, par value $0.001 per share, or the Series F Preferred Stock, held by certain of the selling stockholders, (iii) 1,090,100 shares of our common stock issuable upon the conversion of outstanding shares of Series G Convertible Non-Redeemable Preferred Stock, par value $0.001 per share, or the Series G Preferred Stock, held by certain of the selling stockholders, and (iv) 939,300 shares of our common stock issuable upon the conversion of outstanding shares of Series H Convertible Non-Redeemable Preferred Stock, par value $0.001 per share, or the Series H Preferred Stock, held by the selling stockholders. We will not receive any proceeds from the sale of the shares offered by this prospectus.

We have agreed, pursuant to registration rights agreements that we entered into with the selling stockholders, to bear all of the expenses incurred in connection with the registration of these shares. The selling stockholders will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of these shares of our common stock.

The selling stockholders identified in this prospectus, or their donees, pledgees, transferees or other successors-in-interest, may offer the shares from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus under the caption “Plan of Distribution.” The shares may be sold at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale or at negotiated prices. For a list of the selling stockholders, see the section entitled “Selling Stockholders” on page 8 of this prospectus.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

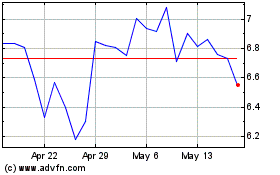

Our common stock is listed on The Nasdaq Capital Market under the symbol “KALA.” On July 24, 2024, the last reported closing sale price of our common stock on The Nasdaq Capital Market was $7.37 per share. You are urged to obtain current market quotations for our common stock.

Investing in our common stock involves significant risks. See “Risk Factors” beginning on page 4 of this prospectus and in the documents incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

22

|

|

|

You should rely only on the information contained or incorporated by reference in this prospectus. We have not and the selling stockholders have not authorized anyone else to provide you with different or additional information from that contained or incorporated by reference in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock. Our business, financial condition, results of operations and prospects may have changed since such date.

Unless the context otherwise indicates, references in this prospectus to “we,” “our” and “us” refer, collectively, to KALA BIO, Inc., a Delaware corporation, and its consolidated subsidiaries.

PROSPECTUS SUMMARY

This summary highlights, and is qualified in its entirety by, the more detailed information included elsewhere in this prospectus or incorporated by reference in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should read and carefully consider the entire prospectus, especially the “Risk Factors” section of this prospectus, before deciding to invest in our common stock.

Our Business

We are a clinical-stage biopharmaceutical company dedicated to the research, development and commercialization of innovative therapies for rare and severe diseases of the front and back of the eye. Our product candidate, KPI-012, which we acquired from Combangio, Inc., or Combangio, on November 15, 2021, is a mesenchymal stem cell secretome, or MSC-S, and is currently in clinical development for the treatment of persistent corneal epithelial defects, or PCED, a rare disease of impaired corneal healing. Based on the positive results of a Phase 1b clinical safety and efficacy trial of KPI-012 in patients with PCED, along with favorable preclinical safety and efficacy results, we submitted an investigational new drug application to the U.S. Food and Drug Administration, which was accepted in December 2022. In February 2023, we dosed our first patient in our CHASE (Corneal Healing After SEcretome therapy) Phase 2b clinical trial of KPI-012 for PCED in the United States.

We believe the multifactorial mechanism of action of KPI-012 also makes our MSC-S a platform technology. We are evaluating the potential development of KPI-012 for additional rare front-of-the-eye diseases, such as for the treatment of Limbal Stem Cell Deficiency and other rare corneal diseases that threaten vision. In addition, we have initiated preclinical studies under our KPI-014 program to evaluate the utility of our MSC-S platform for inherited retinal degenerative diseases, such as Retinitis Pigmentosa and Stargardt Disease.

Corporate Information

We were incorporated under the laws of the state of Delaware on July 7, 2009 under the name Hanes Newco, Inc. We subsequently changed our name to Kala Pharmaceuticals, Inc. on December 11, 2009 and to KALA BIO, Inc. on August 2, 2023. Our principal executive offices are located at 1167 Massachusetts Avenue, Arlington, MA 02476, and our telephone number is (781) 996-5252. Our website address is www.kalarx.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Private Placements

On December 21, 2023, we entered into a securities purchase agreement, or the Series F Purchase Agreement, with certain of the selling stockholders, or the Series F Investors, pursuant to which we issued and sold to the Series F Investors an aggregate of 2,928 shares of our Series F Preferred Stock at a price per share equal to $683.00, for aggregate gross proceeds of approximately $2.0 million.

On March 25, 2024, we entered into a securities purchase agreement, or the Series G Purchase Agreement, with certain of the selling stockholders, or the Series G Investors, pursuant to which we issued and sold to the Series G Investors an aggregate of 10,901 shares of our Series G Preferred Stock at a price per share equal to $788.90, for aggregate gross proceeds of approximately $8.6 million.

On June 26, 2024, we entered into a securities purchase agreement, or the Series H Purchase Agreement, with the selling stockholders, or the Series H Investors, pursuant to which we issued and sold to the Series H Investors an aggregate of 1,197,314 shares of our common stock at a price per share equal to $5.85 and an aggregate of 9,393 shares of our Series H Preferred Stock at a price per share equal to $585.00, for aggregate gross proceeds of approximately $12.5 million.

For a detailed description of the transactions contemplated by the Series F Purchase Agreement, Series G Purchase Agreement and Series H Purchase Agreement, see the section captioned “Selling Stockholders” in this prospectus.

We filed the registration statement on Form S-3, of which this prospectus is a part, to fulfill our contractual obligations under the registration rights agreement we entered into pursuant to the terms of the Series H Purchase Agreement to provide for the resale by certain of the selling stockholders of the shares of common stock acquired pursuant to the Series H Purchase Agreement and the shares of common stock issuable upon conversion of the Series H Preferred Stock acquired pursuant to the Series H Purchase Agreement and to provide for the resale by certain other selling stockholders of shares of common stock issuable upon conversion of the Series F Preferred Stock acquired pursuant to the Series F Purchase Agreement, shares of common stock issuable upon conversion of the Series G Preferred Stock acquired pursuant to the Series G Purchase Agreement, shares of common stock acquired pursuant to the Series H Purchase Agreement and the shares of common stock issuable upon conversion of the Series H Preferred Stock acquired pursuant to the Series H Purchase Agreement.

