Life Meets EPS, Misses Revs - Analyst Blog

April 27 2011 - 2:34PM

Zacks

Life Technologies Corporation (LIFE) reported

an EPS of 50 cents in the first quarter of 2011 compared to 48

cents in the year-ago period. However, after adjusting for certain

one-time items, the EPS was 85 cents, in line with the Zacks

Consensus Estimate,but down 2.3% compared to 87 cents in the

year-ago quarter.

Revenues increased 1% year over year to $897 million, missing

the Zacks Consensus Estimate of $920 million. While foreign

exchange movement had a negative impact of 1 point, prior

acquisitions and divestitures contributed approximately 2 points to

the reported revenue growth.

Organic revenue growth for the quarter was flat due to difficult

year over year comparisons and the recent disaster in Japan.

Excluding these items, organic growth for the quarter was 5%.

On a geographical basis, barring Japan where revenues declined

16% compared to the first quarter of fiscal 2010, revenue growth

was witnessed across all other regions: Europe – 2%, Asia-Pacific –

7% and the Americas – 1%.

Adjusted gross margin during the quarter was 66.3%, down

200 basis points (bps) from the year-ago quarter due to the

negative impact from currency and mix partially offset by the

positive impact of price. Moreover, operating margin (adjusted) was

28.2% in the reported quarter, 130 bps lower than the prior year

quarter due to lower gross margins, partially offset by lower

operating expenses.

Operating expenses were $342 million compared to $343.4 million

in the year-ago quarter due to a 2.8% decline in selling, general

and administrative expenses to $250.5 million, though research and

development expenses increased 6.7% to $91.5 million.

Although revenues increased 1% during the quarter, EPS dropped

by 2.3% due to lower margins, higher interest expense (up 13.4% to

$34.4 million), a 34% fall in interest income, partially offset by

lower effective tax rate (27.6% versus 30%) and a 1.9% decline in

share count.

Life Technologies exited the quarter with $735.2 million in the

form of cash and short-term investments, lower than $854.8 million

at the end of December 2010.

Segments

Life Technologies earns revenues primarily from three divisions

– Molecular Biology Systems, Genetic Systems and Cell Systems,

which recorded adjusted revenues of $426 million (down 1% compared

to the year-ago quarter), $228 million (down 4%) and $238 million

(up 11%), respectively.

The strong growth for the Cell Systems division was a result of

strong demand across the portfolio, led by double-digit growth in

the Beads Based Separation and BioProduction businesses.

However, in case of Molecular Biology systems, strong demand for

TaqMan assay products was offset by the PCR and Molecular Biology

Reagents businesses, both of which faced difficult year-over-year

comparisons. Moreover, revenue of Genetic Systems declined

primarily due to delayed shipment of the new 5500 sequencer owing

to the Japan disaster.

Guidance

Life Technologies reiterated its outlook for 2011. The company

expects its organic revenues to grow in mid-single digits resulting

in an adjusted EPS of $3.80–$3.95.

Recommendation

Life Technologies enjoys a strong position in the life sciences

market. During the quarter the company was affected by the recent

disaster in Japan and difficult year-over-year comparisons.

However, we believe new product launches and focus on emerging

markets will help drive revenues going forward.

Moreover, the situation in Japan is expected to improve

gradually. However, the company could face challenges such as

increased competition from players like, Thermo Fisher

Scientific (TMO), Illumina (ILMN) among

others and unfavorable currency movement.

We are currently Neutral on the stock, which also corresponds to

the Zacks #3 Rank (Hold) in the short term.

ILLUMINA INC (ILMN): Free Stock Analysis Report

LIFE TECHNOLOGS (LIFE): Free Stock Analysis Report

THERMO FISHER (TMO): Free Stock Analysis Report

Zacks Investment Research

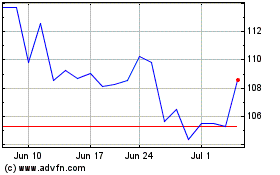

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Nov 2023 to Nov 2024