IPG Photonics Announces Sale of its Russian Operations

August 29 2024 - 4:00PM

IPG Photonics Corporation (NASDAQ: IPGP) today announced that

it has sold its entire interest in its Russian subsidiary,

IRE-Polus. The purchaser is a group led by Softline Projects LLC

and current management of IRE-Polus. The sale marks the

finalization of IPG’s exit from all facilities in Russia, following

imposed sanctions on trade after the start of the war with Ukraine.

The proceeds from the transaction are $51 million before advisory

and other fees.

“Our team executed flawlessly to transition our

manufacturing operations after the war’s outbreak without any

impact to our customers. Our ability to respond to adverse events

out of our control highlights the resilience of the company as we

were able to lean on our global manufacturing capabilities to

increase production in Germany, the United States and Italy and

start production in Poland,” said Dr. Mark Gitin, IPG Photonics’

Chief Executive Officer. “Today, with the sale of our Russian

operations now behind us, we are focusing on optimizing our

operations to drive improved productivity.”

The Company expects that the sale will reduce

third quarter revenue as compared to previously provided guidance

by approximately $5 million. IRE-Polus revenue accounts for less

than 5% of IPG’s full-year revenue. Related to the transaction, the

Company expects to record total estimated charges of $195 million

to $210 million. Of these total estimated charges, $60 million to

$65 million relates to the carrying value of net assets of

IRE-Polus that is in excess of net proceeds received on the sale

and $135 million to $145 million relates to the cumulative

translation adjustment component of other comprehensive income that

is included in shareholders equity. The Company does not expect to

provide any further information regarding the transaction until it

reports earnings results for the third quarter.

Contact

Eugene FedotoffSenior Director, Investor Relations IPG Photonics

Corporation 508-597-4713efedotoff@ipgphotonics.com

About IPG Photonics Corporation

IPG Photonics Corporation is the leader in

high-power fiber lasers and amplifiers used primarily in materials

processing and other diverse applications. The Company’s mission is

to develop innovative laser solutions making the world a better

place. IPG accomplishes this mission by delivering superior

performance, reliability and usability at a lower total cost of

ownership compared with other types of lasers and non-laser tools,

allowing end users to increase productivity and decrease costs. IPG

is headquartered in Marlborough, Massachusetts and has more than 30

facilities worldwide. For more information, visit

www.ipgphotonics.com.

Safe Harbor Statement

Information and statements provided by IPG and

its employees, including statements in this press release, that

relate to future plans, events or performance are forward-looking

statements. These statements involve risks and uncertainties. Any

statements in this press release that are not statements of

historical fact are forward-looking statements. These include but

are not limited to the reduction in third quarter revenue as

compared to previously provided guidance, the impairment charge

related to the carrying value of net assets of IRE-Polus and the

charge related to the cumulative translation adjustment component

of other comprehensive income that is included in shareholders

equity. Factors that could cause actual results to differ

materially include risks and uncertainties, including risks

associated with the strength or weakness of the business conditions

in industries and geographic markets that IPG serves, particularly

the effect of downturns in the markets IPG serves; uncertainties

and adverse changes in the general economic conditions of markets;

inability to manage risks associated with international customers

and operations; changes in trade controls and trade policies; IPG's

ability to penetrate new applications for fiber lasers and increase

market share; the rate of acceptance and penetration of IPG's

products; foreign currency fluctuations; high levels of fixed costs

from IPG's vertical integration; the appropriateness of IPG's

manufacturing capacity for the level of demand; competitive

factors, including declining average selling prices; the effect of

acquisitions and investments; inventory write-downs; asset

impairment charges; intellectual property infringement claims and

litigation; interruption in supply of key components; manufacturing

risks; government regulations and trade sanctions; and other risks

identified in IPG's SEC filings. Readers are encouraged to refer to

the risk factors described in IPG's Annual Report on Form 10-K

(filed with the SEC on February 21, 2024) and IPG's reports filed

with the SEC, as applicable. Actual results, events and performance

may differ materially. Readers are cautioned not to rely on the

forward-looking statements, which speak only as of the date hereof.

IPG undertakes no obligation to update the forward-looking

statements that may be made to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events.

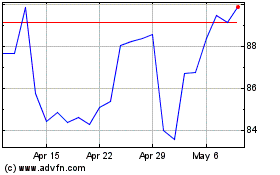

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Oct 2024 to Nov 2024

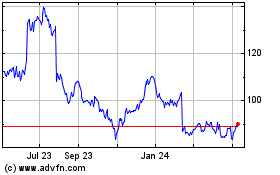

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Nov 2023 to Nov 2024