THE OFFERING

Common Stock Offered by Selling Stockholders

3,519,514 shares, consisting of 1,197,314 outstanding shares of our common stock, 292,800 shares of our common stock issuable upon the conversion of outstanding shares of Series F Preferred Stock, 1,090,100 shares of our common stock issuable upon the conversion of outstanding shares of Series G Preferred Stock and 939,300 shares of our common stock issuable upon the conversion of outstanding shares of Series H Preferred Stock.

We will not receive any proceeds from the sale of shares in this offering.

You should read the “Risk Factors” section of this prospectus and in the documents incorporated by reference in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock.

Nasdaq Capital Market Symbol

“KALA”

RISK FACTORS

Investing in our common stock involves significant risks. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties described under the section captioned “Risk Factors” contained in our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q and other filings we make with the Securities and Exchange Commission, or the SEC, from time to time, which are incorporated by reference herein in their entirety, together with the other information in this prospectus and in the documents incorporated by reference in this prospectus.

The risks described in our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q and the other filings we make with the SEC incorporated by reference herein are not the only ones facing our company. Additional risks and uncertainties may also impair our business operations. If any of the risks described in our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q and the other filings incorporated by reference herein occurs, our business, financial condition, results of operations and future growth prospects could be harmed. In these circumstances, the market price of our common stock could decline, and you may lose all or part of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

AND INDUSTRY DATA

This prospectus and the documents incorporated by reference in this prospectus contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, the Exchange Act.

All statements, other than statements of historical fact, contained or incorporated by reference in this prospectus, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this prospectus and the documents incorporated by reference in this prospectus include, among other things, statements about:

•

our expectations with respect to our dependency on and potential advantages of KPI-012, our product candidate for the treatment of persistent corneal epithelial defects, or PCED;

•

our expectations with respect to the potential impacts the sale of our commercial business to Alcon Pharmaceuticals Ltd. and Alcon Vision, LLC, which we refer collectively as Alcon, will have on our business, results of operations and financial condition;

•

our expectations with respect to, and the amount of, future milestone payments we may receive from Alcon in connection with the sale of our commercial business;

•

our expectations with respect to, and the amount of, future milestone payments we may pay in connection with the acquisition of Combangio, Inc., or Combangio, or the Combangio Acquisition;

•

our development efforts for KPI-012 and our ability to discover and develop new programs and product candidates;

•

the timing, progress and results of clinical trials for KPI-012, including statements regarding the timing of initiation and completion of clinical trials, dosing of subjects and the period during which the results of the trials will become available;

•

the timing, scope and likelihood of regulatory filings, including the filing of any biologics license applications for KPI-012 and any other product candidate we may develop in the future;

•

our ability to obtain regulatory approvals for KPI-012;

•

our commercialization, marketing and manufacturing capabilities and strategy for KPI-012, if approved;

•

our estimates regarding potential future revenue from sales of KPI-012, if approved;

•

our ability to negotiate, secure and maintain adequate pricing, coverage and reimbursement terms and processes on a timely basis, or at all, with third-party payors for KPI-012, if approved;

•

the rate and degree of market acceptance and clinical utility of KPI-012 and our estimates regarding the market opportunity for KPI-012, if approved;

•

plans to pursue the development of, and the timing, progress and results of preclinical studies of, KPI-012 for indications in addition to PCED, including Limbal Stem Cell Deficiency;

•

our expectations with respect to our determination to cease the development of our preclinical pipeline programs that are unrelated to our mesenchymal stem cell secretome, or MSC-S, platform;

•

the timing, progress and results of preclinical studies for our KPI-014 program;

•

our expectations regarding our ability to fund our operating expenses, lease and debt service obligations, and capital expenditure requirements with our cash on hand;

•

our expectations regarding our ability to achieve the specified milestones under our award from the California Institute for Regenerative Medicine, or CIRM, and obtain the full funding under the CIRM award;

•

our expectations regarding our ability to comply with the covenants under our loan agreement;

•

our intellectual property position, including intellectual property acquired in the Combangio Acquisition;

•

our ability to identify additional products, product candidates or technologies with significant commercial potential that are consistent with our commercial objectives;

•

our estimates regarding expenses, future revenue, timing of any future revenue, capital requirements and needs for additional financing;

•

the impact of government laws and regulations;

•

our competitive position;

•

developments relating to our competitors and our industry;

•

our ability to maintain and establish collaborations or obtain additional funding;

•

our business and business relationships, including with employees and suppliers; and

•

the potential impact of global economic and geopolitical developments on our business, operations, strategy and goals.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included, or incorporated by reference, in this prospectus, particularly in the “Risk Factors” section, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. You should also carefully review the risk factors and cautionary statements described in the other documents we file from time to time with the SEC, specifically our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this prospectus, the documents incorporated by reference in this prospectus and the documents that we have filed as exhibits to the registration statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements, except as required by applicable law.

This prospectus includes or incorporates by reference certain statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by us and third parties as well as our estimates of potential market opportunities. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our estimates of the potential market opportunity for KPI-012 include several key assumptions based on our industry knowledge, industry publications, third-party research and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While we believe that our internal assumptions are reasonable, no independent source has verified such assumptions.

USE OF PROCEEDS

We are filing the registration statement of which this prospectus is a part to permit the holders of the shares of our common stock described in the section entitled “Selling Stockholders” to resell such shares. We are not selling any shares under this prospectus, and we will not receive any proceeds from the sale or other disposition of shares of our common stock held by the selling stockholders and offered hereby.

The selling stockholders will pay any discounts, commissions, fees of underwriters, selling brokers or dealer managers and expenses incurred by the selling stockholders for brokerage, accounting, tax or legal services or any other expenses incurred by the selling stockholders in disposing of the shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares covered by this prospectus, including, without limitation, all registration and filing fees, Nasdaq listing fees and fees and expenses of our counsel and our accountants.

