IPG Photonics Corporation (NASDAQ: IPGP) today reported

financial results for the first quarter ended March 31, 2023.

| |

|

Three Months Ended March 31, |

|

|

|

(In millions, except per share data and

percentages) |

|

|

2023 |

|

|

|

2022 |

|

|

Change |

| Revenue |

|

$ |

347.2 |

|

|

$ |

370.0 |

|

|

(6)% |

| Gross margin |

|

|

42.3 |

% |

|

|

46.4 |

% |

|

|

| Operating income |

|

$ |

75.4 |

|

|

$ |

93.1 |

|

|

(19)% |

| Operating margin |

|

|

21.7 |

% |

|

|

25.2 |

% |

|

|

| Net income attributable to IPG

Photonics Corporation |

|

$ |

60.1 |

|

|

$ |

69.6 |

|

|

(14)% |

| Earnings per diluted

share |

|

$ |

1.26 |

|

|

$ |

1.31 |

|

|

(4)% |

| |

|

|

|

|

|

|

|

|

|

|

Management Comments

"We were pleased with our continued strong

results in welding, which were driven by record sales into EV

battery applications and all-time high sales for LightWELD, our

handheld welder," said Dr. Eugene Scherbakov, IPG Photonics' Chief

Executive Officer. "Despite muted general industrial activity, we

saw increased demand in e-mobility and solar cell manufacturing

across most geographies as well as higher sales in cleaning

applications that are driven by investments in sustainable energy

and eco-friendly solutions. Our diversification efforts and

increased revenue in emerging growth products are successfully

offsetting soft demand in general industrial applications such as

cutting and marking."

Financial Highlights

First quarter revenue of $347 million decreased

6% year over year. The strong U.S. dollar reduced revenue by

approximately $15 million or 4% and divestitures reduced

revenue by approximately 1% compared to the same period last year.

Materials processing sales accounted for 90% of total revenue and

decreased 8% year over year with higher sales in welding, cleaning

and solar cell applications offset by lower revenue in cutting and

marking applications. Sales into other applications increased 10%

year over year, driven by strength in advanced applications and

medical, partially offset by the telecom divestiture. Emerging

growth products sales continued to grow and accounted for 45% of

total revenue.

Revenue in high power continuous wave (CW)

lasers declined 8% year over year as the strong growth in welding,

driven by higher demand from e-mobility applications, was offset by

lower demand in high power cutting applications. Sales of pulsed

lasers declined 16% compared with the prior year due to lower

demand in cutting and marking applications, partially offset by

growth in cleaning and solar cell manufacturing applications. By

region, sales decreased 1% in North America, 7% in Europe, and 22%

in China, but were up 68% in Japan on a year-over-year basis.

Earnings per diluted share (EPS) of $1.26

decreased 4% year over year. Foreign exchange transaction gains

increased operating income by $3 million and earnings per diluted

share by $0.06. The effective tax rate in the quarter was 28%.

During the first quarter, IPG generated $37 million in cash from

operations. Capital expenditures were $33 million and stock

repurchases were $113 million in the quarter.

Business Outlook and Financial Guidance

“First quarter book-to-bill was approximately

one. Bookings improved sequentially from the fourth quarter lows,

but we continue to see soft industrial demand across many regions.

Nevertheless, orders from e-mobility and solar cell manufacturing

remain strong across several geographies as a result of significant

new investments going into these markets. We are focusing our

resources on developing new product offerings, such as cleaning

solutions, to broaden our exposure in the emerging growth

opportunities and to drive adoption of laser technologies across

different applications. We expect that this would further diversify

our revenue, helping offset volatility in general industrial

markets," concluded Dr. Scherbakov.

For the second quarter of 2023, IPG expects

revenue of $325 million to $355 million. The Company expects the

second quarter tax rate to be approximately 26%. IPG anticipates

delivering earnings per diluted share in the range of $1.05 to

$1.35.

As discussed in more detail in the "Safe Harbor"

passage of this news release, actual results may differ from this

guidance due to various factors including, but not limited to,

trade policy changes and trade restrictions with Russia, the

COVID-19 pandemic, product demand, order cancellations and delays,

competition, tariffs, currency fluctuations and general economic

conditions. This guidance is based upon current market conditions

and expectations, and is subject to the risks outlined in the

Company's reports filed with the SEC, and assumes exchange rates

relative to the U.S. dollar of Euro 0.92, Russian ruble 77,

Japanese yen 133 and Chinese yuan 6.87, respectively.

Authorization of New Stock Buyback Program

After completing in the quarter the $300 million

share repurchase program announced in August 2022, the Board of

Directors authorized a new program to purchase up to $200 million

of IPG common stock. Share repurchases may be made periodically in

open-market or other transactions, and are subject to market

conditions, legal requirements and other factors. The share

repurchase program authorization does not obligate the Company to

repurchase any dollar amount or number of its shares, and

repurchases may be commenced or suspended from time to time without

prior notice. Since the beginning of 2022, IPG has repurchased over

$600 million of its common stock.

