Europe From the Ashes... Already? - Real Time Insight

May 07 2013 - 7:53AM

Zacks

Have you see the European stock indexes lately?

Or those Italian and Spanish government bond yields dropping to

levels not seen since the fall of 2010?

Here's a chart of the EuroStoxx

600...

And I'll spare you a boring chart of the bond

yields; suffice to say that the Italian 10-year fell below 4% and

Spain's is hovering just above there.

Could these barometers of risk appetite be

signaling that the worst is over for Europe? Or is this just a

global liquidity event, especially after Japanese investors have

been loosed upon the world to buy every other financial asset they

can?

When you look at the following graph of Eurozone

composite PMI and GDP, it's hard to get excited about an economic

recovery any time soon.

And the bond market picture makes sense --

especially if the continent is staring down into the spiral of

deflation.

The ECB finally capitulated last week and lowered

short-term rates again in an effort to stem the slow-down. But it

may be far too little, too late. What strong central bank action

has accomplished in Europe with the ESM and OMT is that it helped

stabilize the banks and provide the ultimate currency

-- confidence.

But getting the economy to turn around while

austerity is all the rage could be a completely different

challenge. Here's what Chris Williamson, Chief Economist at Markit

had to say in late April after the PMI data was

released...

"Although the PMI was unchanged in April, the

survey is signaling a worrying weakness in the economy at the start

of the second quarter, with signs that the downturn is more likely

to intensify further in coming months rather than

ease.

The renewed decline in Germany will also raise

fears that the region's largest growth engine has moved into

reverse, thereby acting as a drag on the region at the same time as

particularly steep downturns persist in France, Italy and

Spain.

Policymakers will at least be relieved to see

inflationary pressures cooling, which could further open the door

to renewed policy stimulus."

The question is, will the ECB "evolve" their

single mandate for price stability and embark on a full QE monetary

stimulus plan to save their economy? And will they do it soon

enough?

Also, why do you think European stocks have been

so attractive to investors lately?

WISDMTR-J HEF (DXJ): Free Stock Analysis Report

SPDR-EU STX 50 (FEZ): Get Free Report

CRYSHS-EURO TR (FXE): Free Stock Analysis Report

SPDR-SP 500 TR (SPY): Free Stock Analysis Report

ISHARS-BR 20+ (TLT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

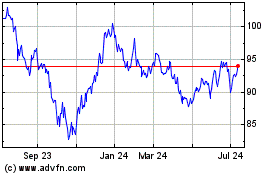

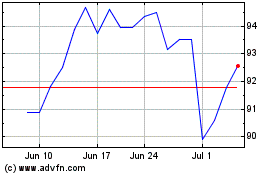

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Apr 2024 to May 2024

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From May 2023 to May 2024