SELLING STOCKHOLDERS

Series F Private Placement

On December 21, 2023, we entered into a securities purchase agreement, or the Series F Purchase Agreement, with certain institutional investors, or the Series F Investors, pursuant to which we agreed to issue and sell, in a private placement priced at-the-market under Nasdaq rules, shares of our Series F Preferred Stock for aggregate gross proceeds of approximately $2.0 million, which we refer to as the Series F Private Placement. Pursuant to the Series F Purchase Agreement, at the closing of the Series F Private Placement on December 22, 2023, we issued and sold to the Series F Investors 2,928 shares of Series F Preferred Stock at a price per share equal to $683.00. The rights, preferences and privileges of the Series F Preferred Stock are set forth in the Certificate of Designations, Preferences and Rights of Series F Convertible Non-Redeemable Preferred Stock filed with the Secretary of State of the State of Delaware on December 21, 2023, or the Series F Certificate of Designations.

Series G Private Placement

On March 25, 2024, we entered into a securities purchase agreement, or the Series G Purchase Agreement, with certain institutional investors, or the Series G Investors, pursuant to which we agreed to issue and sell, in a private placement priced at-the-market under Nasdaq rules, shares of our Series G Preferred Stock for aggregate gross proceeds of $8.6 million, which we refer to as the Series G Private Placement. Pursuant to the Series G Purchase Agreement, at the closing of the Series G Private Placement on March 26, 2024, we issued and sold to the Series G Investors 10,901 shares of Series G Preferred Stock at a price per share equal to $788.90. The rights, preferences and privileges of the Series G Preferred Stock are set forth in the Certificate of Designations, Preferences and Rights of Series G Convertible Non-Redeemable Preferred Stock filed with the Secretary of State of the State of Delaware on March 25, 2024, or the Series G Certificate of Designations.

Series H Private Placement

On June 26, 2024, we entered into a securities purchase agreement, or the Series H Purchase Agreement, with certain institutional investors, or the Series H Investors, pursuant to which we agreed to issue and sell, in a private placement, shares of our common stock and shares of our Series H Preferred Stock for aggregate gross proceeds of approximately $12.5 million, which we refer to as the Series H Private Placement. Pursuant to the Series H Purchase Agreement, at the closing of the Series H Private Placement on June 28, 2024, we issued and sold to the Series H Investors an aggregate of 1,197,314 shares of common stock at a price per share equal to $5.85 and an aggregate of 9,393 shares of Series H Preferred Stock at a price per share equal to $585.00. The rights, preferences and privileges of the Series H Preferred Stock are set forth in the Certificate of Designations, Preferences and Rights of Series H Convertible Non-Redeemable Preferred Stock filed with the Secretary of State of the State of Delaware on June 26, 2024, or the Series H Certificate of Designations.

In connection with the Series H Private Placement, we entered into a registration rights agreement with certain of the Series H Investors, dated as of June 26, 2024, or the 2024 Registration Rights Agreement, pursuant to which we agreed to file a registration statement with the Securities and Exchange Commission covering the resale of the shares of common stock and the shares of common stock issuable upon conversion of the shares of Series H Preferred Stock acquired by certain of the Series H Investors in the Series H Private Placement. The 2024 Registration Rights Agreement includes customary indemnification rights in connection with the registration statement. The registration statement of which this prospectus is a part has been filed in accordance with the 2024 Registration Rights Agreement. We also agreed with the Baker Funds (as defined below) in each of the Series F Purchase Agreement, Series G Purchase Agreement and Series H Purchase Agreement to register for resale the shares of common stock and the shares of common stock issuable upon conversion of preferred stock issued to the Baker Funds pursuant to such purchase agreements, upon demand by such investors, in accordance with the terms and conditions of the registration rights agreement, dated March 2, 2023, by and among us and the Baker Funds, or the 2023 Registration Rights Agreement.

The foregoing summary descriptions of the Series F Purchase Agreement, the Series G Purchase Agreement, the Series H Purchase Agreement, the 2023 Registration Rights Agreement and the 2024 Registration Rights Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of such documents, which are filed as exhibits to the registration statement of which this prospectus is a part and are incorporated by reference herein.

Beneficial Ownership Limitation

Each share of Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock is initially convertible into 100 shares of our common stock (subject to adjustment as provided in the applicable Certificate of Designations) at any time at the option of the holder, provided that the holder will be prohibited, subject to certain exceptions, from converting such shares of preferred stock for shares of common stock to the extent that immediately prior to or following such conversion, the holder, together with its affiliates and other attribution parties, would own in excess of 9.99% of the total number of shares of our common stock then issued and outstanding after giving effect to such conversion, which percentage may be changed at the holder’s election to a lower percentage at any time or to a higher percentage not to exceed 19.99% upon 61 days’ notice to us, which we refer to, collectively, as the Beneficial Ownership Limitation.

Scope of this Prospectus

This prospectus covers the sale or other disposition by the selling stockholders of up to the total number of shares of our common stock that were issued to the Series H Investors pursuant to the Series H Purchase Agreement, plus the total number of shares of our common stock issuable upon conversion of (1) the shares of Series F Preferred Stock issued to the Series F Investors pursuant to the Series F Purchase Agreement, (2) the shares of Series G Preferred Stock issued to the Series G Investors pursuant to the Series G Purchase Agreement and (3) the shares of Series H Preferred Stock issued to the Series H Investors pursuant to the Series H Purchase Agreement, in each case, without giving effect to the Beneficial Ownership Limitation described above. The shares of common stock covered hereby may be offered from time to time by each selling stockholder, provided that the shares of common stock issuable upon conversion of the Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock, as applicable, may only be offered after the relevant shares of preferred stock are converted into shares of common stock pursuant to the terms of the applicable Certificate of Designations.