Supplemental Financial Information

Additional supplemental financial information is

provided in the unaudited First Quarter 2023 Financial Data

Workbook and Earnings Call Presentation available on the investor

relations section of the Company's website at

investor.ipgphotonics.com.

Conference Call Reminder

The Company will hold a conference call today,

May 2, 2023 at 10:00 am ET. To access the call, please dial

877-407-6184 in the US or 201-389-0877 internationally. A live

webcast of the call will also be available and archived on the

investor relations section of the Company's website at

investor.ipgphotonics.com.

Contact

Eugene FedotoffDirector of Investor Relations IPG Photonics

Corporation 508-597-4713efedotoff@ipgphotonics.com

About IPG Photonics Corporation

IPG Photonics Corporation is the leader in

high-power fiber lasers and amplifiers used primarily in materials

processing and other diverse applications. The Company’s mission is

to develop innovative laser solutions making the world a better

place. IPG accomplishes this mission by delivering superior

performance, reliability and usability at a lower total cost of

ownership compared with other types of lasers and non-laser tools,

allowing end users to increase productivity and decrease costs. IPG

is headquartered in Marlborough, Massachusetts and has more than 30

facilities worldwide. For more information, visit

www.ipgphotonics.com.

Safe Harbor Statement

Information and statements provided by IPG and

its employees, including statements in this press release, that

relate to future plans, events or performance are forward-looking

statements. These statements involve risks and uncertainties. Any

statements in this press release that are not statements of

historical fact are forward-looking statements, including, but not

limited to diversification efforts and increased revenue in the

emerging growth products to offset soft demand in general

industrial applications, focusing of our resources on developing

new product offerings to broaden our exposure in the emerging

growth opportunities and to drive adoption of laser technologies

across different applications, and further diversifying our revenue

and helping offset volatility in general industrial markets,

revenue, tax rate and earnings guidance, and the impact of the U.S.

dollar on our guidance for second quarter of 2023. Factors that

could cause actual results to differ materially include risks and

uncertainties, including risks associated with the strength or

weakness of the business conditions in industries and geographic

markets that IPG serves, particularly the effect of downturns in

the markets IPG serves; uncertainties and adverse changes in the

general economic conditions of markets; inability to manage risks

associated with international customers and operations; changes in

trade controls and trade policies; IPG's ability to penetrate new

applications for fiber lasers and increase market share; the rate

of acceptance and penetration of IPG's products; foreign currency

fluctuations; high levels of fixed costs from IPG's vertical

integration; the appropriateness of IPG's manufacturing capacity

for the level of demand; competitive factors, including declining

average selling prices; the effect of acquisitions and investments;

inventory write-downs; asset impairment charges; intellectual

property infringement claims and litigation; interruption in supply

of key components; manufacturing risks; government regulations and

trade sanctions; and other risks identified in IPG's SEC filings.

Readers are encouraged to refer to the risk factors described in

IPG's Annual Report on Form 10-K (filed with the SEC on February

27, 2023) and IPG's reports filed with the SEC, as applicable.

Actual results, events and performance may differ materially.

Readers are cautioned not to rely on the forward-looking

statements, which speak only as of the date hereof. IPG undertakes

no obligation to update the forward-looking statements that may be

made to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events.