Beneficial Ownership of Selling Stockholders

The table below sets forth, to our knowledge, information concerning the beneficial ownership of shares of our common stock held by the selling stockholders as of June 30, 2024. The information in the table below with respect to the selling stockholders has been obtained from the respective selling stockholders. When we refer to the “selling stockholders” in this prospectus, or, if required, a post-effective amendment to the registration statement of which this prospectus is a part, we mean the selling stockholders listed in the table below as offering shares, as well as their respective donees, pledgees, transferees or other successors-in-interest. Throughout this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholders, we are referring to the shares of our common stock and the shares of our common stock issued or issuable upon conversion of the shares of Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock issued to the selling stockholders pursuant to the Series F Purchase Agreement, Series G Purchase Agreement and Series H Purchase Agreement, as applicable, without giving effect to the Beneficial Ownership Limitation described above. The selling stockholders may sell all, some or none of the shares of our common stock subject to this prospectus. See the “Plan of Distribution” section of this prospectus as it may be supplemented and amended from time to time.

In the table below, the number of shares of common stock beneficially owned prior to the offering for each selling stockholder includes all shares of our common stock beneficially held by such selling stockholder as of June 30, 2024, including (1) all shares of our common stock purchased by such selling stockholder pursuant to the Series H Purchase Agreement and (2) all shares of our common stock issuable upon conversion of the Series E Preferred Stock (as defined below), Series F Preferred Stock, Series G Preferred Stock and

Series H Preferred Stock held by such selling stockholder, in each case, subject to the Beneficial Ownership Limitation. The percentages of shares owned prior to and after the offering are calculated based on 4,598,419 shares of our common stock outstanding as of June 30, 2024. Such amount includes the outstanding shares of common stock offered by this prospectus but does not include any shares of common stock offered by this prospectus that are issuable upon the conversion of the Series F Preferred Stock, Series G Preferred Stock or Series H Preferred Stock.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our common stock. Generally, a person “beneficially owns” shares of our common stock if the person has or shares with others the right to vote those shares or to dispose of them, or if the person has the right to acquire voting or disposition rights within 60 days. In computing the number of shares of our common stock beneficially owned by a selling stockholder and the percentage ownership of that selling stockholder, we deemed outstanding shares of common stock issuable upon conversion of the Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock or Series H Preferred Stock, as applicable, held by that selling stockholder up to the Beneficial Ownership Limitation because such shares are issuable within 60 days of June 30, 2024. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for any selling stockholder named below.

| |

|

|

Shares of

Common Stock

Beneficially Owned

Prior to Offering

|

|

|

Number of

Shares of

Common Stock

Being

Offered(1)

|

|

|

Shares of

Common Stock

to be Beneficially

Owned After

Offering(2)

|

|

|

Name of Selling Stockholder

|

|

|

Number

|

|

|

Percentage

|

|

|

Number

|

|

|

Percentage

|

|

|

Entities affiliated with Baker Bros. Advisors LP(3)

|

|

|

|

|

891,335 |

|

|

|

|

|

19.38% |

|

|

|

|

|

2,237,522 |

|

|

|

|

|

480,777 |

|

|

|

|

|

9.99% |

|

|

|

Affiliates of SR One Capital Management, LP(4)

|

|

|

|

|

461,061 |

|

|

|

|

|

9.99% |

|

|

|

|

|

854,661 |

|

|

|

|

|

— |

|

|

|

|

|

—% |

|

|

|

Entities affiliated with ADAR1 Capital Management GP, LLC(5)

|

|

|

|

|

461,331 |

|

|

|

|

|

9.99% |

|

|

|

|

|

427,331 |

|

|

|

|

|

312,500 |

|

|

|

|

|

6.80% |

|

|

(1)

The number of shares of our common stock in the column “Number of Shares of Common Stock Being Offered” represents all of the shares of our common stock that a selling stockholder may offer and sell from time to time under this prospectus, including shares issuable upon conversion of the Series F Preferred Stock, Series G Preferred Stock or Series H Preferred Stock, as applicable, without giving effect to the Beneficial Ownership Limitation.

(2)

We do not know when or in what amounts the selling stockholders may offer shares for sale. The selling stockholders might not sell any or might sell all of the shares offered by this prospectus. Because the selling stockholders may offer and sell all, some or none of the shares offered pursuant to this prospectus, and because there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares, we cannot estimate the number of the shares that will be held by the selling stockholders after completion of the offering. However, for purposes of this table, we have assumed that, after completion of the offering, none of the shares covered by this prospectus will be held by the selling stockholders, including all shares of common stock issuable upon conversion of the Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock.

(3)

The shares reported under “Shares of Common Stock Beneficially Owned Prior to Offering” consist of (i) 87,876 shares of common stock held by 667, L.P. and (ii) 803,459 shares of common stock held by Baker Brothers Life Sciences, L.P. We refer to Baker Brothers Life Sciences, L.P. and 667, L.P. together as the Baker Funds. The Baker Funds are prohibited from converting shares of Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock into shares of common stock to the extent that immediately prior to or following such conversion, the holder, together with its affiliates and other attribution parties, would own in excess of 9.99% of the total number of shares of our common stock then issued and outstanding after giving effect to such conversion, which percentage may be changed at the holder’s election to a lower percentage at any time or to a higher percentage not to exceed 19.99% upon 61 days’ notice to us. As a result, the shares reported under “Shares of Common Stock Beneficially Owned Prior to Offering” does not include 6,737,400 shares

of common stock issuable upon conversion of shares of Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock and/or Series H Preferred Stock held by the Baker Funds. The shares reported under “Number of Shares of Common Stock Being Offered” consist of (i) the shares of common stock issued to the Baker Funds in the Series H Private Placement and (ii) the shares of common stock issuable upon conversion of the Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock held by the Baker Funds described above, in each case, without giving effect to the Beneficial Ownership Limitation. Due to the Beneficial Ownership Limitation, the Baker Funds cannot presently convert any shares of Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock and/or Series H Preferred Stock. Baker Bros. Advisors LP, or Advisor, is the management company and investment adviser to the Baker Funds and has sole voting and investment power with respect to the shares held by the Baker Funds. Baker Bros. Advisors (GP) LLC, or Advisor GP, is the sole general partner of Advisor. Julian C. Baker and Felix J. Baker are managing members of Advisor GP. Advisor GP, Felix J. Baker, Julian C. Baker, and Advisor may be deemed to be beneficial owners of the securities directly held by the Baker Funds. Julian C. Baker, Felix J. Baker, Advisor GP and Advisor disclaim beneficial ownership of all shares held by the Baker Funds, except to the extent of their indirect pecuniary interest therein. The address for the above referenced entities and persons is 860 Washington Street, 3rd Floor, New York, NY 10014.

(4)

The shares reported under “Shares of Common Stock Beneficially Owned Prior to Offering” consist of (i) 443,661 shares of common stock and (ii) 17,400 shares of common stock issuable upon conversion of shares of Series H Preferred Stock held by SR One Capital Fund II Aggregator, LP, or SR One. SR One is prohibited from converting shares of Series H Preferred Stock into shares of common stock to the extent that immediately prior to or following such conversion, the holder, together with its affiliates and other attribution parties, would own in excess of 9.99% of the total number of shares of our common stock then issued and outstanding after giving effect to such conversion, which percentage may be changed at the holder’s election to a lower percentage at any time or to a higher percentage not to exceed 19.99% upon 61 days’ notice to us. As a result, the shares reported under “Shares of Common Stock Beneficially Owned Prior to Offering” does not include 393,600 shares of common stock issuable upon conversion of shares of Series H Preferred Stock held by SR One. The shares reported under “Number of Shares of Common Stock Being Offered” consist of (i) the shares reported as beneficially owned by SR One under “Shares of Common Stock Beneficially Owned Prior to Offering” and (ii) the shares of common stock issuable upon conversion of the Series H Preferred Stock held by SR One, in each case, without giving effect to the Series H Beneficial Ownership Limitation. SR One disclaims beneficial ownership of any shares of common stock the issuance of which would violate the Beneficial Ownership Limitation. SR One Capital Partners II, LP, is the general partner of SR One. SR One Capital Management, LLC, is the general partner of SR One Capital Partners II, LP. Simeon George, MD, is the Manager of SR One Capital Management, LLC. SR One Capital Partners II, LP, SR One Capital Management, LLC and Simeon George, MD, share voting and investment power with respect to the shares directly held by SR One Capital Fund II Aggregator, LP. All indirect holders of the above referenced shares disclaim beneficial ownership of all applicable shares except to the extent of their pecuniary interest therein. The address for the above referenced entities and person is 985 Old Eagle School Road, Suite 511, Wayne, PA 19087.

(5)

The shares reported under “Shares of Common Stock Beneficially Owned Prior to Offering” consist of (i) 405,920 shares of common stock held by ADAR1 Partners, LP, or ADAR1, (ii) 35,511 shares of common stock held by Spearhead Insurance Solutions IDF, LLC — Series ADAR1, or Spearhead, and (iii) 19,900 shares of common stock issuable upon conversion of shares of Series H Preferred Stock held by ADAR1 and Spearhead, or the ADAR1 Funds. The ADAR1 Funds are prohibited from converting shares of Series H Preferred Stock into shares of common stock to the extent that immediately prior to or following such conversion, the holder, together with its affiliates and other attribution parties, would own in excess of 9.99% of the total number of shares of our common stock then issued and outstanding after giving effect to such conversion, which percentage may be changed at the holder’s election to a lower percentage at any time or to a higher percentage not to exceed 19.99% upon 61 days’ notice to us. As a result, the shares reported under “Shares of Common Stock Beneficially Owned Prior to Offering” does not include 278,500 shares of common stock issuable upon conversion of shares of Series H Preferred Stock held by the ADAR1 Funds. The shares reported under “Number of Shares of Common Stock Being Offered” consist of (i) the shares of common stock issued to the

ADAR1 Funds in the Series H Private Placement and (ii) the shares of common stock issuable upon conversion of the Series H Preferred Stock held by the ADAR1 Funds, in each case, without giving effect to the Beneficial Ownership Limitation. The ADAR1 Funds disclaim beneficial ownership of any shares of common stock the issuance of which would violate the Beneficial Ownership Limitation. The investment manager of ADAR1 and the sub-adviser of Spearhead is ADAR1 Capital Management, LLC. The general partner of ADAR1 is ADAR1 Capital Management GP, LLC. The manager of ADAR1 Capital Management GP, LLC is Daniel Schneeberger. This individual may be deemed to have shared voting and investment power of the securities held by the ADAR1 Funds. This individual disclaims beneficial ownership of such securities, except to the extent of his pecuniary interest therein. The address for the above referenced entities and person is 3503 Wild Cherry Drive, Building 9, Austin, TX 78738.

Relationships with Selling Stockholders

None of the selling stockholders has had a material relationship with us or any of our subsidiaries within the past three years except as set forth herein.

Entities Affiliated with Baker Bros. Advisors LP

Series E Private Placement

In November 2022, we entered into a securities purchase agreement, or the Series E Purchase Agreement, with the Baker Funds, who are identified as selling stockholders in the table above, pursuant to which we issued and sold, in a private placement priced at-the-market under Nasdaq rules, shares of our common stock and Series E Convertible Non-Redeemable Preferred Stock, par value $0.001 per share, or the Series E Preferred Stock, which we refer to as the Series E Private Placement. In addition, we also entered into the 2023 Registration Rights Agreement with the Baker Funds.

Under the Series E Purchase Agreement, the Baker Funds have certain participation rights. If at any time during the four-year period following December 1, 2022, or the Participation Period, we propose to offer and sell new equity securities in an offering that is conducted pursuant to an exemption from registration under the Securities Act of 1933, as amended, or the Securities Act, or in an offering that is registered under the Securities Act that is not conducted as a firm-commitment underwritten offering, then, subject to compliance with securities laws and regulations, we have agreed to offer each Baker Fund the right to purchase its pro rata share of the total amount of the new equity securities, subject to certain conditions and limitations. In addition, if during the Participation Period, we propose to offer and sell new equity securities in a firm-commitment underwritten offering registered under the Securities Act, then subject to compliance with securities laws and regulations, we have agreed to use our commercially reasonable efforts to cause the managing underwriters of such offering to contact the Investors about potentially participating in such offering and to provide to each Baker Fund the opportunity to purchase its pro rata share of such new equity securities, subject to certain conditions and limitations. The participation rights will terminate if the Baker Funds are offered the opportunity to participate in an offering pursuant to the participation rights and do not purchase at least 50% of their aggregate pro rata share of the new equity securities offered for sale in such offering.