|

|

|

IPG PHOTONICS CORPORATIONCONDENSED CONSOLIDATED

STATEMENTS OF INCOME (UNAUDITED) |

|

|

| |

|

Three Months Ended March 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

(In thousands, except per share data) |

| Net sales |

|

$ |

347,174 |

|

|

$ |

369,979 |

|

| Cost of sales |

|

|

200,236 |

|

|

|

198,158 |

|

| Gross profit |

|

|

146,938 |

|

|

|

171,821 |

|

| Operating expenses: |

|

|

|

|

|

Sales and marketing |

|

|

21,088 |

|

|

|

20,374 |

|

|

Research and development |

|

|

22,770 |

|

|

|

33,450 |

|

|

General and administrative |

|

|

30,128 |

|

|

|

30,664 |

|

|

Other restructuring charges |

|

|

181 |

|

|

|

— |

|

|

Gain on foreign exchange |

|

|

(2,655 |

) |

|

|

(5,810 |

) |

|

Total operating expenses |

|

|

71,512 |

|

|

|

78,678 |

|

| Operating income |

|

|

75,426 |

|

|

|

93,143 |

|

| Other income (expense),

net: |

|

|

|

|

|

Interest income (expense), net |

|

|

7,533 |

|

|

|

(70 |

) |

|

Other income (expense), net |

|

|

331 |

|

|

|

(236 |

) |

|

Total other income (expense) |

|

|

7,864 |

|

|

|

(306 |

) |

| Income before provision of

income taxes |

|

|

83,290 |

|

|

|

92,837 |

|

| Provision for income

taxes |

|

|

23,155 |

|

|

|

23,209 |

|

| Net income |

|

|

60,135 |

|

|

|

69,628 |

|

| Less: net income attributable

to non-controlling interests |

|

|

— |

|

|

|

56 |

|

| Net income attributable to IPG

Photonics Corporation |

|

$ |

60,135 |

|

|

$ |

69,572 |

|

| Net income attributable to IPG

Photonics Corporation per share: |

|

|

|

|

|

Basic |

|

$ |

1.26 |

|

|

$ |

1.32 |

|

|

Diluted |

|

$ |

1.26 |

|

|

$ |

1.31 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

Basic |

|

|

47,542 |

|

|

|

52,810 |

|

|

Diluted |

|

|

47,776 |

|

|

|

53,100 |

|

|

|

|

IPG PHOTONICS CORPORATIONCONDENSED CONSOLIDATED

BALANCE SHEETS (UNAUDITED) |

|

|

| |

|

March 31, |

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

(In thousands, except share and per

share data) |

|

ASSETS |

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

521,137 |

|

|

$ |

698,209 |

|

|

Short-term investments |

|

|

548,473 |

|

|

|

479,374 |

|

|

Accounts receivable, net |

|

|

236,575 |

|

|

|

211,347 |

|

|

Inventories |

|

|

506,149 |

|

|

|

509,363 |

|

|

Prepaid income taxes |

|

|

47,054 |

|

|

|

40,934 |

|

|

Prepaid expenses and other current assets |

|

|

56,199 |

|

|

|

47,047 |

|

|

Total current assets |

|

|

1,915,587 |

|

|

|

1,986,274 |

|

| Deferred income taxes,

net |

|

|

59,089 |

|

|

|

75,152 |

|

| Goodwill |

|

|

38,388 |

|

|

|

38,325 |

|

| Intangible assets, net |

|

|

32,104 |

|

|

|

34,120 |

|

| Property, plant and equipment,

net |

|

|

594,273 |

|

|

|

580,561 |

|

| Other assets |

|

|

31,715 |

|

|

|

28,848 |

|

| Total assets |

|

$ |

2,671,156 |

|

|

$ |

2,743,280 |

|

|

LIABILITIES AND EQUITY |

| Current liabilities: |

|

|

|

|

|

Current portion of long-term debt |

|

$ |

15,734 |

|

|

$ |

16,031 |

|

|

Accounts payable |

|

|

40,902 |

|

|

|

46,233 |

|

|

Accrued expenses and other current liabilities |

|

|

189,786 |

|

|

|

202,764 |

|

|

Income taxes payable |

|

|

3,100 |

|

|

|

9,618 |

|

|

Total current liabilities |

|

|

249,522 |

|

|

|

274,646 |

|

| Other long-term liabilities

and deferred income taxes |

|

|

83,109 |

|

|

|

83,274 |

|

|

Total liabilities |

|

|

332,631 |

|

|

|

357,920 |

|

| Commitments and

contingencies |

|

|

|

|

| IPG Photonics Corporation

equity: |

|

|

|

|

|

Common stock, $0.0001 par value, 175,000,000 shares authorized;

56,183,735 and 47,305,551 shares issued and outstanding,

respectively, at March 31, 2023; 56,017,672 and 48,138,257

shares issued and outstanding, respectively, at December 31,

2022. |

|

|

6 |

|

|

|

6 |

|

|

Treasury stock, at cost, 8,878,184 and 7,879,415 shares held at

March 31, 2023 and December 31, 2022, respectively. |

|

|

(1,051,103 |

) |

|

|

(938,009 |

) |

|

Additional paid-in capital |

|

|

957,103 |

|

|

|

951,371 |

|

|

Retained earnings |

|

|

2,636,651 |

|

|

|

2,576,516 |

|

|

Accumulated other comprehensive loss |

|

|

(204,132 |

) |

|

|

(204,524 |

) |

|

Total IPG Photonics Corporation equity |

|

|

2,338,525 |

|

|

|

2,385,360 |

|

| Total liabilities and

equity |

|

$ |

2,671,156 |

|

|

$ |

2,743,280 |

|

| |

|

IPG PHOTONICS CORPORATIONCONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED) |