Under the Series E Purchase Agreement, the Baker Funds also have the right to have up to two non-voting observers attend and participate in all of our board of directors and committee meetings and, subject to the Baker Funds owning directly specified minimum amounts of our common stock, the right to have our board of directors nominate and recommend for election by the stockholders up to three Baker Fund designees to our board of directors (one designee at 9.9%, two designees at 15.0% and three designees at 25.0%) designated by the Baker Funds, provided that at such time as the Baker Funds have designated three board designees, at least one such designee must qualify as an “independent” director under Nasdaq rules and be acceptable to the members of our board of directors who are not Baker Fund designees.

The Baker Funds’ participation rights, observer rights and board designation rights also will terminate at such time as the Baker Funds and their affiliates cease to own, in the aggregate, specified minimum amounts of the shares purchased in the Series E Private Placement.

Under the Series E Purchase Agreement, we also agreed that we will not without the prior approval of the requisite Baker Funds (i) issue or authorize the issuance of any equity security that is senior or pari passu to the Series E Preferred Stock with respect to liquidation preference, (ii) incur any additional indebtedness for borrowed money in excess of $1,000,000, in the aggregate, outside the ordinary course of business, subject to specified exceptions, including the refinancing of our existing indebtedness or (iii) pay or declare any dividend or make any distribution on, any shares of our capital stock, subject to specified exceptions.

Series F Private Placement

As discussed above, in December 2023, we entered into the Series F Purchase Agreement with the Series F Investors, who are identified as the Baker Funds in the table above, pursuant to which we issued and sold shares of Series F Preferred Stock in the Series F Private Placement. Under the Series F Purchase Agreement, we agreed that we will not without the prior approval of the requisite Baker Funds (i) issue or authorize the issuance of any equity security that is senior or pari passu to the Series F Preferred Stock with respect to liquidation preference, (ii) incur any additional indebtedness for borrowed money in excess of $1,000,000, in the aggregate, outside the ordinary course of business, subject to specified exceptions, including the refinancing of our existing indebtedness or (iii) pay or declare any dividend or make any distribution on, any shares of our capital stock, subject to specified exceptions.

Series G Private Placement

As discussed above, in March 2024, we entered into the Series G Purchase Agreement with the Series G Investors, who are identified as the Baker Funds in the table above, pursuant to which we issued and sold shares of Series G Preferred Stock in the Series G Private Placement. Under the Series G Purchase Agreement, we agreed that we will not without the prior approval of the requisite Baker Funds (i) issue or authorize the issuance of any equity security that is senior or pari passu to the Series G Preferred Stock with respect to liquidation preference, (ii) incur any additional indebtedness for borrowed money in excess of $1,000,000, in the aggregate, outside the ordinary course of business, subject to specified exceptions, including the refinancing of our existing indebtedness or (iii) pay or declare any dividend or make any distribution on, any shares of our capital stock, subject to specified exceptions.

Series H Private Placement

As discussed above, in June 2024, we entered into the Series H Purchase Agreement with the Series H Investors, who are identified as the selling stockholders in the table above, including the Baker Funds, pursuant to which we issued and sold shares of our common stock and Series H Preferred Stock in the Series H Private Placement. Under the Series H Purchase Agreement, we agreed that we will not without the prior approval of the requisite Series H Investors issue or authorize the issuance of any equity security that is senior or pari passu to the Series H Preferred Stock with respect to liquidation preference. In addition, we also entered into the 2024 Registration Rights Agreement with certain of the Series H Investors, as more fully described above.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is intended as a summary only and therefore is not a complete description of our capital stock. This description is based upon, and is qualified by reference to, our certificate of incorporation, our by-laws and applicable provisions of the Delaware General Corporate Law. You should read our certificate of incorporation and our by-laws, which are filed as exhibits to the registration statement of which this prospectus is a part, for the provisions that are important to you.

Our authorized capital stock consists of 120,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per share, of which (i) 54,000 shares of preferred stock are designated the “Series E Convertible Non-Redeemable Preferred Stock,” or the Series E Preferred Stock, (ii) 2,928 shares of preferred stock are designated the “Series F Convertible Non-Redeemable Preferred Stock”, or the Series F Preferred Stock, (iii) 10,901 shares of preferred stock are designated the “Series G Convertible Non-Redeemable Preferred Stock,” or the Series G Preferred Stock, and (iv) 9,393 shares of preferred stock are designated the “Series H Convertible Non-Redeemable Preferred Stock,” or the Series H Preferred Stock.

As of June 30, 2024, 4,598,419 shares of common stock were outstanding, 51,246 shares of Series E Preferred Stock were outstanding, 2,928 shares of Series F Preferred Stock were outstanding, 10,901 shares of Series G Preferred Stock were outstanding and 9,393 shares of Series H Preferred Stock were outstanding.

Common Stock

Annual Meeting. Annual meetings of our stockholders are held on the date designated in accordance with our by-laws. Written notice must be mailed to each stockholder entitled to vote not less than ten nor more than 60 days before the date of the meeting. The presence in person or by proxy of the holders of one third of the voting power of the shares of the capital stock of the corporation issued and outstanding and entitled to vote at such meeting constitutes a quorum for the transaction of business at meetings of the stockholders. Special meetings of the stockholders may be called for any purpose by the board of directors, the chairman of the board or the chief executive officer. Except as may be otherwise provided by applicable law, our certificate of incorporation or our by-laws, all elections of directors shall be decided by a plurality, and all other questions shall be decided by a majority, of the votes cast by stockholders entitled to vote thereon at a duly held meeting of stockholders at which a quorum is present.

Voting Rights. Holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders and do not have cumulative voting rights.

Dividends. Holders of common stock are entitled to receive proportionately any dividends as may be declared by our board of directors, subject to any preferential dividend rights of outstanding preferred stock.

Liquidation and Dissolution. In the event of our liquidation or dissolution, the holders of our common stock are entitled to receive proportionately all assets available for distribution to stockholders after the payment of all debts and other liabilities and subject to any preferential rights of any outstanding preferred stock.

Other Rights. Holders of our common stock have no preemptive, subscription, redemption or conversion rights. The rights, preferences and privileges of holders of our common stock are subject to and may be adversely affected by the rights of the holders of our Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock and shares of any series of our preferred stock that we may designate and issue in the future.

Transfer Agent and Registrar. Equiniti Trust Company, LLC is transfer agent and registrar for the common stock.

Nasdaq Capital Market. Our common stock is listed on The Nasdaq Capital Market under the symbol “KALA”.

Preferred Stock

General Description

We are authorized to issue “blank check” preferred stock, which may be issued in one or more series upon authorization of our board of directors. Our board of directors is authorized to fix the designations, powers, preferences and the relative, participating, optional or other special rights and any qualifications, limitations and restrictions of the shares of each series of preferred stock. The authorized shares of our preferred stock are available for issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any stock exchange on which our securities may be listed. If the approval of our stockholders is not required for the issuance of shares of our preferred stock, our board may determine not to seek stockholder approval.

A series of our preferred stock could, depending on the terms of such series, impede the completion of a merger, tender offer or other takeover attempt. Our board of directors will make any determination to issue preferred shares based upon its judgment as to the best interests of our stockholders. Our directors, in so acting, could issue preferred stock having terms that could discourage an acquisition attempt through which an acquirer may be able to change the composition of our board of directors, including a tender offer or other transaction that some, or a majority, of our stockholders might believe to be in their best interests or in which stockholders might receive a premium for their stock over the then-current market price of the stock.

Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock

Certificates of Designation. Pursuant to our Certificate of Designations, Preferences and Rights of Series E Convertible Non-Redeemable Preferred Stock, or the Series E Certificate of Designations, filed with the Secretary of State of the State of Delaware, we designated 54,000 shares of our authorized and unissued preferred stock as Series E Preferred Stock, and established the rights, preferences and privileges of the Series E Preferred Stock, which are summarized below. Pursuant to our Certificate of Designations, Preferences and Rights of Series F Convertible Non-Redeemable Preferred Stock, or the Series F Certificate of Designations, filed with the Secretary of State of the State of Delaware, we designated 2,928 shares of our authorized and unissued preferred stock as Series F Preferred Stock, and established the rights, preferences and privileges of the Series F Preferred Stock, which are summarized below. Pursuant to our Certificate of Designations, Preferences and Rights of Series G Convertible Non-Redeemable Preferred Stock, or the Series G Certificate of Designations, filed with the Secretary of State of the State of Delaware, we designated 10,901 shares of our authorized and unissued preferred stock as Series G Preferred Stock, and established the rights, preferences and privileges of the Series G Preferred Stock, which are summarized below. Pursuant to our Certificate of Designations, Preferences and Rights of Series H Convertible Non-Redeemable Preferred Stock, or the Series H Certificate of Designations, filed with the Secretary of State of the State of Delaware, we designated 9,393 shares of our authorized and unissued preferred stock as Series H Preferred Stock, and established the rights, preferences and privileges of the Series F Preferred Stock, which are summarized below.

Conversion. Each share of Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock is initially convertible into 100 shares of our common stock (subject to adjustment as provided in the applicable Certificate of Designations) at any time at the option of the holder, provided that the holder will be prohibited, subject to certain exceptions, from converting such shares of preferred stock for shares of our common stock to the extent that immediately prior to or following such conversion, the holder, together with its affiliates and other attribution parties, would own in excess of 9.99% of the total number of shares of our common stock then issued and outstanding after giving effect to such conversion, which percentage may be changed at the holder’s election to a lower percentage at any time or to a higher percentage not to exceed 19.99% upon 61 days’ notice to us, which we refer to, collectively, as the Beneficial Ownership Limitation.

Voting Rights. The shares of Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock will generally have no voting rights, except to the extent provided by applicable law, and except that (i) the consent of the holders of a majority of the outstanding Series E Preferred Stock will be required to waive any provisions of our Series E Certificate of Designations, (ii) the consent of the holders of a majority of the outstanding Series F Preferred Stock will be required to waive any

provisions of our Series F Certificate of Designations, (iii) the consent of the holders of a majority of the outstanding Series G Preferred Stock will be required to waive any provisions of our Series G Certificate of Designations and (iv) the consent of the holders of two-thirds of the outstanding Series H Preferred Stock will be required to waive any provisions of our Series H Certificate of Designations.

Rank. The Series E Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock and Series H Preferred Stock shall rank:

•

on parity with each other and on parity with any class or series of our capital stock created in the future specifically ranking by its terms on parity with such series of preferred stock, or collectively, the Parity Securities;

•

senior to all of our common stock;

•

senior to any class or series of our capital stock created in the future specifically ranking by its terms junior to each such series of preferred stock, or the Junior Securities;

•

junior to any class or series of our capital stock created in the future specifically ranking by its terms senior to each such series of preferred stock, or the Senior Securities;

in each case, as to distributions of assets upon our liquidation, dissolution or winding up, whether voluntarily or involuntarily, each of which we refer to as a Dissolution.

Dissolution. In the event of a Dissolution, subject to any prior or superior rights of the holders of Senior Securities, if any, the holders of the Series E Preferred Stock, the holders of Series F Preferred Stock, the holders of Series G Preferred Stock and the holders of Series H Preferred Stock will be entitled to receive on a pari passu basis with each other and all other Parity Securities, and before any distributions to the holders of our common stock and to the holders of Junior Securities, if any, to the greater of an amount per share of such preferred stock equal to the purchase price for such share of preferred stock (subject to adjustment in the event of any stock split, combination or reclassification), plus any dividends declared but unpaid thereon and such amount per share as would have been payable had all shares of such preferred stock been converted into our common stock (without regard to any restrictions on conversion, including the Beneficial Ownership Limitation) immediately prior to such Dissolution. For the avoidance of any doubt, neither a change in control of us, the merger or consolidation of us with or into any other entity, nor the sale, lease, exchange or other disposition of all or substantially all of our assets shall, in and of itself, be deemed to constitute a Dissolution.