|

|

| |

|

Three Months Ended March 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

(In thousands) |

| Cash flows from

operating activities: |

|

|

|

|

|

Net income |

|

$ |

60,135 |

|

|

$ |

69,628 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

17,889 |

|

|

|

23,435 |

|

|

Provisions for inventory, warranty & bad debt |

|

|

17,214 |

|

|

|

16,142 |

|

|

Other |

|

|

19,561 |

|

|

|

6,572 |

|

|

Changes in assets and liabilities that used cash, net of

acquisitions: |

|

|

|

|

|

Accounts receivable and accounts payable |

|

|

(29,242 |

) |

|

|

(5,827 |

) |

|

Inventories |

|

|

(8,989 |

) |

|

|

(50,951 |

) |

|

Other |

|

|

(39,288 |

) |

|

|

(42,576 |

) |

|

Net cash provided by operating activities |

|

|

37,280 |

|

|

|

16,423 |

|

| Cash flows from

investing activities: |

|

|

|

|

|

Purchases of and deposits on property, plant and equipment |

|

|

(33,404 |

) |

|

|

(25,177 |

) |

|

Proceeds from sales of property, plant and equipment |

|

|

1,600 |

|

|

|

428 |

|

|

Purchases of short-term investments |

|

|

(343,820 |

) |

|

|

(475,435 |

) |

|

Proceeds from short-term investments |

|

|

279,499 |

|

|

|

505,818 |

|

|

Acquisitions of businesses, net of cash acquired |

|

|

— |

|

|

|

(2,000 |

) |

|

Other |

|

|

107 |

|

|

|

(1,164 |

) |

|

Net cash (used in) provided by investing activities |

|

|

(96,018 |

) |

|

|

2,470 |

|

| Cash flows from

financing activities: |

|

|

|

|

|

Principal payments on long-term borrowings |

|

|

(298 |

) |

|

|

(964 |

) |

|

Proceeds from issuance of common stock under employee stock option

and purchase plans less payments for taxes related to net share

settlement of equity awards |

|

|

(3,844 |

) |

|

|

(724 |

) |

|

Purchase of treasury stock, at cost |

|

|

(113,094 |

) |

|

|

(78,757 |

) |

|

Net cash used in financing activities |

|

|

(117,236 |

) |

|

|

(80,445 |

) |

| Effect of changes in exchange

rates on cash and cash equivalents |

|

|

(1,098 |

) |

|

|

(5,036 |

) |

| Net decrease in cash and cash

equivalents |

|

|

(177,072 |

) |

|

|

(66,588 |

) |

| Cash and cash equivalents —

Beginning of period |

|

|

698,209 |

|

|

|

709,105 |

|

| Cash and cash equivalents —

End of period |

|

|

521,137 |

|

|

|

642,517 |

|

| Supplemental disclosures of

cash flow information: |

|

|

|

|

|

Cash paid for interest |

|

$ |

525 |

|

|

$ |

857 |

|

|

Cash paid for income taxes |

|

$ |

19,203 |

|

|

$ |

25,423 |

|

|

|

|

IPG PHOTONICS CORPORATIONSUPPLEMENTAL SCHEDULE OF

AMORTIZATION OF INTANGIBLE ASSETS (UNAUDITED) |

|

|

| |

|

Three Months Ended March 31, |

| |

|

2023 |

|

2022 |

| |

|

(In thousands) |

| Amortization of intangible

assets: |

|

|

|

|

|

Cost of sales |

|

$ |

564 |

|

$ |

1,173 |

|

Sales and marketing |

|

|

1,457 |

|

|

1,848 |

| Total amortization of

intangible assets |

|

$ |

2,021 |

|

$ |

3,021 |

| |

|

IPG PHOTONICS CORPORATIONSUPPLEMENTAL SCHEDULE OF

STOCK-BASED COMPENSATION (UNAUDITED) |

|

|

| |

|

Three Months Ended March 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

(In thousands) |

| Cost of sales |

|

$ |

2,646 |

|

|

$ |

3,058 |

|

| Sales and marketing |

|

|

1,293 |

|

|

|

1,209 |

|

| Research and development |

|

|

1,796 |

|

|

|

2,529 |

|

| General and

administrative |

|

|

3,876 |

|

|

|

3,162 |

|

| Total stock-based

compensation |

|

|

9,611 |

|

|

|

9,958 |

|

| Tax effect of stock-based

compensation |

|

|

(2,096 |

) |

|

|

(2,134 |

) |

| Net stock-based

compensation |

|

$ |

7,515 |

|

|

$ |

7,824 |

|

| |

|

Three Months Ended March 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

(In thousands) |

| Excess tax detriment on

stock-based compensation |

|

$ |

(1,708 |

) |

|

$ |

(1,713 |

) |

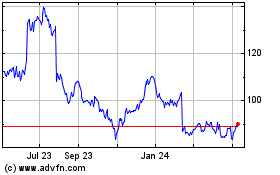

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Oct 2024 to Nov 2024

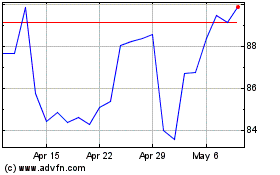

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Nov 2023 to Nov 2024