Shares of Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock and Series H Preferred Stock will be entitled to receive dividends equal to (on an as-if-converted-to-common stock basis), and in the same form and manner as, dividends actually paid on shares of our common stock.

Warrants

As of June 30, 2024, we had outstanding warrants to purchase up to an aggregate of 4,303 shares of our common stock at a weighted average exercise price of $578.62 per share. These warrants provide for adjustments in the event of specified mergers, reorganizations, reclassifications, stock dividends, stock splits or other changes in our corporate structure.

Options

As of June 30, 2024, we had outstanding options to purchase an aggregate of 901,432 shares of our common stock at a weighted average exercise price of $13.19 per share.

Restricted Stock Units

As of June 30, 2024, 583,511 shares of our common stock were issuable upon vesting and settlement of outstanding restricted stock units.

Provisions of Our Certificate of Incorporation and By-laws and Delaware Law That May Have Anti-Takeover Effects

Delaware Law. We are subject to Section 203 of the Delaware General Corporation Law. Subject to certain exceptions, Section 203 prevents a publicly held Delaware corporation from engaging in a “business combination” with any “interested stockholder” for three years following the date that the person became an interested stockholder, unless either the interested stockholder attained such status with the approval of our board of directors, the business combination is approved by our board of directors and stockholders in a prescribed manner or the interested stockholder acquired at least 85% of our outstanding voting stock in the transaction in which it became an interested stockholder. A “business combination” includes, among other things, a merger or consolidation involving us and the “interested stockholder” and the sale of more than 10% of our assets. In general, an “interested stockholder” is any entity or person beneficially owning 15% or more of our outstanding voting stock and any entity or person affiliated with or controlling or controlled by such entity or person.

Staggered Board; Removal of Directors. Our certificate of incorporation and our bylaws divide our board of directors into three classes with staggered three-year terms. In addition, our certificate of incorporation and our bylaws provide that directors may be removed only for cause and only by the affirmative vote of the holders of 75% of our shares of capital stock present in person or by proxy and entitled to vote. Under our certificate of incorporation and bylaws, any vacancy on our board of directors, including a vacancy resulting from an enlargement of our board of directors, may be filled only by vote of a majority of our directors then in office. Furthermore, our certificate of incorporation provides that the authorized number of directors may be changed only by the resolution of our board of directors. The classification of our board of directors and the limitations on the ability of our stockholders to remove directors, change the authorized number of directors and fill vacancies could make it more difficult for a third party to acquire, or discourage a third party from seeking to acquire, control of our company.

Stockholder Action; Special Meeting of Stockholders; Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our certificate of incorporation and our bylaws provide that any action required or permitted to be taken by our stockholders at an annual meeting or special meeting of stockholders may only be taken if it is properly brought before such meeting and may not be taken by written action in lieu of a meeting. Our certificate of incorporation and our bylaws also provide that, except as otherwise required by law, special meetings of the stockholders can only be called by the chairman of our board of directors, our chief executive officer or our board of directors. In addition, our bylaws establish an advance notice procedure for stockholder proposals to be brought before an annual meeting of stockholders, including proposed nominations of candidates for election to our board of directors. Stockholders at an annual meeting may only consider proposals or nominations specified in the notice of meeting or brought before the meeting by or at the direction of our board of directors, or by a stockholder of record on the record date for the meeting who is entitled to vote at the meeting and who has delivered timely written notice in proper form to our secretary of the stockholder’s intention to bring such business before the meeting. These provisions could have the effect of delaying until the next stockholder meeting stockholder actions that are favored by the holders of a majority of our outstanding voting securities. These provisions also could discourage a third party from making a tender offer for our common stock because even if the third party acquired a majority of our outstanding voting stock, it would be able to take action as a stockholder, such as electing new directors or approving a merger, only at a duly called stockholders meeting and not by written consent.

Super-Majority Voting. The Delaware General Corporation Law provides generally that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend a corporation’s certificate of incorporation or bylaws unless a corporation’s certificate of incorporation or bylaws, as the case may be, requires a greater percentage. Our bylaws may be amended or repealed by a majority vote of our board of directors or the affirmative vote of the holders of at least 75% of the votes that all our stockholders would be entitled to cast in any annual election of directors. In addition, the affirmative vote of the holders of at least 75% of the votes that all our stockholders would be entitled to cast in any election of directors is required to amend or repeal or to adopt any provisions inconsistent with any of the provisions of our certificate of incorporation described above.

Exclusive Forum Selection. Our certificate of incorporation provides that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for (1) any derivative action or proceeding brought on behalf of our company, (2) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or employees to our company or our stockholders, (3) any action asserting a claim arising pursuant to any provision of the General Corporation Law of the State of Delaware or as to which the General Corporation Law of the State of Delaware confers jurisdiction on the Court of Chancery of the State of Delaware, or (4) any action asserting a claim arising pursuant to any provision of our certificate of incorporation or bylaws (in each case, as they may be amended from time to time) or governed by the internal affairs doctrine. Although our certificate of incorporation contains the choice of forum provision described above, we do not expect this choice of forum provision will apply to suits brought to enforce a duty or liability created by the Securities Act of 1933, as amended, the Exchange Act of 1934, as amended, or any other claim for which federal courts have exclusive jurisdiction.

PLAN OF DISTRIBUTION

The selling stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholders may use any one or more of the following methods when disposing of shares or interests therein:

•

distributions to members, partners, stockholders or other equityholders of the selling stockholders;

•

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•

an exchange distribution in accordance with the rules of the applicable exchange;

•

privately negotiated transactions;

•

short sales and settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

•

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share;

•

a combination of any such methods of sale; and

•

any other method permitted by applicable law.

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933, as amended, or the Securities Act, amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the selling

stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

The selling stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.